No use crying over spilled diesel.

The Snapshot

- Diesel prices have started to fall, kind of.

- The average wholesale diesel price is A$1.90/l

- This is well above the last decade average of A$1.27/l

- Diesel is at a premium of 9% over petrol, which is better than recent months at around 30%.

- The high diesel prices could start to stimulate a reduction in demand.

- Let’s hope we can see some reduced diesel pricing as we move into seeding.

The Detail

Wollongong to Echua (to the haggis factory), then down to Melbourne. Apart from the terrible car karaoke, the worst thing about a road trip with Matt is the cost of diesel. It’s still frightening.

Let’s get into it.

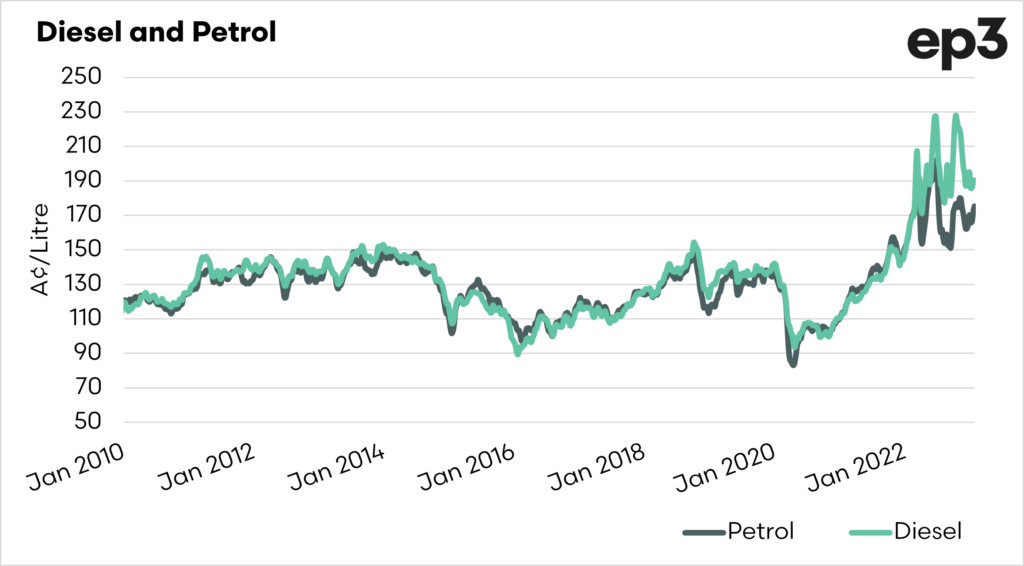

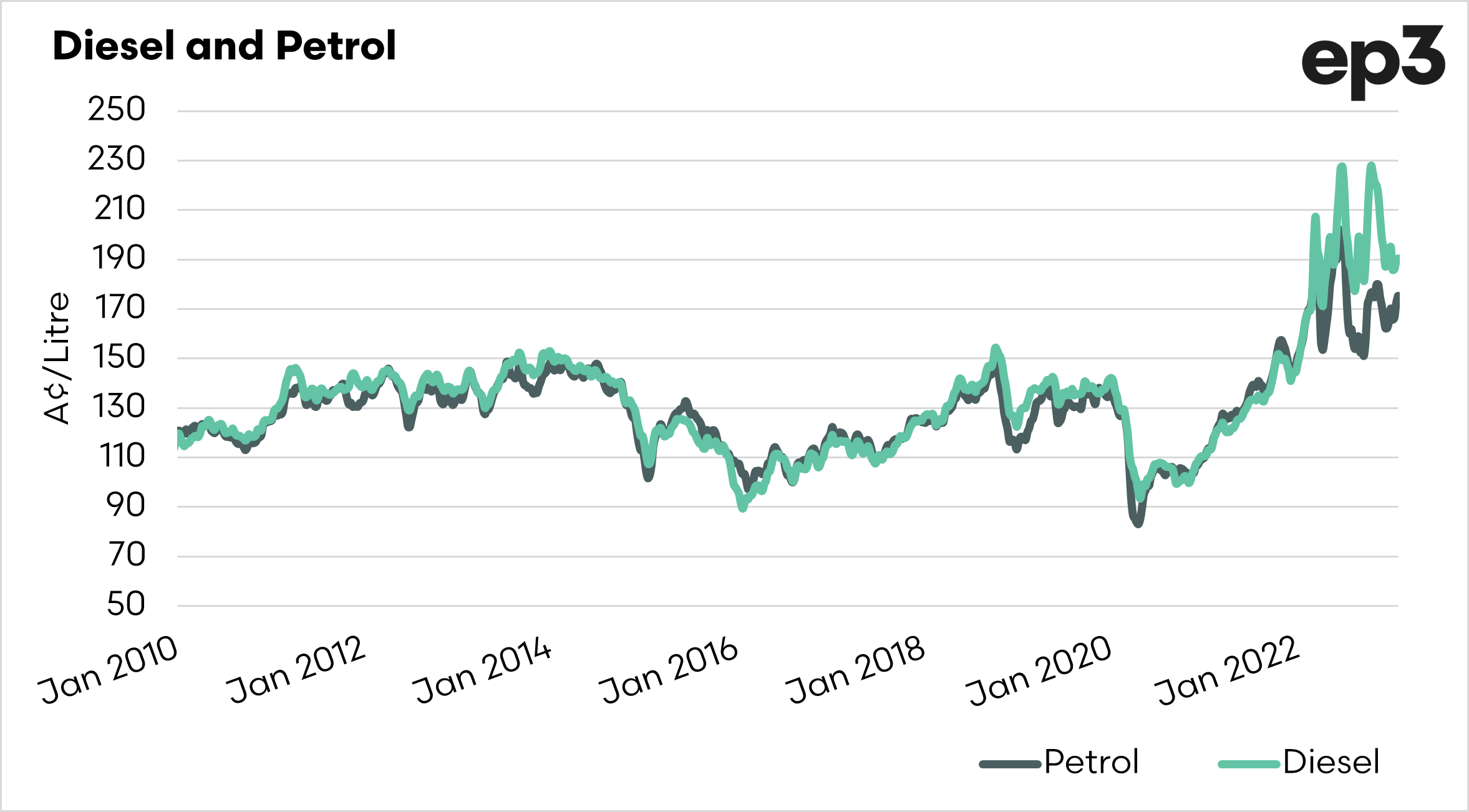

The chart below shows the cost of Australian fuel. It is important to note that this is an average which we have produced of the terminal pricing in each state. There is a bit of variance between states, and if anyone wants specific state-based charts – get in touch.

The diesel price has fallen in recent months, in line with the fall in crude oil pricing. However, one thing to take into consideration is that it has fallen to A$1.90/l (remember at terminal). Phew, it’s fallen and it’s cheap.

It’s odd to think that these prices are a bit of a relief when the reality is that the average price of diesel over the past decade was A$1.27/l! It just goes to show how quick perceptions change on price.

When we are looking at markets, we are looking at the past and trying to view trends. The chart above in the past clearly shows petrol and diesel having a close relationship, with them trading at very similar levels.

