Market Morsel: Urea is cheap?

Market Morsel

The biggest cost on Australian cropping farms is typically fertilizer. This industry doesn’t have a huge amount of price transparency. At Episode 3, we were the first and continue to be the only independent Australian-based analyst of fertilizer markets.

Earlier on in the week, I wrote about the imports of urea. In this article, I wrote about how imports for the year’s first four months were at record levels. What about the price, though?

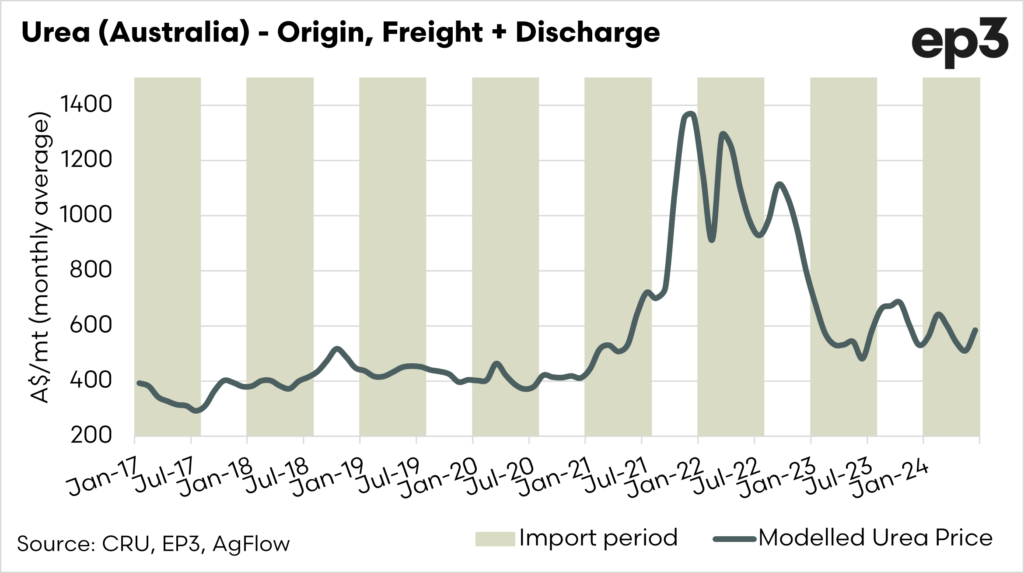

Due to the lack of transparency in the Australian fertilizer market, EP3 produces a landed price model. This is effectively the cost of purchasing urea and having it shipped to Australia.

The purpose of this is to give an indicator of the trend of urea. It won’t be the price you pay on the farm, but it is the price of the urea landed at an average Australian port before additional land costs and margins. To be clear, it indicates the trend of pricing.

In the first chart below, we can see the cost of fertilizer(modelled). The current pricing is between A$575 and 600 landed in Australia for June. This is a rise month on month but significantly lower than the highs of recent years. We are still higher than the pre-COVID average of the low A$400s

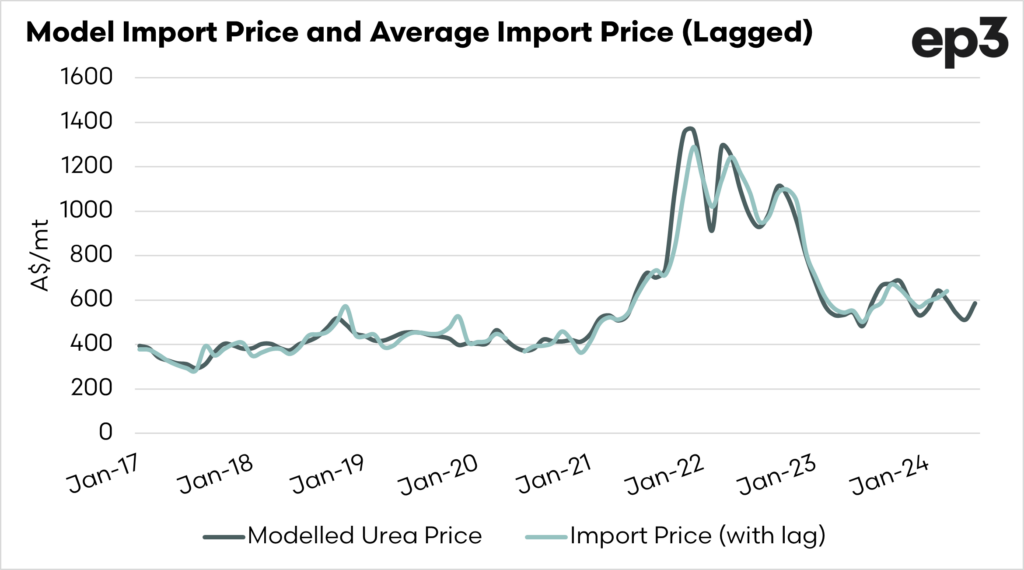

The second chart below shows our model import price against the actual average price as quoted by import statistics. As we can see from this chart, our modelled price follows the import values with a very strong correlation. This gives us faith that our model provides the information which we believe it should.

