A winter of discontent

The Snapshot

- A combination of high local cattle prices and falling beef export prices since the start of 2020 have seen the average monthly beef processor margin retreat into negative territory.

- June 2020 saw the lowest monthly margin to date at a loss per head of $137. While the annual average beef processor margin sits at a loss of $63 per head.

- Given the tight state of supply forecast by Meat and Livestock Australia into the 2021 season there may be further tough times ahead for beef processors with the annual average margins not anticipated to head towards positive territory until into 2022.

The Detail

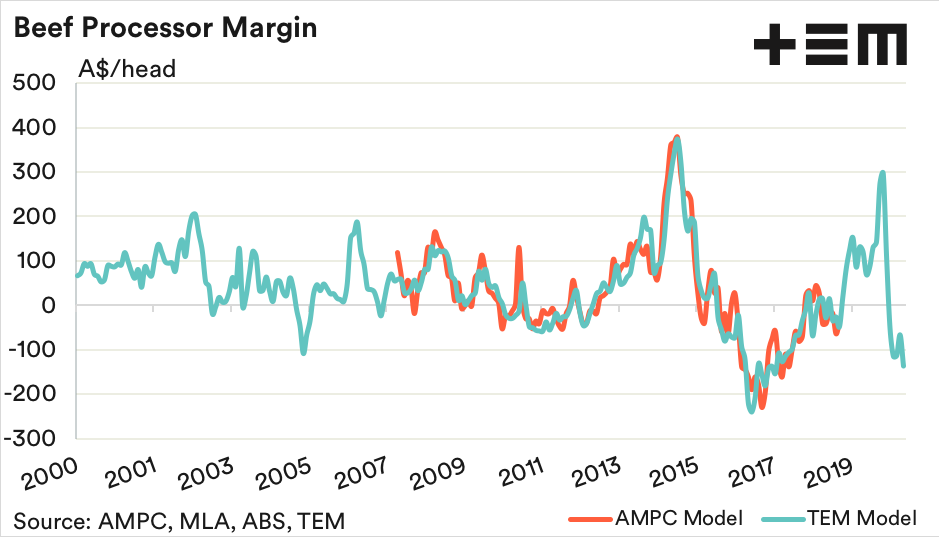

In late 2018 the Australian Meat Processor Corporation (AMPC) published an excellent report on theoretical beef processor margins which showed the average monthly margin per head received by a representative abattoir.

Using an estimate from the data within this report the team at Episode3 were able to come up with their own version of the beef processor margin model. While it doesn’t perfectly fit the pattern set by the AMPC model it’s still a pretty good representation of how the beef processing industry is faring, based on the key inputs that drive the model.

The AMPC model was calculated from 2008 to 2018. However, using our growing datasets at EP3 we were able to reconstruct our model further back in time and have projected it out to June 2020. We aim to update this model on a regular basis and report on it via the EP3 website so make sure to subscribe to the email list to get the updates as they are released.

A combination of high local cattle prices and falling beef export prices since the start of 2020 have seen the average monthly beef processor margin retreat into negative territory.

