A streak of lean times

The Snapshot

- The beef processor margin for May 2021 has come in at a $306 per head loss, bringing the annual average margin to a loss of $322.

- The current period of processor losses is the first time in the last two decades that margins have moved into territory that would be considered extreme, based on losses as a percentage of cattle prices. The margin loss for May 2021 of $306 sits at 44% of the heavy steer carcass weight price.

- Based on an annual slaughter forecast of 6.4 million head, correlation analysis suggests that processor losses would average $150 per head this season.

The Detail

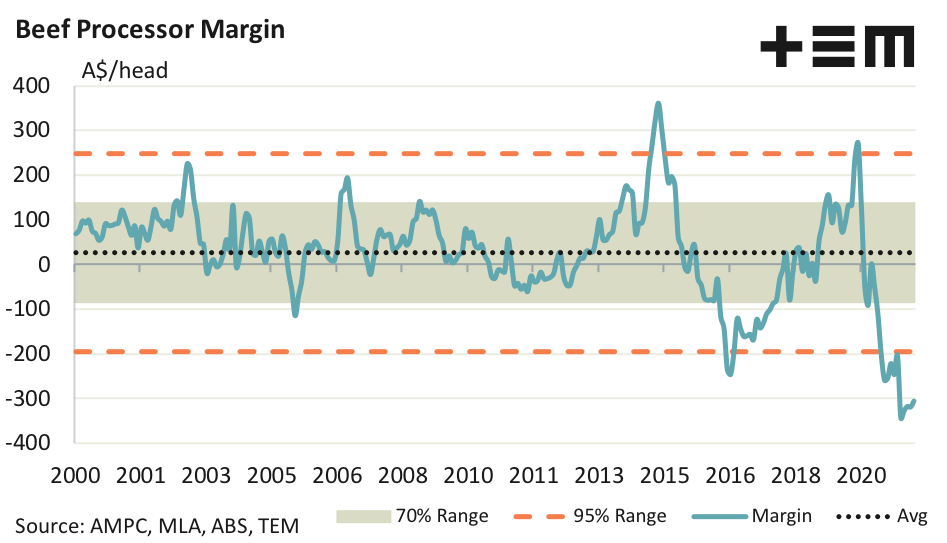

The EP3 beef processor margin model recorded its fourth consecutive month with a loss in excess of $300 per head of cattle processed for the month of May to record a $306 loss. The margin figure for April was revised down from a $336 loss to $319 as updates to the co-product values provided additional benefit to the processor bottom line.

Accounting for the updated inputs to the model this brings the annual average processor margin for the 2021 season to $322 per head of cattle processed.

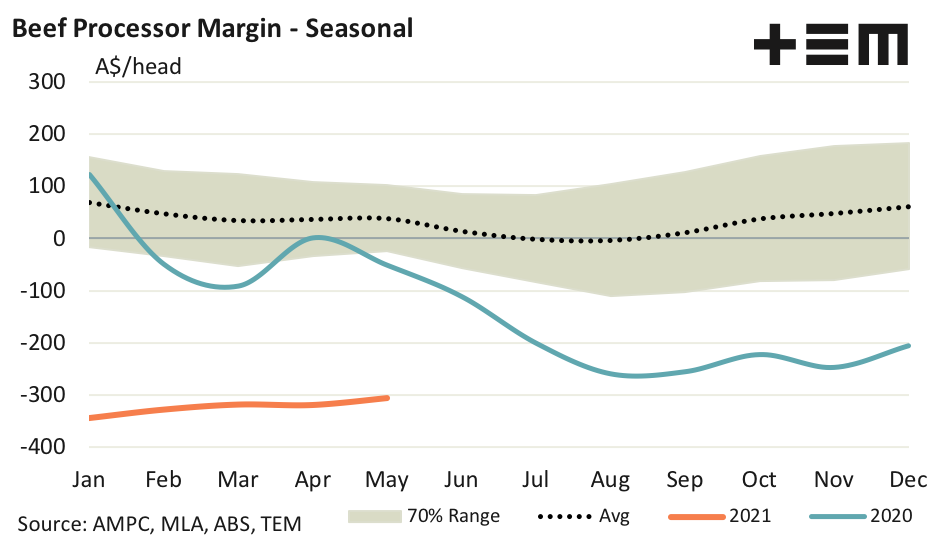

Analysis of the historic monthly pattern of beef processor margins since 2000 shows that movements beyond a profit of $220 per head or below a loss of $195 per head would be considered extreme, as identified by the 95% range boundary (dotted orange lines).

EP3 subscribers have often queried why the fluctuations in the processor margin appear to be growing, with noticeable wider volatility in margin movements for the most recent decade, 2010 to current, compared to the previous decade, 2000 to 2010. Indeed, in the previous decade the margin never extended beyond the extreme 95% range boundary. However since 2010 we have seen it occur four times.

