A lamb spangled banner

The Snapshot

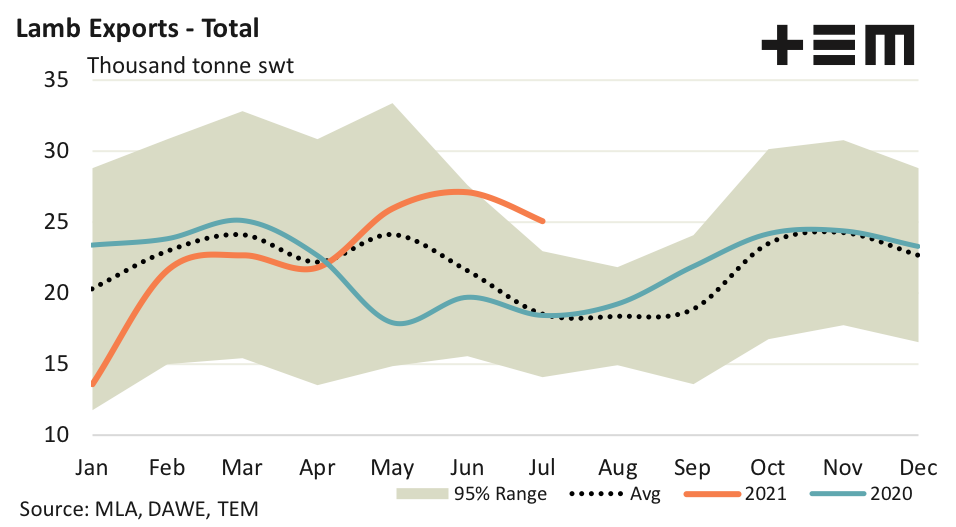

- Total Australian lamb export volumes for July eased nearly 8% over July to 25,066 tonnes, but managed to record levels that were 35% higher than the five-year average for July.

