A view to a kill

The Snapshot

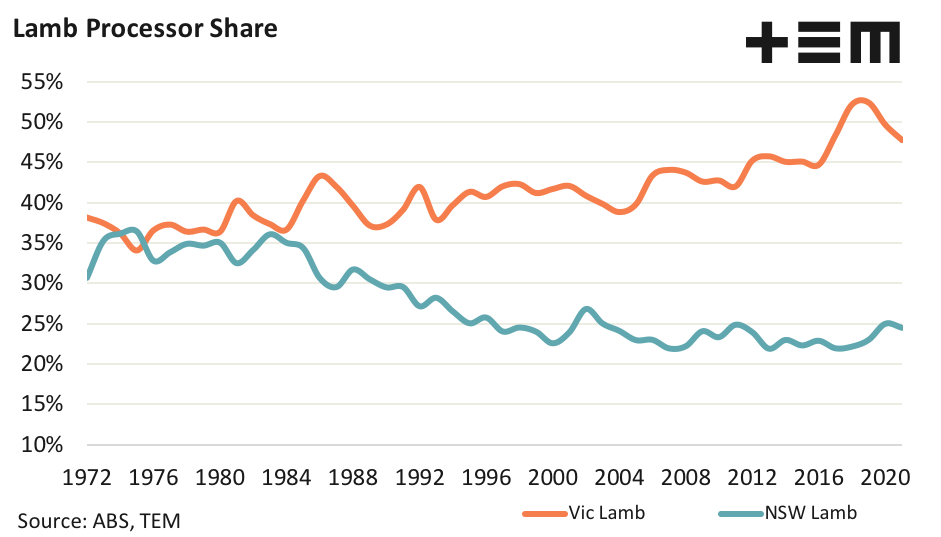

- Victorian abattoirs carry the majority of the load when it comes to the processing of the nation’s lamb and sheep, accounting for about 40% of the national sheep slaughter and 50% of the national lamb slaughter.

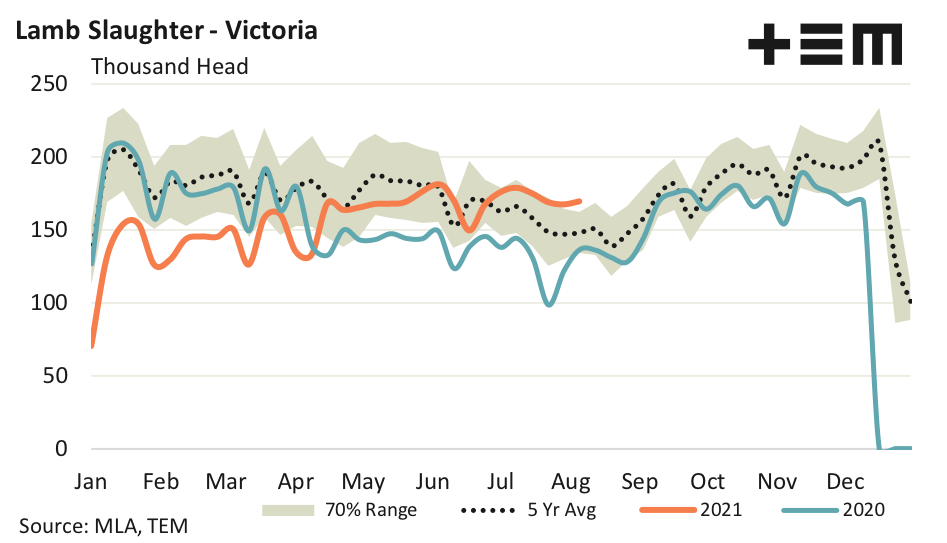

- Over the last four weeks Victorian lamb slaughter has maintained levels 13% higher than the five-year average seasonal trend, compared to being 14% under trend for much of the 2021 season.

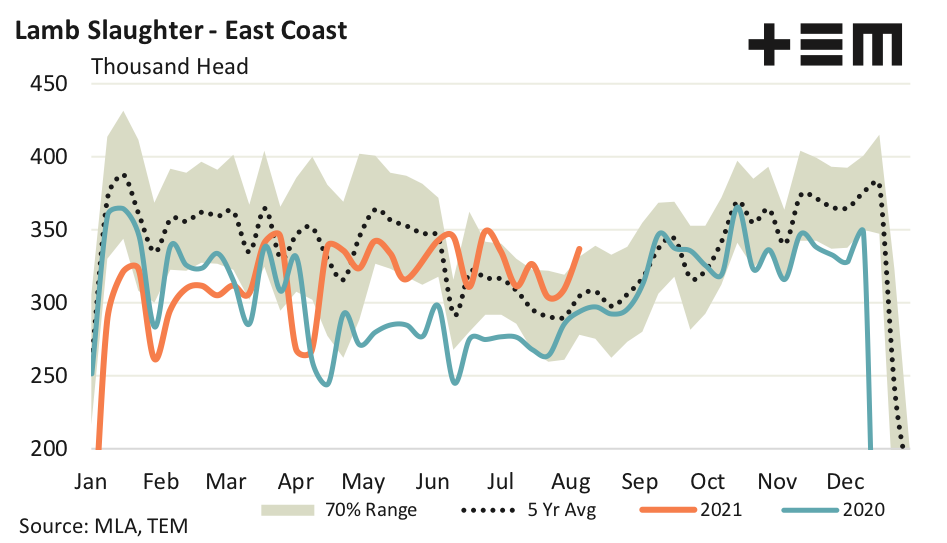

- During winter 2020 average weekly lamb slaughter across the east coast ran at about 280,000 head, in contrast this year it is sitting at about 325,000 head, or 16% higher.

