A reversal of fortune

Market Morsel

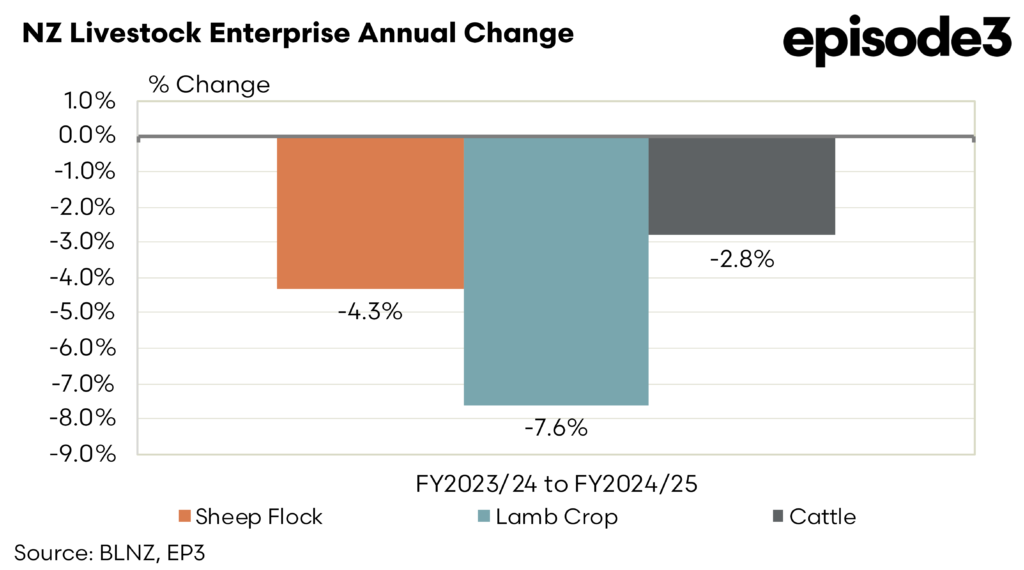

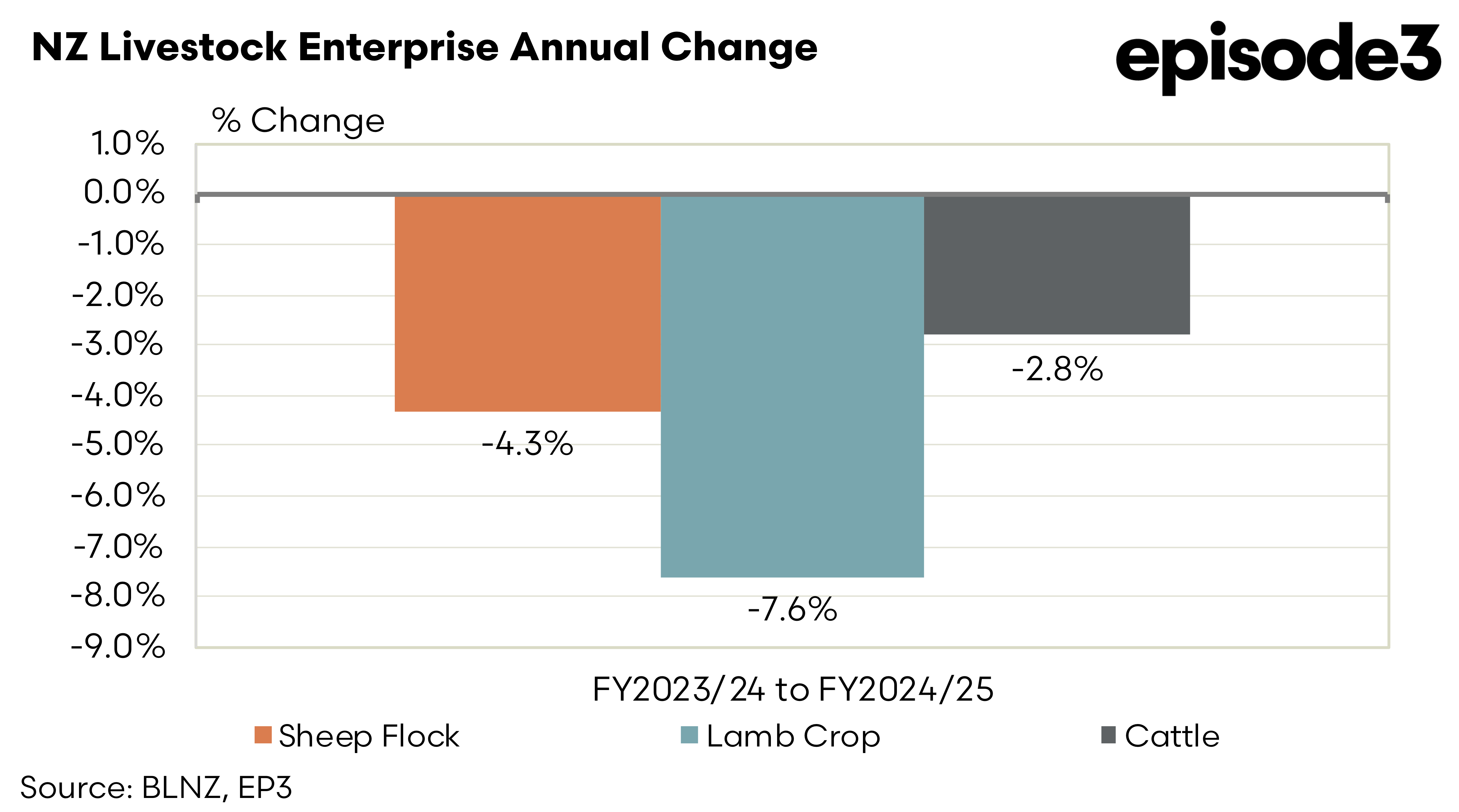

The most recent update to New Zealand’s sheep industry shows that it is now facing a continued decline, a reversal of their earlier forecasts reported upon by Episode 3 in March 2024. Recent projections indicate that the national sheep flock is continuing to shrink, with a 4.3% decline in total numbers expected for the 2024/25 season. This reduction is even more pronounced in the lamb crop, which is forecast to fall by 7.6%, representing a significant contraction in production capacity. These figures illustrate a broader structural shift away from sheep farming, driven by factors such as land-use changes, climate-related challenges, and economic pressures that favour alternative agricultural enterprises.

The latest projections indicate that cattle numbers will also decline by 2.8% in the 2024/25 season. This reflects an industry-wide contraction rather than a simple substitution effect, highlighting the broader challenges faced by red meat producers. However, cattle farming has been relatively more resilient, with beef prices holding firm due to strong international demand, particularly from markets such as the United States and Europe. By contrast, the sheep sector has struggled with volatile market conditions, high input costs, and increased competition from alternative land uses, including forestry and dairy farming.

