A worrying trend

The Snapshot

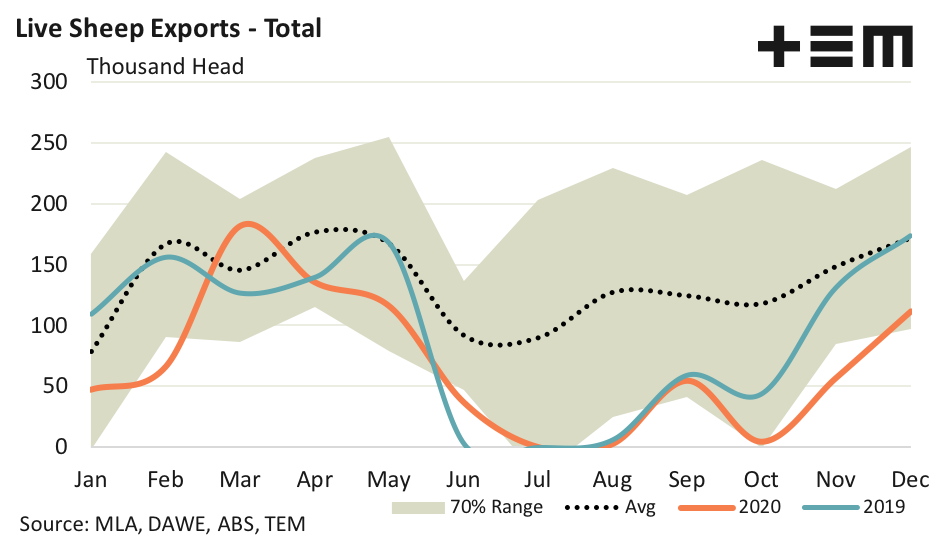

- Total annual live sheep export volumes were 30% under the five-year average trend in 2019 and came in 49% below the average in 2020.

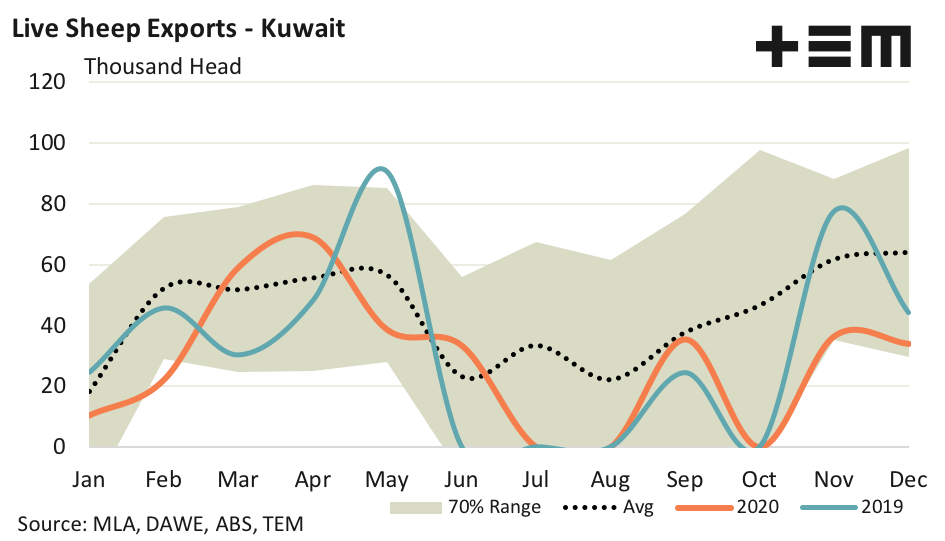

- Average monthly flows from Australia to Kuwait for the last four months of the year show that 2020 flows were 28% under the levels seen in 2019.

