Urea back to affordable levels.

The Snapshot

- EP3 were the first to provide a transparent pricing model for urea in Australia since 2020.

- This model gives industry stakeholders an insight into the actual international market for urea and how its price relates to Australia.

- The model has proven to be close to the actual import value of urea.

- Urea pricing has fallen from the highs of 2021 and 2022.

- The affordability of urea in comparison to wheat is slightly lower than the pre-height average.

The Detail

At EP3, our analysts have long been discussing the importance of transparency in the fertiliser market in Australia, even before we set up this business. Shortly after setting up EP3 (at the time TEM) in 2020, we launched the first publicly available cost and freight model for urea in Australia.

This wasn’t popular with many in the fertiliser industry (based on the angry calls we received). However, we continued to provide this information on a regular basis without any charge. This was so farmers could be aware of the trend of fertiliser pricing in Australia, the same kind of information you would get about any other agricultural commodity. This was especially important in recent years when fertiliser prices rose sky-high.

In order to improve transparency in the Australian fertiliser industry, we produced a cost, freight and unloading model.

We take the price of urea at the origin, add freight to Australia, and an unloading cost. This gives us an indication of the cost of getting urea to Australia. On this website, we provide this on a monthly basis publicly and more regularly to our private clients.

The purpose of this is not to give an exact price that the farmer will pay in Australia but to focus more on the trend of where the price is moving. So if the price for import has dropped A$500, we want to see some falls reflect in the local price you are being offered.