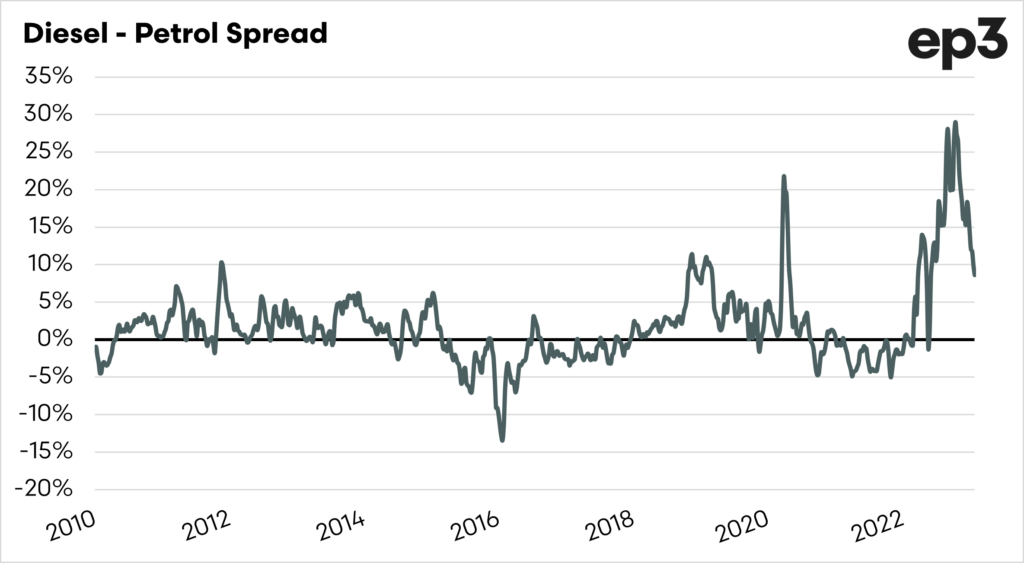

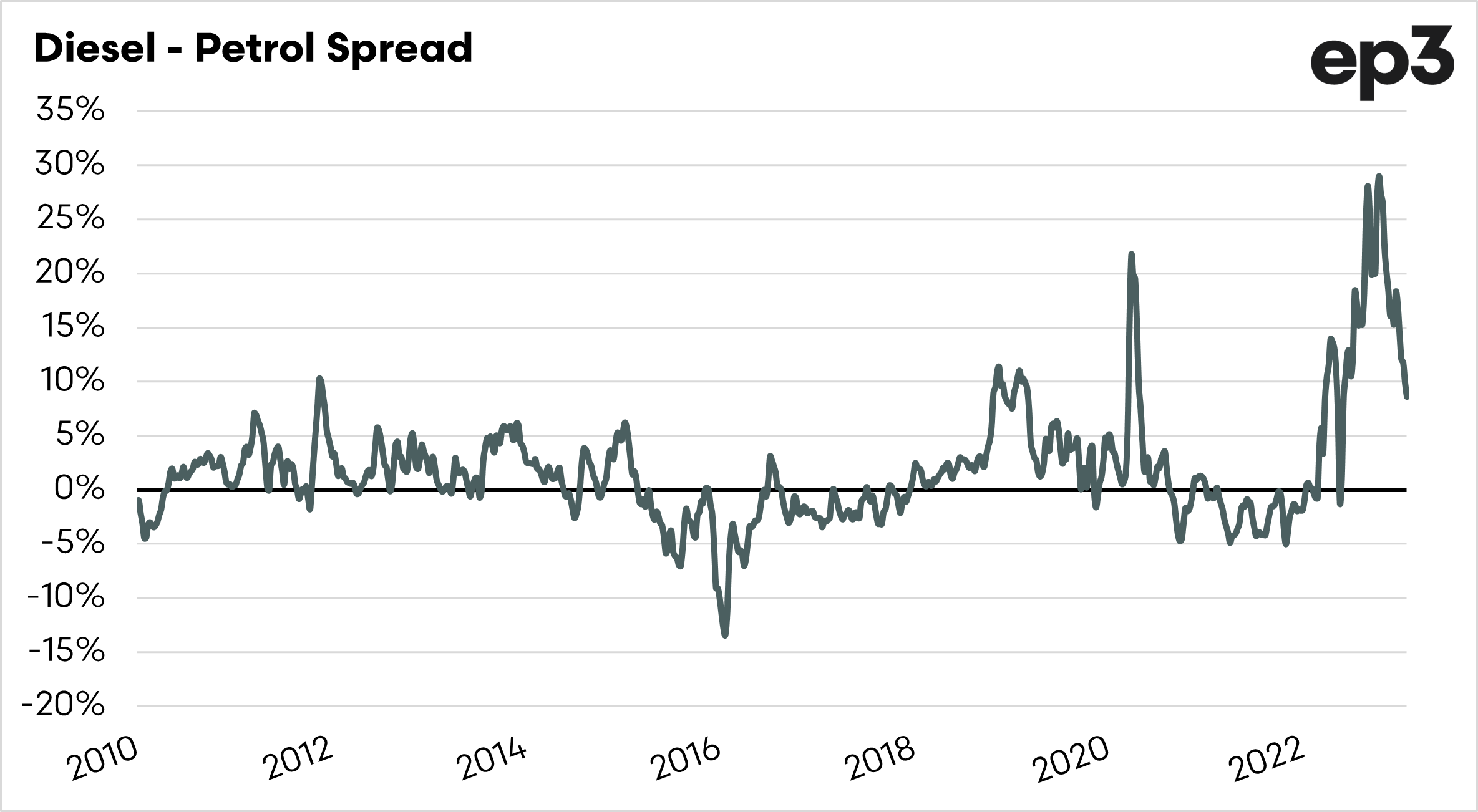

Let’s look at that spread below. In recent times, Australia has seen diesel move to a premium of 30% over petrol. Luckily it has started breaking back down towards more normal levels, at a current premium of 9%.

