Say goodbye to Chinese fertilizer?

The Snapshot

- China has introduced a raft of changes to discourage exports.

- Environmental laws have been relaxed to encourage production.

- Subsidies for selling into the domestic market through cheaper logistics have been introduced.

- Local governments have banned state-owned enterprises from exporting fertilizer.

- We import only small quantities of Urea from China.

- We are reliant on MAP/DAP from China.

The Detail

It was only on Monday that we last covered fertilizer and the huge increases in prices caused by a myriad of different factors – mostly black swan events that were unforeseen.

On Monday night, there were further upsets, enough to warrant further updates.

In August, I had covered the potential of a Chinese ban on the exports of fertilizer. It now looks like this is occurring, at least to an extent.

Last week the Chinese national government announced that there would be a raft of changes to the policy in regards to fertilizer production. These were intended to assist in keeping down domestic prices:

- Reduce the cost of freight for fertilizer going to the domestic market.

- Increase the number of inspections of export cargoes.

- Reduce some of the environmental red tape, allowing plants to operate at higher capacities.

- It guarantees access to power.

- Access to state reserves of feedstocks.

Subsequently, local governments have joined the party. These local governments have mandated that all state-owned enterprises producing fertilizer now cease exports. It is important to note that this mandate only applies to state-owned fertilizer companies.

However, there is concern that this could leak through to private enterprises who may not want to get on the wrong side of the government consensus.

So what does this mean?

It’s important to look into what impact this reduced trade flow may have on Australia.