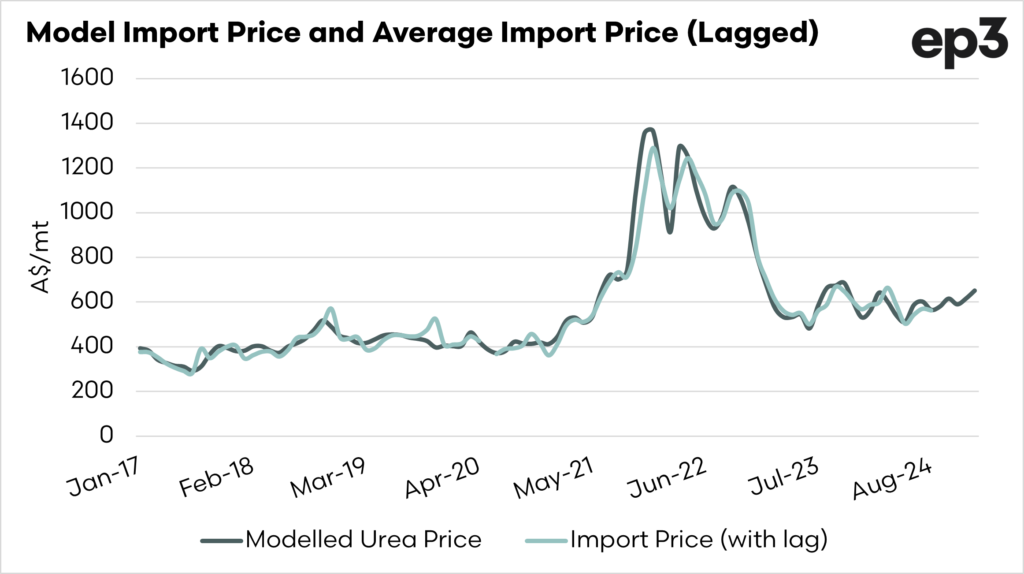

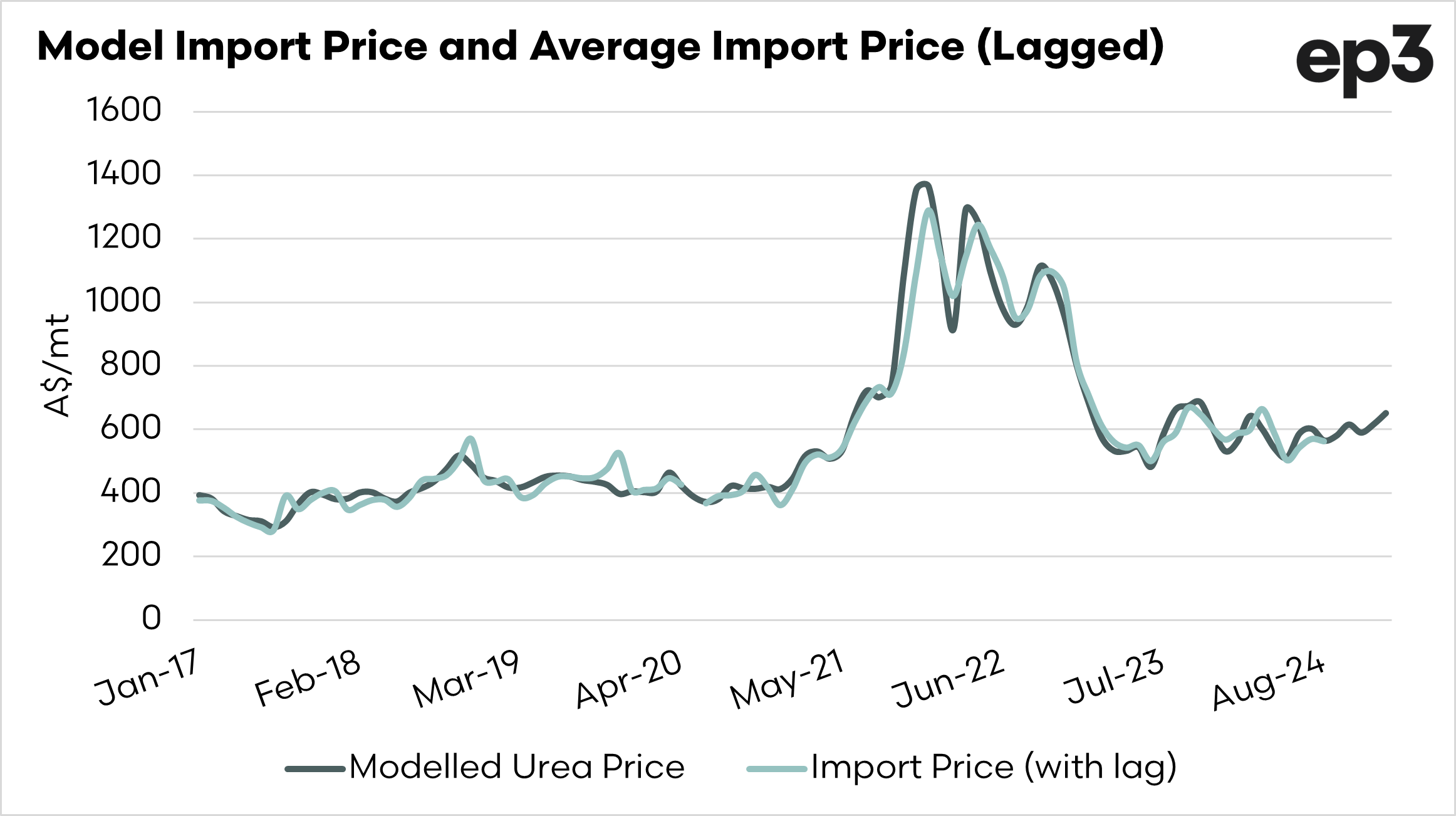

To validate our model, we review against the actual import price of urea, as reported by import data. This can be seen in the chart below, which shows both alongside each other.

We use a one-month lag, which provides a correlation of 0.98, with 1 being a perfect correlation and 0 being no correlation. So this is as close to a perfect relationship as possible.

So let’s have a look at the pricing.

