The Fert Bullets

New Updates

Episode 3 has been reporting on Australian fertiliser markets for a long time, and in this update, we are changing the format slightly, to become our weekly updates. Our format will cover the main points impacting the fertilizer market, along with updates on local pricing and imports.

Our fair value model for pricing, which has recently been revised and improved after the you all filled in our fertilizer census, which you can continue to fill in here

Market Drivers

Severe Supply Disruptions Due to Middle East Conflict

The ongoing Israel–Iran conflict has halted all urea and ammonia production in Iran (about 500,000 tonnes/month) and Egypt (about 400–500,000 tonnes/month of potential exports), abruptly removing over 1 million tonnes per month from global supply. Further escalation could tighten the supply even more.

Surge in Urea Prices and Market Panic

Urea spot prices have surged sharply across all export regions. Vietnam sold a cargo destined for Australia. Many buyers are struggling to get offers from manufacturers.

Breakdown of Normal Trade Flows and Tender Failures

India’s tender for 1.5 million tonnes of urea saw its lowest offer at $399 USD/t CFR (A$614/mt), but that price quickly became unworkable as the market moved higher. Sellers are withdrawing or refusing to commit, and major buyers in Brazil and Turkey are struggling to secure cargoes amid escalating prices.

Pricing

The fair value model, which we have been producing on a monthly basis for years, has now been updated to a weekly model. This model calculates the fair value cost of urea imports into the country.