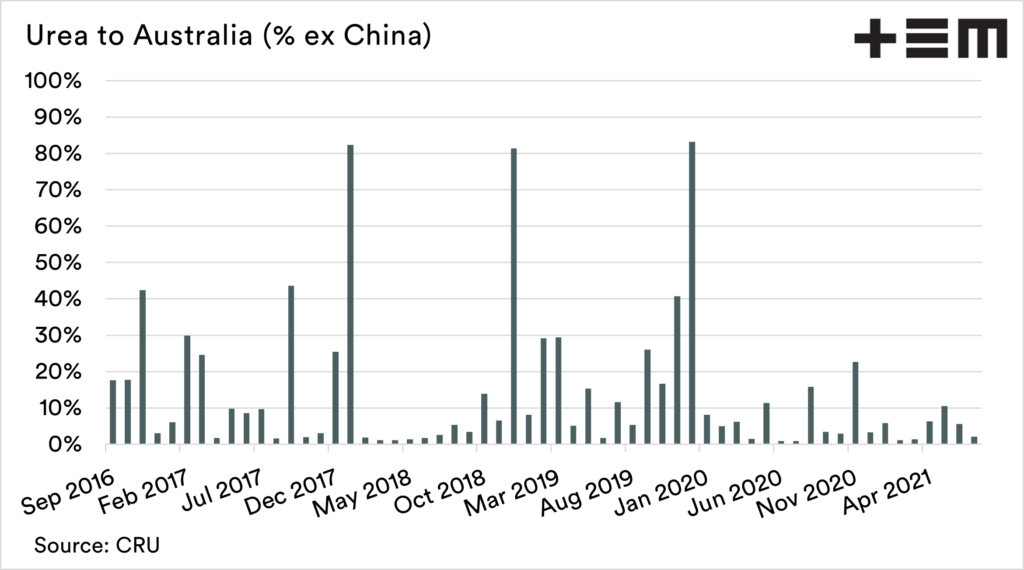

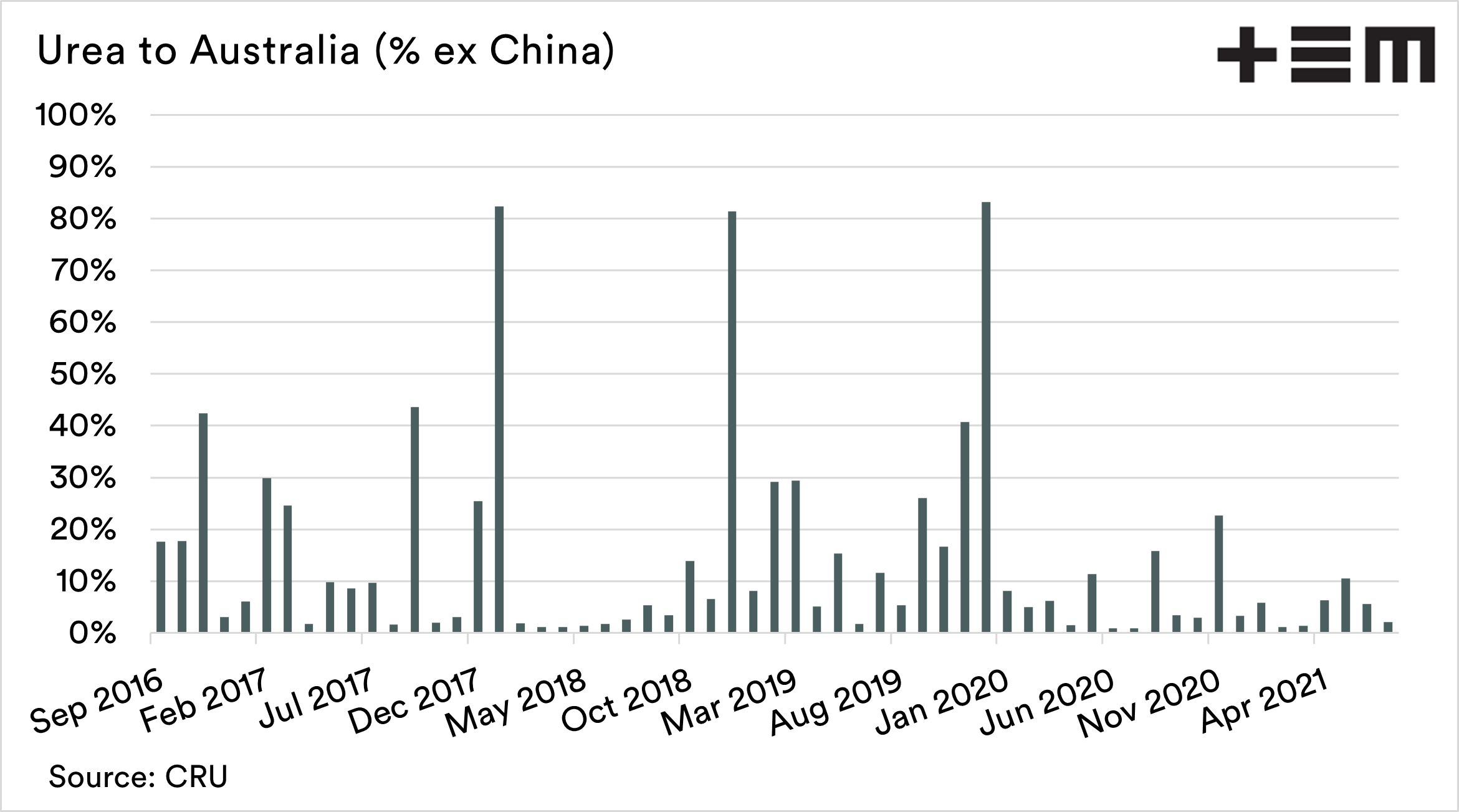

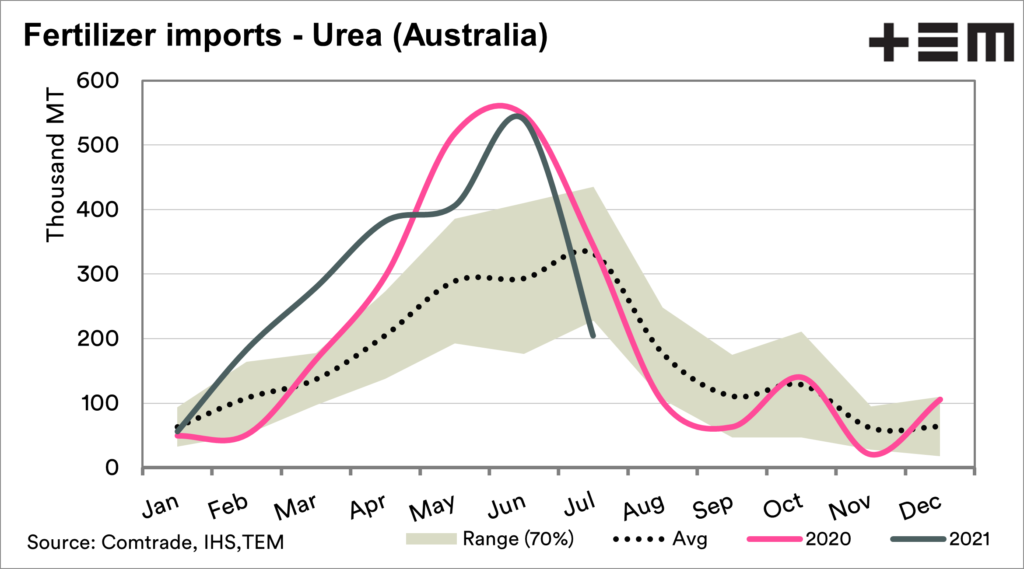

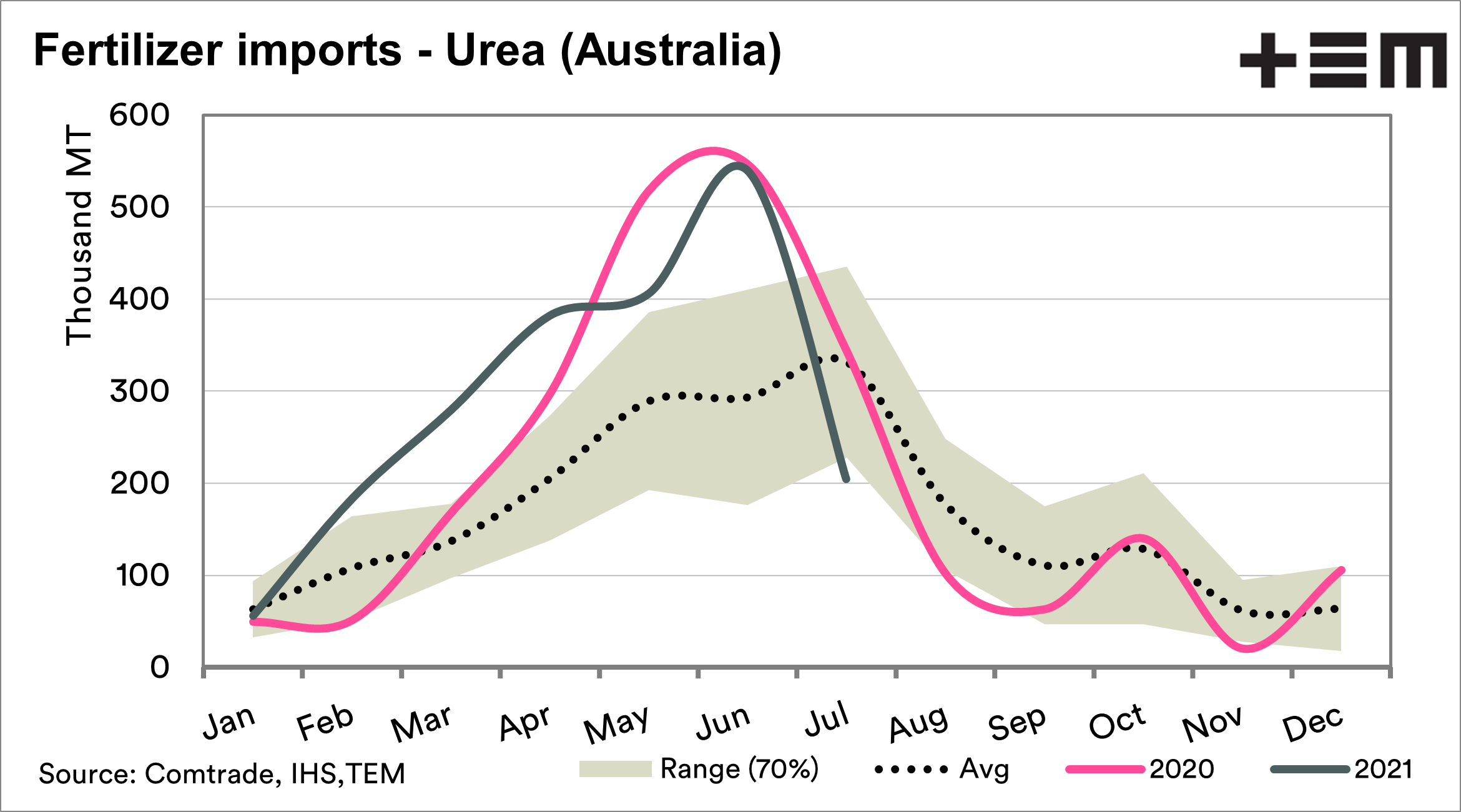

Urea:

On a monthly average, we have imported approximately 14% of our urea from China. However, we have had months where the volume has been as high as 83% and as low as 1%.

Luckily, we do not rely on China as a supplier for our urea, with most coming from the middle east.

