A promising end to 2023

Live Cattle Export Summary - December 2023

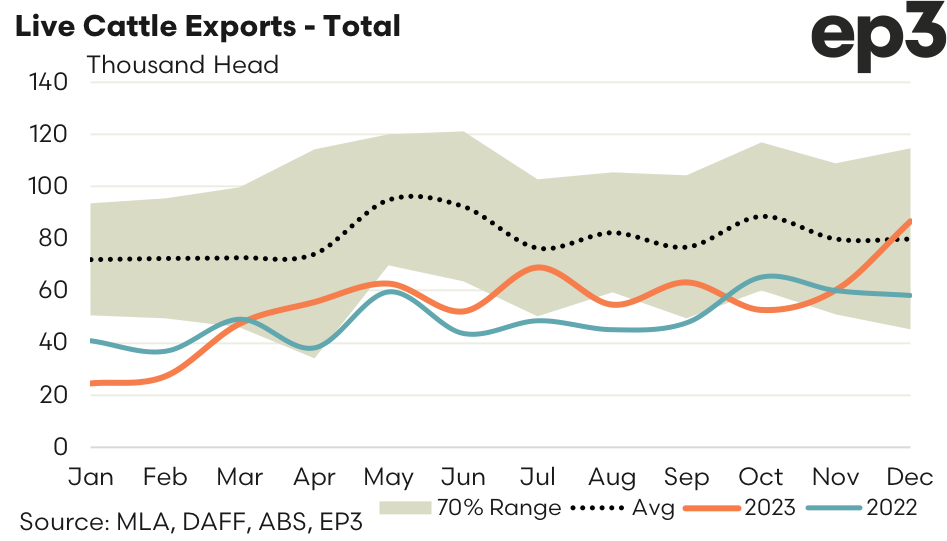

December was the strongest month for the 2023 season for live cattle export flows out of Australia with 86,696 head reported shipped during the month, the first month this year that volumes were able to move above the five-year average trend.

This represented a 44% increase on the volumes reported exported during November 2023 and brought the total live cattle export tally to 673,630 head for the year. In 2022 there were a total of 600,024 head so the total live cattle cattle export volumes for 2023 represents a 12% increase in trade flows.

A summary of the top trade destinations is outlined below.

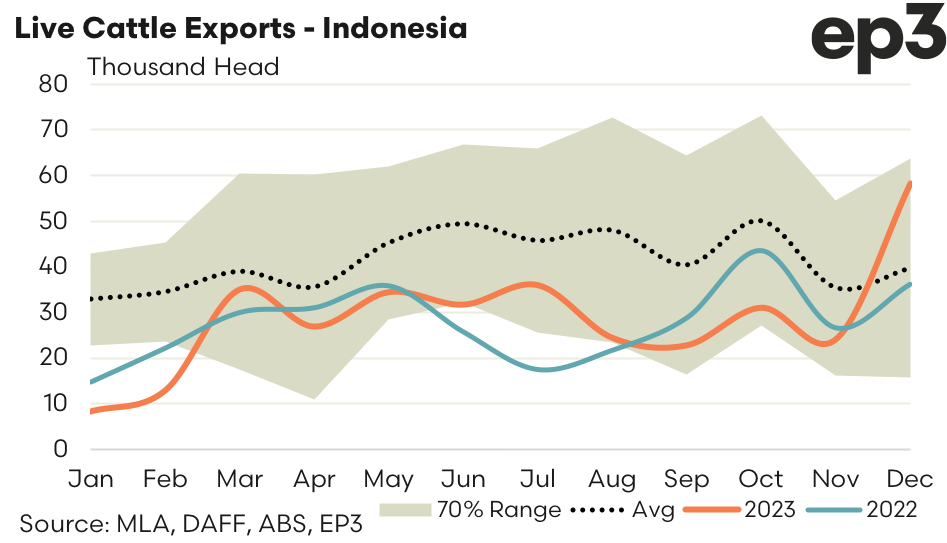

Indonesia – Demonstrated an improved picture in the final quarter of 2023 with December managing the strongest monthly trade flows on record for the year at 58,250 head pushing the monthly tally above the average trend for the first time this year. Unfortunately, due to Indonesian electioneering there have been no permits issued to Australian exporters so far in 2024, so the strong end to 2023 has not translated into a firm start to this year. Despite the strong finish to 2023 average monthly exports to Indonesia over the year show that Indonesian demand for Aussie live cattle was about 30% below the five-year average pattern for the year.

