A tale of two Wagyu

Market Morsel

It was the best of Wagyu; it was the worst of Wagyu. Well not quite, there isn’t really any ‘bad Wagyu’ is there? Few niches in global agriculture generate as much mystique per kilogram as Wagyu beef. Yet to the uninitiated, the sector can appear opaque, divided by national borders, breed categories and an alphabet soup of classification grades.

Japan’s carcass grades combine a yield letter (A, B or C) with a quality score (1-5). An A5 animal therefore delivers both the highest dressing-out percentage and the finest marbling, colour, texture and fat lustre that Japanese assessors can record.

A B2 or B3 steer, while still Wagyu, carries less intramuscular fat and therefore occupies the middle of the domestic price ladder.

Episode 3 plan to produce a Wagyu price summary report providing aggregated weighted average price indicators for several Wagyu cattle classifications to allow more price transparency to the Australian Wagyu industry. Episode 3 is currently running a survey, which you can participate in anonymously here.

In Australia, the terminology is genetic rather than numeric. A Fullblood Wagyu holds a 100 per cent pedigree tracing back to the original Japanese imports of the 1990s; there is no other breed genetics in their mix.

An F1 Wagyu, by contrast, is the first-generation cross (typically a Fullblood sire over an Angus dam). While Australia does assign marble scores on the hook, it is the breeding label that markets notice first.

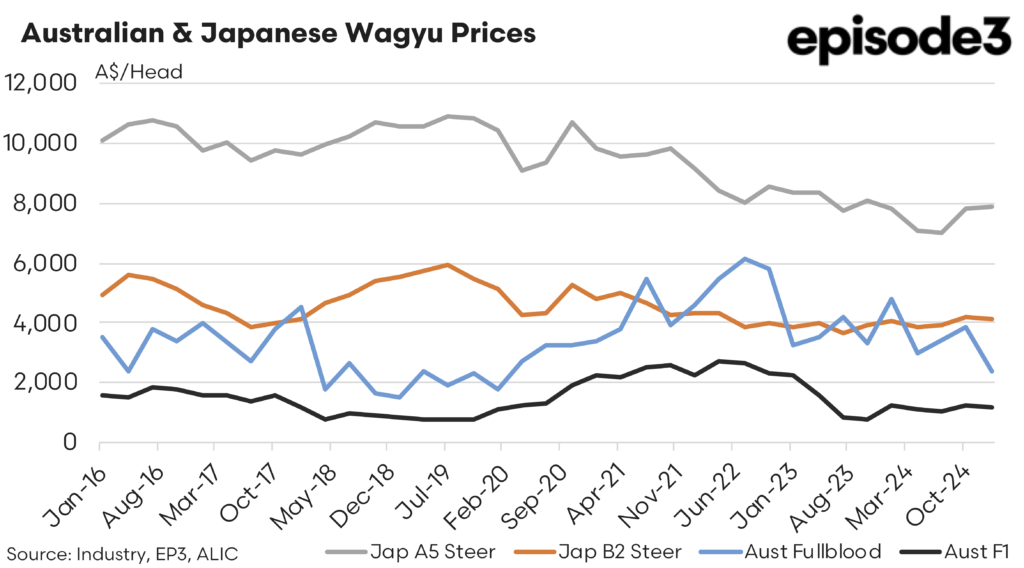

The price trend from early 2016 to early 2025 highlights that the Japanese A5 Wagyu sit loftily above the pack.

Quarterly average pricing begins close to A$10,000 per head, dips briefly below that mark between late 2017/early 2018, rebounds to a pre Covid peak of A$10,900 in late 2019, then gradually eases back towards A$8000 by early 2025 after posting a low of A$7000 in the third quarter of 2024.

The Japanese B2 Wagyu tracks a gentler profile. It starts near A$5000 per head, slides to around $3800 in quarter three of 2017, recovers to A$5945 pre-COVID, and then stabilises around the A$4000 per head mark from early 2023 onwards.

Australian Wagyu cattle occupy a lower price plane. The Fullblood series opens at around A$3600, bottoms out just under A$2000 from Q2 2018 through to Q1 2020, and then climbs dramatically to peak above A$6000 during the Australian Wagyu industry expansion phase seen between 2020 to 2022. In early 2023, average quarterly Fullblood values halved sharply, stabilising between the A$3000 to A$5000 range thereafter.

The F1 Wagyu price trend never approaches those heights. It oscillates between A$800 to $2000 for most of the period, although manages a brief surge toward A$2700 during 2022, and then retreats to roughly A$1200 by late 2024/early 2025.

Two observations leap from the price chart. Firstly, no category ever threatens Japanese A5’s price supremacy. Secondly, F1 prices are comparatively stable, trading as a kind of affordable commercial Wagyu class: rarely spectacular, occasionally pressured, but generally able to find a buyer at the right discount.

