Market Morsel: Urea prices drop

Market Morsel

At EP3, our analysts have long been discussing the importance of transparency in the fertiliser market in Australia, even before we set up this business. Shortly after setting up EP3 (at the time TEM) in 2020, we launched the first publicly available cost and freight model for urea in Australia.

This was produced so farmers could be aware of the trend of fertiliser pricing in Australia, which is the same kind of information you would get about any other agricultural commodity. This was especially important in recent years when fertiliser prices rose sky-high.

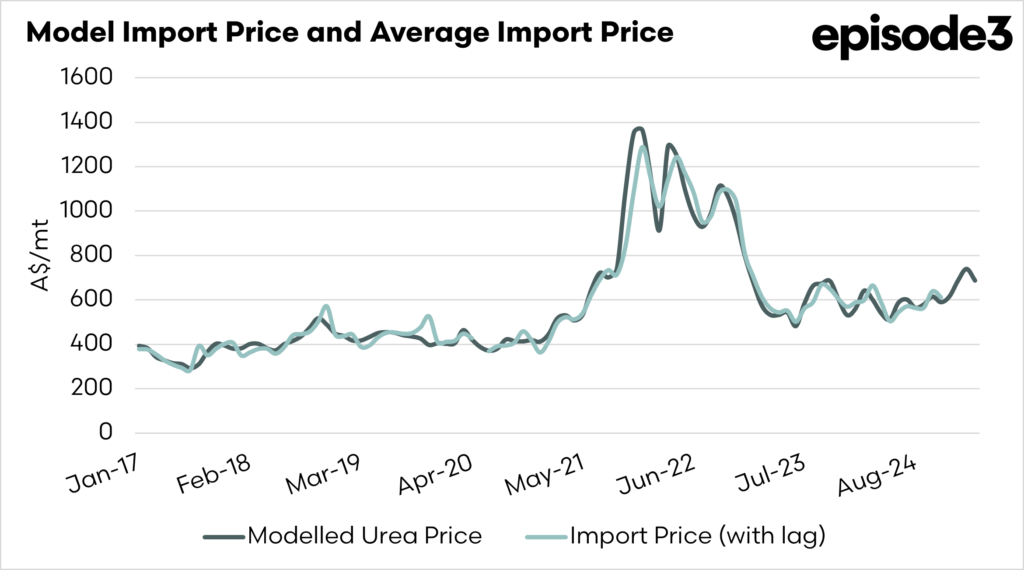

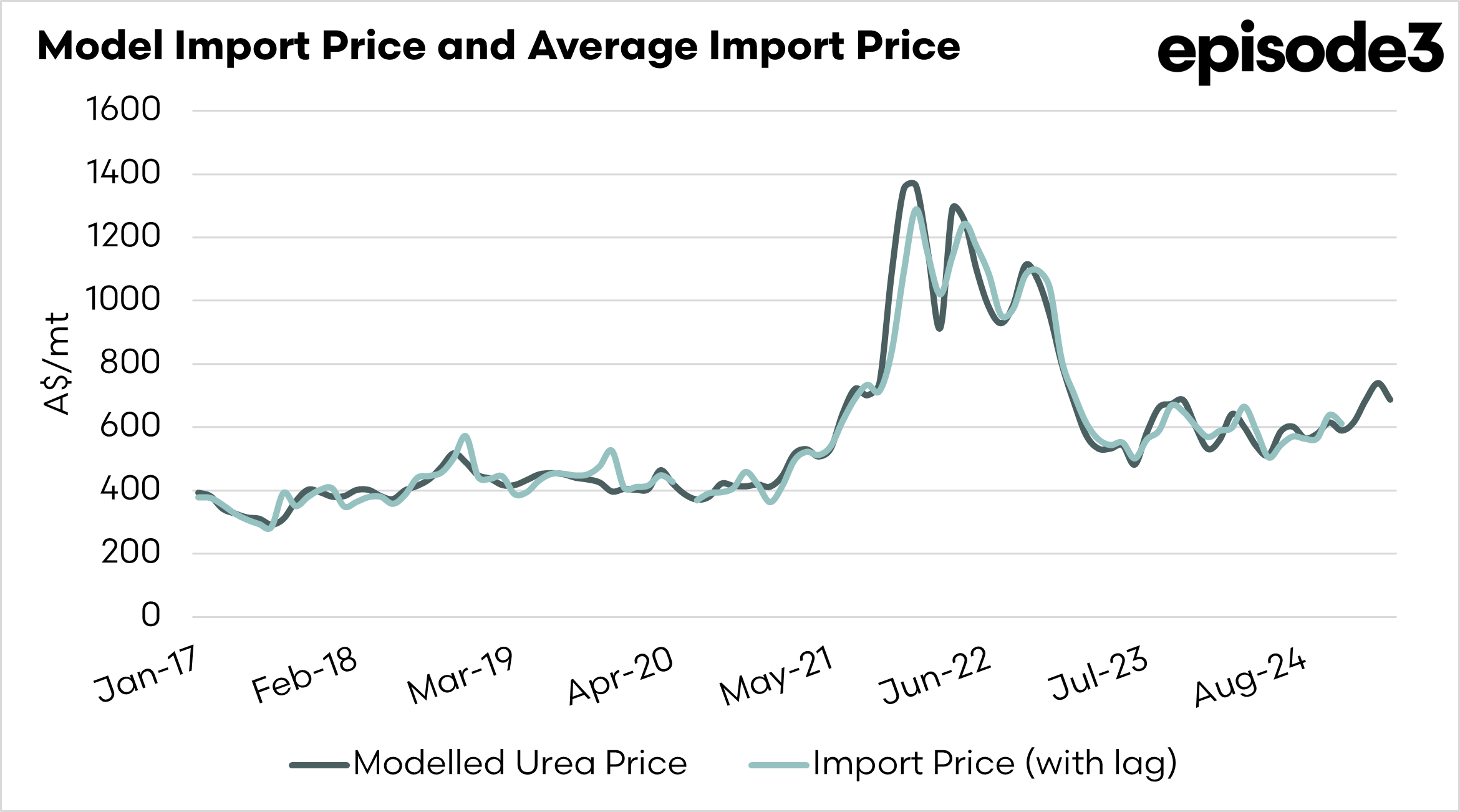

In order to improve transparency in the Australian fertiliser industry, we produced a cost, freight and unloading model.

We take the price of urea at the origin, add freight to Australia, and an unloading cost. This gives us an indication of the cost of getting urea to Australia, it is important to note that this is not a delivered price. On this website, we provide this on a monthly basis publicly and more regularly to our private clients.

In the first chart below, we can see the urea model. Based on our model, urea’s price has moved from approximately A$740 to A$690 in March compared to February. A large part of the fall is due to India not really coming to the table in its most recent tenders.