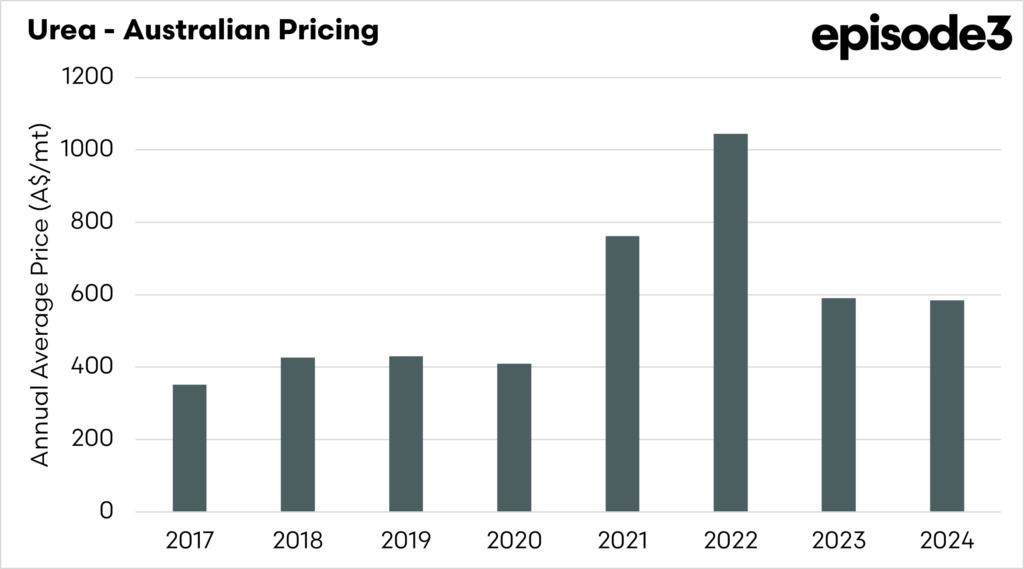

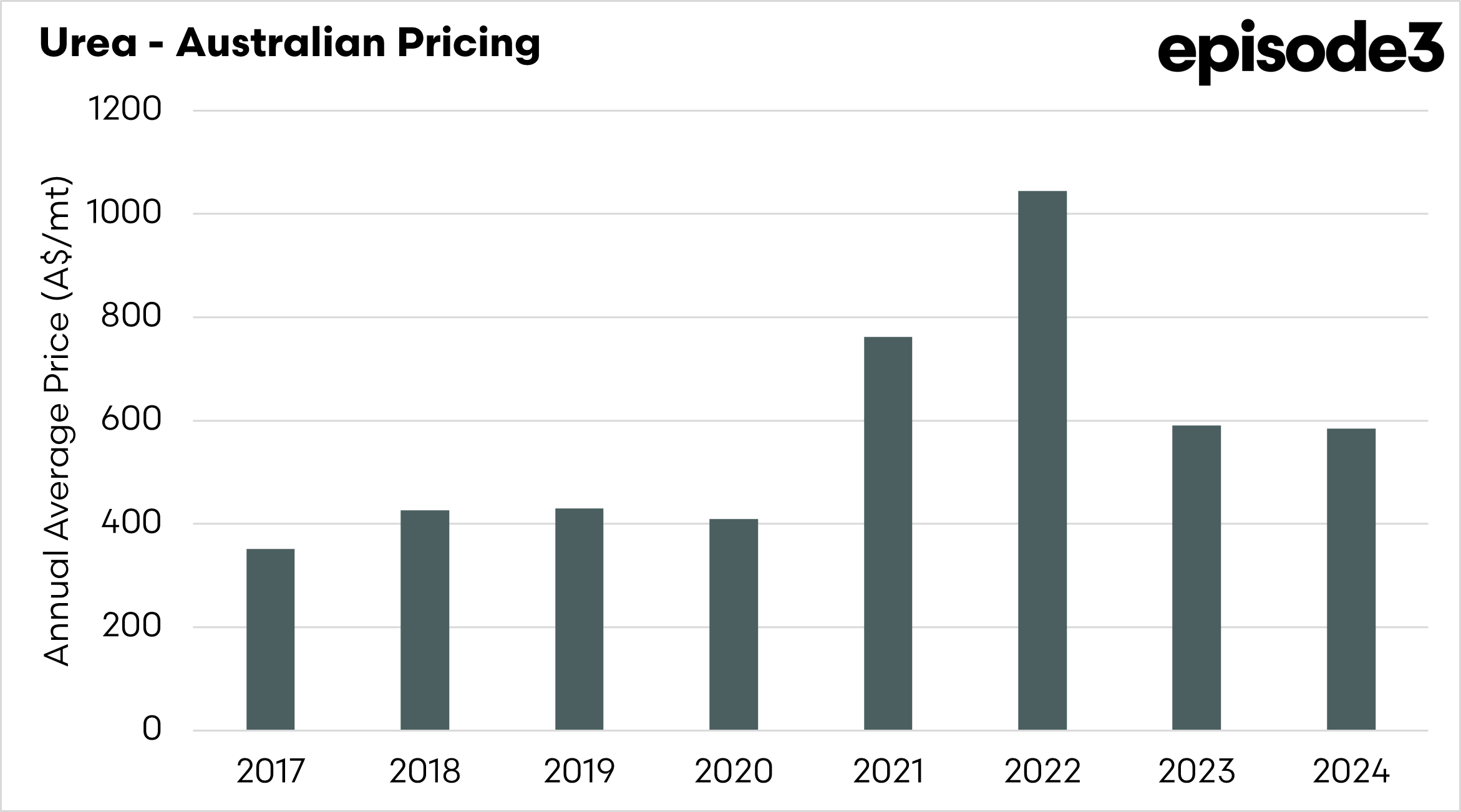

The chart below shows the annual average price for urea each year back to 2017 (based on our model). The past two years have averaged around the A$600 per tonne mark, which is substantially below that of 2021 and 2022, when the price skyrocketed due to higher energy costs, in part caused by the war in Ukraine.

Prices are a lot more attractive than during that time, but still above the average from 2017 to 2020. The important thing to note is that during those times of high pricing, there was an expectation that prices would stay at these levels forever to hit a new norm. This doesn’t happen in commodities very often; they tend to go through high and low pricing cycles.

The current price for January is calculated at A$650, although this only includes a short period of data for the month.

Affordability.