It doesn’t really make all that much sense, because diesel is cheaper to produce than petrol. There are a number of reasons used for the increase, including the old one of the Russian invasion of Ukraine causing increased demand for diesel for power generation in Europe.

The other concern is whether the wholesale terminal price falling is being passed onto the retail market.

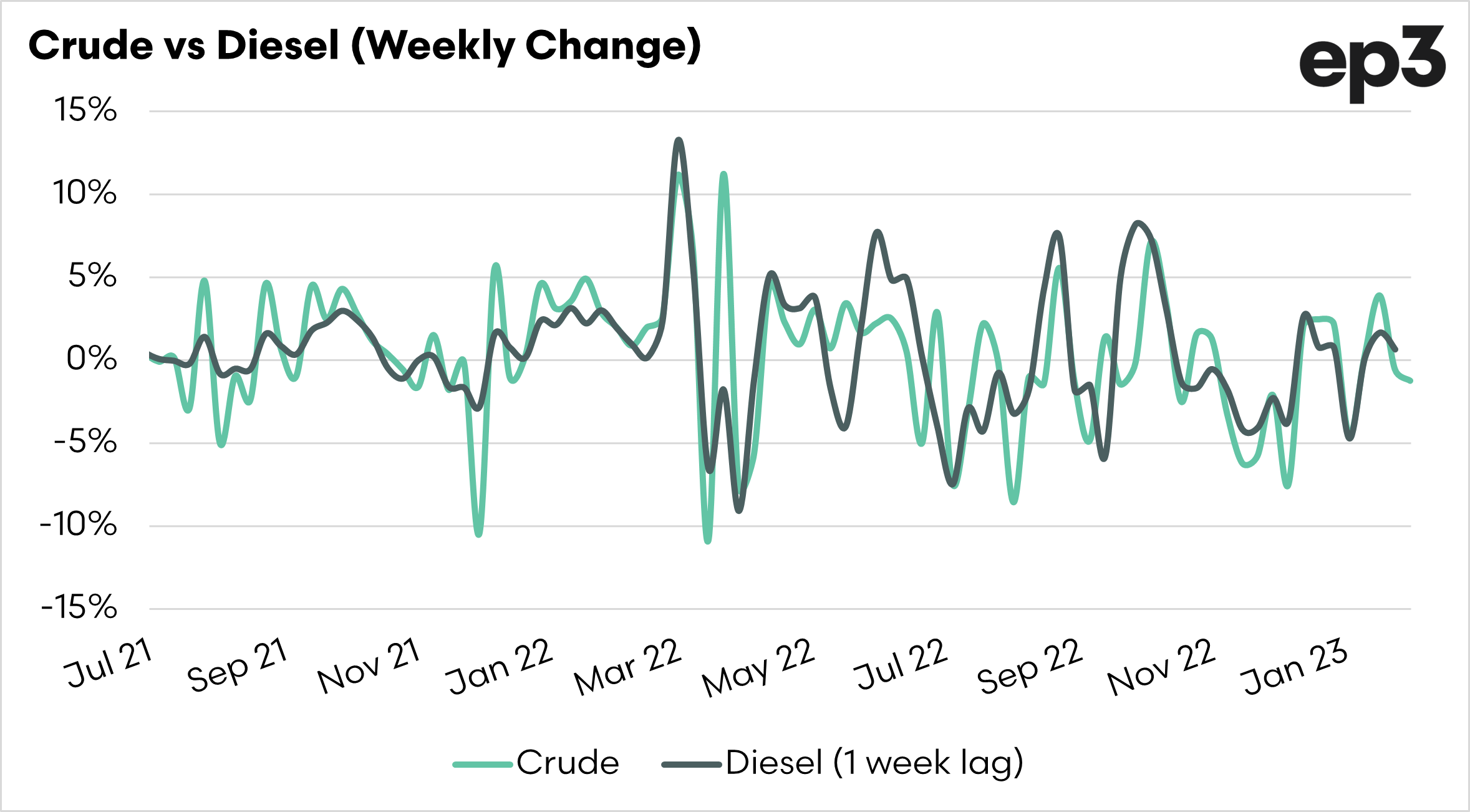

The chart below shows the change in price on a weekly basis between the crude oil price, and the cost of diesel at the terminal.

When we lag the change in price, they do tend to follow somewhat of a pattern. However, it is important to note that this pricing is wholesale and not retail.