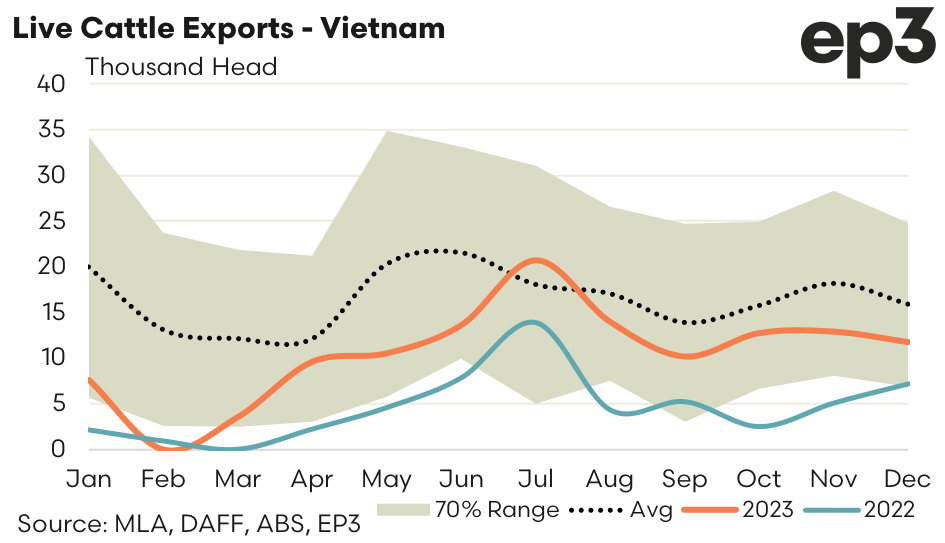

Vietnam – There was a reasonably consistent end to 2023 for flows of cattle to Vietnam with monthly flows averaging about 12,500 over the final quarter of the year. However every month except July saw export volumes to Vietnam below the five-year average seasonal trend so the demand for Aussie cattle to Vietnam ended the 2023 season nearly 37% under the five-year average trend.

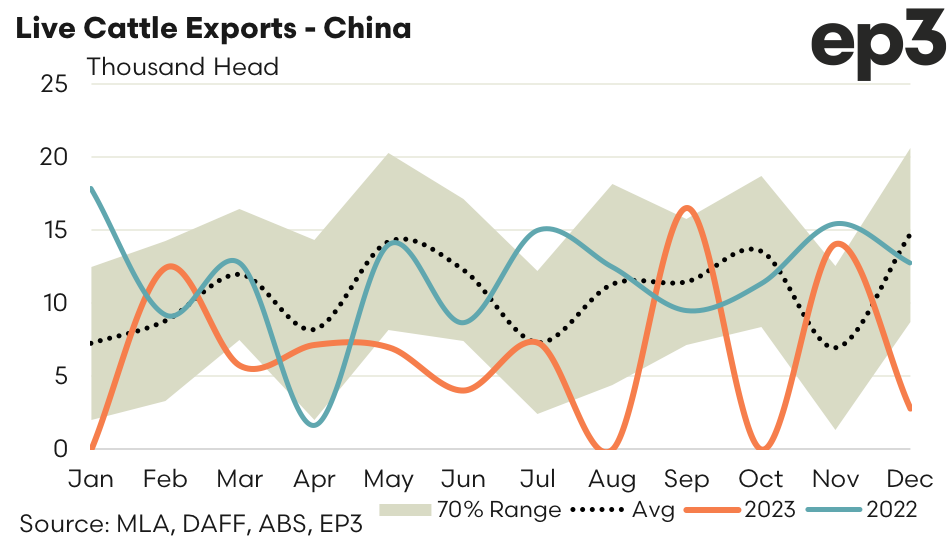

China – It was a rather volatile end to 2023 for Chinese demand for Aussie cattle with monthly trade volumes fluctuating between minimal flows to around 15,000 head per month for the last half of the year. Average monthly trade across the while year came in at around 6,500 head per month during 2023, which is about 44% under the average monthly flows seen during 2022 and 41% below the five-year average seasonal trend.