- A severe enough shock to our processing capacity could see lamb prices ease 30-40% from current levels placing the ESTLI in the mid/low 600 cent region or perhaps slightly under 600 cents by late spring.

The Detail

Victorian abattoirs carry the majority of the load when it comes to the processing of the nation’s lamb and sheep, accounting for about 40% of the national sheep slaughter and 50% of the national lamb slaughter in 2020. In contrast, New South Wales account for around 30% of the annual sheep slaughter volumes and 25% of the Australian lamb cull.

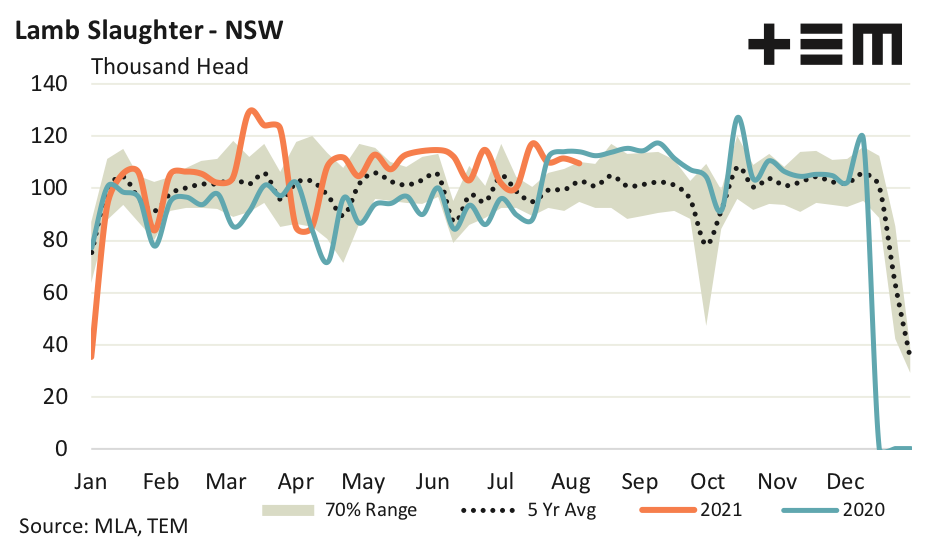

In 2020 when Victorian abattoirs were faced with Covid-19 workforce capacity restrictions during late winter NSW based processors picked up some of the slack, averaging about 115,000 head of lamb per week until September, when the Victorian restrictions began to ease.

The timing of the return of the Victorian abattoirs to full capacity couldn’t have come at a better time as spring is synonymous with a surge in lamb throughput in Victoria, much of which end up at the meat works throughout spring and summer. Indeed, it is not uncommon to see Victorian abattoirs recording in excess of 200,000 lambs processed each week during November and December.

Last season there were real concerns that an extended Victorian abattoir lockdown could force a bottle neck of spring lambs and lead to a sharp price decline. Thankfully, this outcome never eventuated. However, there are concerns this year that a lack of seasonal abattoir workers, due to international travel restrictions, could create a similar capacity bottle neck for lamb processing this spring.

The seasonality chart for Victorian lamb slaughter shows an underwhelming start to 2021 through to Easter. However, since July Victorian lamb slaughter volumes have picked up considerably, maintaining weekly levels at the upper end of the normal seasonal range. Indeed, over the last four weeks Victorian lamb slaughter has maintained levels 13% higher than the five-year average seasonal trend. As a comparison the average weekly lamb slaughter in Victoria for the first six months of the 2021 season has been averaging weekly slaughter levels nearly 14% below the seasonal trend, so it has been a significant turnaround.

In NSW lamb slaughter has been running hot for much of the year, mirroring the large volumes that were being put through when they came to the assistance of the Victorian abattoirs in 2020. Apart from the usual Easter lull and a relatively average start in the first quarter the majority of the weekly NSW lamb slaughter volumes have at or above the top of the normal seasonal range.

Since the start of 2021 NSW lamb slaughter has been averaging weekly figures of around 107,000 head compared to the five-year weekly average of 99,000 head, approximately 8% higher than the seasonal average trend.

The impact of the increased Victorian lamb slaughter activity in recent weeks is beginning to show up in the broader east coast slaughter data with weekly volumes moving ahead of the average trend and achieving results at the upper end of the normal seasonal range for the first time this year multiple times since the start of winter.

In fact, current weekly east coast lamb slaughter volumes of around 335,000 head are more consistent with the levels that would be expected to be seen in spring than in winter. Indeed, winter of 2020 saw average weekly lamb slaughter across the east coast run at about 280,000 head and in contrast this year it is sitting at about 325,000 head, or 16% higher.

It begs the question, are processors trying to front load some of their lamb processing this year in an attempt to get ahead of the normal surge in lambs over spring so they don’t end up subject to a disastrous bottle neck? If last years abattoir capacity concerns are realised this season it could place greater than normal pressure on lamb prices than we usually experience over spring.

As a general rule, the Eastern States Trade Lamb Indicator (ESTLI) declines about 15%-20% from late winter to early summer. In the USA last year there was a similar disruption to their beef and pork processing capacity due to Covid-19 lockdowns and it created a backlog of livestock. The subsequent price decline at the saleyard for cattle and hogs during the bottle neck was around 40%-50%.

While my gut feeling tells me this magnitude decline for lamb prices this season is a little extreme there is the possibility that a severe enough shock to our processing capacity could see lamb prices ease 30-40% from current levels placing the ESTLI in the mid/low 600 cent region or perhaps slightly under 600 cents by late spring.