A hard grind

Market Morsel

The US cattle herd are entering their fifth year of liquidation and US cattle prices saw historic peaks in 2023 as herd numbers and US domestic beef production declined. The reduced beef supply has seen beef prices increase for domestic US beef and a staple beef ingredient is the humble US beef burger mince.

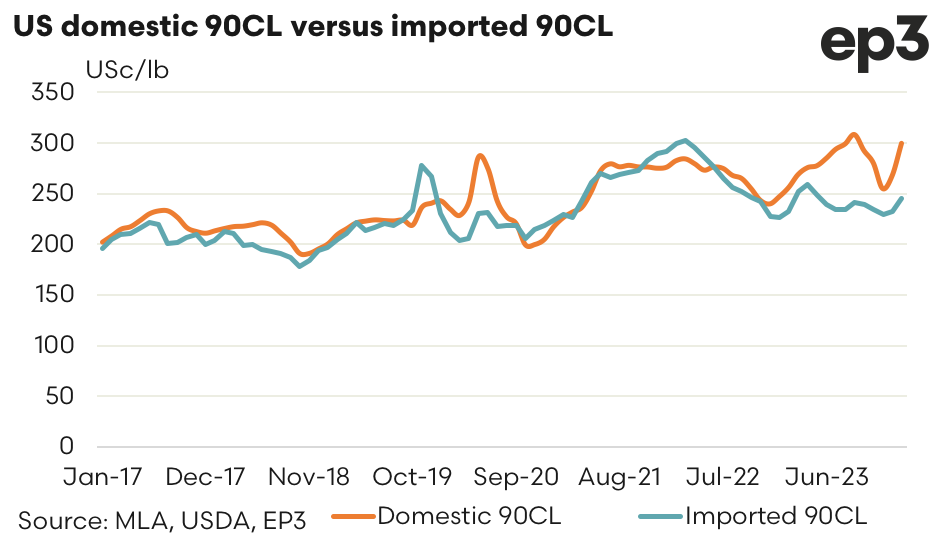

There are various ratios of lean to fatty beef mince that can be traded on the wholesale market and often a way to measure these mince types is to assess the chemical lean ratio or CL of the beef mince. Australia imports large quantities beef mince to the USA and one price benchmark that can be measured is the price differential between imported beef in the US that comes from Australia and New Zealand versus the domestic beef mince produced in the USA. For this analysis we have focused on the 90CL domestic US beef mince versus the 90CL imported beef mince item that is sourced from Australia and NZ.

During 2023 the US domestic 90CL price increased toward 300USc/lb while the price for the imported 90CL from Australia/NZ eased marginally from around 260USc/lb in April 2023 toward 230USc/lb by the end of the year. Competitive cattle pricing in Australia during the later half of 2023 allowed the imported CL from the Oceania region to remain price competitive while the domestic US beef mince was peaking. So far in 2024 US domestic 90CL is marching higher again sitting at an average of 300USc/lb in February 2024 versus the imported 90CL February average of 245USc/lb.

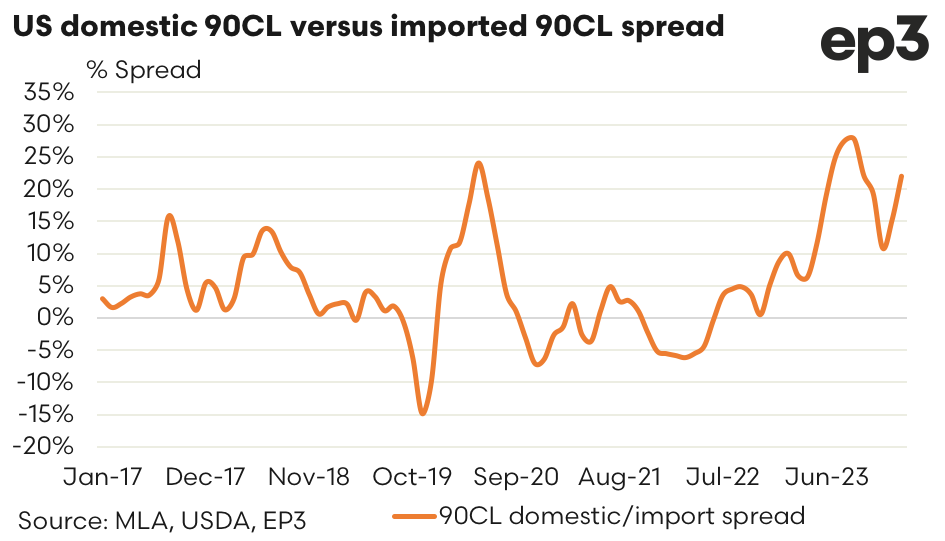

Analysis of the percentage price spread between the domestic US 90CL beef mince versus the imported 90CL shows that since the start of 2017 the spread recorded a record premium in September 2023 of 28%, which is in stark contrast to the discount spread seen through much of the 2020 to 2022 period when Australia cattle were very expensive versus US cattle and US 90CL beef was cheaper than the imported 90CL. Currently, the spread sits at a premium of 22%, well above the average spread seen from January 2017 to February 2024 which sits at a premium of 5%.