A heavy Kuwait champion

The Snapshot

- Trade statistics for the first two months of the season highlight that live sheep exports to Kuwait account for 70.2% of the flows so far in 2022.

- Live export trade volumes since the start of 2022 to Kuwait are running 83% above the five-year average pattern.

- Sheep export flows to the UAE and Oman are running ahead of their five-year average seasonal pattern so far in 2022 by 50% and 141%, respectively.

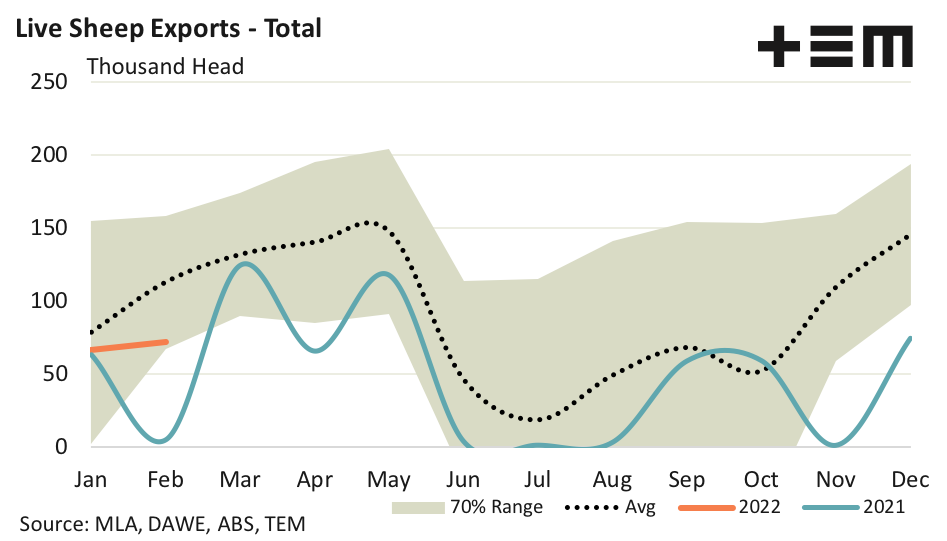

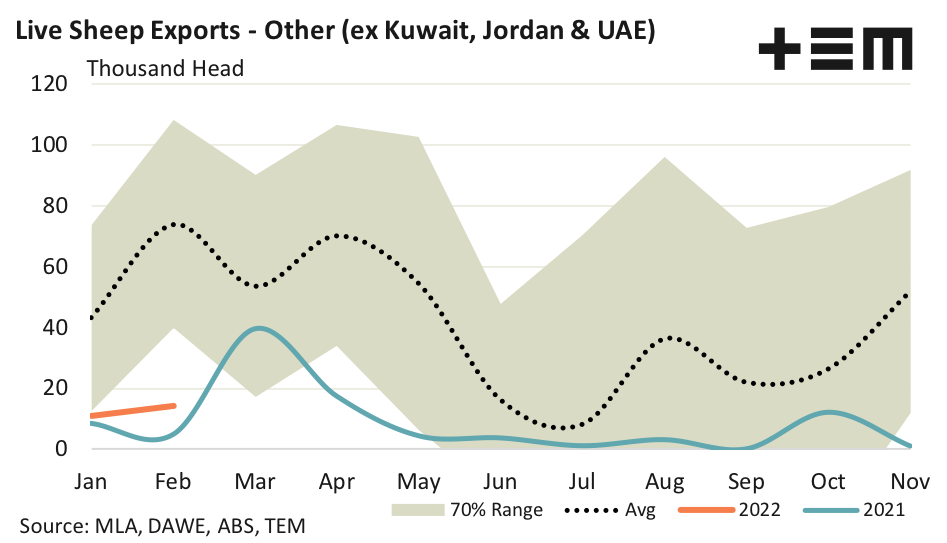

- Total export flows are running 27% below the average trend, despite the strong start to the year shown by Kuwait, UAE and Oman. This is because flows to all the other trade destinations are trekking 78% below the average seasonal trend.

