A year in review – Part 2: Cattle

The Snapshot

Last week we provided a summary of Episode3 analysis offering over the 2021 season and also took a look at grain markets. This week, during the Xmas lull we have put together a quick price summary of beef markets and included a suggestion of interesting items to keep an eye on during 2022.

The Detail

The 2021 season was dominated by restockers and producers chasing breeding stock and young cattle. Record prices were achieved in most cattle categories throughout the season, with some indicators like the Eastern Young Cattle Indicator (EYCI) closing the year on an all time high at 1169c/kg cwt.

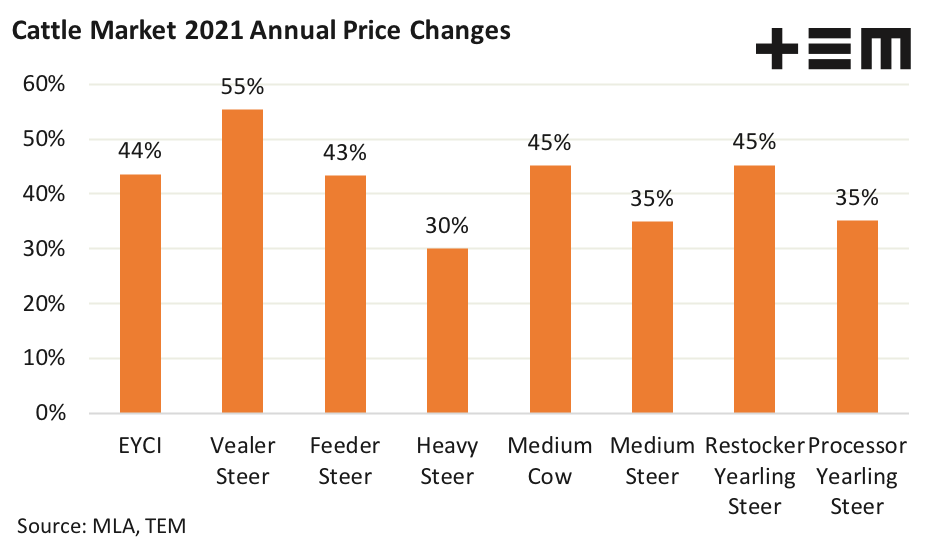

A look at the price behaviour over the year shows lighter, younger cattle and breeding types saw the strongest price gains. In percentage gain terms the National Vealer Steer saw the largest gain of 55% over the 2021 season, closing at 631 c/kg lwt, 225 cents higher than the same time last season.

The Medium Cow Indicator and Restocker Yearling Steer in a dead heat for second place, posting a 45% price gain over the year. The EYCI managing a respectable third with a 44% lift in prices over 2021.

The National Heavy Steer was the laggard of the group. However, it still managed to register a 30% price lift over the year, finishing at 457c/kg lwt and over 100 cents higher than where it closed in 2020.

