The Baltic Dry Index

The Snapshot

- The Baltic Dry Index (BDI) is first and foremost an indicator of the cost of bulk shipping.

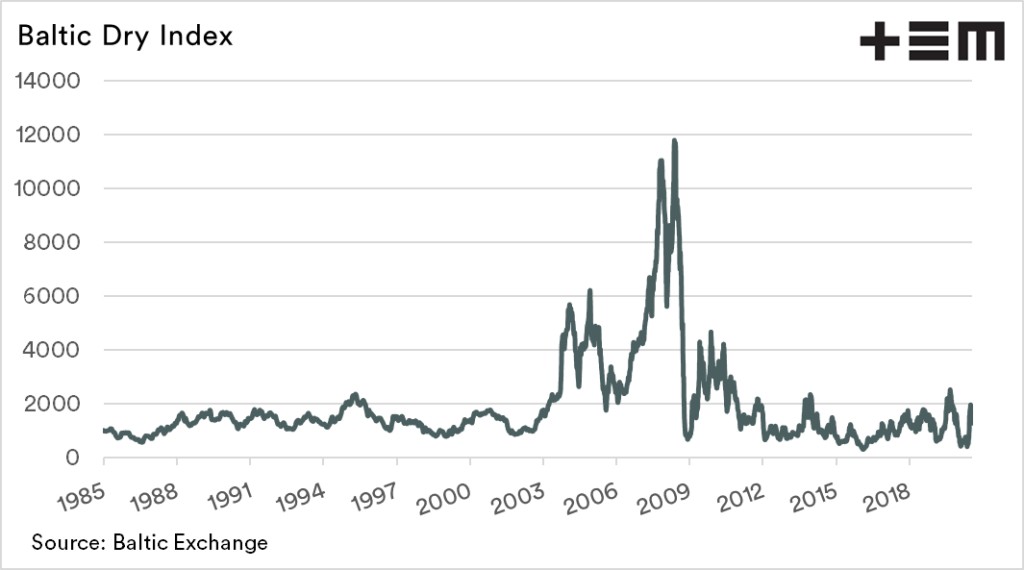

- The BDI reached its peak during the commodities boom of the 2000’s when it reached 11793.

- Since 2015 the BDI has averaged 1026.

- The BDI is also a leading economic indicator. When the BDI is high it points to improving economic conditions (and vice versa).

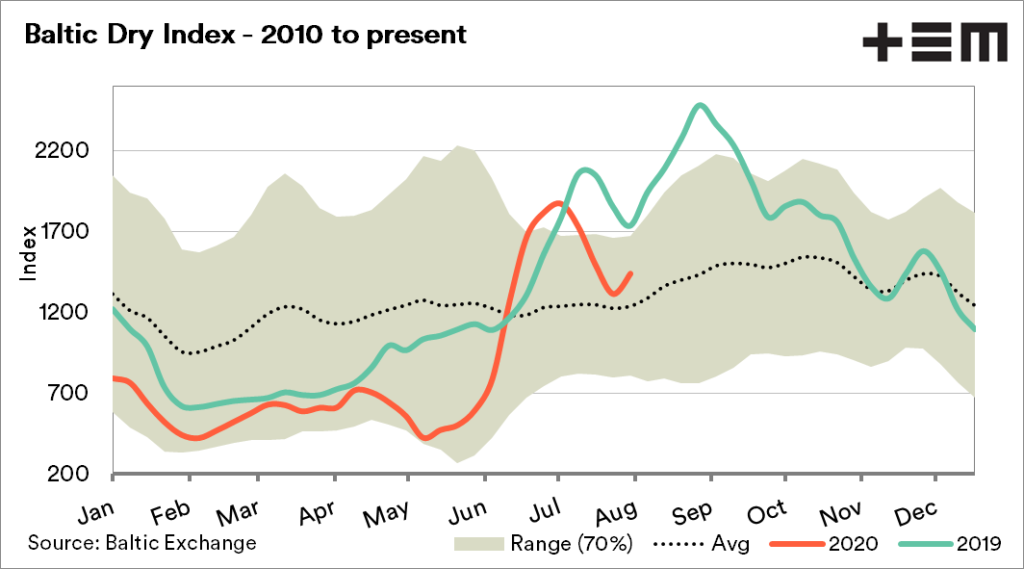

- During 2020 the BDI has followed a similar seasonal pattern as 2019, albeit at a lower level.

The Detail

The Baltic Dry Index (BDI) is an indicator, which I have for many years regularly kept track of. It is important for several reasons, especially for those involved in bulk industries such as grain or fertilizer.

So what is it?

The BDI is an indicator which is released daily by the Baltic Exchange in London. This index tracks 20 routes, over three different dry bulk vessel classes (capesize, panamax & supramax). The exchange gathers assessment of freight rates from a qualified panel, to then form the index.

The index, therefore, provides a guide to the cost of shipping bulk goods such as grain, minerals or fertilizer around the world. Through using the BDI, we are able to gain an insight into whether freight is becoming cheaper or more expensive.

As an example of the importance of freight rates to general pricing, when the cost of shipping increases, then this makes geographic advantages critical.

Alternate purpose?

The BDI also holds a further, and likely equally important role. The BDI is considered by many economists to be a leading economic indicator.

As mentioned previously the BDI represents bulk cargoes, which typically require further processing. A good example is iron ore, which is shipped to other nations to produce steel. A higher BDI signifies increased demand for bulk vessels, and as a proxy for the materials which they transport.

A higher BDI therefore points to an indication of future economic growth, and vice versa. This can be seen in the early 2000’s during the commodities boom. During this period of accelerated economic growth, there was a massive demand for bulk carries which drove the BDI to a record 11793.

How has it been performing recently?

The BDI has performed surprisingly well during 2020. The BDI has followed a similar trend to last year, albeit at a lower level. In May the BDI, substantially fell against 2019, however, show strong growth through June as Chinese demand for iron ore fed the freight market.

While July has experienced a downtrend, again in a similar pattern to last year, the demand in recent months points towards improving manufacturing in China.