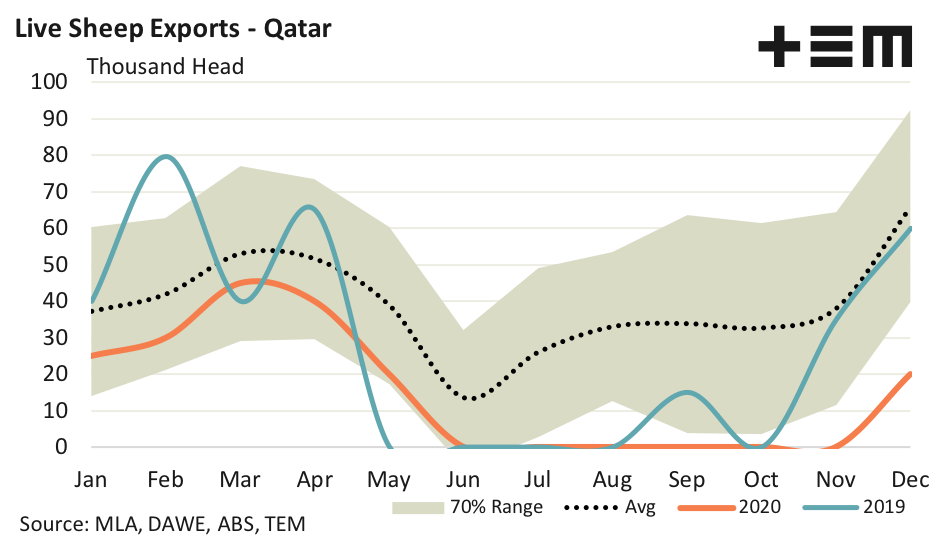

- Live sheep exports to Qatar in 2020 has been decidedly lacklustre with flows running 46% under the 2019 trend and 61 % below the five-year seasonal pattern.

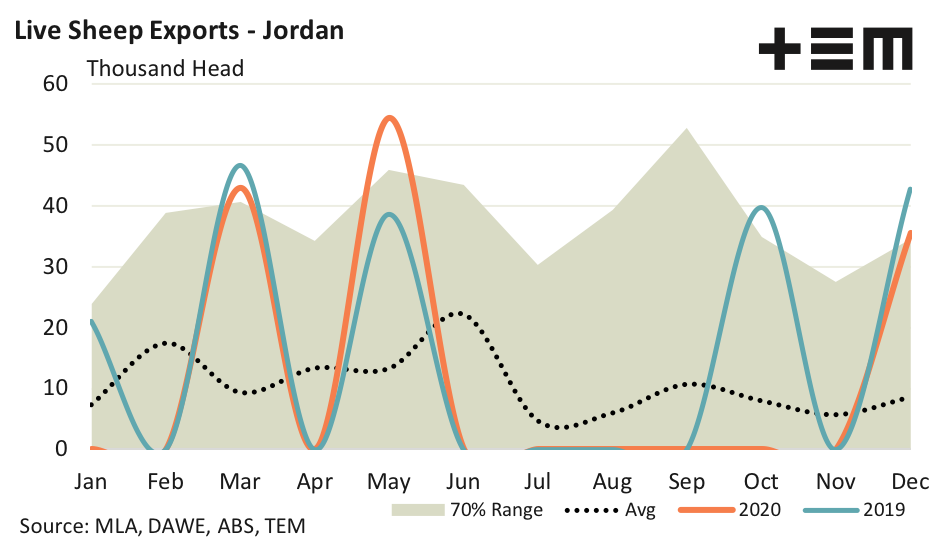

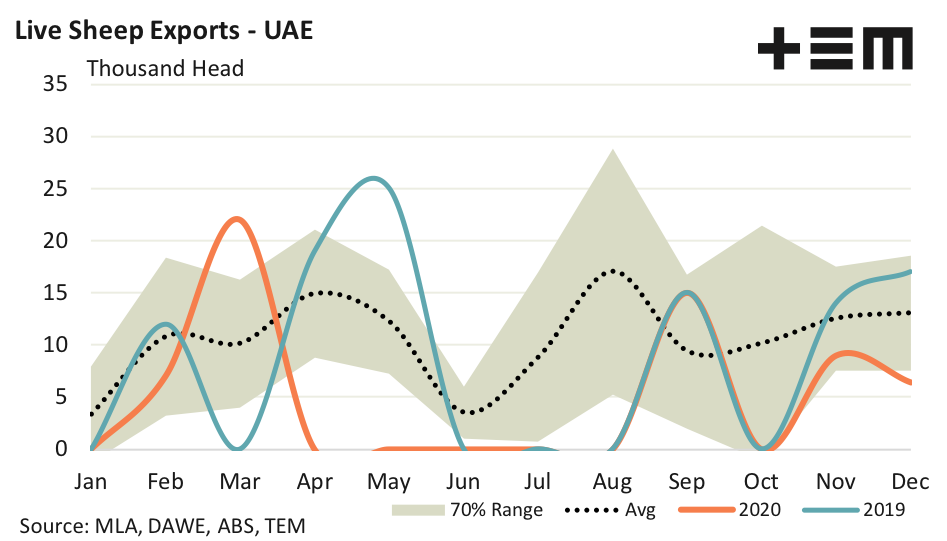

- The lack of a spike in volumes to Jordan in October meant that the 2020 flows to Jordan were 29% lower than levels seen during 2019. Meanwhile, flows to the UAE in 2020 were 42% under the 2019 volumes and 53% below the five-year trend.