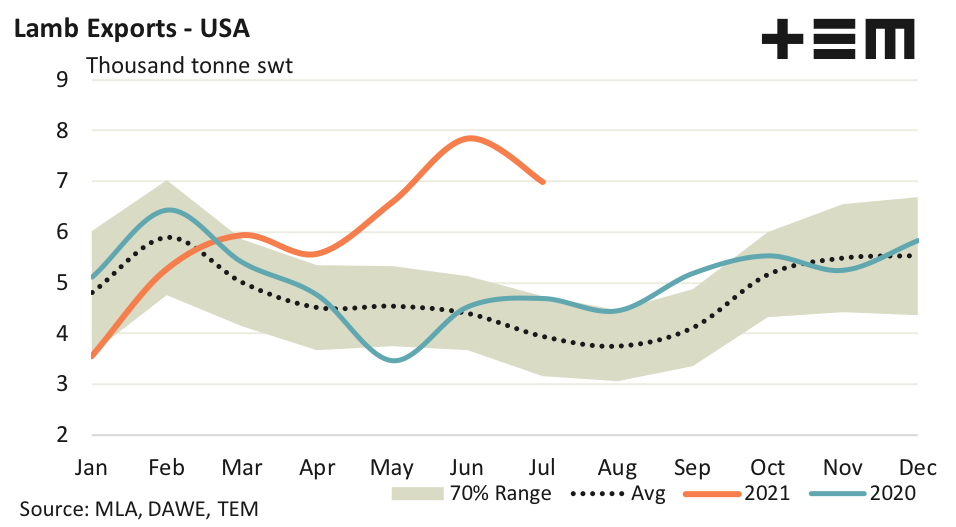

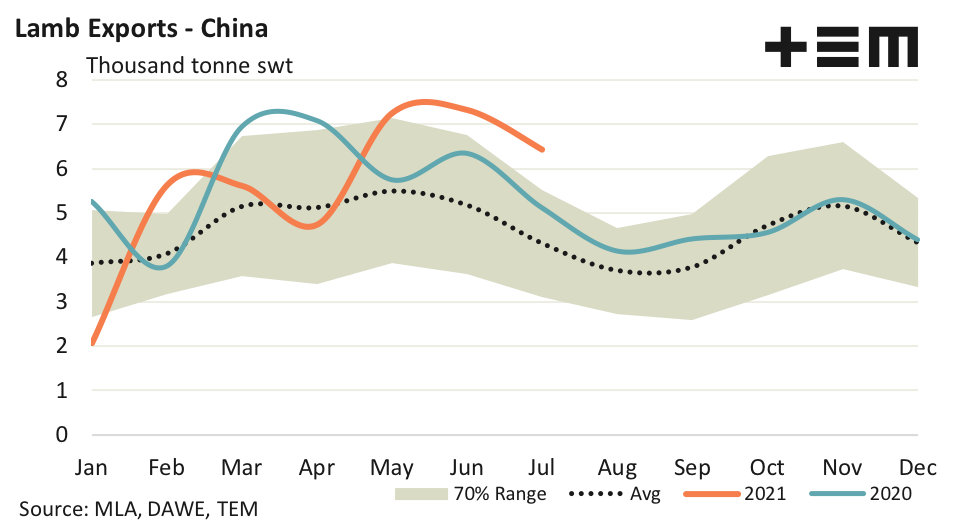

- Lamb export flows to the USA and China in July were 77% and 49% above their respective seasonal average trends.

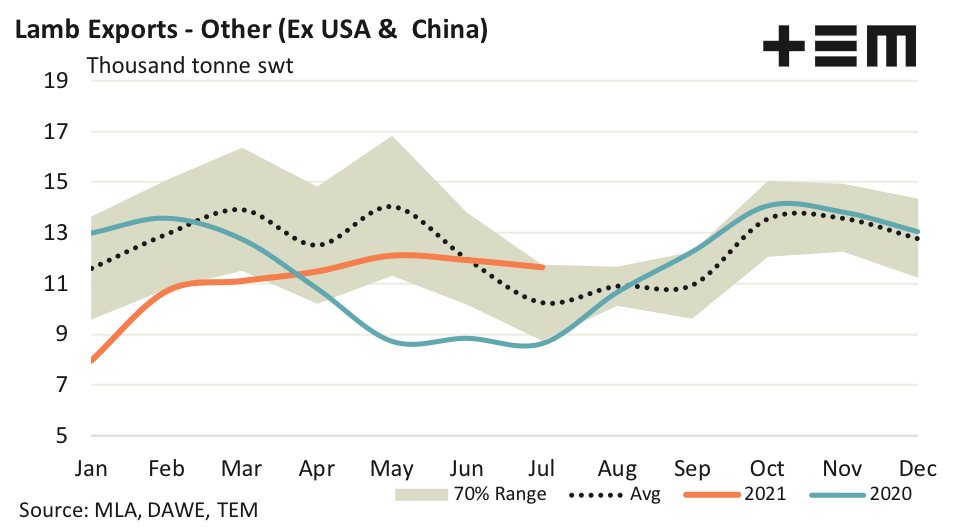

- Meanwhile, lamb export volumes for the remaining destinations (ex USA and China) registered levels that were a comfortable 14% above the five-year average for July.

The Detail

Total Australian lamb export volumes for July eased nearly 8% over July, but this was coming from very strong levels based on the normal seasonal volumes seen during winter. Despite the lower lamb export flows July 2021 managed to record 25,066 tonnes swt consigned, which is 35% higher than the five-year average for July.

Normally on our seasonal charts we highlight the 70% range, which shows the usual range in trade flows that could be expected, based on where the monthly trade data had fluctuated for 70% of the time over the last decade. However, in this instance we have widened the range to encompass the 95% thresh hold, which highlights that movements outside of the range occur relatively infrequently and could be considered extreme. The very high volumes of lamb exports seen in July signal that we are about 3,000 tonnes above the level that would be considered extreme for July.

A key driver of the robust demand for Aussie lamb exports is coming from the USA. Despite registering an 11% dip in flows from June to July the current monthly lamb trade figures came in at 6,987 tonnes swt, which are levels that are 77% higher than the five-year July average, according to the seasonal average trend.

The upper thresh hold on a 95% range measure for Australian lamb exports to the USA in July is around 5,500 tonnes swt, so the export flows seen recently are sitting nearly 1,500 tonnes above levels that would already be considered extreme.

Additionally, lamb export flows to China are performing reasonably well too with the July volumes of 6,421 tonnes sitting 49% above the five-year July average. The level of Chinese demand for Aussie lamb remains outside the upper end of the normal seasonal range despite July registering a 12% dip from the figures reported for June.

Capping off a solid performance all round for the Australian lamb export sector was the trend shown by all other export destinations (once the two largest players of the USA and China were removed). Lamb exports to “other” countries trekked sideways during July to register 11,657 tonnes consigned, a level that is at the top of the normal range that could be expected for this time in the season and around 14% above the July five-year average level.