A Winter Tightening as Processors Hunt for Cows

Market Morsel

The national cattle market showed further signs of winter tightening during July 2025, with a notable easing in yarding volumes across several southern states when compared to June. As the supply pulse out of Queensland moderated and southern states struggled with seasonal gaps and lighter offerings, processors continued to sharpen bids for cows, particularly as manufacturing beef demand abroad remained supportive.

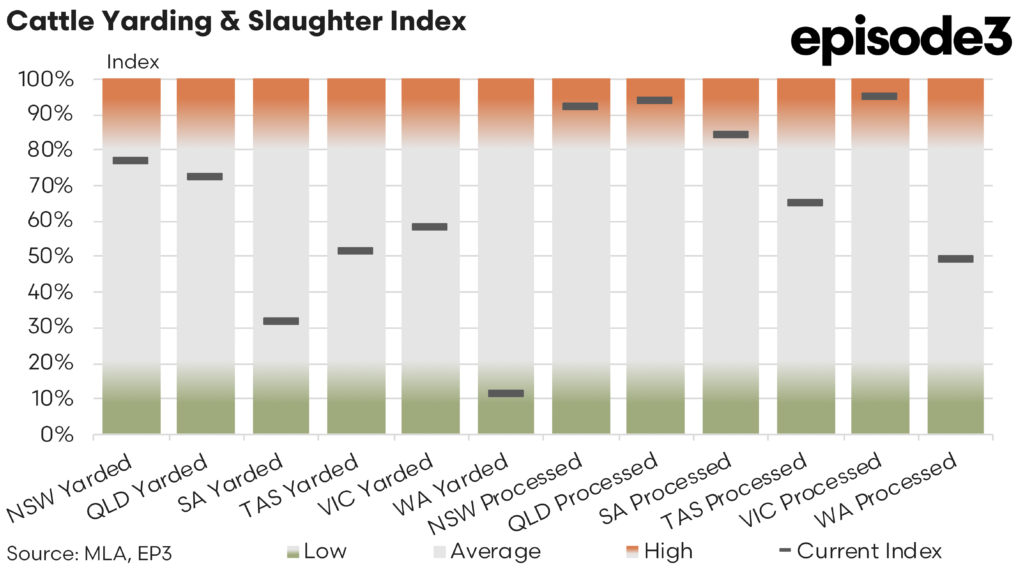

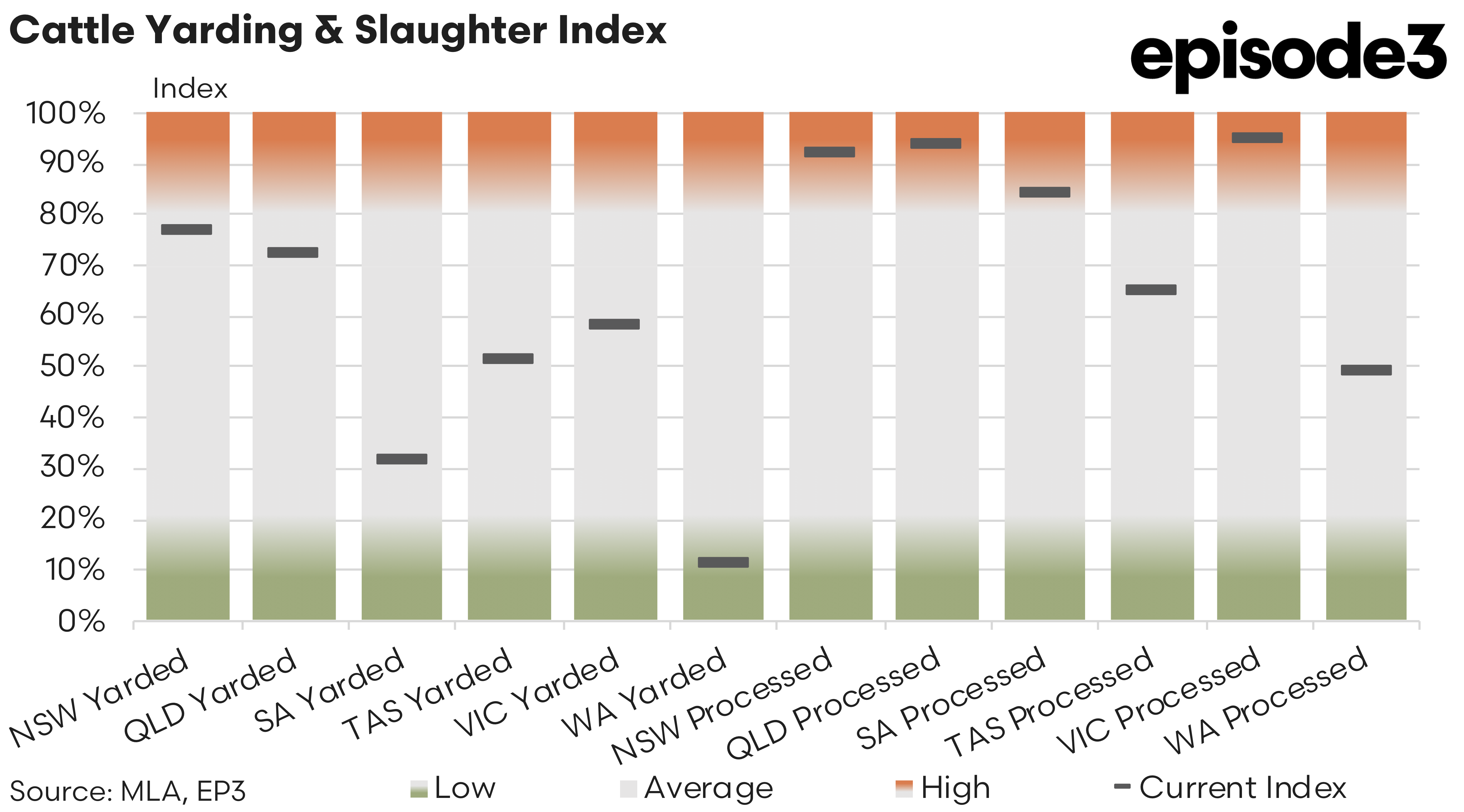

Fresh figures from the yardings index reflect a clear pullback in available stock across some states. In New South Wales, yardings held steady at 77 percent, suggesting some stability in paddock supply despite winter conditions. However, Queensland recorded a minor decline from 74 percent to 72 percent, indicating that the earlier flurry of grain-fed turn-off may be tapering as local grids reset and available weight slips seasonally.

South Australia posted a sharp fall in yardings from 44 percent to just 31 percent, underscoring a tightening supply pipeline out of the state’s southeast. Tasmania recorded a modest easing from 53 percent to 51 percent, while Victoria experienced a dramatic reduction, dropping thirty percentage points from 88 percent in June to just 58 percent in July. This pullback likely reflects both weather-related constraints and broader herd management strategies, especially in regions where cow liquidation may have been front-loaded.

Western Australia continued to struggle, falling from an already low base of 17 percent in June to just 11 percent in July, consistent with its ongoing structural supply challenges.

Processing activity echoed some of these movements. Queensland remained near its operating ceiling, dipping slightly from 96 percent to 94 percent as labour constraints and logistics held throughput near its natural cap. In contrast, New South Wales processors lifted sharply, surging from 73 percent in June to 92 percent in July as plants returned from maintenance shutdowns and sought to refill kill sheets ahead of expected late-winter weather disruptions.

