The Baltic Dry Index has sunk.

The Snapshot

• The Baltic Dry Index (BDI) is first and foremost an indicator of the cost of bulk shipping.

• The BDI is also a leading economic indicator. When the BDI is high, it points to improving economic conditions (and vice versa).

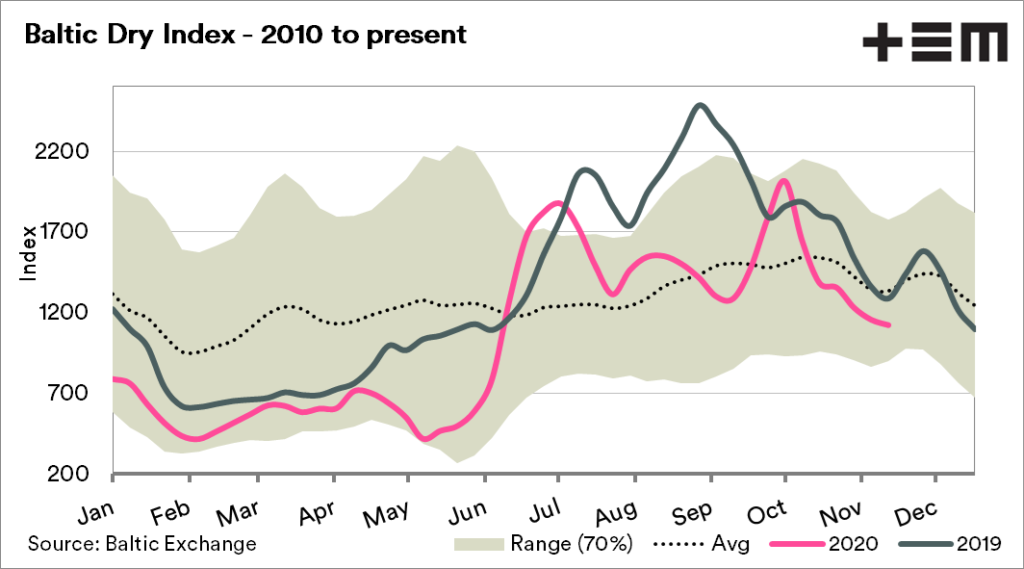

• The BDI rose through September/October, but has lost all the gains and has fallen back to peak Covid-19 levels.

• Lower freight costs assist in finding markets for the large Australian crop, as it reduces geographic advantages.

The Detail

The Baltic Dry Index (BDI) is a crucial indicator in the commodity trade. It is important for two reasons. Firstly as an indicator of freight, and secondly as a leading economic indicator.

This article will briefly explain both purposes and highlight the current situation.

Freight

First and foremost the BDI is an indicator of the cost of shipping bulk commodities. In Australia, we export a large volume of bulk materials, from grains to ore. Therefore the cost of freight is an important factor in our trade.

This index tracks 20 routes, over three different dry bulk vessel classes (capesize, panamax & supramax). The exchange gathers assessment of freight rates from a qualified panel, to then form the index.

Economic Indicator

The BDI also holds a further, and equally important role. Many economists consider the BDI to be a leading economic indicator.

As mentioned previously, the BDI represents bulk cargoes, which typically require further processing. A good example is iron ore, which is shipped to other nations to produce steel. A higher BDI signifies increased demand for bulk vessels, and as a proxy for the materials which they transport.

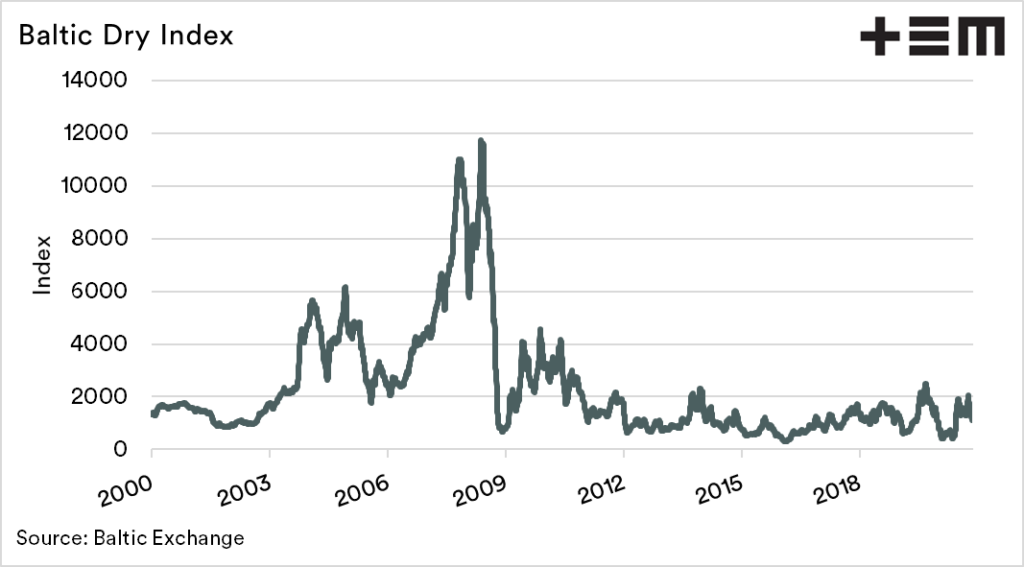

A higher BDI, therefore, points to an indication of future economic growth and vice versa. This can be seen in the early 2000’s during the commodities boom. During this period of accelerated economic growth, there was a massive demand for bulk carries which drove the BDI to a record 11793.

Whilst important for judging freight, it is essential to understand that this indicator is an indicator of the health of the global economy.

What does it all mean?

The Baltic Dry Index rose strongly during September/October; it has subsequently capsized losing all the gains and returning to the levels at the height of the first wave of COVID-19. This lower freight rate helps Australian grain reach destinations further away, which is beneficial in a year with large surplus stocks.

At the moment the BDI is mostly following the seasonal pattern for this time of year. The big question will be if we see continued low levels as we move into the new year.

There is plenty of optimism of the recovery of the global economy, but at present large swathes of the world are still under forms of lockdown. The reality is that fiscal stimulus is propping everything up, will the recovery be more contracted?

The BDI may provide an indicator of the recovery (or not).