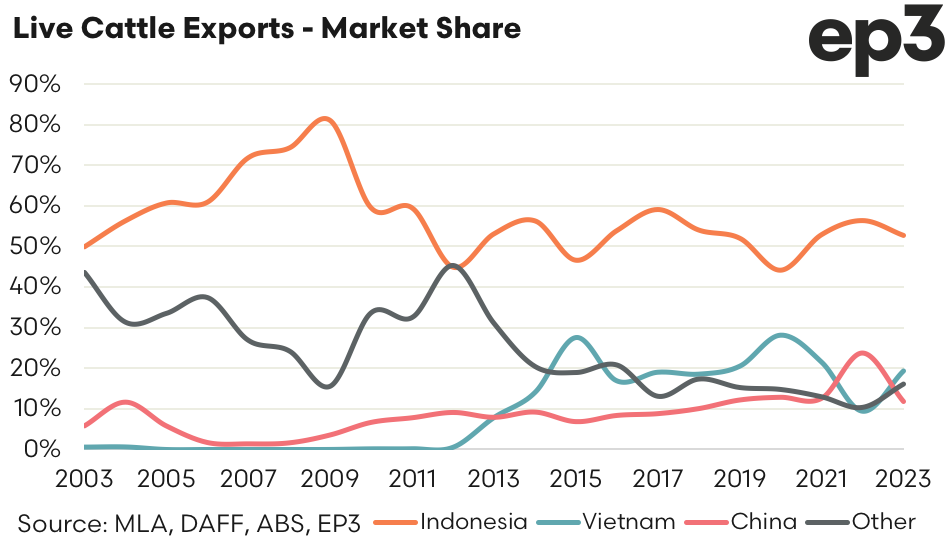

In terms of market share Indonesia retained the top destination during 2023 with 53.5% of the total trade, or 360,093 head shipped from Australia over the year. This is a slight decrease from the 56.4% of the trade they captured in 2022. Vietnam saw an increase in market share from 9.7% in 2022 to 18.8% in 2023 as more competitive Australian cattle pricing saw their demand return. This improved market share translated to an increase in annual cattle volumes from 58,242 head in 2022 to 126,930 head in 2023. Meanwhile the Chinese market share of total Australian cattle exports slipped from 23.4% in 2022 to 11.7% in 2023. This equated to a drop in volumes from 140,651 head in 2022 to 78,723 head in 2023.

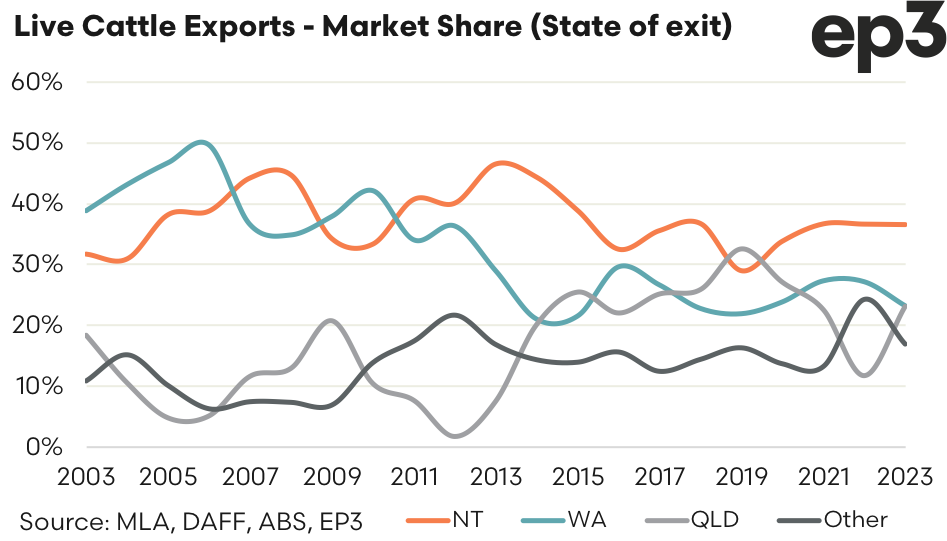

In terms of port of exit from Australia the final tally for 2023 shows that nearly 37% of cattle exited from Northern Territory ports, 23% left via WA ports and 23% went out via QLD ports. The remainder (circa 17%) exited from all other ports, of which the bulk was from Victoria (which accounted for a little over 14% of total flows).