A year in review – Part 3: Sheep

The Snapshot

Last week we provided a summary of Episode3 analysis offering over the 2021 season and also took a look at grain markets. This week, during the Xmas lull we have put together a quick price summary of sheep and lamb markets and included a suggestion of interesting items to keep an eye on during 2022.

The Detail

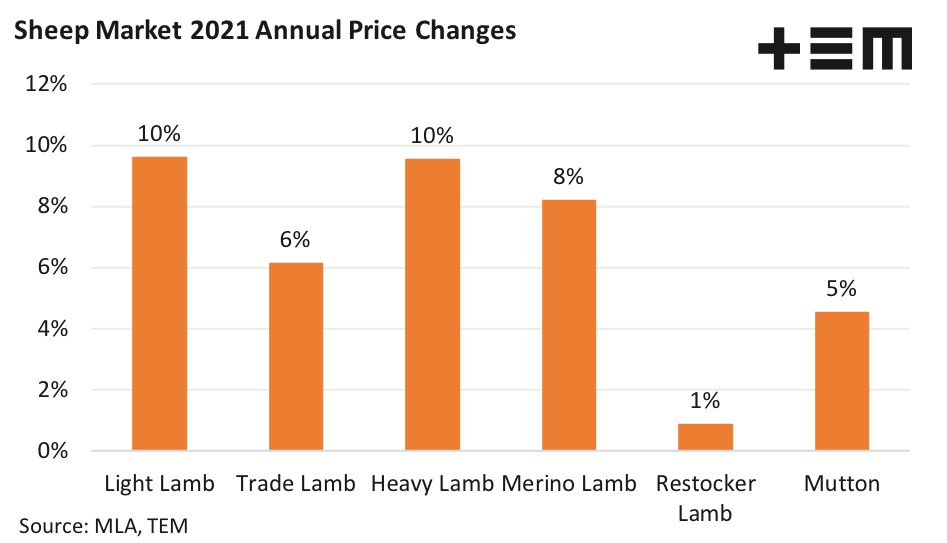

Analysis of annual price changes for a selection of lamb categories over the 2021 season highlights moderate growth across most categories. The price increases haven’t recorded the 30-50% gains seen in beef cattle markets over the year, but the more moderate price lifts suggest that the higher prices seen in sheep and lamb markets are probably more sustainable over the longer term than the heady gains seen in cattle markets.

Most categories saw price increases between 5%-10% over 2021, with National Heavy and Light Lambs lifting the trophy for highest annual gains, coming in at a 10% increase, each. Light Lambs ended at 888c/kg cwt in December 2021, some 78 cents above the December closing price during 2020 and Heavy Lambs gained 76 cents to close at 871c/kg cwt. Somewhat surprisingly, given the very strong restocking intent seen in 2021, the National Restocker Lamb managed just a 1% increase from this time last season after closing the year at 910c/kg cwt.

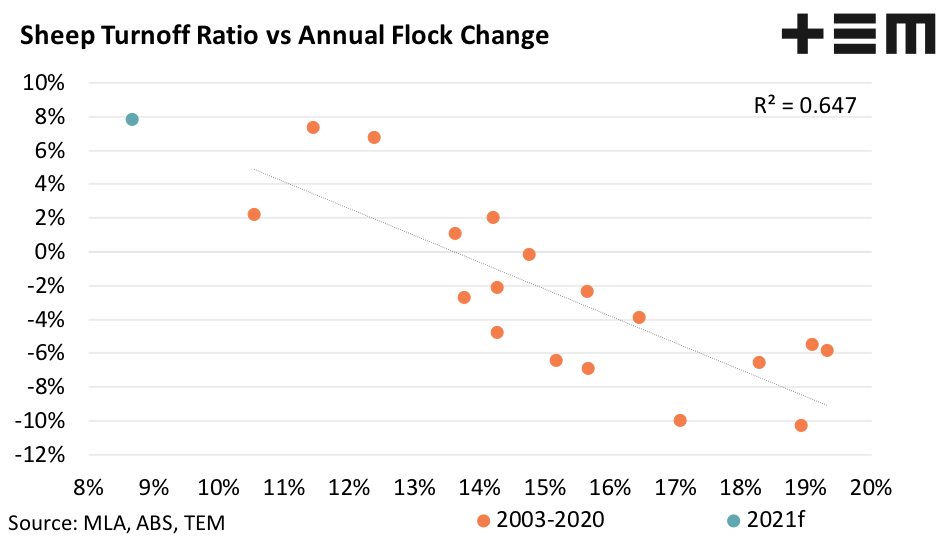

The strength of the restocking intent seen during 2021 for sheep and lamb markets has been remarkable with the sheep turnoff ratio (STR) moving to it’s lowest point on record, based on data back to the early 1990s. An STR below 14% denotes that the flock is in rebuild and the current annual average STR for the 2021 season sits at 8.7%. The last time the STR signified a flock rebuild was briefly in 2016 when the STR dipped toward 12%. Prior to this, the 2010-13 seasons saw it down toward 10%. During 2010 to 2013 the STR remained under 14% and those three years saw the flock increase by more than 6% in 2010 and then by about 2% in the following two years.