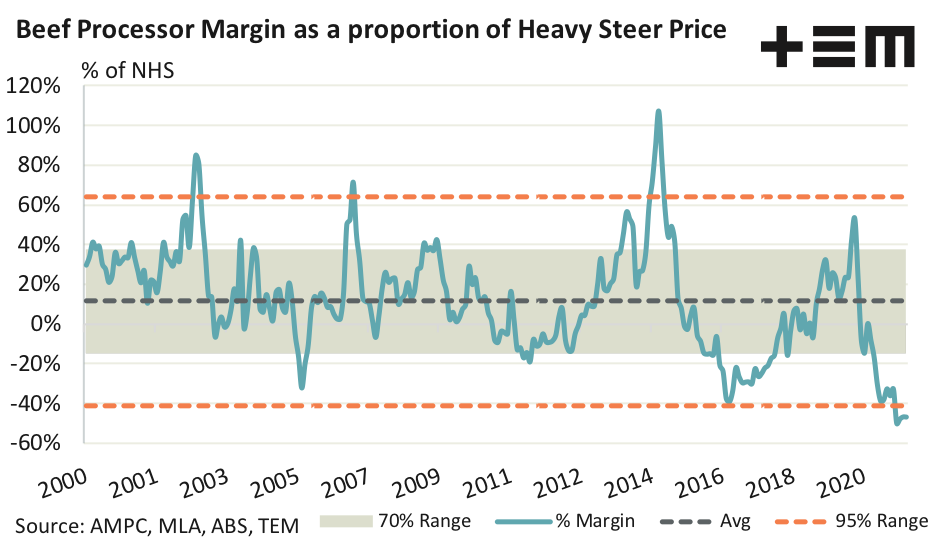

One aspect to consider is that the price of cattle, a key cost input to the processor model, has risen significantly with much of the price growth occurring in the last decade. Perhaps a more fitting measure of the long term volatility in processor margins is to compare the margins as a percentage of the cattle price.

Using this method of comparison highlights that extreme peaks in the processor margin on the profitable side of the ledger, greater than 65% of the heavy steer price, have occurred just three times in the last two decades. Meanwhile, losses would not be considered extreme until they extended beyond 40% of the heavy steer price.

The current period of processor losses is the first time in the last two decades that margins have moved into territory that would be considered extreme. The margin loss for May 2021 of $306 sits at 44% of the heavy steer carcass weight price.

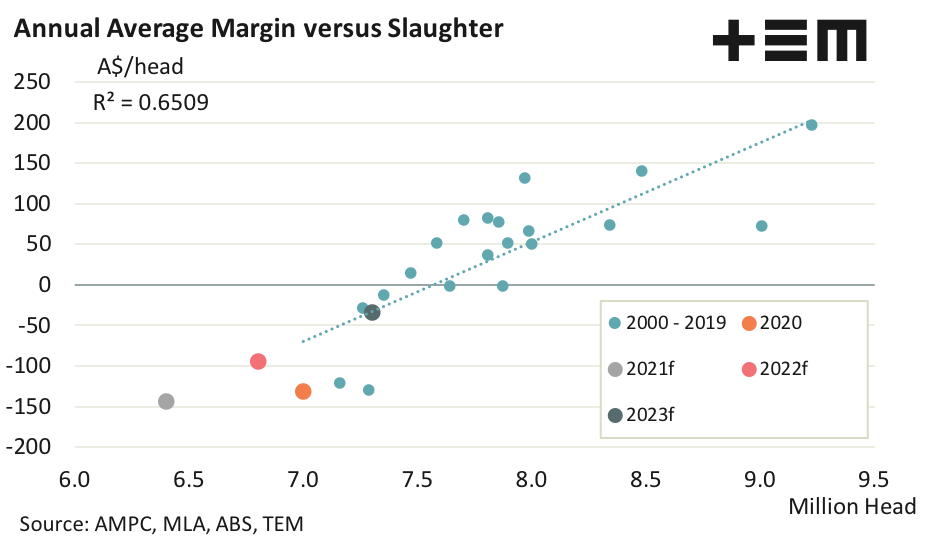

In April 2021, Meat and Livestock Australia published their revised projections for the Australian cattle market indicating that annual slaughter will be lower than anticipated this season. Slaughter is now forecast to come in at 6.4 million head this year, compared to the 6.9 million head they had been anticipating in their February 2021 release of cattle market projections.

Furthermore, MLA revised slaughter levels down for 2022 from 7.2 million head to 6.8 million head. The correlation analysis between annual slaughter and annual average processor margins highlights that during periods of very low slaughter the processor margin comes under significant pressure. Based on a line of best fit, the annual slaughter forecast of 6.4 million head suggests that processor losses would average $150 per head this season. Although, it appears more likely that by then end of 2021 average annual processor losses will exceed this figure.

More worryingly, based on the historic relationship between slaughter levels and processor margins the sector isn’t likely to return to profitable operations until sometime during the 2023 season.