A tale of two lambs

The Snapshot

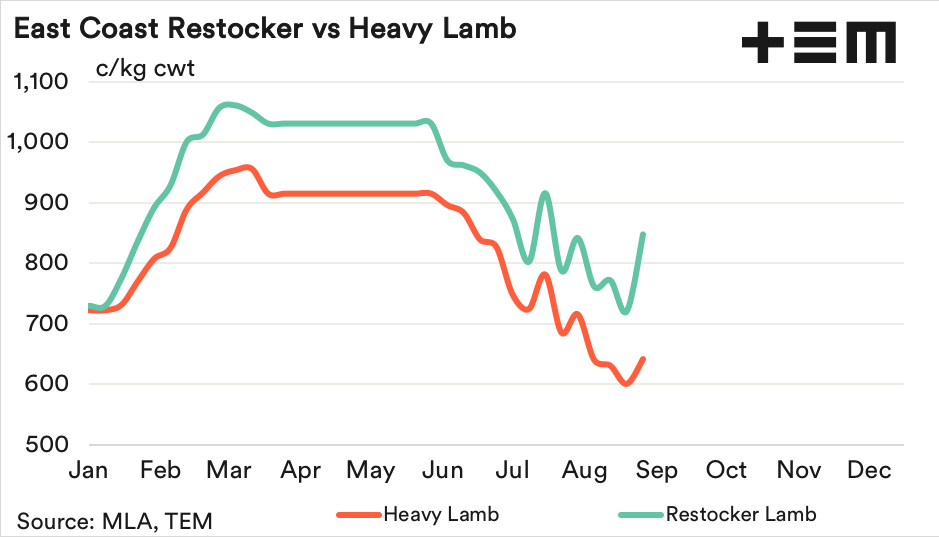

- In the last fortnight the East coast Restocker Lamb Indicator has lifted 18% to close yesterday at 847c/kg cwt. Meanwhile, the East coast Heavy Lamb Indicator has gained just 7% to sit at 641c/kg cwt.

- The NSW Restocker Lamb Indicator saw a 22% jump on the week prior to close yesterday at 881c/kg cwt. In contrast the Victorian Restocker Lamb Indicator managed just a 7% increase from last Monday to close at 694c/kg cwt.

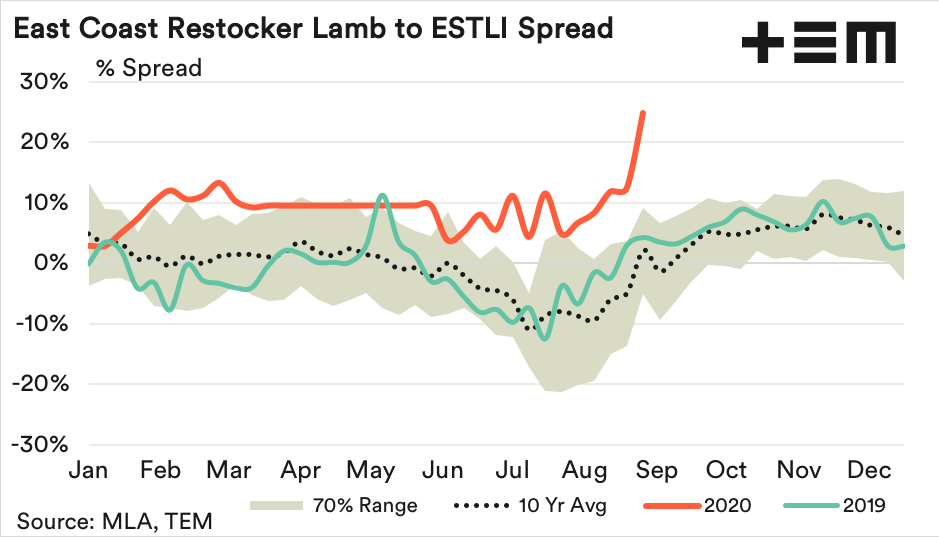

- The prospect of a very wet spring in the east of the country has seen the Restocker Lamb spread widen to the highest premium seen this season, hitting 24.7% this week. This is the highest weekly premium Restocker spread in at least the last two decades.