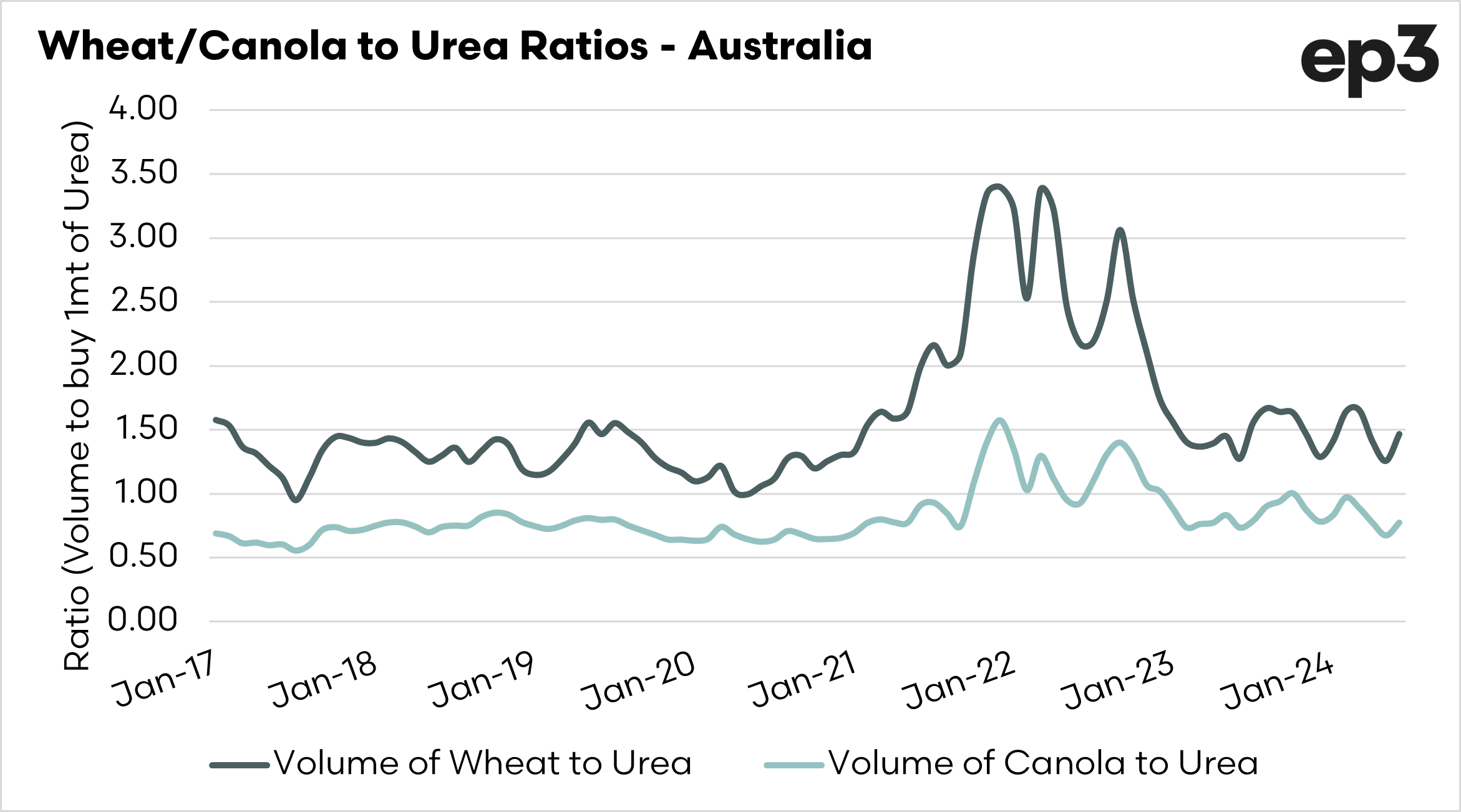

The third chart, and most importantly, is our urea affordability chart. This chart represents how many tonnes of wheat or canola you must sell to purchase 1 tonne of urea.

The affordability of urea has dropped back to long-term average levels. This is due to the falling urea price and the relatively higher grain prices.