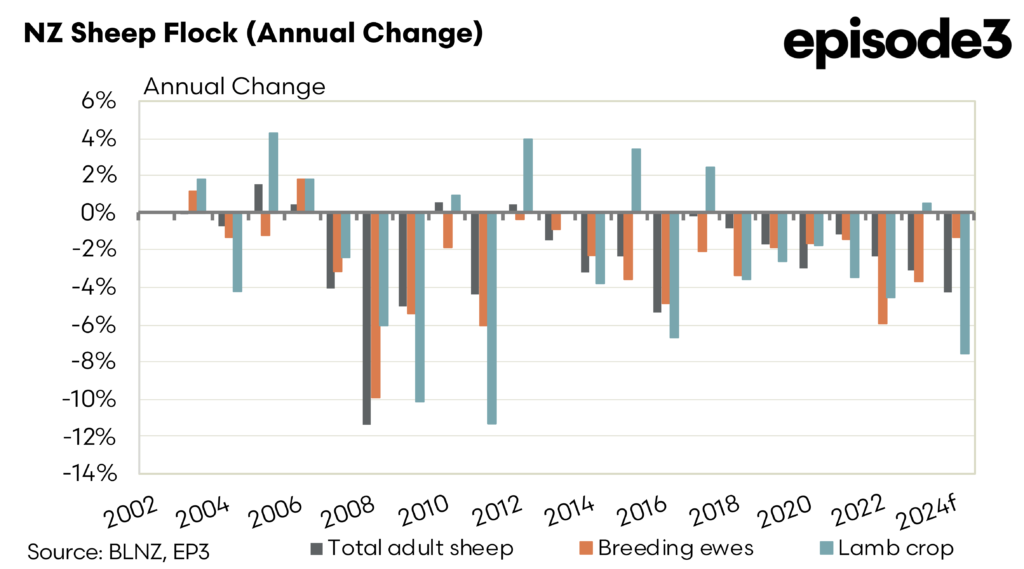

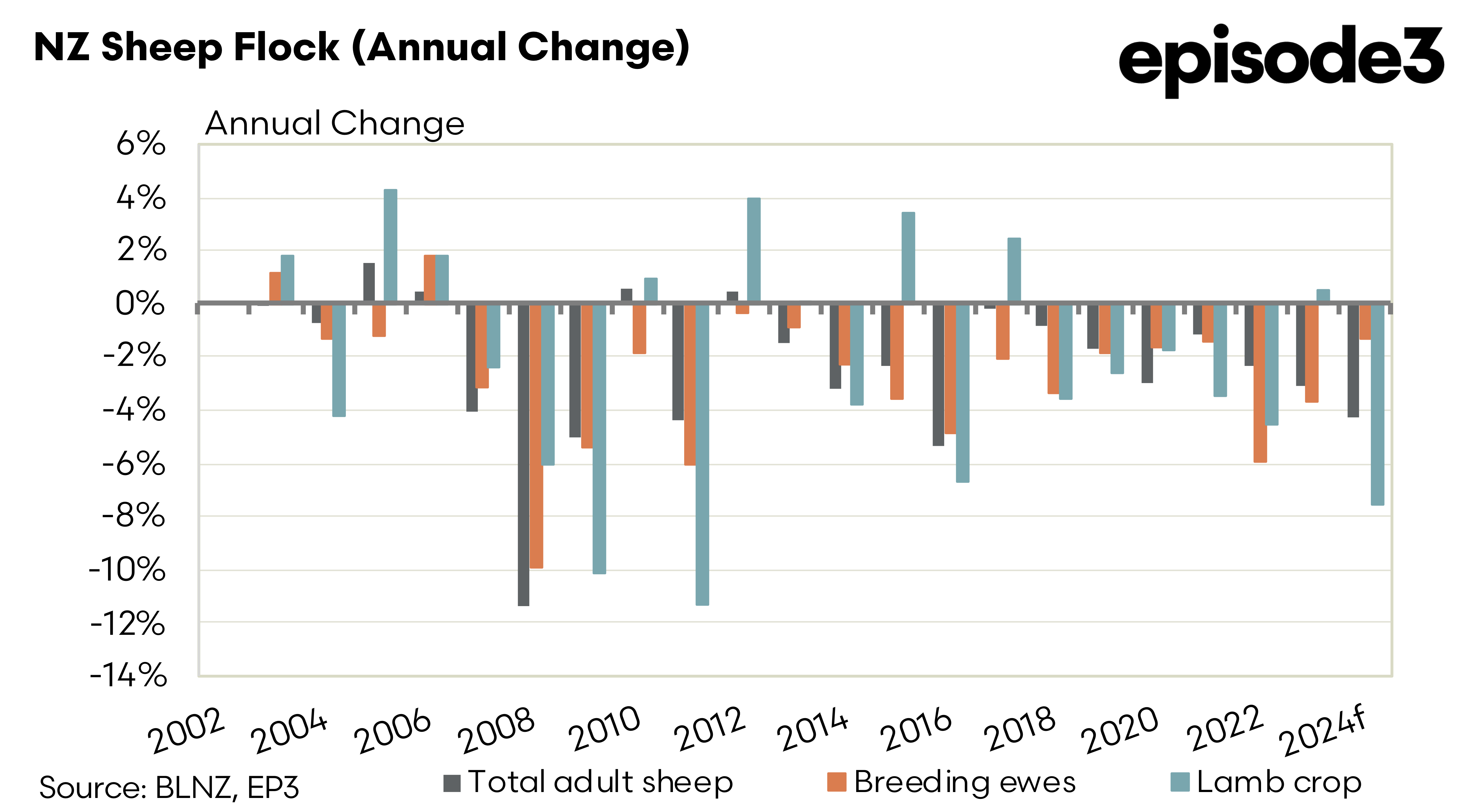

The contraction in the Kiwi sheep industry is more evident when looking at the longer term adjustments to sheep flock, breeding ewe numbers and the lamb crop each season. This year will see the largest drop in the lamb crop in over a decade and breeding ewe numbers haven’t seen an annual increase since 2006.