Victoria retreated from 95 percent to 84 percent, in line with lower yardings and sustained cow liquidation earlier in the season. South Australia also slipped from 90 percent to 84 percent, while Tasmania moved down from 71 percent to 65 percent. Western Australia recorded the most meaningful jump, with processor utilisation lifting from 21 percent to 49 percent, though this remains well short of full operational capacity.

The broader industry narrative remains dominated by cow pricing. The latest MLA market indicators show that processor cows continue to be the standout in terms of price momentum. As of late July, the processor cow indicator reached 374 cents per kilogram live weight, having climbed by over 71 cents in the past four weeks. Week-on-week movements were also positive, with the indicator up 42 cents over the week.

This ongoing strength reflects a combination of tightening domestic cow availability and robust international demand, particularly for lean grinding beef into the United States. Exporters continue to find reliable support from offshore customers as US cow numbers remain low and South American competition is increasingly constrained by quota access and seasonality.

Heavy steers, meanwhile, have taken a more tempered path. The national indicator sits at 396 cents per kilogram live weight, reflecting a monthly increase of 24 cents. Feedback from industry sources indicates that while there is still underlying demand for finished steers, the price escalation seen in May and early June has left some processors cautious, especially given steady retail beef pricing.

Looking ahead into August, the focus will remain on how much further processor demand can stretch in the face of limited yardings, especially if recent rain events restrict paddock access or slows deliveries. Cow weights are expected to remain light through the remainder of winter, adding further incentive for buyers to extend their reach into higher-yielding northern zones.

While heavy steer markets may pause to consolidate recent gains, the cow market appears poised to continue benefiting from its stronger fundamentals. With international interest holding firm and few signs of domestic oversupply, processor cows may well remain the meat works buyer’s favourite item as spring approaches.