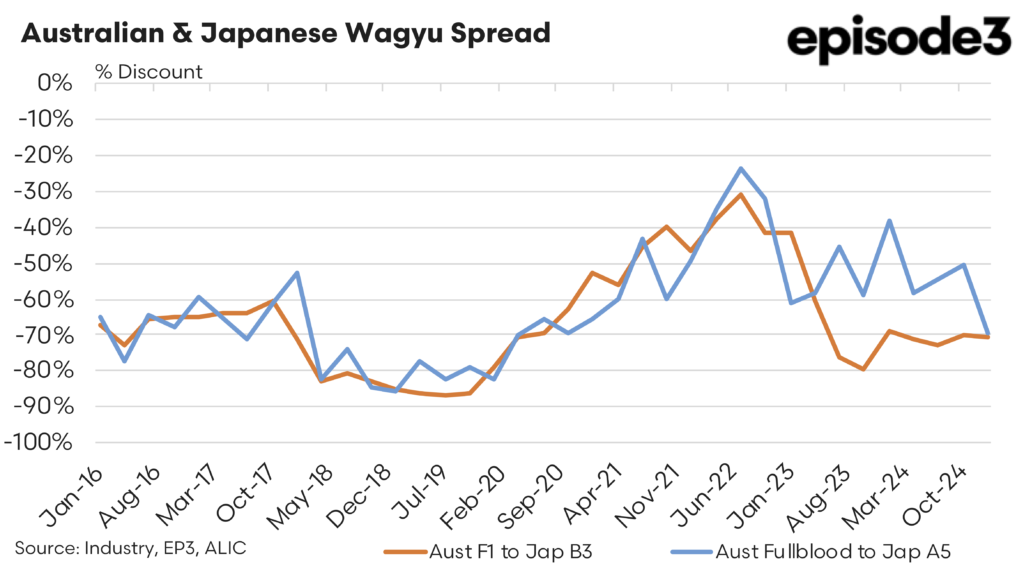

That discount is quantified in the percentage spread chart. The blue-coloured series shows the percentage difference between Australian Fullbloods and Japanese A5 steers.

The orange line does the same for Australian F1s against Japanese B-grade cattle. In 2016 both Australian categories were roughly two-thirds cheaper than their Japanese counterparts, a discount of about 65pc. The following three years were unkind to Australian producers. As drought forced stock onto the market and Japan held its pricing line, the discount stretched beyond 80pc on several occasions.

A dramatic reversal arrived during 2020. COVID stimulus cheques, restaurant reopenings and a global protein shortage collided to lift Australian Wagyu values faster than Japanese values.

By mid-2022 the Fullblood discount had narrowed to 25 per cent and F1s had narrowed to a 30pc discount. Australia had never looked so close to parity.

Yet the narrowing spread trend proved transitory. When post-pandemic demand normalised and higher feed costs gnawed at feedlot margins, Australian prices fell far more quickly than Japanese ones.

Through the second half of 2023, the F1 discount returned to the 70-80pc range while Fullbloods oscillated between 40pc and 60pc. By the start of 2025, spreads in both series had settled at a 70pc discount.

Episode 3 plan to produce a Wagyu price summary report providing aggregated weighted average price indicators for several Wagyu cattle classifications to allow more price transparency to the Australian Wagyu industry. Episode 3 is currently running a survey, which you can participate in anonymously here.

Linking the two graphs suggests four broad conclusions. Firstly, Japan continues to insulate its highest grades from international price cycles, preserving both brand prestige and farm gate returns.

Secondly, Australia’s premium Wagyu segment is highly leveraged to the global cattle cycle, so when grain costs, Wagyu supply and consumer sentiment adjust, Fullblood pricing can halve or double in value within 24 months.

Thirdly, F1 production behaves more like a margin business. A price floor is set by the broader Australian feeder steer market, and its ceiling price is capped by how much a restaurateur in Seoul, Dubai or Los Angeles is willing to pay for mid-marbled commercial Wagyu beef product.

Finally, the percentage spread can act as an early-warning signal. When it narrows sharply, as it did in 2022, Australian Wagyu producers would do well to bank some of the windfall because history shows the gap rarely stays tight for long.

For anyone weighing a first foray into Wagyu, the lesson is not that Australian cattle are inferior, as sensory panels routinely score well-fed Australian Fullblood beef alongside, and sometimes above, Japanese product.

Rather, the charts reveal the economic reality behind the romance. Wagyu is a luxury product sold through an agricultural pipeline, which means its farm gate price is buffeted by both fine-dining fashion and the humdrum forces of weather and feed cost.

A successful strategy, therefore, blends genetic excellence with commercial vigilance. Aim for marbling, manage the cattle cycle, and watch the spread. The cattle may be bred for indulgence, but the business demands discipline.