A Brazilian Opportunity

Market Morsel

President Donald Trump’s announcement last week of a sweeping 50% tariff on all Brazilian imports could have major implications for global meat markets, particularly beef. This policy will hit Brazil’s fast-growing meat trade with the USA hard, especially given the country’s recent success in expanding its share of American meat imports.

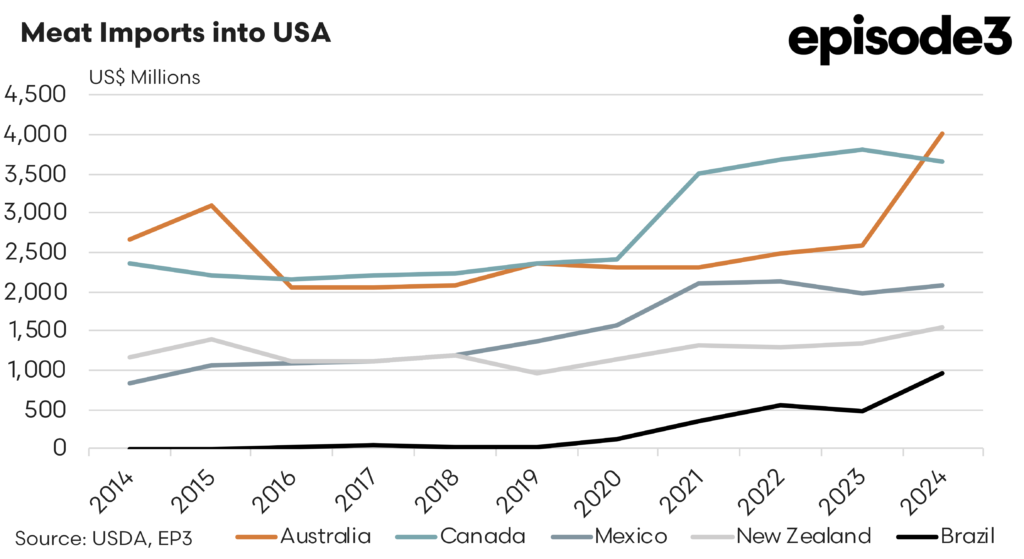

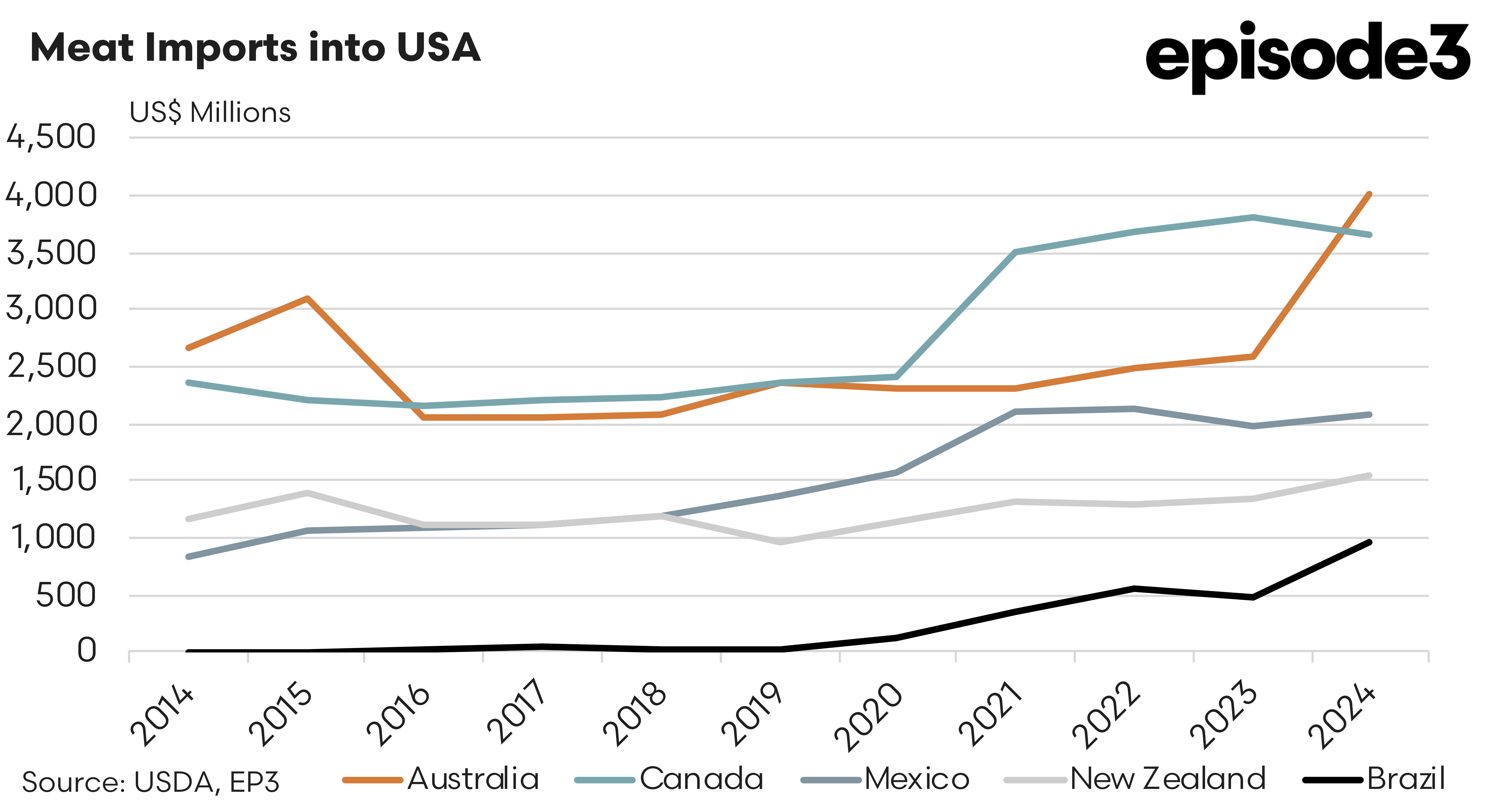

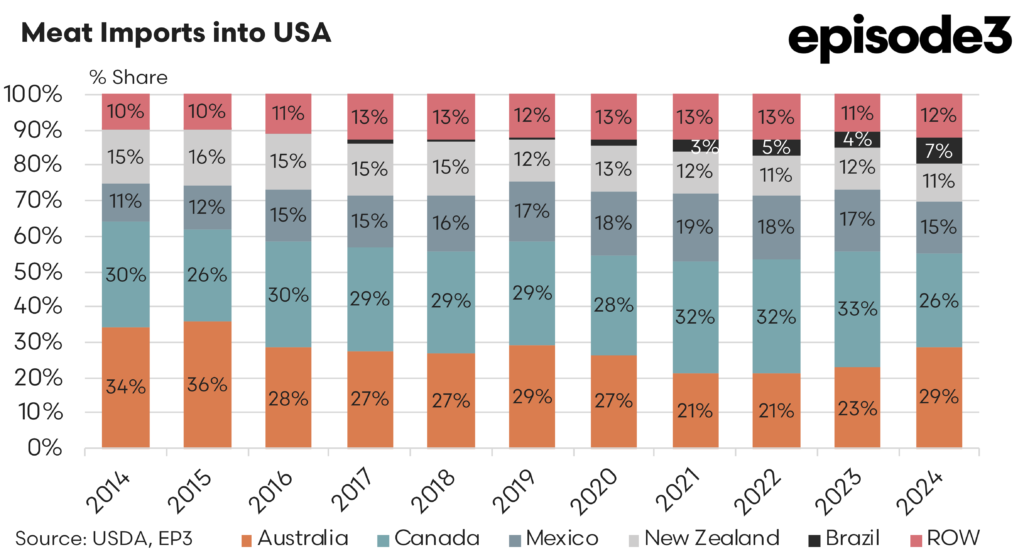

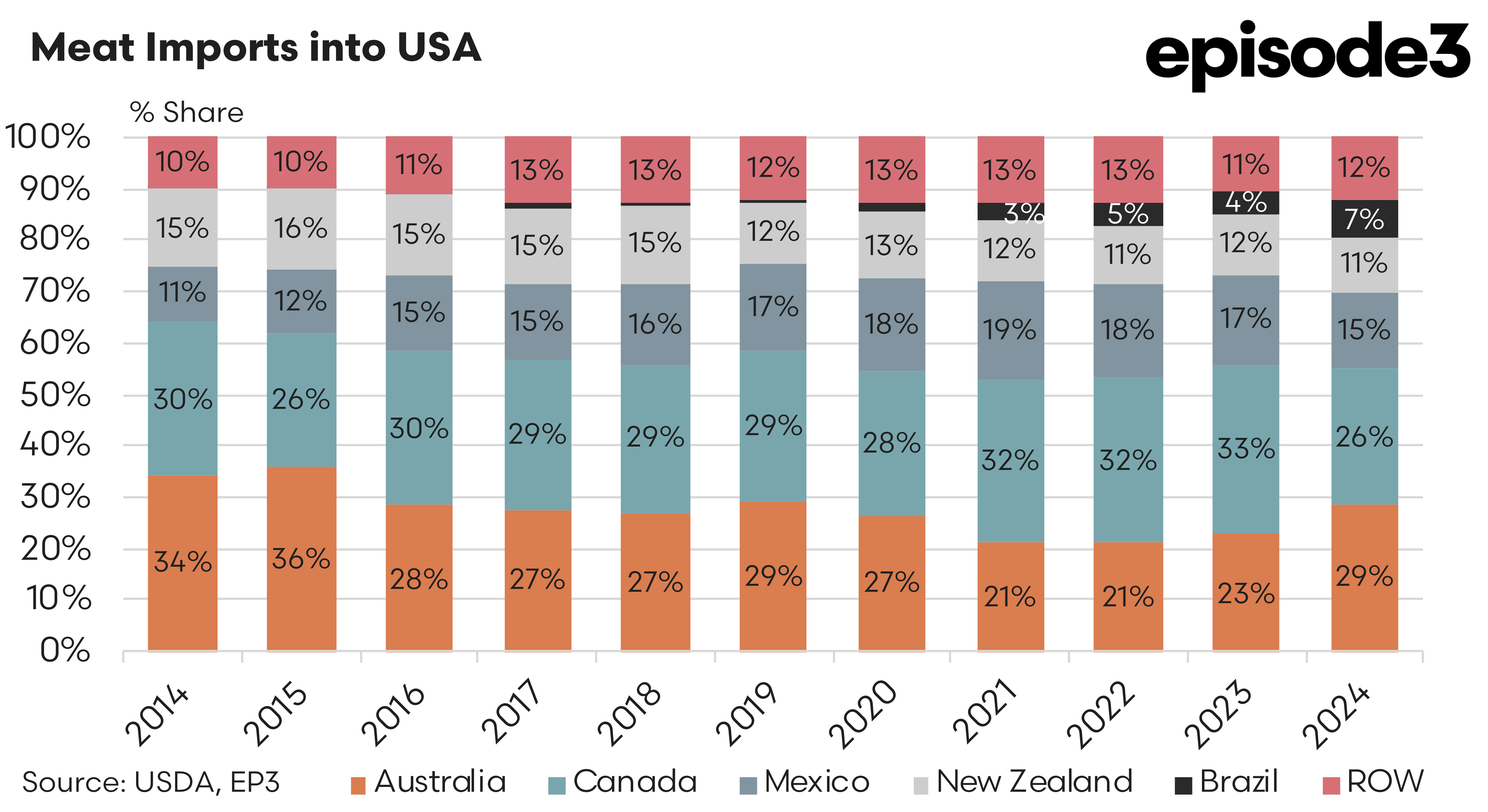

In 2024, Brazil captured around 7% of the U.S. meat import market, up from just 3–5% in the early 2020s. While still behind major suppliers like Australia, Canada, and Mexico, their growth trajectory was clear. Brazilian meat, especially beef, was gaining ground.

On a value basis, Brazilian meat exports to the USA surged in recent years, reaching nearly $1 billion in 2024, up sharply from five years earlier. This growth was driven by fresh access being granted into the US market, a cost-competitive product and strong demand in the US where cattle inventories remain at multi-decade lows, creating a gap that beef imports help to fill.

