A weight of numbers

Market Morsel

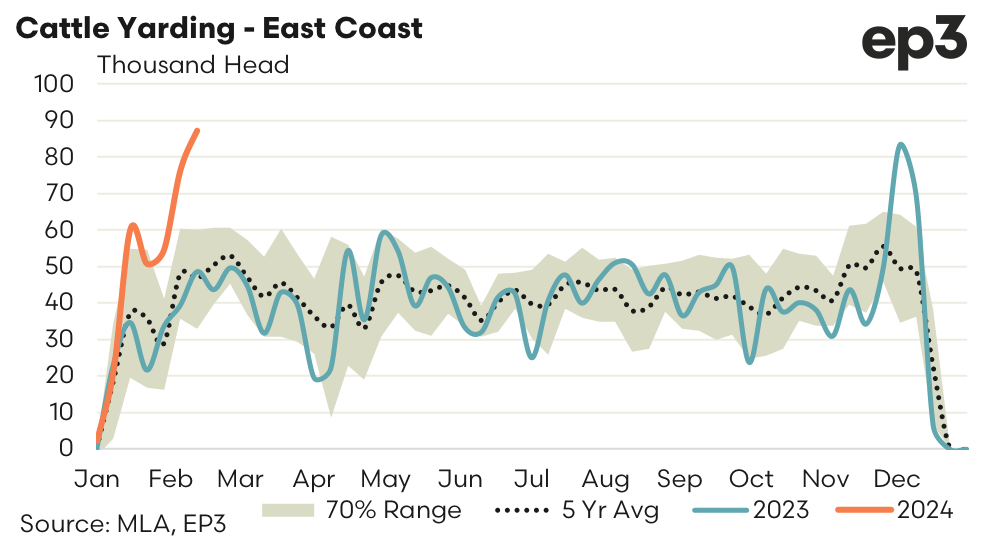

The first three weeks of February have seen some very solid throughput numbers presented at east coast saleyards, particularly for cattle. Average weekly cattle yardings across the eastern seaboard saleyards has sat at around 73,000 head which is 82% higher than the saleyard volumes seen for the start of February in 2023 and 78% stronger than the five-year average trend for the first three weeks of February.

The stronger than normal cattle turnoff has impacted prices with the national heavy steer indicator easing from a recent peak of 312c/kg lwt to 280c/kg, a decline of around 10%. However, considering the strong supply being presented the price easing isn’t too bad and is probably being supported by the strong start to beef export flows in 2024.

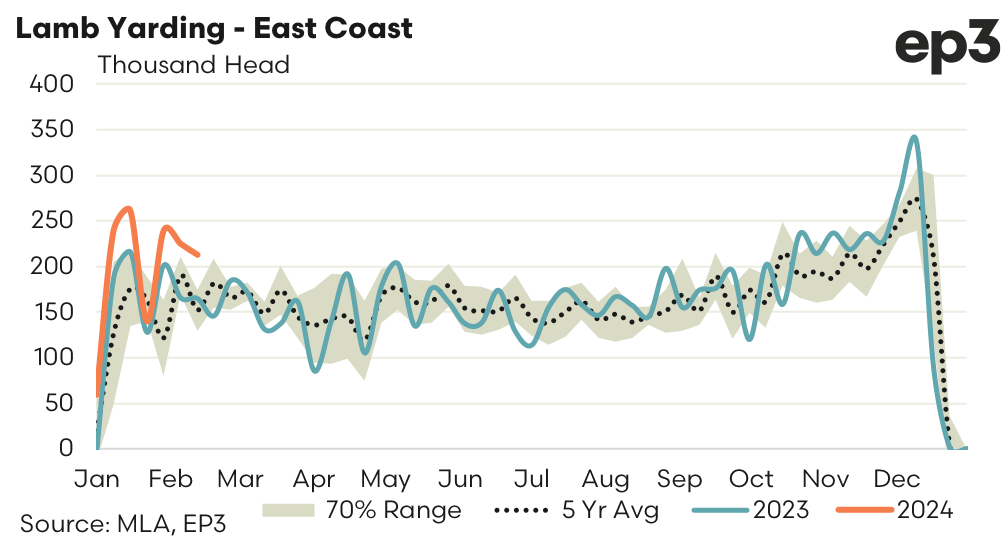

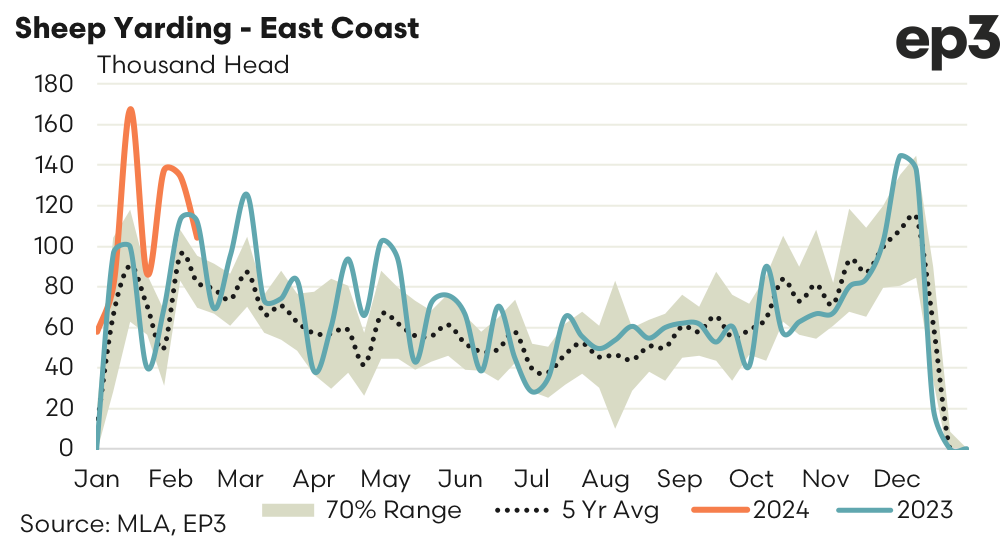

Weekly saleyard throughput for sheep and lamb was strong into February too. Average weekly east coast lamb and sheep volumes during the first three weeks of February 2024 have both been 28% higher than levels seen in February 2023. Comparing the February yarding levels to the five-year average trend shows that sheep volumes have been stronger in percentage terms.

East coast sheep have averaged weekly yardings of around 125,000 head this February which is 64% higher than the five-year seasonal pattern. Meanwhile, east coast weekly yardings of lamb have averaged 226,000 head during February, which represents saleyard throughput levels that are 47% higher than the five-year pattern for February.

The higher supply of sheep and lamb have impacted prices too. The trade lamb indicator has eased 18% from the January peak of 775c/kg cwt to sit at 636 cents presently. Meanwhile, the mutton indicator has dropped 33% in recent weeks from a peak of 313c/kg cwt to 209 cents.