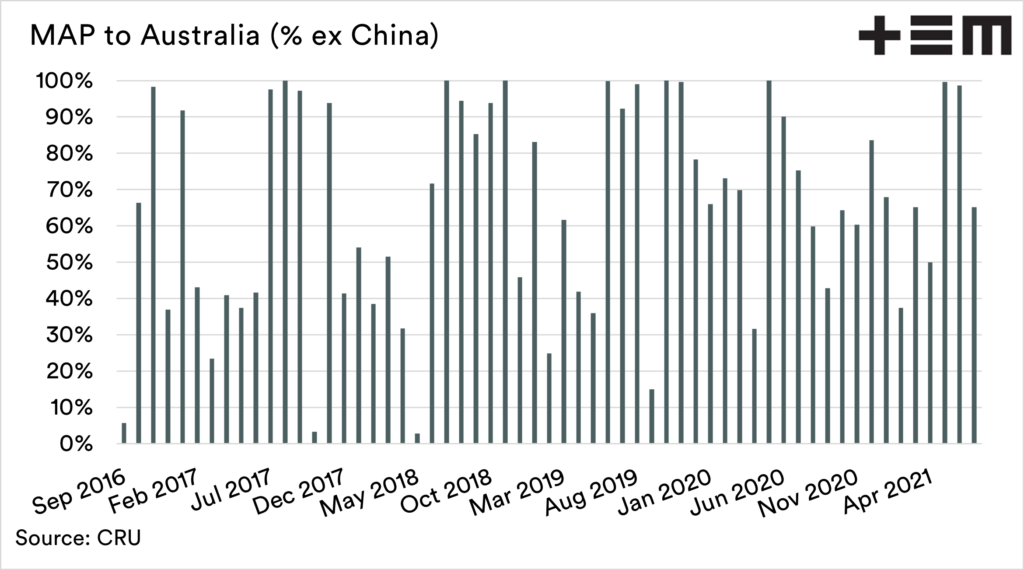

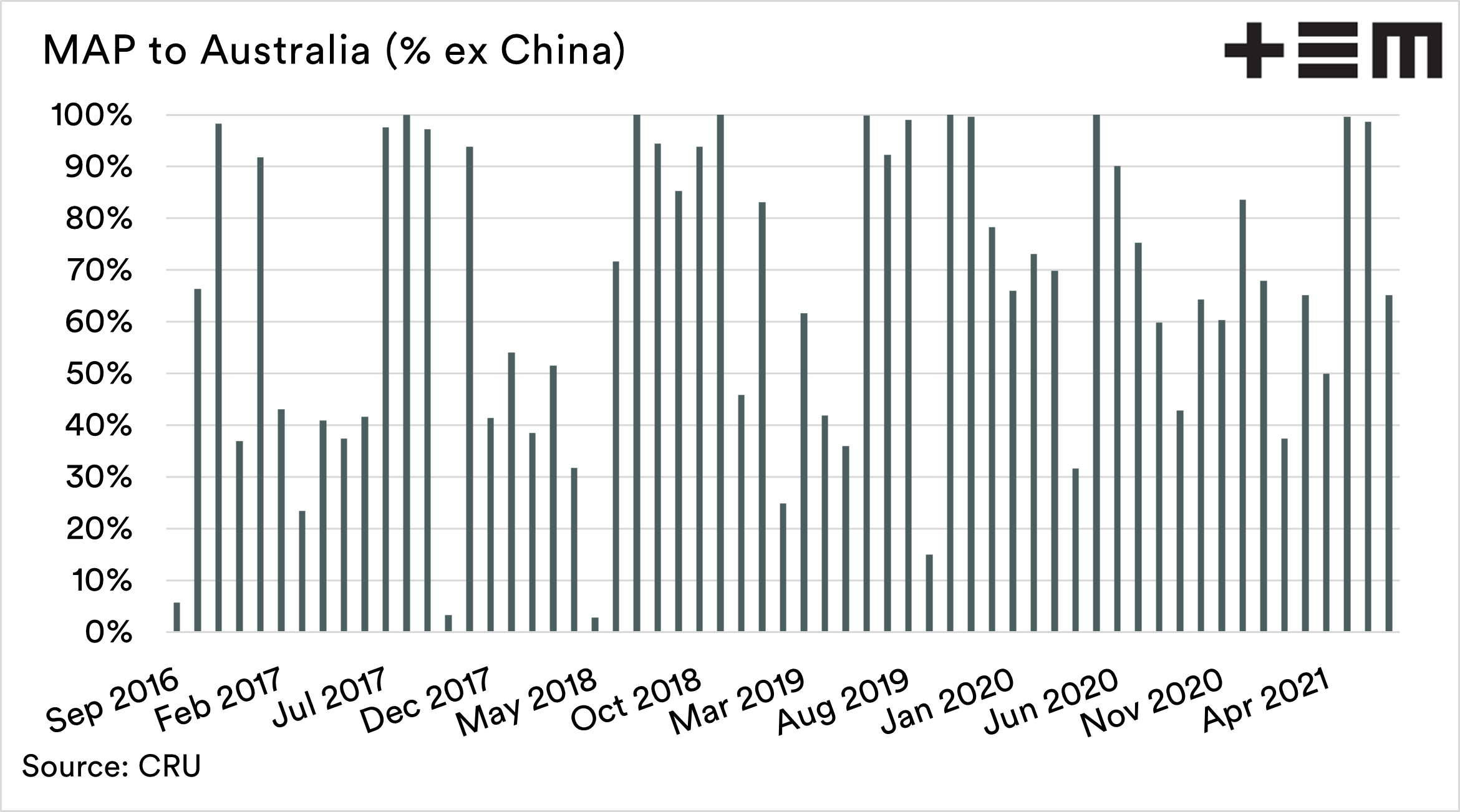

MAP:

We have a much bigger reliance on China for our supply of MAP/DAP. On a monthly average, we import 65% of our MAP from China. On a number of periods, Chinese volume has represented >70% for extended periods.

What’s going to happen?

Prices are liable to remain quite high for the foreseeable future. The likelihood is that based on the indicators driving fertilizer pricing that we will be in a high priced environment right through until seeding.

Australian importers are likely going to have to look at switching origins for our DAP/MAP, but with Urea there will likely just be a slight reshuffling.

I don’t think we will struggle with access. There always seems to be ‘scarcity’ calls every year for fertilizer, and we somehow always manage to get access to our overall requirements. Even throughout the COVID crisis, we have still been able to import large quantities of fertilizer.

We don’t like reporting on a rising fertilizer market, but we want to ensure you the reader is prepared. Sorry.

If you liked reading this article and you haven’t already done so, make sure to sign up for the free Episode3 email update here. You will get notified when there are new analysis pieces available and you won’t be bothered for any other reason, we promise. If you like our offering please remember to share it with your network too – the more the merrier.