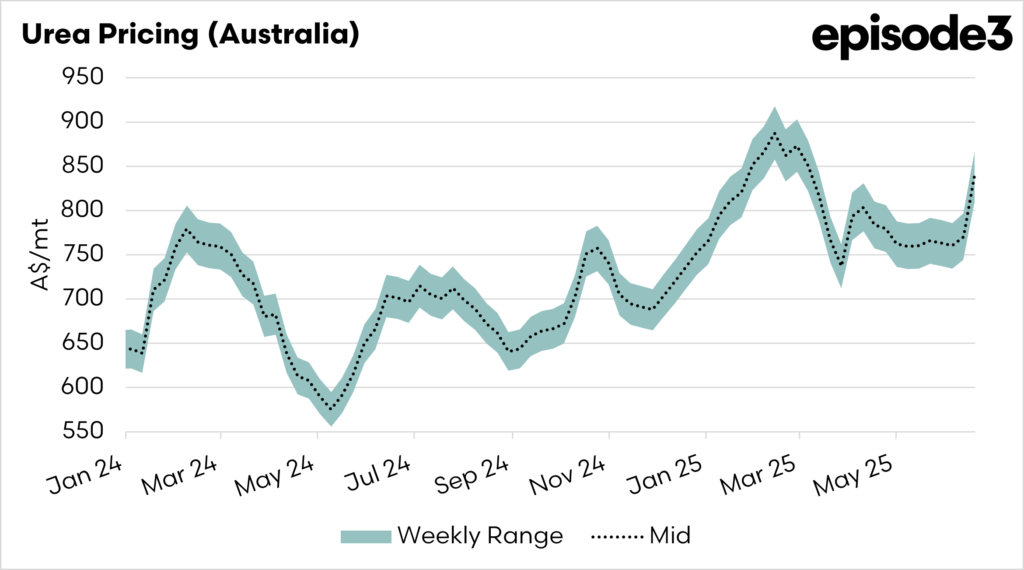

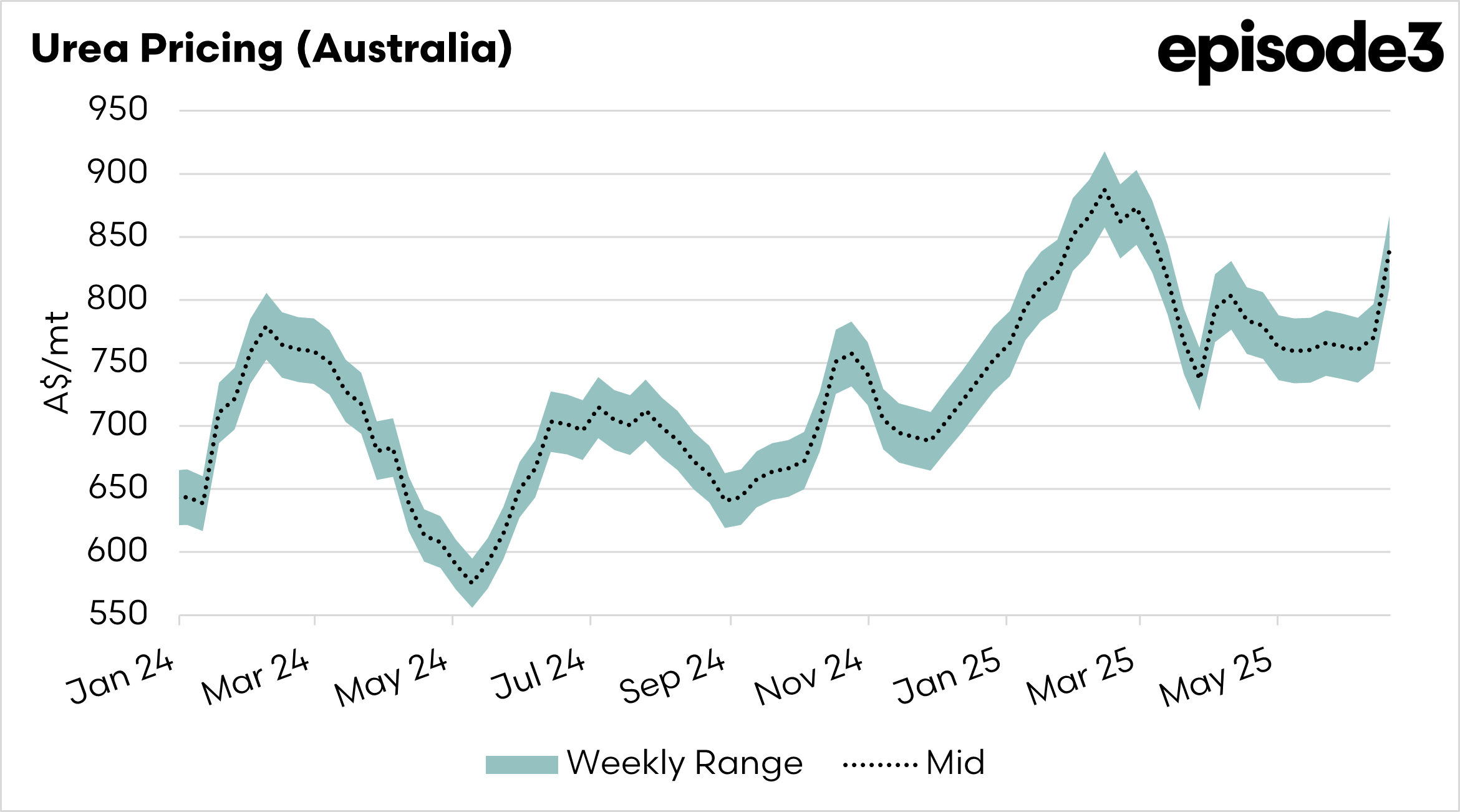

The first chart below shows our new weekly urea pricing model, which we will be producing (and continuing to improve). This gives an indicator of where the market should roughly be for urea, which the grower pays.

