All out of love

The Snapshot

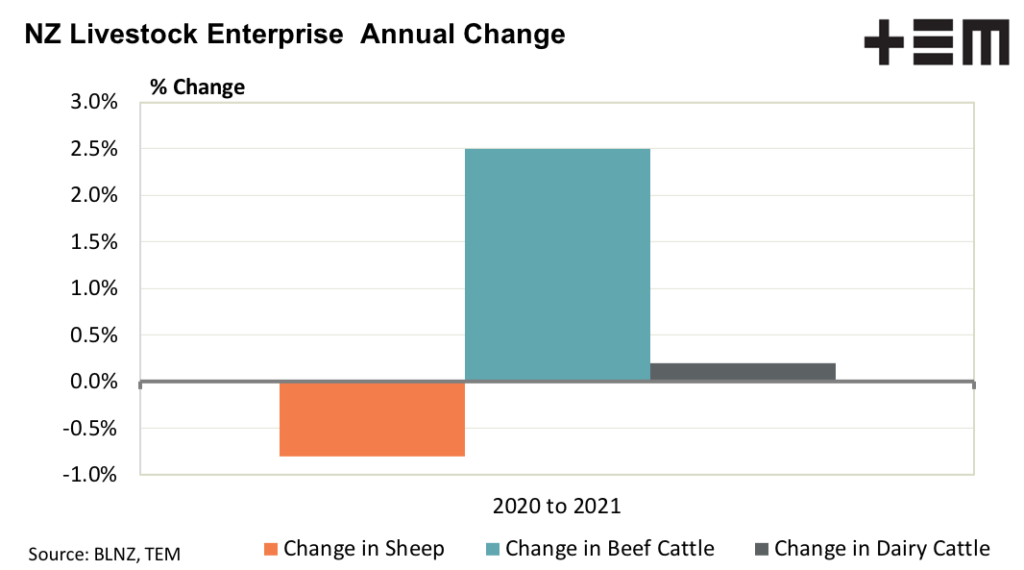

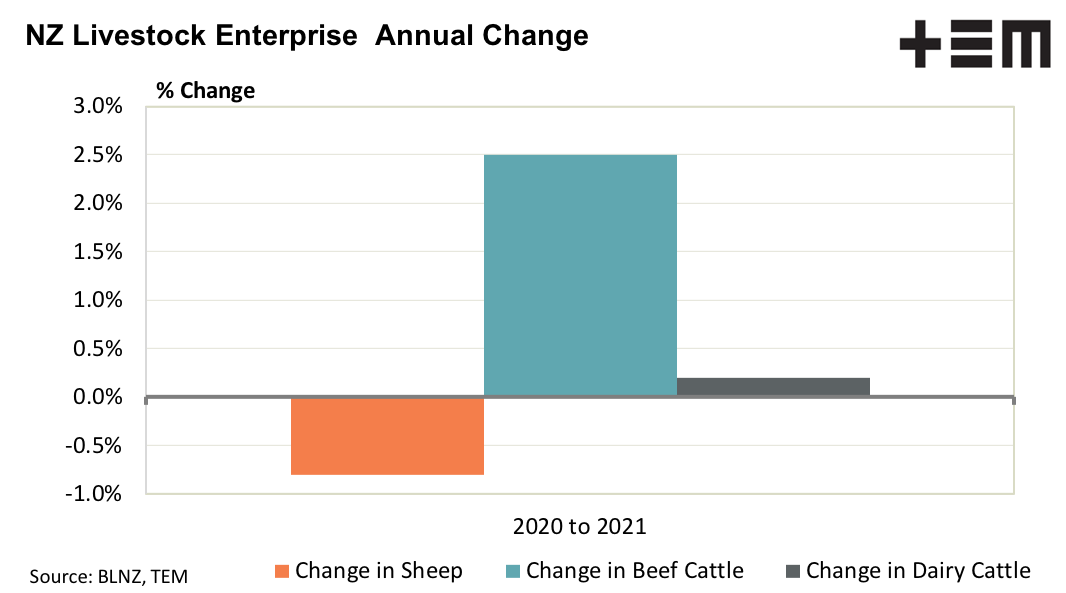

- The annual change in New Zealand sheep flock numbers is anticipated to decline by 0.8% this year.

