A new hope

Market Morsel

It is becoming a bit of a tradition that we take a look at Wagyu pricing nearing “May the 4th be with you” international Star Wars appreciation day and any avid fan will spot the current reference in the title of this item.

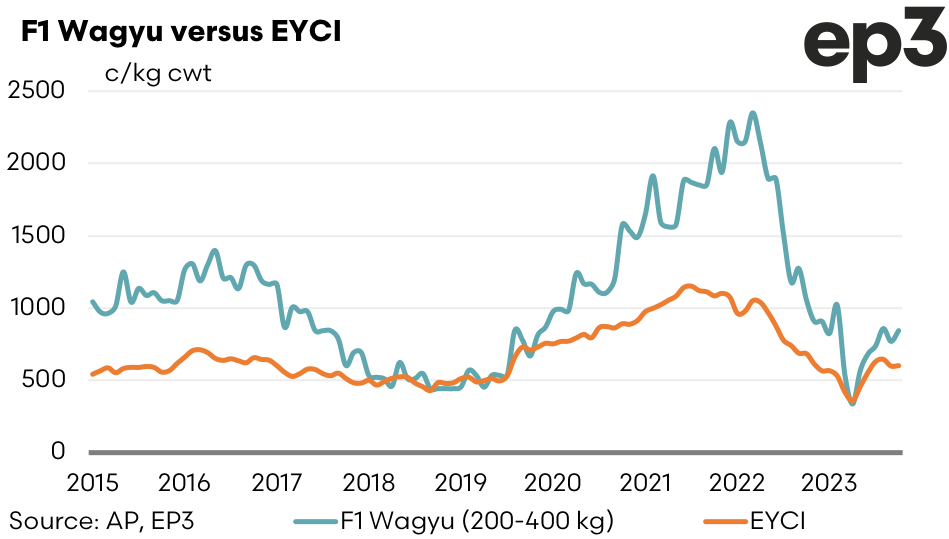

In 2023 we focused upon some of the supply and demand metrics in the Australian Wagyu sector with our May the fourth be Wagyu analysis piece. This year we will return our focus towards F1 Wagyu pricing, particularly as the back end of 2023 saw some significant price pressure for F1 Wagyu pricing. Indeed, for a brief period during October 2023 F1 Wagyu pricing for 200-400kg live-weight steers and heifers were sitting pretty much on a par with the Eastern Young Cattle Indicator (EYCI) levels, which is fairly uncommon.

The significant drop in F1 Wagyu pricing in late 2023 has been attributed to a combination of supply and demand issues that created a “perfect storm” scenario. Several factors contributed to the decline in prices.

Oversupply: There was an increase in the supply of F1 Wagyu feeders, partly due to drought conditions in eastern Australia, which compelled farmers to sell off cattle prematurely. Additionally, there was a significant amount of opportunistic breeding during the previous years when prices were high, leading to an oversupply in the market.

Quality Issues: The market experienced a dramatic fall in prices for lower quality F1 feeders. The decline was particularly severe for F1 Wagyu with lesser genetic merit, where these feeders quickly became commoditised, fetching prices significantly lower than those of higher quality. Many breeders had entered the market lured by high returns and bred F1s without secure end-destinations, affecting the overall quality and market value.

Reduced Demand: On the demand side, there was a global slowdown in consumer spending due to economic pressures, higher living costs, and energy prices. This reduction in consumer spending affected high-end products like Wagyu beef. Specific international markets, such as China and Korea, also showed a reduced appetite for imports due to domestic factors. For instance, in Korea, there was a push to consume more domestic Hanwoo beef, which competes directly with Wagyu in terms of quality.

Long Production Cycles: The Wagyu beef industry is also challenged by long production cycles. Cattle being processed now still carry the high costs from when they were purchased as feeders at peak prices, making it difficult to adjust quickly to market changes.

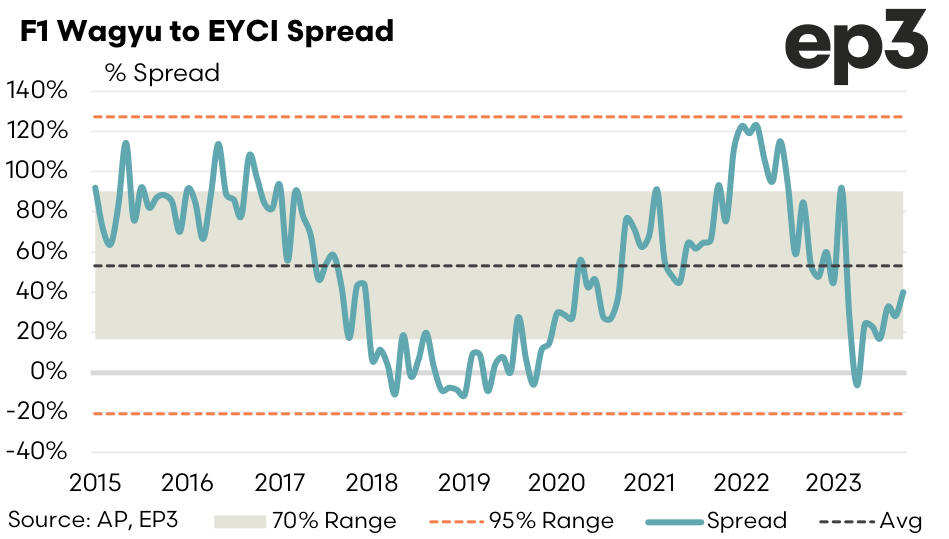

During this F1 Wagyu crash in the final quarter of 2023 the percentage spread to the EYCI went briefly to a discount of 7% in October 2023, but it didn’t last long with prices recovering to sit at a 24% premium spread by November 2023.

In early 2024 the F1 Wagyu market recover and begin to return to more normal premiums to indicators like the EYCI. Analysis of the percentage spread between F1 Wagyu young cattle and the EYCI demonstrates that since 2015 the long term average spread premium for F! Wagyu sits at around 53% above the EYCI (as per the black dotted line on the spread chart below).

Historically, the “normal range” in spread fluctuation is between percentage premiums of 16% to 90%, which is where the spread has ranged for 70% of the time since 2015. During April 2024 F1 Wagyu prices averaged 842c/kg cwt, which is a 40% premium spread to the EYCI average monthly price of 602c/kg cwt for the month.