The majority of diesel consumption goes into industrial processes (mining etc), with only 30% being for regular punters.

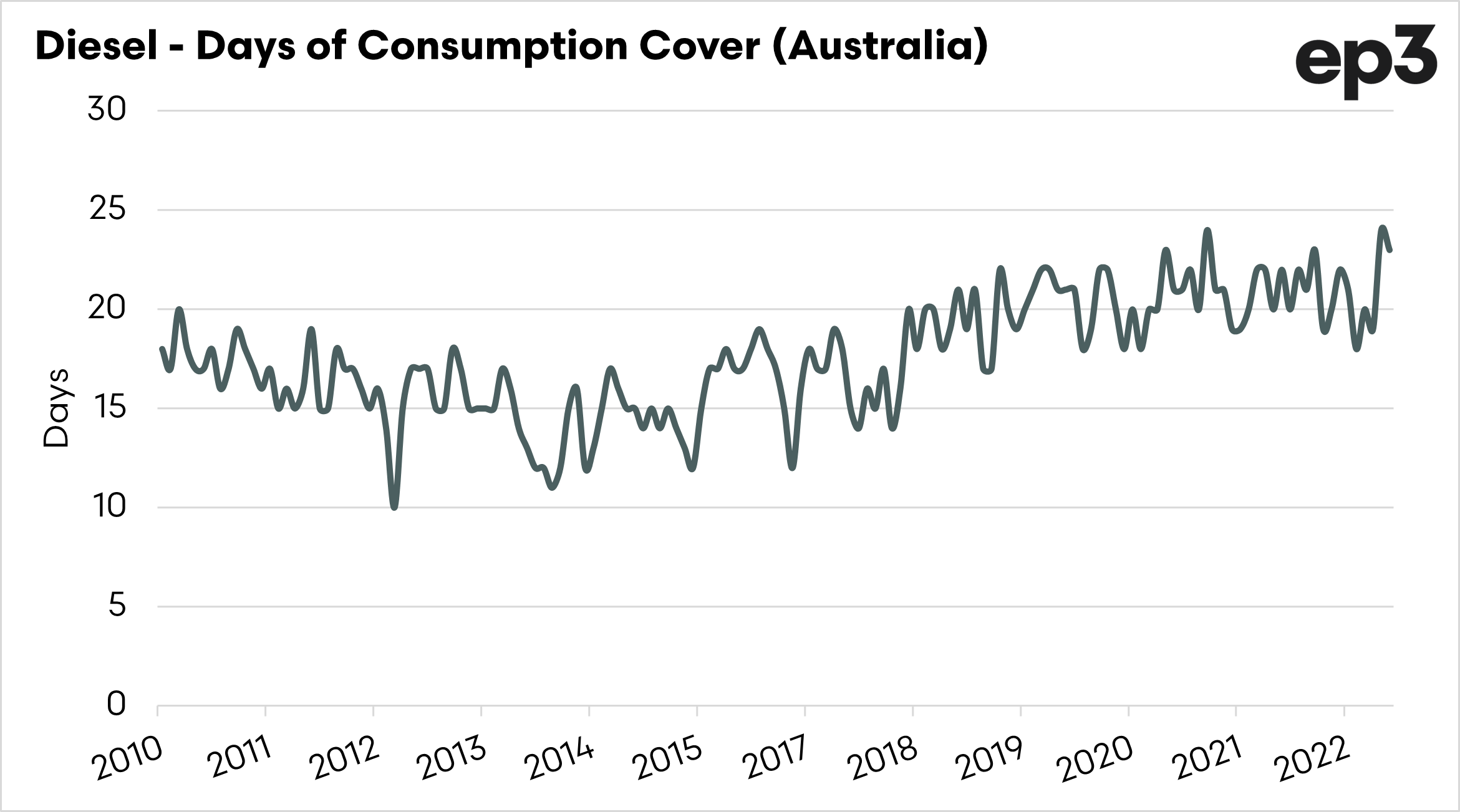

In recent years people have been concerned about national fuel security. There have been all the logistical challenges of COVID and the conflict in Ukraine.

We need to make sure we have stocks on hand of key commodities, with diesel being one of the most important ones.

The chart below shows how many days of consumption Australia has on hand, with the most updated month being November.

In November, there were 23 days of consumption on hand, one day short of the record 24 days in October 2022.

My questions for the coming months are, will the retailers pass on the wholesale price and will we start to see reductions in demand for diesel?