A rational perspective

The Snapshot

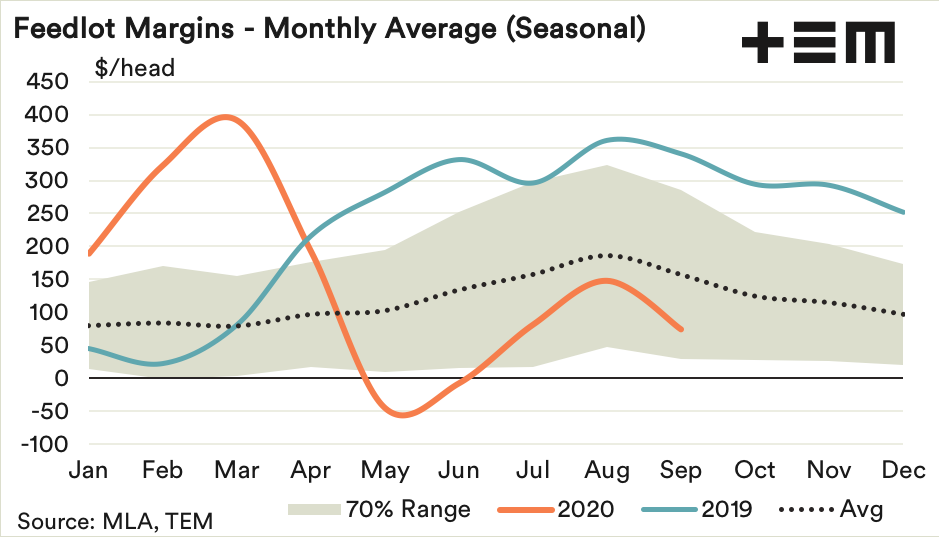

- The average monthly feedlot gross margin for August reached $147 per head, while September currently sits nearer $75.

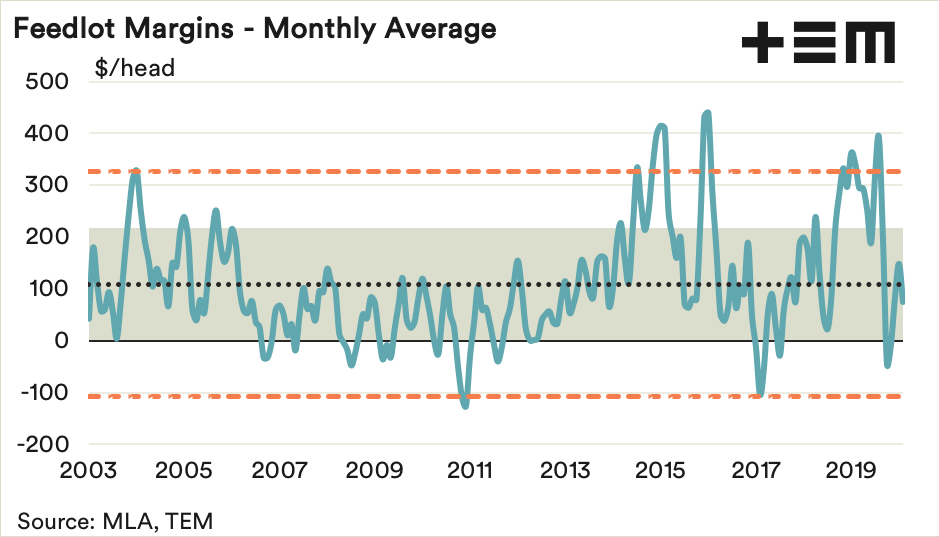

- Historical analysis of the gross margins since 2003 demonstrates a long-term average of $110 profit per head is achieved, with a normal fluctuation between $0 to $220.

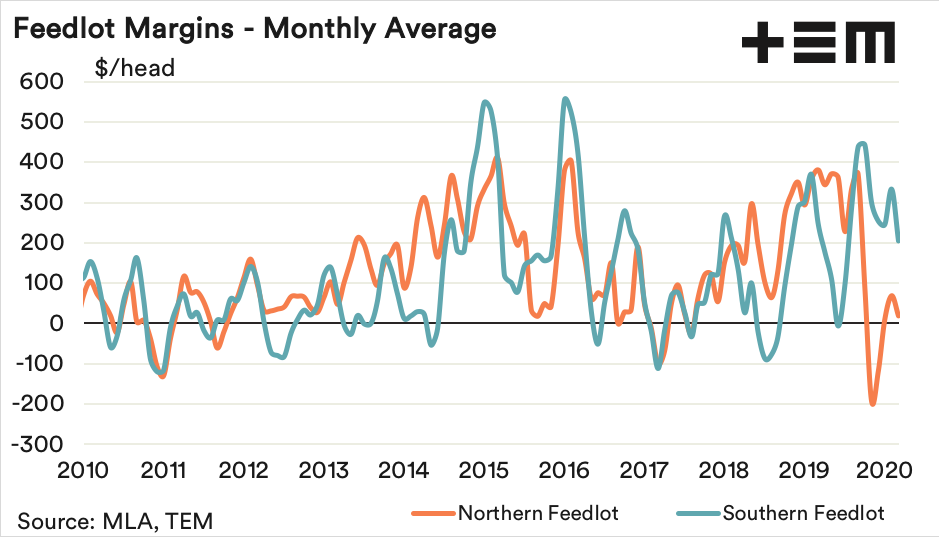

- Filtering the margin trend between northern and southern operations shows that relatively cheaper feed costs in the southern regions have been providing some support.

The Detail

Easing finished grain-fed cattle prices through winter, particularly in northern markets, saw feedlot margins dip briefly into negative territory before posting a mild recovery into August/September.

Falling feed costs, with sorghum off 23% and barley down 15% from quarter two to quarter three, helped push the average monthly east coast feedlot gross margins back into the black. The average margin for August reached $147 per head, while September currently sits nearer $75.

Historical analysis of the gross margin since 2003 demonstrates a long-term average of $110 profit per head is achieved, with a normal fluctuation between $0 to $220 – as identified by the 70% range boundary. Average monthly feedlot gross margins below a loss of $110 or above a profit of $325 would be considered extreme.

It is important to note that the calculations used to create this feedlot gross margin estimate only focus upon the sale price achieved on a short fed grain trade less the cost of animal and feed/ration costs. The margin does not include other operational/capital costs such as wages, transport, animal health, fuel, maintenance, etc.

Filtering the margin trend between northern and southern operations shows that relatively cheaper feed costs in the southern regions have been providing some support. Since the start of 2020 sorghum prices delivered Darling Downs are down 33% to average close to $310 per tonne as of September.

In contrast, the lingering issues with Barley markets and Chinese trade tensions have seen prices ease 40% since the start of the season to trade nearer to $220 per tonne for southern delivery zones.

Heading into a strong southern harvest season should keep feed costs moving in the right direction. However, competition among restockers for young cattle underpinning feeder steer and heifer prices should limit gross margins from expanding beyond the normal seasonal range as we head toward the end of the year.