As the scatter plot highlights, an annual average STR of 8.7% suggests a flock rebuild in 2021 of nearly 8% is on the cards taking the flock back towards 70 million head this year. The prospect of a continued La Nina into 2022 should see the intent to rebuild persist in Australia. The good news for the Australian sheep producer is that despite the increased flock and higher lamb production levels expected in the coming years it is anticipated that global demand for sheep meat will continue to outweigh supply.

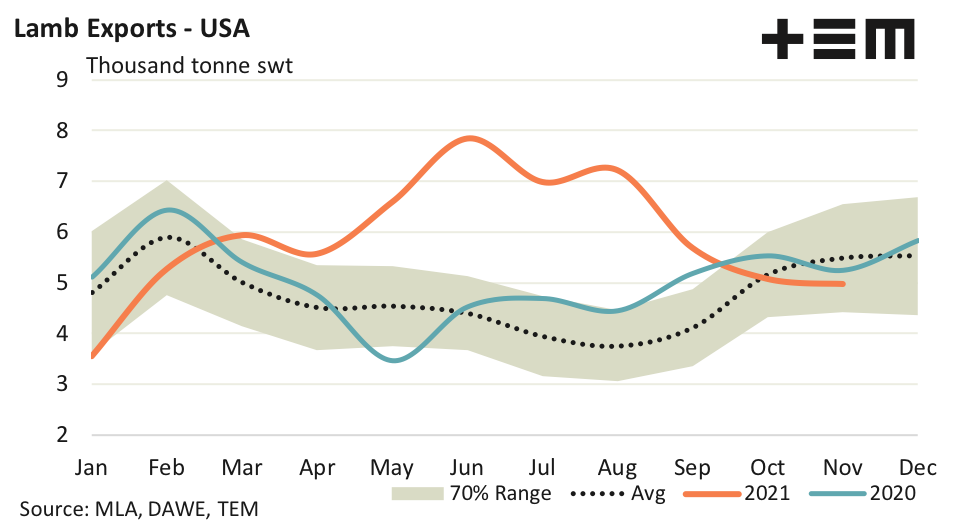

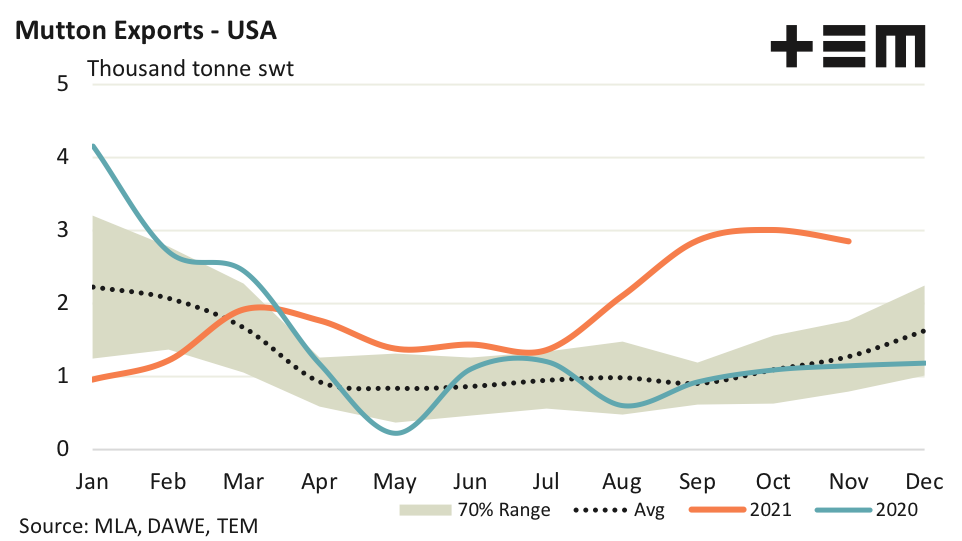

A growing market for Australian sheep meat exports this year has been the USA. Through the middle of 2021 Aussie lamb exports to America saw several months of uncharacteristically high volumes. As the year drew to a close, and lamb exports to the USA began to taper off, the demand for Aussie mutton exports increased significantly.

As we head into 2022 it will be interesting to see how the US market continues to respond to Australian lamb and sheep exports. There appears to be a changing dynamic in the demand landscape in the USA that is favouring the Australian sheep meat producer. As the world continues to recover from the economic impact of Covid-19 we should see increased demand returning to traditional markets for sheep meat in the Middle East. Solid growth prospects continues to be seen in South East Asia and China. Meanwhile, the emergence of a free trade agreement with the UK (post Brexit) could open up more opportunities for the Australian sheep meat sector in the coming years.

At present, the Kiwi’s are focused on increasing their beef and dairy cattle herds in favour of their sheep/lamb industry which provides the Australian sheep meat producer the opportunity to dominate the global sheep meat export space and take advantage of the strong demand prospects that exist across multiple geographic regions.