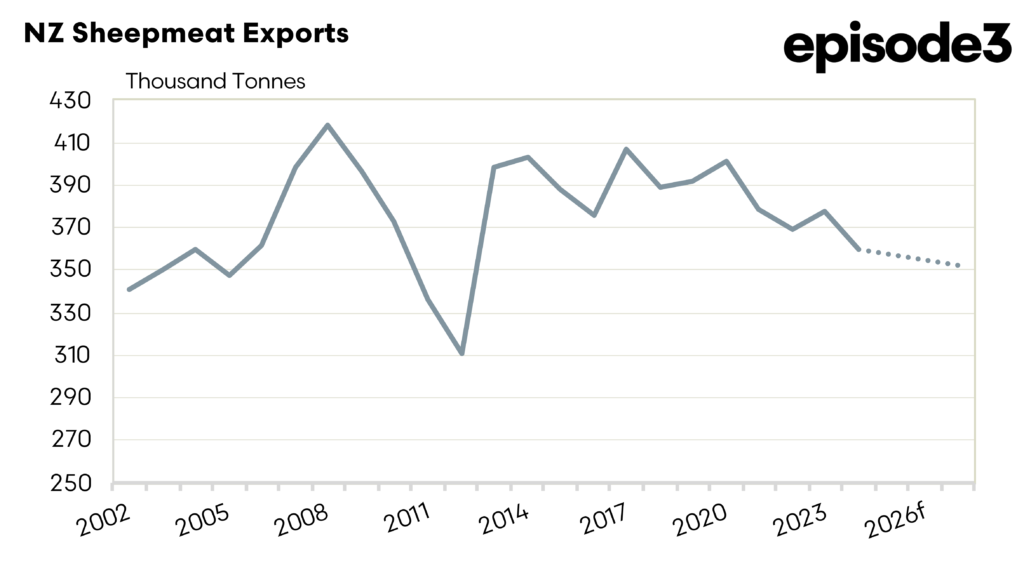

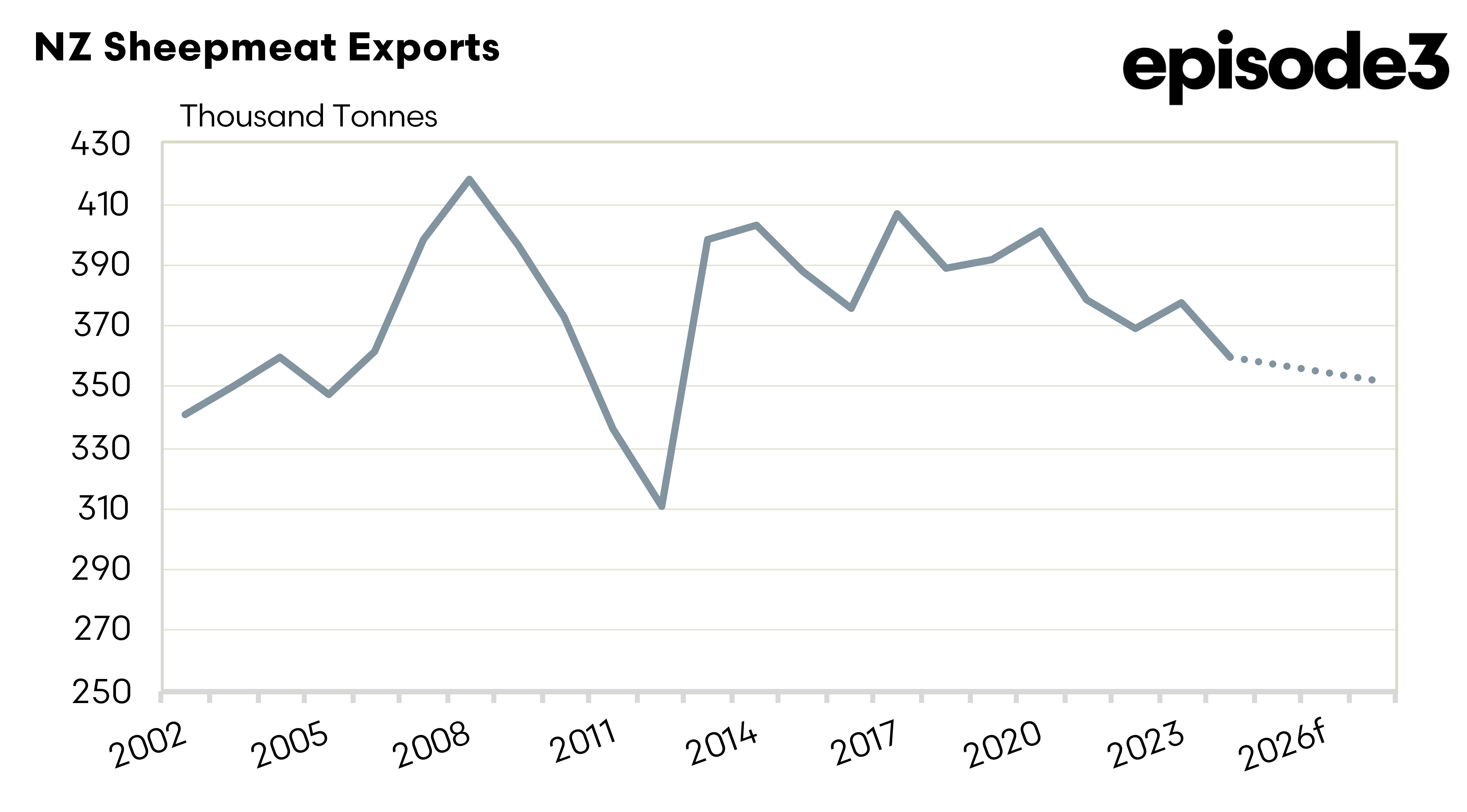

One of the most immediate consequences of this decline is its impact on exports, anticipated to fall by nearly 5% this year to the lowest level since 2012 at 360,000 tonnes. The latest forecasts of a drop this season follows a downward trajectory that has persisted over the past decade. The long-term trend, as depicted in historical export data, reveals a peak in shipments around 2008, followed by a notable decline and periods of volatility. While there have been occasional rebounds, the overall direction remains downward, with the current forecast suggesting a continuation of this trend into the near future. Industry contraction naturally translates into fewer animals available for processing, reinforcing the downward pressure on export volumes.

The continued decline in New Zealand’s sheep industry presents a significant opportunity for Australian sheep producers to strengthen their position in global markets. With New Zealand facing ongoing production constraints due to a shrinking breeding ewe base and lower lambing rates, Australia is well-placed to capitalise on the demand for high-quality lamb, particularly in key export destinations such as the United States, Europe, and China.

As New Zealand struggles to maintain export volumes, Australian producers can expand their market share by leveraging their larger flock, stable production systems, and access to well-established trade networks. This shift is not just a short-term gain but a structural advantage that could see Australia cement its dominance in the global sheepmeat trade for years to come. By focusing on efficiency, genetics, and targeted marketing, Australian producers have a prime opportunity to step into the space left by New Zealand’s declining supply.