Market Morsel: Supply Chain Disruptions

Market Morsel

The 2020s have been a decade of disruption to supply chains. Let’s look at some of the events that have caused disruption to supply chains.

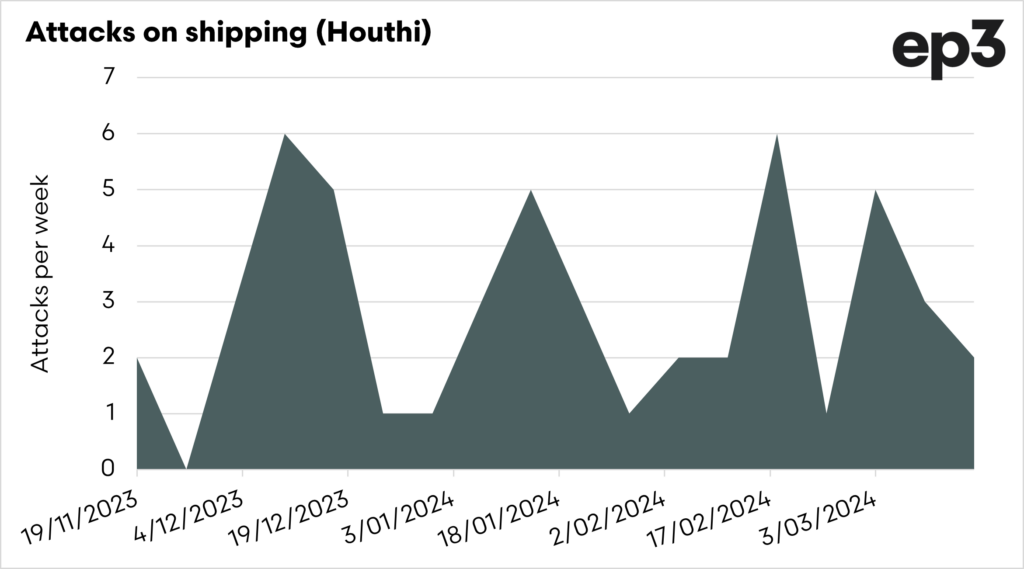

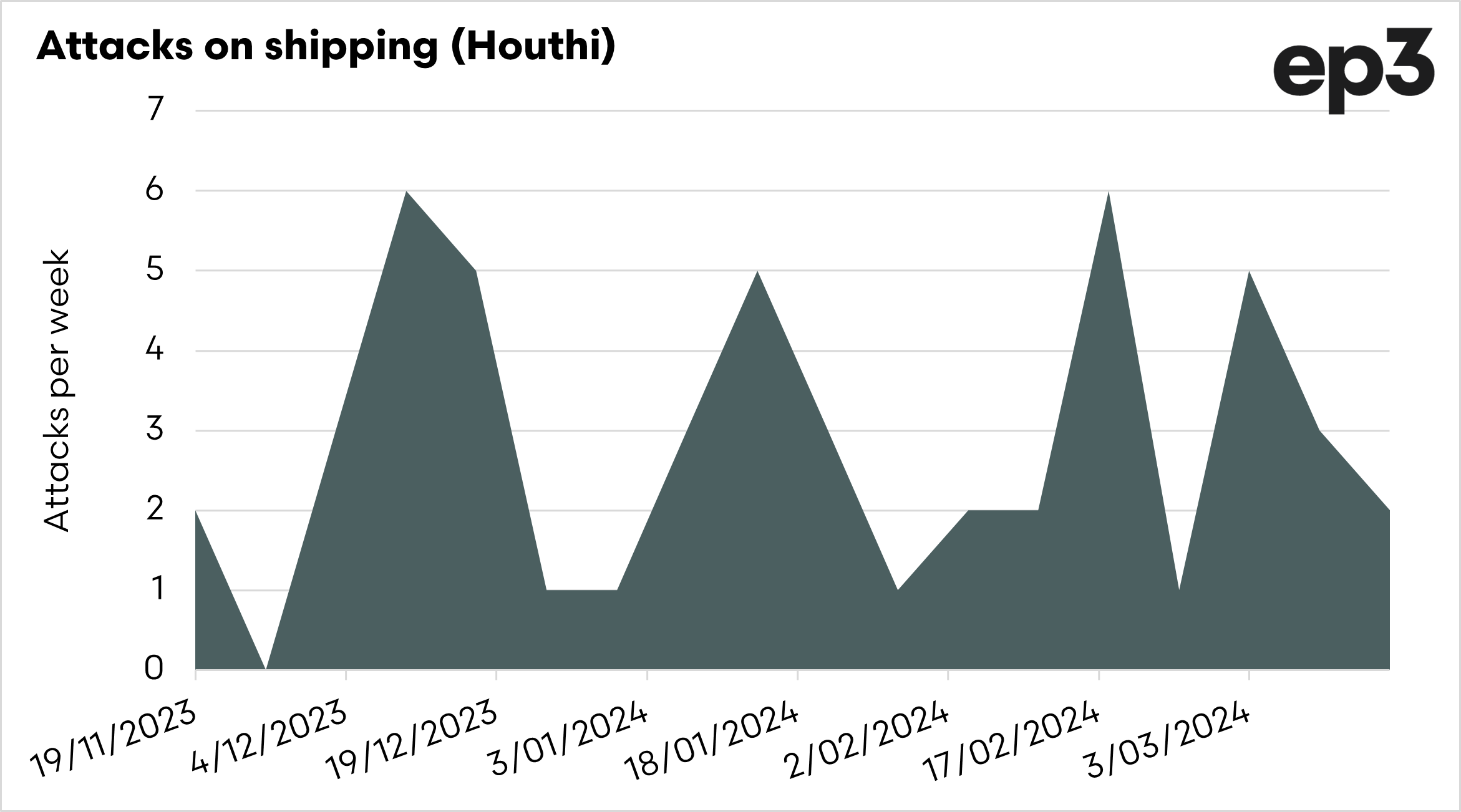

The Ever Given, a large container ship, was stuck sideways in the Suez Canal for a week. The Suez Canal has just over 10% of the worlds trade transiting on an annual basis. This last six months has seen the Red Sea effectively closed down for transport after repeated attacks by Houthi rebels.

Since November, there have been 51 missile or drone attacks on shipping in this region, resulting in vessels having to reroute around the Cape of Good Hope in South Africa. This equates to around 15 days extra voyage time.

The invasion of Ukraine caused huge issues with the supply of grains. Ukraine and Russia contribute around a third of the world’s grain, and the invasion meant that grain moved from sea bourne to land-based into Europe. This caused European grain prices to crash and grain prices in the Middle East to rise dramatically.

This week, we saw the horrific imagery out of Baltimore as the MV Dali struck a bridge, killing road workers, but fortunately avoiding a much greater tragedy due to giving a mayday and the time of day.

The total trade through the Baltimore port is US$80bn per year; this means that around US$217m per day is missed whilst access to the port is closed. The closure has meant that companies will have to change their supply chains.

Baltimore is the 13th most important port in the US for trade. In terms of exports, the port sends coal, natural gas and vehicles. In imports, the port unloads mainly cars and agricultural/heavy machinery.

It just goes to show how one small event can have huge impact on supply chains, and we seem to be getting more of these events.