When assessing the fertiliser market, it is important to note that some of the pricing for fertiliser comes down to the capacity to pay. When farmers are doing well, the price may go up.

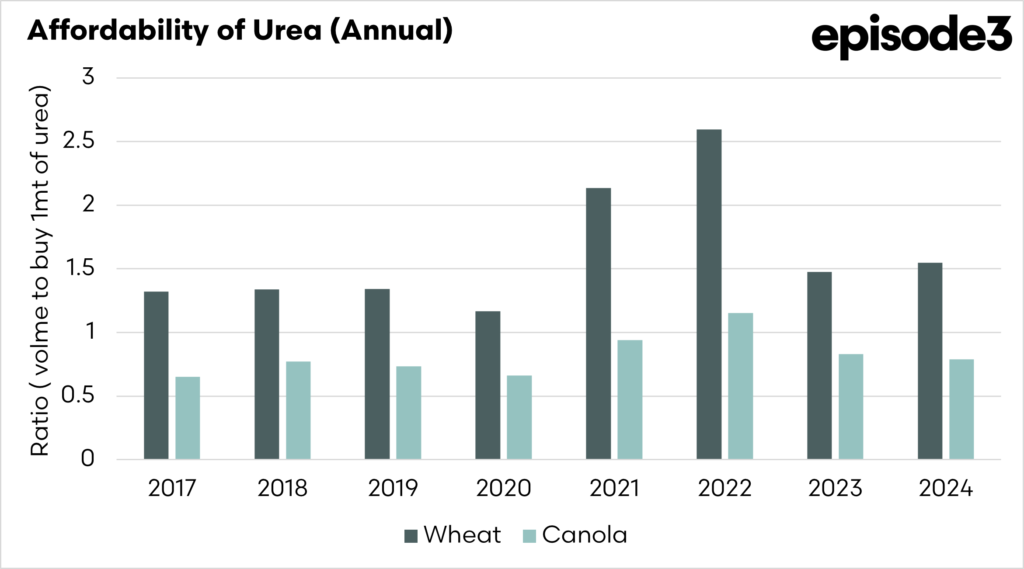

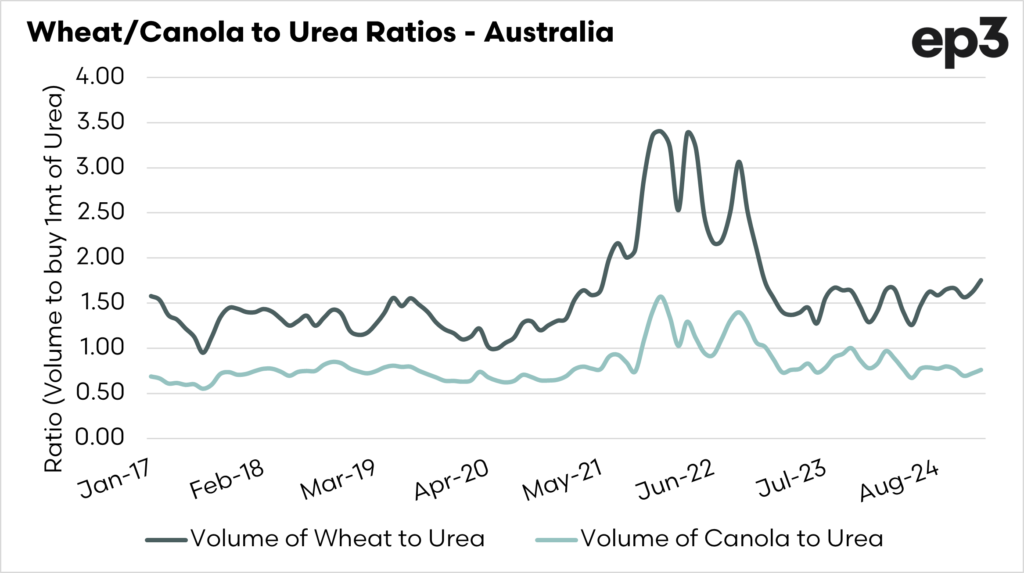

So we look at the affordability of urea in a simple way – how many tonnes of wheat or barley do you need to sell in order to buy one tonne of urea? This is displayed in the chart below.

We can see that at its height of unaffordability, you needed to sell nearly 3.5 tonnes of wheat to buy a tonne of urea and just over 1.5 tonnes of canola.

The affordability has improved in the past two years, as urea has returned close to pre-high levels and wheat/canola have stayed at higher than average prior levels.

It is important to keep a close eye on, and we will continue to provide it on EP3 at no charge. If you want to continue supporting EP3 to ensure that we can continue to provide this kind of service, remember to subscribe and encourage your contacts to do the same.