However, Brazil’s exports to the USA were already constrained by tariff-rate quotas (TRQs), which offer a limited volume of beef imports at low duty before higher tariffs apply. Brazil maxed out its beef quota allocation within just 17 days at the start of 2025. Once maxed out, Brazilian exporters have had to compete with a 26.4% tariff.

It is believed that the newly imposed 50% blanket tariff by the Trump administration would sit on top of this 26.4% TRQ, essentially rendering Brazilian beef uncompetitive in the USA. For many Brazilian exporters, this may likely force a pivot away from the USA and towards alternative markets like China. Thankfully, Australian beef exports don’t really compete in the same market segments as the Brazilian beef products into China. Our closer competitors in China are the USA, Argentina, Uruguay and New Zealand.

For red meat exporters like Australia, the timing could not be more favourable. The USA remains Australia’s largest market for beef, lamb, and goat meat, and Australian exporters have not faced the same quota bottlenecks. As of late June 2025, Australia had only filled 57% of its beef quota to the USA, leaving nearly 200,000 tonnes of room to move in the second half of the year. With Brazil’s supply options curtailed, Australia is well placed to fill the gap.

Meanwhile, the broader quota data from US customs shows that some other suppliers, such as New Zealand and Uruguay, are progressing steadily through their own allocations. New Zealand had cleared 51% of its beef quota by late June 2025, while Uruguay sat at 45%. Argentina remained slightly lower at just 42%. Brazil, as mentioned earlier, had already used 100% of its available quota access.

Altogether, this emerging trade tension not only reshapes competitive dynamics in the US meat market, but also underlines the complexity of global meat supply chains. Unexpected and unpredictable political intervention can create rapid, disruptive shifts in trade flows. For Australian meat exporters, this may represent a strategic opportunity, at least in the short term. But for the US consumers and meat packers, it risks higher prices and tighter supply in an already strained domestic market.