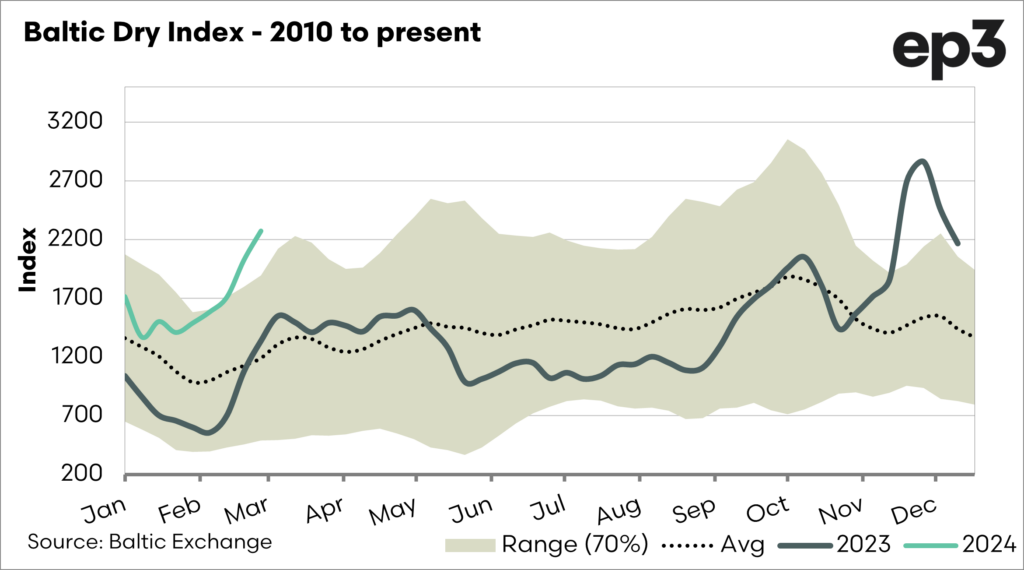

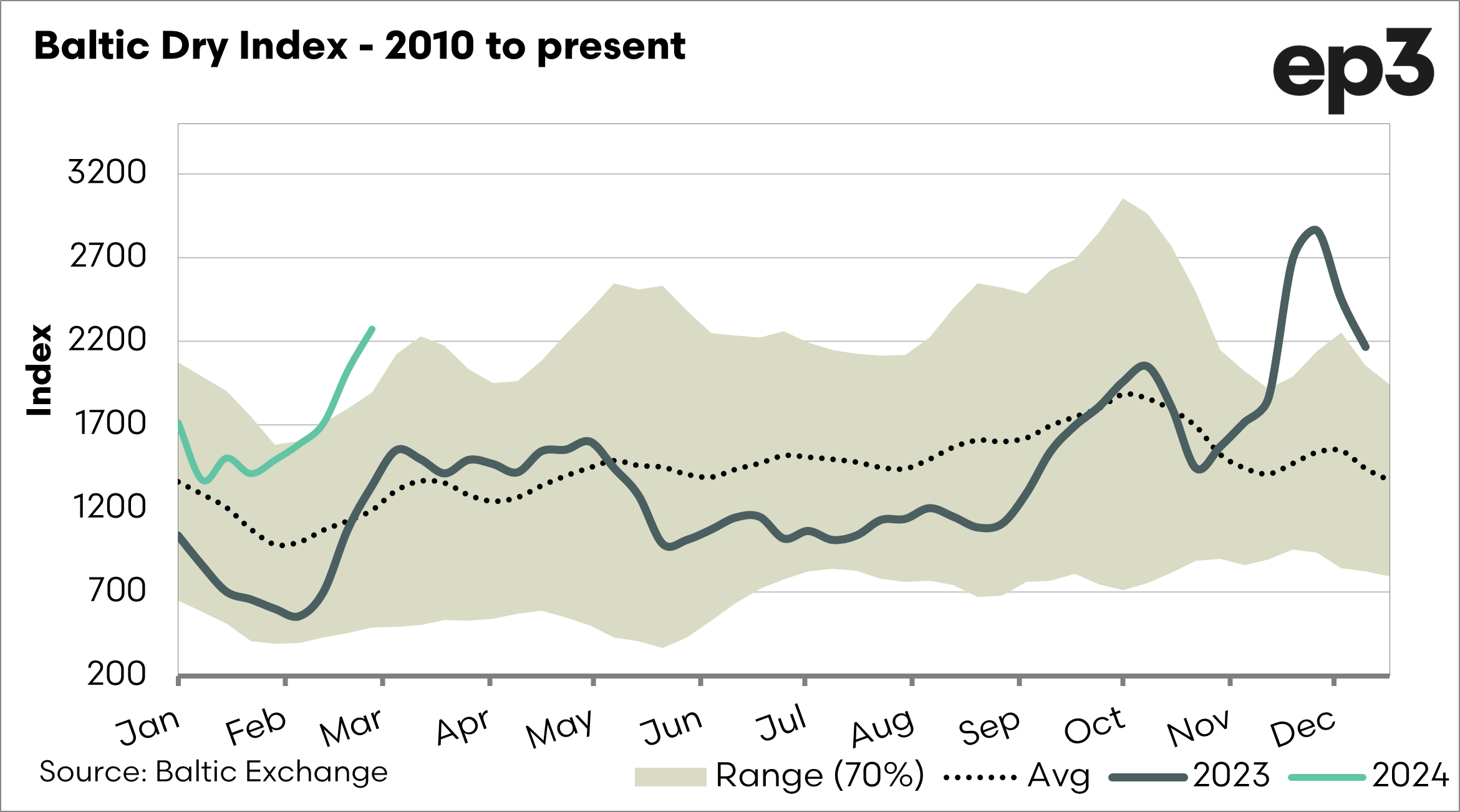

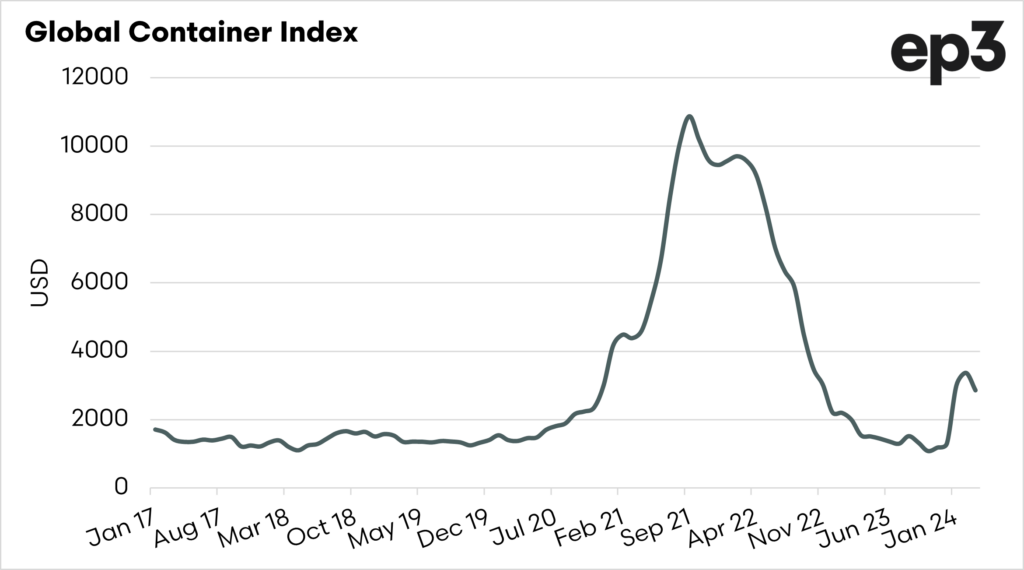

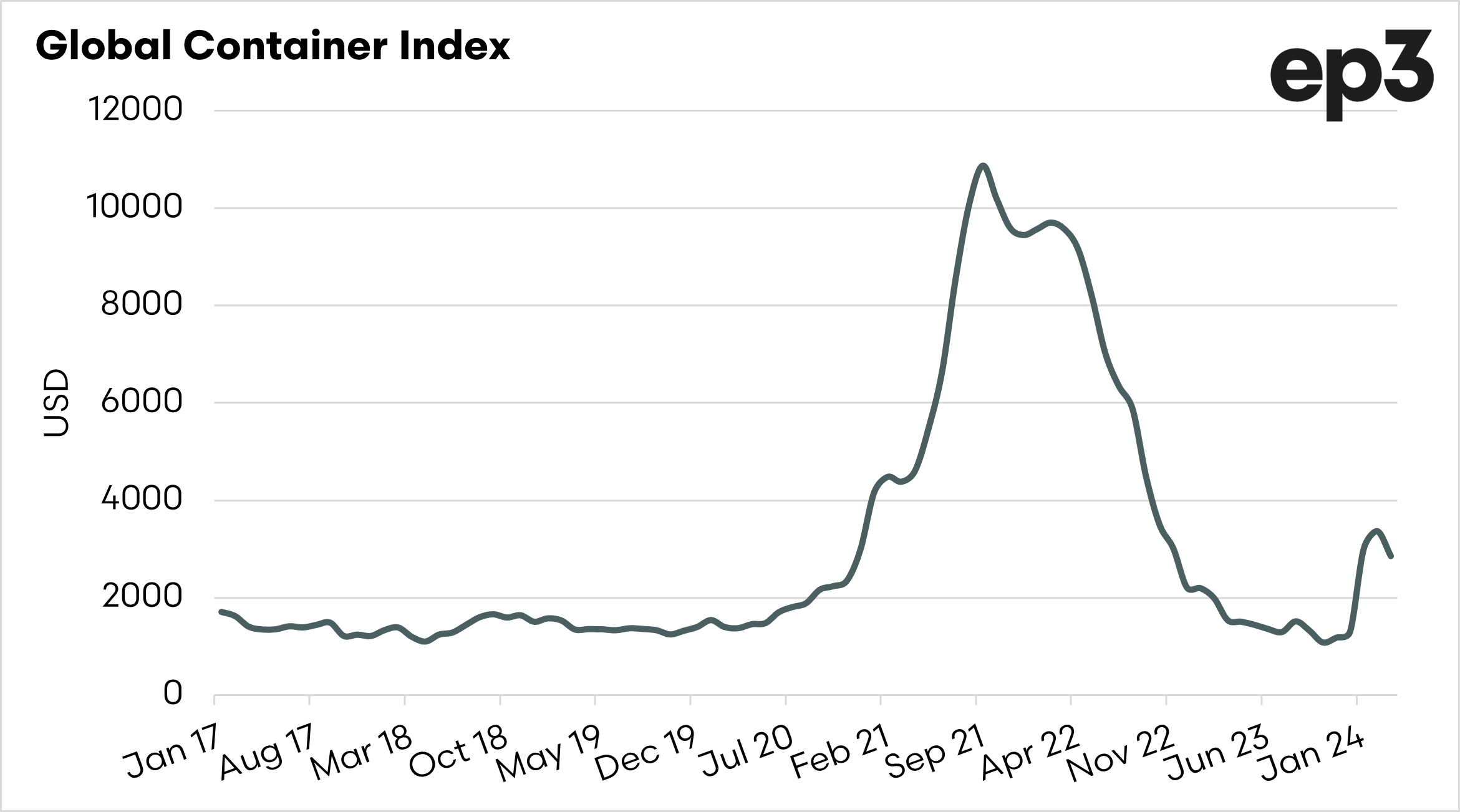

In 2024, the baltic dry index (represents bulk) and the container index increased strongly. +This adds costs to our inputs and the cost of sending our export commodities.