The Detail

Total live sheep export volumes for 2020 came in at 811,511 head, which is a 49% decline in flows from the five-year average pattern. The 2019 season ran 30% below the average trend. This signals that the northern hemisphere summer moratorium and the tight supply of sheep are having a negative impact on live sheep export volumes.

Indeed, the average annual volumes for the last three seasons (2018-2020) have been running 48% under the average annual volumes for the three years prior (2015-2017).

Analysis of the seasonal live sheep flows to Australia’s top four export destinations shows a recurring pattern of higher than average flows leading up to, and after, the moratorium period. However, each of the key destinations show a concerning trend when comparing the 2020 pattern to the 2019 trend.

Kuwait is Australia’s top destination for live sheep exports, taking 41.6% of total flows in 2020. A comparison of the average flows for the months either side of the moratorium shows that the March – April 2020 period saw volumes 19% ahead of the average trend. Meanwhile, May 2019 saw volumes 60% ahead of the five-year average for May and November 2019 saw flows 25% ahead of the average November trend.

While the increase to average monthly live sheep consignments to Kuwait in the months leading up to the moratorium for 2019 and 2020 were within 2% of each other, the average monthly flows for the last four months of each year show that 2020 flows were 28% under those seen in 2019. While it is early days, it could signal that Kuwait is beginning to consider other supply options.

The next three destinations in line behind Kuwait for Australian live sheep are Qatar, holding 22.2% of market share, Jordan, with 16.4% of market share, and the United Arab Emirates (UAE) on 7.3% of market share for the 2020 season.

All of these destinations show declining volumes from the 2019 to 2020 season. Indeed, Qatar saw above average flows in 2019 leading up to the northern hemisphere summer moratorium and a good improvement in flows for the last quarter of 2019. However, 2020 has been decidedly lacklustre with flows running 46% under the 2019 trend and 61 % below the five-year seasonal pattern.

Jordan experienced similar sized spikes in volumes pre and post moratorium for 2019 and 2020. Although there was no spike in volumes during October of 2020. The net result of this lack of a spike in October meant that the 2020 flows to Jordan were 29% lower than during 2019.

Meanwhile the UAE saw a single above average spike pre the moratorium and two above average months post the moratorium in 2019. However, in 2020 there was only one above average spike in volumes before the moratorium and remained below the average pattern for the later half of the season. This meant that flows to the UAE in 2020 were 42% under the 2019 volumes and 53% below the five-year trend.

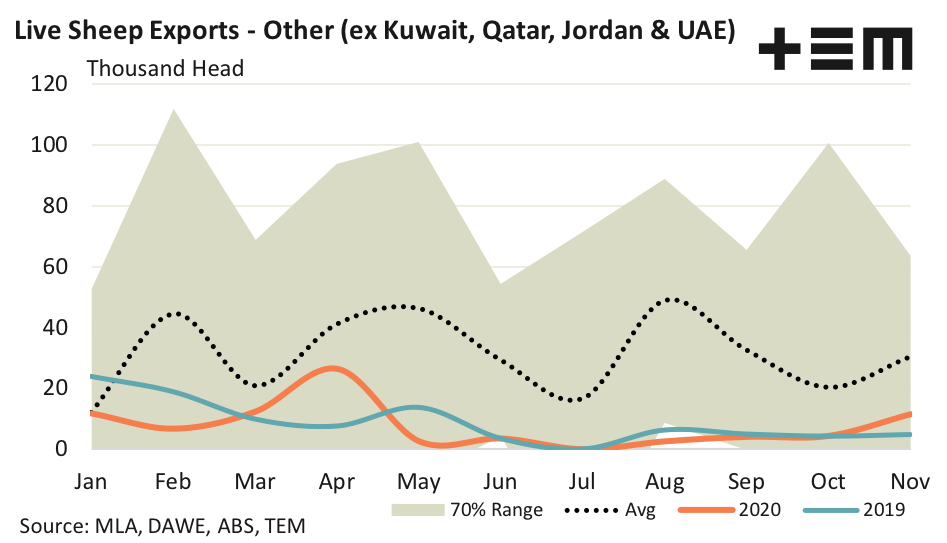

Analysis of the remaining “other destination” for Australian live sheep exports highlight that both the 2019 and 2020 pattern has been below the five-year average pattern throughout the entire season, with particularly low flows in the second half of the year.

While it maybe a dual issue of low supply and high prices impacting our live sheep export volumes the changed behaviour and reduced volumes pre and post the moratorium for all of out key trading partners signals a worrying possibility that we are losing our status as a reliable and trusted supplier of live sheep throughout the season.