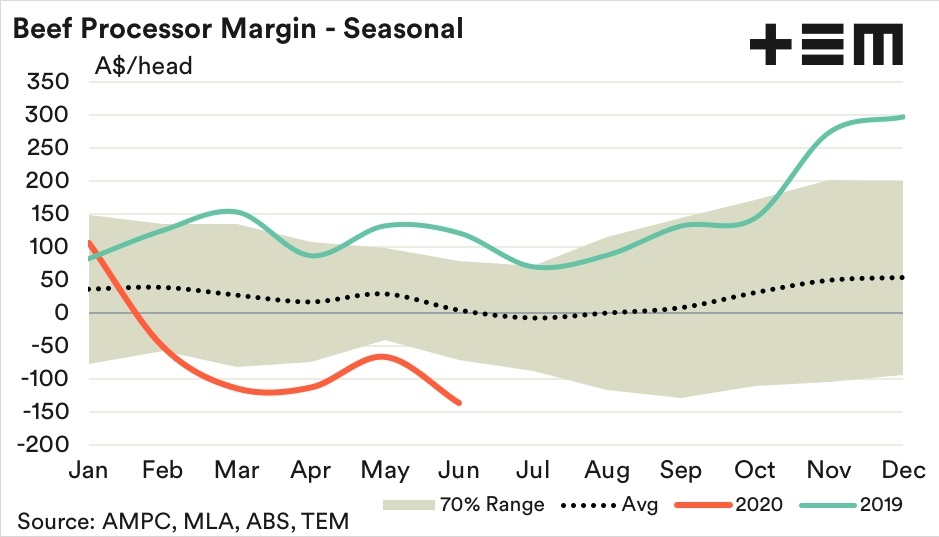

Indeed, the seasonal pattern highlights the margin slipping below zero in February and has remained there for the remainder of the 2020 season. June 2020 saw the lowest monthly margin to date at a loss per head of $137. While the annual average beef processor margin sits at a loss of $63 per head.

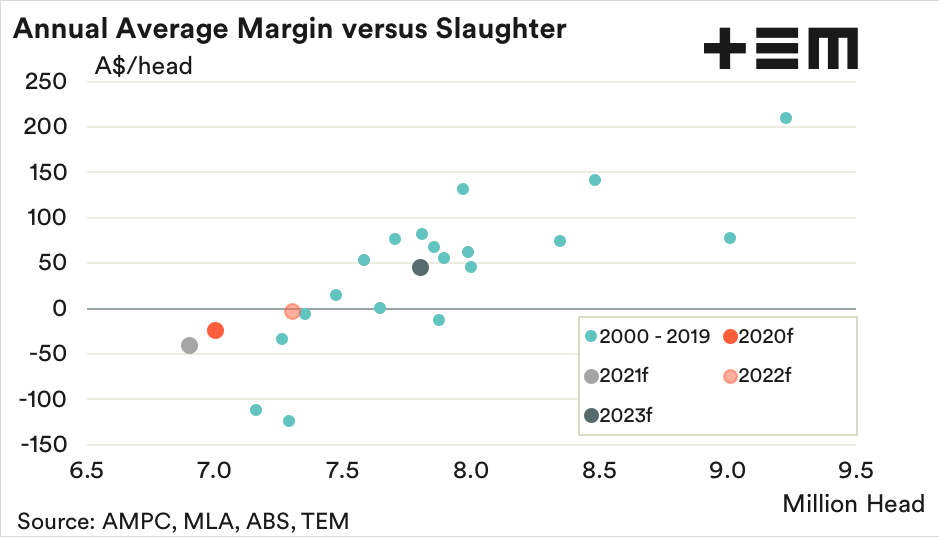

Analysis of the relationship between the annual average margin and annual average cattle slaughter in Australia shows that during tight supply seasons or during herd rebuild, when slaughter levels are low, processor margins tend to gravitate toward negative territory.

Similarly, when drought conditions present and slaughter levels are higher processors can benefit from the easing cattle prices. This was particularly true for the 2014 season when annual cattle slaughter hit 9.2 million head and annual average beef processor margins were above $200 per head.

Adding to the processor bottom lines during this period was the strong demand for Aussie beef from the USA as tight supplies there caused an increase in beef imports.

The current disruption to processors in Victoria due to Covid19 comes at a time when the season is already quite difficult for meat works. Hopefully, the restrictive period doesn’t extend beyond the current six-week timeframe and interstate abattoirs can pick up the slack in the meantime, so prices at the saleyard aren’t impacted too significantly for producers.

Given the tight state of supply forecast by Meat and Livestock Australia into the 2021 season there may be further tough times ahead for beef processors with the annual average margins not anticipated to head towards positive territory until into 2022, unless we see a big lift in beef export demand and prices. Which may be unlikely given economies around the world are slipping into a recessionary phase.