The Detail

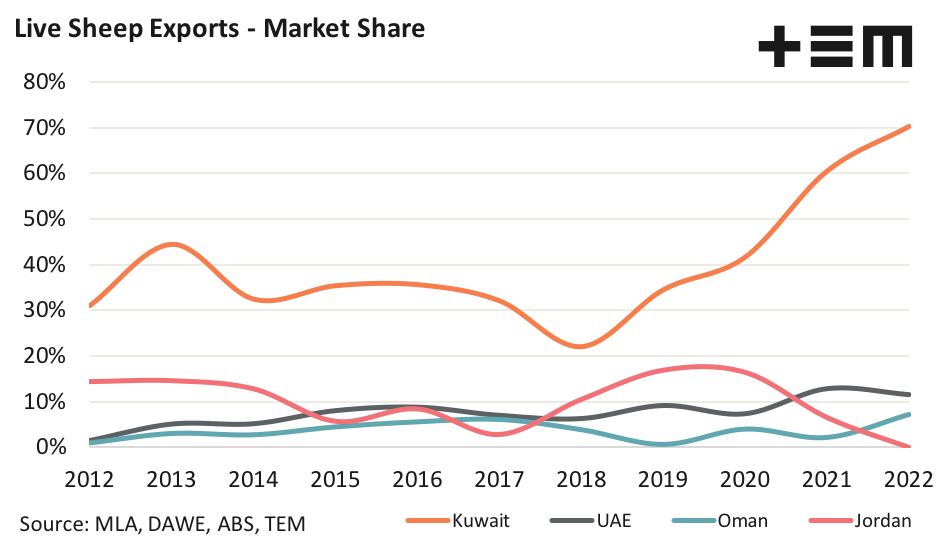

Live sheep export flows are being dominated by Kuwait so far during 2022. Department of Agriculture, Water and Environment (DAWE) trade statistics for the first two months of the season highlight that exports to Kuwait account for 70.2% of the flows to date. Since 2018 Kuwaiti demand for Australian sheep has been on a steady growth trajectory, in terms of market share of the total trade, lifting from 22.0% in 2018 to 41.6% in 2020. By 2021 flows to Kuwait from Australia were sitting at 60.4%.

The United Arab Emirates (UAE) is the second top destination for Australian live sheep exports in 2022. So far in 2022, market share for the UAE is sitting at 11.5% after registering 12.8% of the trade volume during 2021.

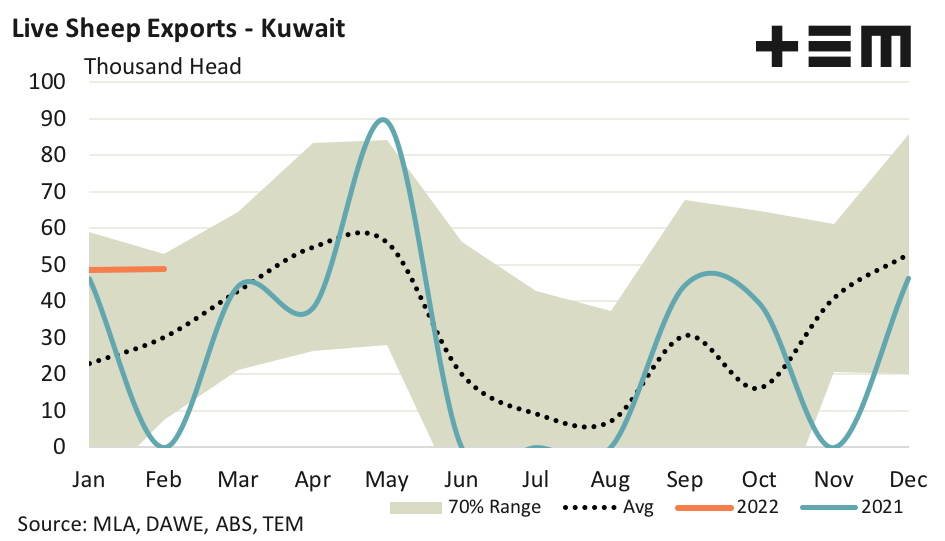

The seasonal picture for sheep exports to Kuwait show a relatively stable start to the season. January saw 48,718 head transported and February has recorded a marginal lift to 48,850 head of sheep. Live export trade volumes since the start of 2022 to Kuwait are running 83% above the five-year average pattern for the first two months of the year.

Total live sheep exports for February were recorded at 72,188 head, an increase of 8% on the January volumes. Sheep export flows to the UAE and Oman are running ahead of their five-year average seasonal pattern so far in 2022 by 50% and 141%, respectively. However, the trade to all other destinations (excluding the top four destinations of Kuwait, UAE, Jordan and Oman) are running 78% below the five-year average pattern for this time in the season.

These low volumes to other destinations are weighing on the total export flows, keep the trend this season running 27% under the average seasonal pattern for the first two months of the year.