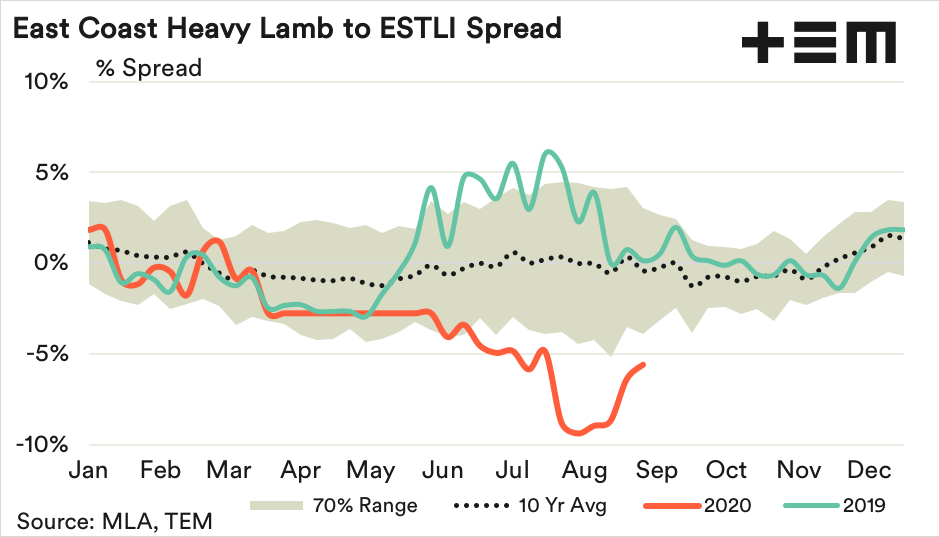

- Victoria processes around 50% of the national lamb cull each year so the capacity restrictions on processors in that state have pushed the Heavy Lamb spread to the ESTLI to a significant discount.

The Detail

This piece should start with the phrase “It was the best of lamb, it was the worst of lamb” but you can’t have too many puns in the one article. In the last fortnight the East coast Restocker Lamb Indicator has lifted 18% to close yesterday at 847c/kg cwt. Meanwhile, the East coast Heavy Lamb Indicator has gained just 7% to sit at 641c/kg cwt.

Much of the momentum in Restocker Lamb prices has been in NSW. After a very dry few years the prospect of the wettest spring across the Eastern seaboard in nearly a decade has NSW sheep producers scrambling to rebuild their flock.

The NSW Restocker Lamb Indicator saw a 22% jump on the week prior to close yesterday at 881c/kg cwt. While not the most expensive Restocker Lambs in the country (they are in Queensland at 1067c/kg cwt) the impressive price rally underlies the tight availability of suitable restocker lambs in the northern states. In contrast the Victorian Restocker Lamb Indicator managed just a 7% increase from last Monday to close at 694c/kg cwt.

Since February the Restocker Lamb spread to the ESTLI has been trending on the upper band of the normal seasonal range, after spending much of 2019 following the ten-year seasonal average pattern.

However, the prospect of a very wet spring in the east of the country has seen the Restocker Lamb spread widen to the highest premium seen this season, hitting 24.7% this week. Indeed, this is the highest weekly premium Restocker spread in at least the last two decades.

Unfortunately for producers with Heavy Lambs to clear the same robust price behaviour can’t be attributed. A combination of an increasing Australian dollar, weakening offshore demand and capacity restrictions on Victorian processors are limiting the price gains.

Analysis of the East coast Heavy Lamb spread to the ESTLI provides a succinct summary of the recent woes befalling this lamb category. After a similar trend to the 2019 season for the first half of the year the spread began to deteriorate in June/July as an appreciating Aussie dollar and Covid19 inspired trade complications saw offshore demand weaken.

Further adding to the price pressure on East coast heavy lambs was the capacity restrictions on Victorian meat processors during August. Victoria processes around 50% of the national lamb cull each year so the capacity restrictions on processors in that state have pushed the Heavy Lamb spread to the ESTLI to a significant discount.

In late July/early August the Heavy Lamb spread discount hit 9.4%, the lowest it has been in over a decade. Currently the Heavy Lamb spread sits at a 5.6% discount to the ESTLI, still below the normal range that could be expected for this spread for this time in the season.

It is crucial that Victorian processors are back at full capacity in time for the Victorian spring flush of lambs. While processors in other states have been able to pick up the slack during winter this is usually a low ebb for lamb processing and there has been spare capacity in other states to cover the reduced Victorian processor output.

However, the large numbers of lambs that will be turned off during October/November will require Victorian processors running at full steam, otherwise producers and the entire supply chain could suffer.