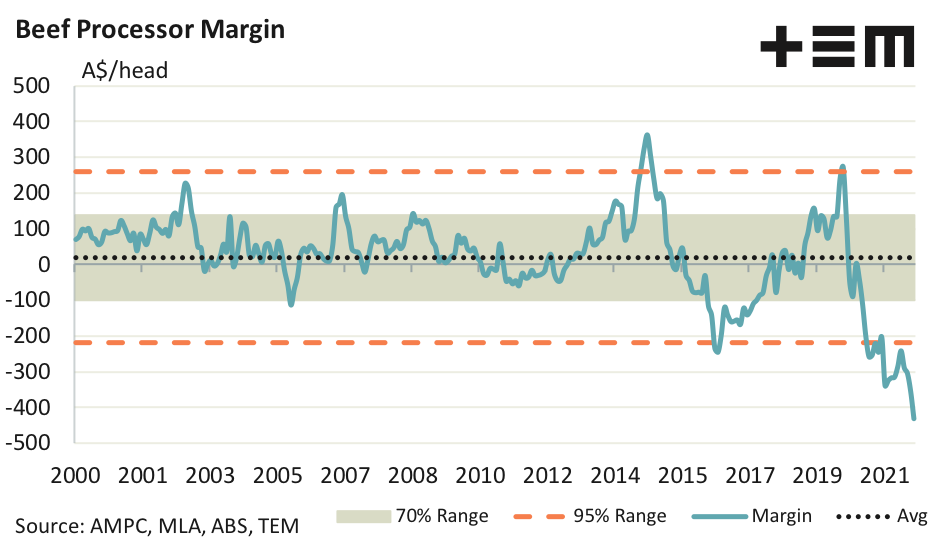

Hampering the Heavy Steer somewhat has been the difficult season facing Australian beef processors. The theoretical beef processor margin model highlighted the difficulty faced this season with the annual average margin coming in at a loss of $321, so far for 2021. Indeed, the last quarter of 2021 saw the margin dip to the lowest monthly point on record since 2000 with per head losses extending beyond $400.

Processor margins are something to keep an eye on in 2022 as the forecast tight supply and continued low volumes of cattle slaughter anticipated by Meat and Livestock Australia will mean trading conditions will remain hard for Australian beef processors. Historically, there has been a high correlation between industry rationalisation and processor closure during times when margins remain in negative territory for an extended period of time. It is unlikely that much of 2022 will provide any relief for processors so be prepared for further industry consolidation within the processing sector.

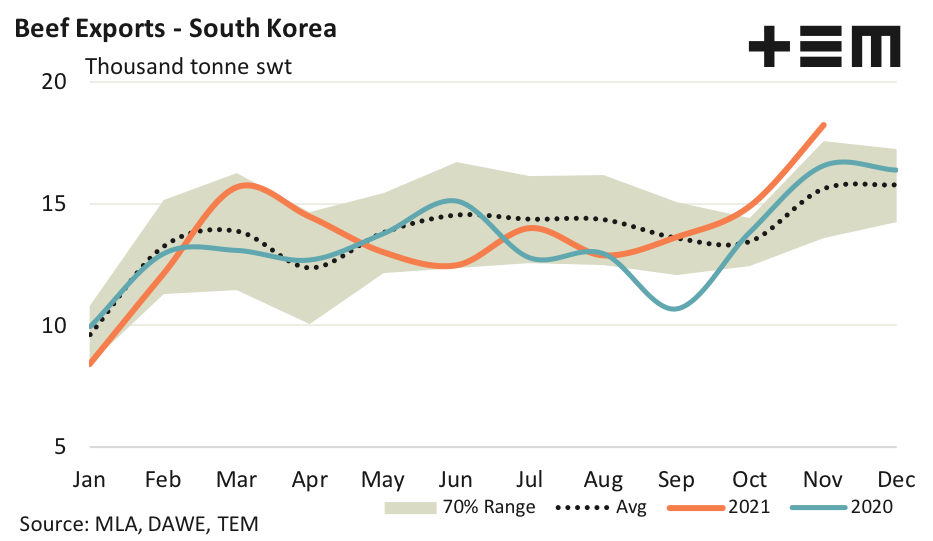

In a year when Australian beef exports remained relatively subdued, due to our high prices and low production volumes, we saw continued strength in demand for Australian beef from South Korea. Indeed, South Korea moved from the fourth highest beef export destination to the second highest during the 2021 season for Australian beef exports. The free trade agreement reached between South Korea and Australia will continue to benefit Australian beef producers as tariff levels will ease over the coming years and the safeguard threshold, which is the level of beef we can export annually to South Korea before we attract a tariff penalty, will continue to expand.

While we are seeing good signs of growth in South Korea, we are facing increased competition from the USA into China. A combination of trade tensions between Australia and China along with the success of the Trump administration’s trade deal with China has seen the US beef producer gain a foothold into China. It will be prudent to keep an eye on how this situation develops over 2022. The USA are already our top beef export competitor into Japan and South Korea (our top two markets for beef exports). During 2021 China was Australia’s third top destination for beef exports and currently our main competitors are Brazil and Argentina. The emergence of the USA as a potential additional threat in the Chinese market is worthy of our attention.