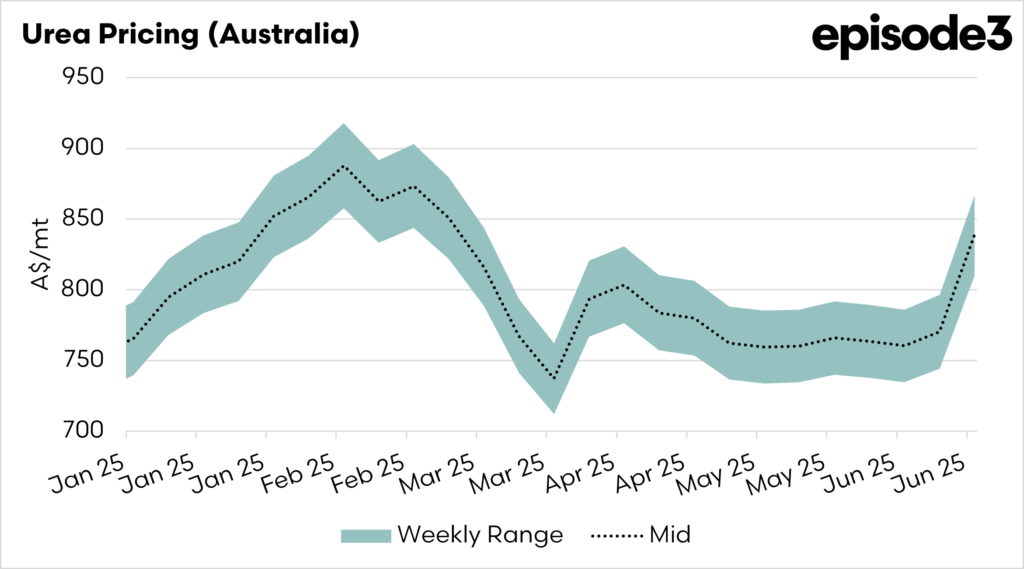

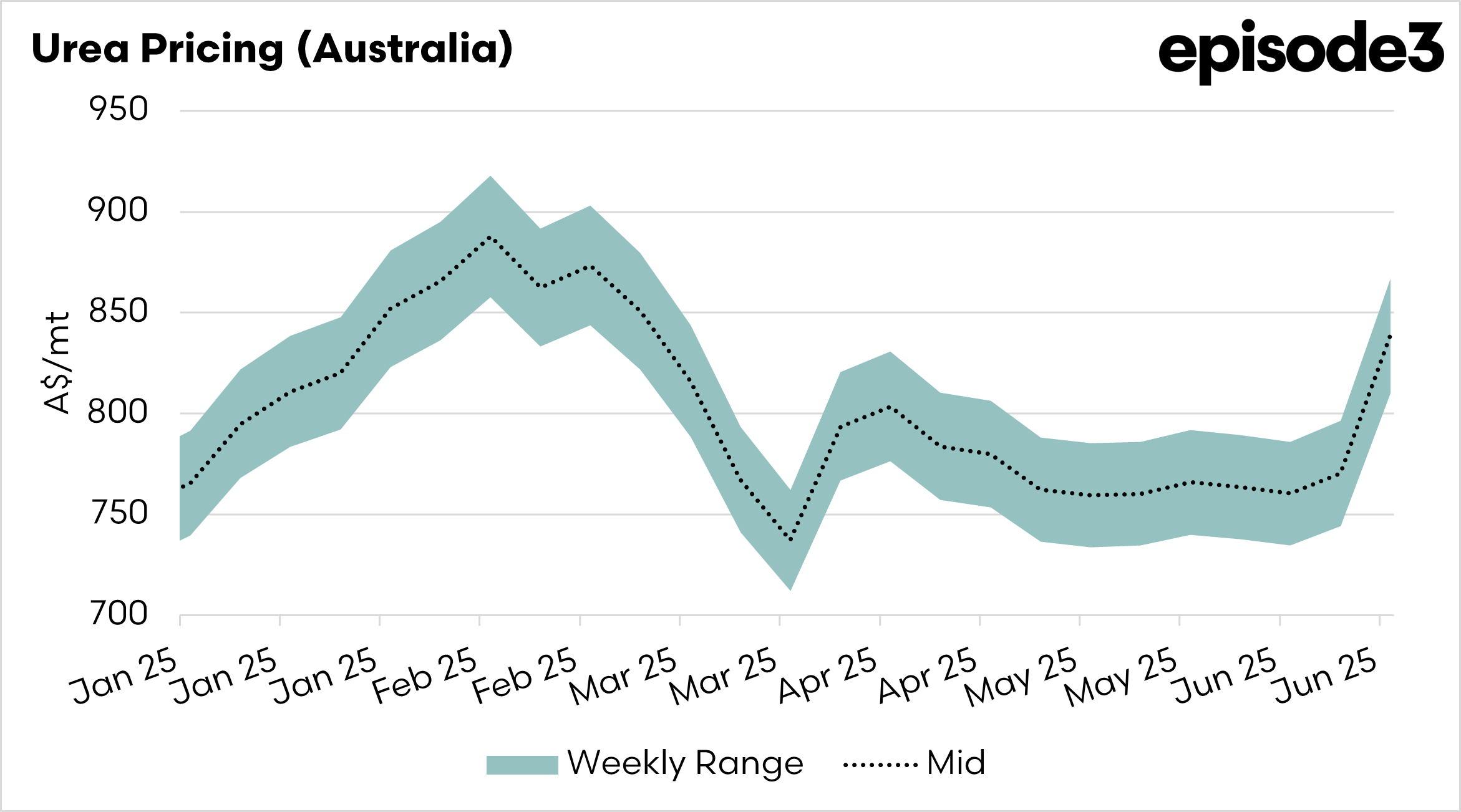

In the past, fertiliser companies have complained to us about reporting on fertiliser pricing. I imagine they won’t have the same complaints this week, as the market has risen sharply. In the week commencing June 9th, our midpoint was approximately A$770. Last week, the price rallied significantly to approximately A$840, with a range dependent on location. It is essential to note that this is a weekly average, and developments are progressing rapidly in the fertiliser space.

There were reports of a cargo bought from Vietnam at A$616 FOB, which is destined for Australia. This was purchased just before the market’s rise, and will likely be priced higher when it arrives in Australia.

As mentioned in the previous section, this is a very volatile environment for urea. If this conflict persists, we can expect to see higher prices if the supply remains constrained.

The second chart zooms in on this year’s pricing.

If you want to help EP3 continue to provide this type of insights, help us out, to help you, by completing our census by clicking here