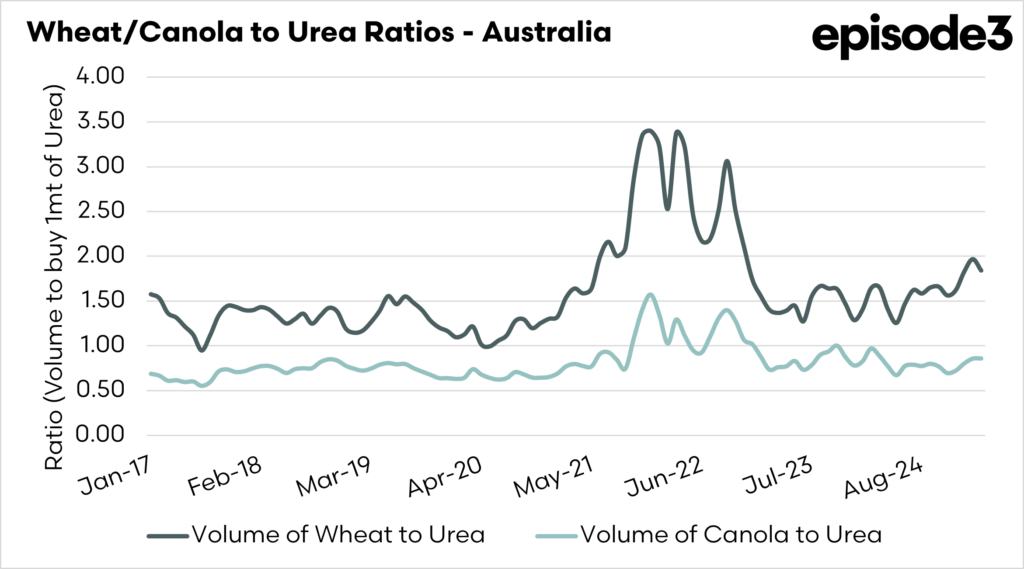

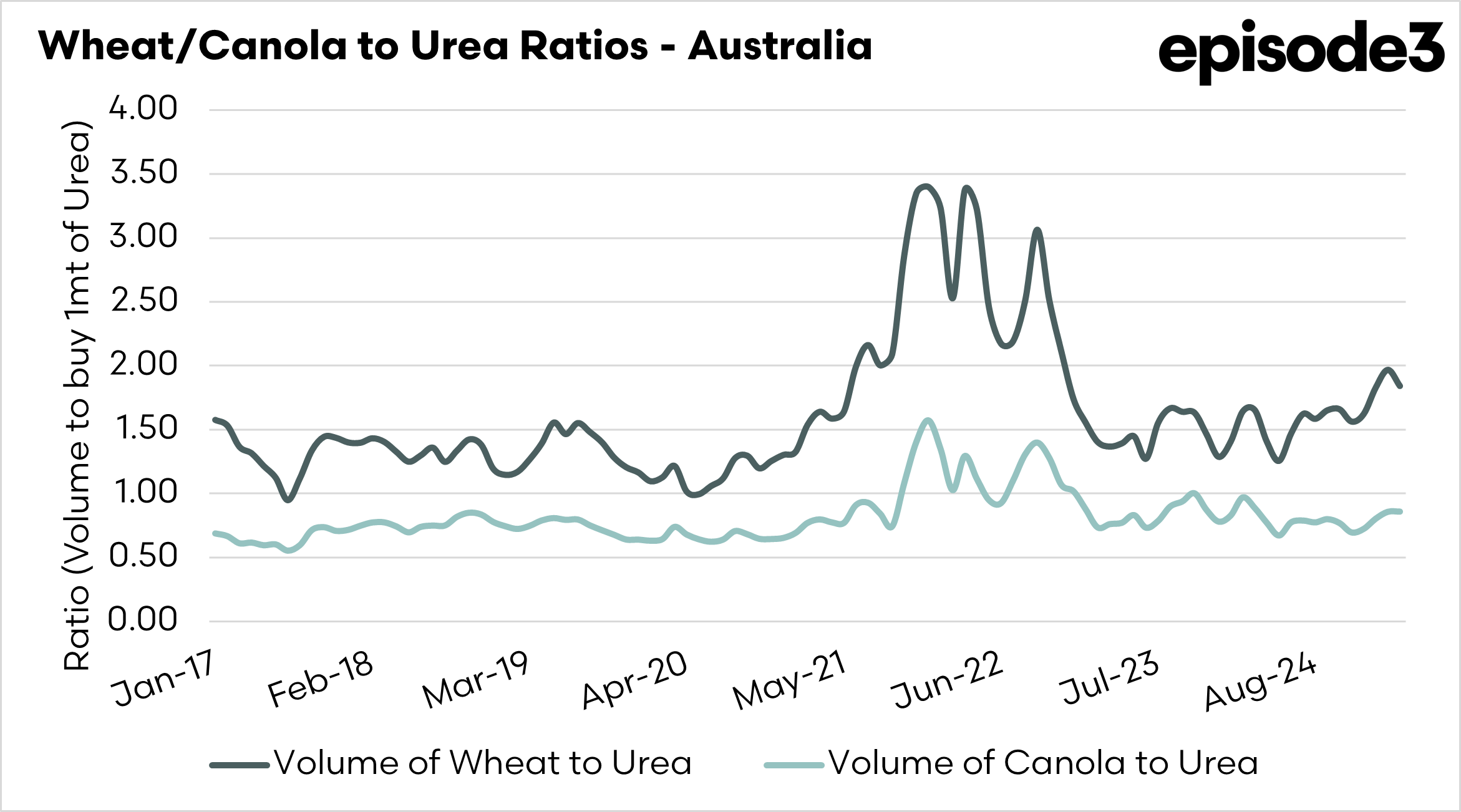

The second chart shows the urea affordability ratio. This shows how much grain you need to sell to buy a tonne of urea. Urea remains affordable compared to canola, but in recent times, price declines have seen affordability drop in wheat, although with a slight improvement in March.

It is good news to see overseas values drop in urea. Hopefully, some of that will be reflected in local pricing levels. Let us know the prices you are being offered by filling in our census by clicking here