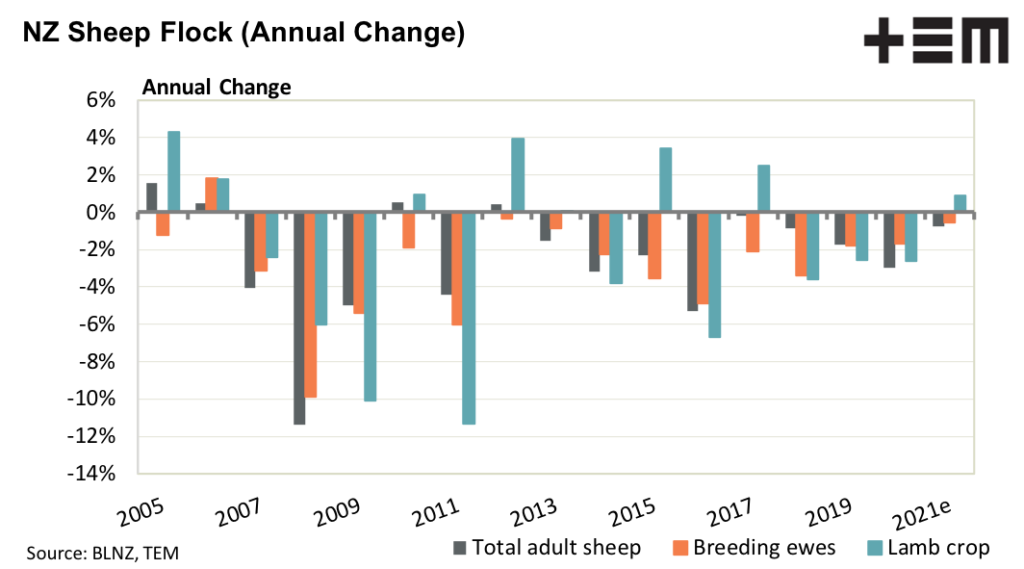

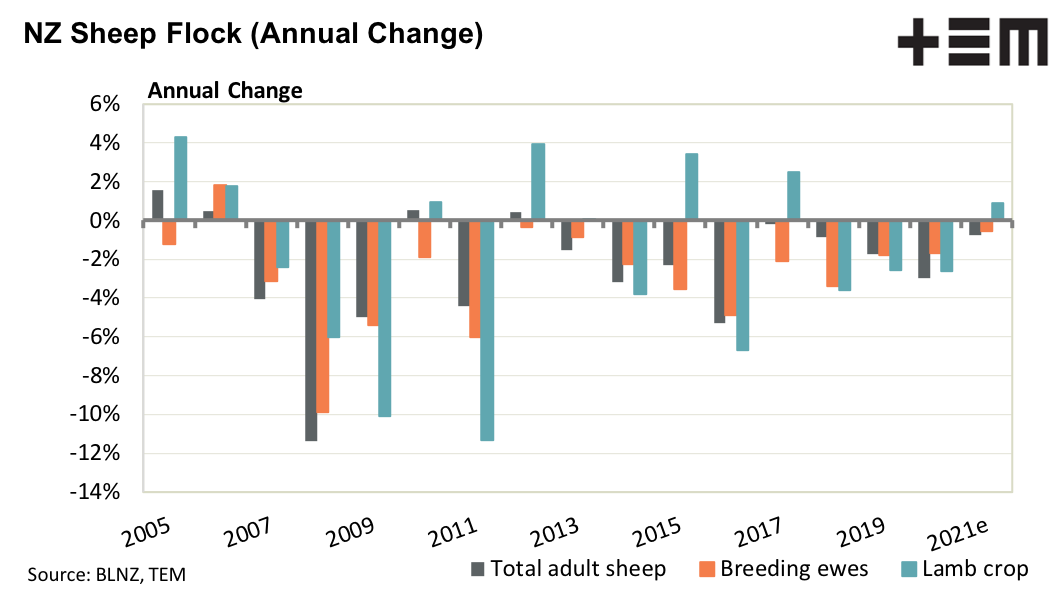

- Furthermore, their breeding ewes have followed suit with a 0.5% decline from 16.6 million head in 2020 to 16.5 million head.

- In contrast, the Kiwi beef cattle herd is expected to grow by 2.5% in 2021.

- Beef and Lamb NZ anticipate their 2021 lamb crop to grow 0.9% and this will underpin a 1.1% increase in lamb slaughter.

The Detail

Beef and Lamb New Zealand (BLNZ) have updated their livestock industry forecasts for the 2021 season and it shows that the Kiwis remain out of love with sheep, in favour of cattle. The annual change in sheep flock numbers from 2020 to 2021 is anticipated to decline by 0.8% to put the national flock at 25.8 million head.

In contrast beef and dairy cattle are posting annual gains. New Zealand’s beef cattle herd is expected to grow by 2.5% during 2021 to reach nearly 4 million head. The Kiwi beef cattle herd has been on an upward trajectory since 2015 and the 2021 forecast herd will be the largest seen in over a decade.

The dairy sector is also demonstrating some marginal growth this year with numbers up 0.2% to 6.2 million head. The kiwi dairy herd saw significant growth from 2005 to 2015 with numbers lifting from 5.1 million head to peak at around 6.7 million head in 2014. Dairy numbers softened between 2017 to 2019, but in recent years the herd has stabilised.

A breakdown of sheep and lamb categories within New Zealand highlights that while total sheep numbers remain in decline this year the lamb crop has experienced marginal growth. Total sheep numbers have eased 0.8% and the number of breeding ewes have followed suit with a 0.5% decline from 16.6 million head in 2020 to 16.5 million head this year.

This is the lowest annual decline in breeding ewe numbers since 2012. Over the last decade the average annual decline in breeding ewes in New Zealand has been 2.7%, so the momentum of the ever shrinking Kiwi flock maybe coming to an end.

The lamb crop has managed to move into positive territory for the first time since 2017. BLNZ anticipate the 2021 crop to grow 0.9% this year to see 22.8 million head recorded and this will underpin a 1.1% increase in lamb slaughter to see 18.5 million lambs processed this season. A 7.9% decline in adult sheep slaughter expected this year contributing to the reduced magnitude of annual sheep flock decline anticipated for 2021.

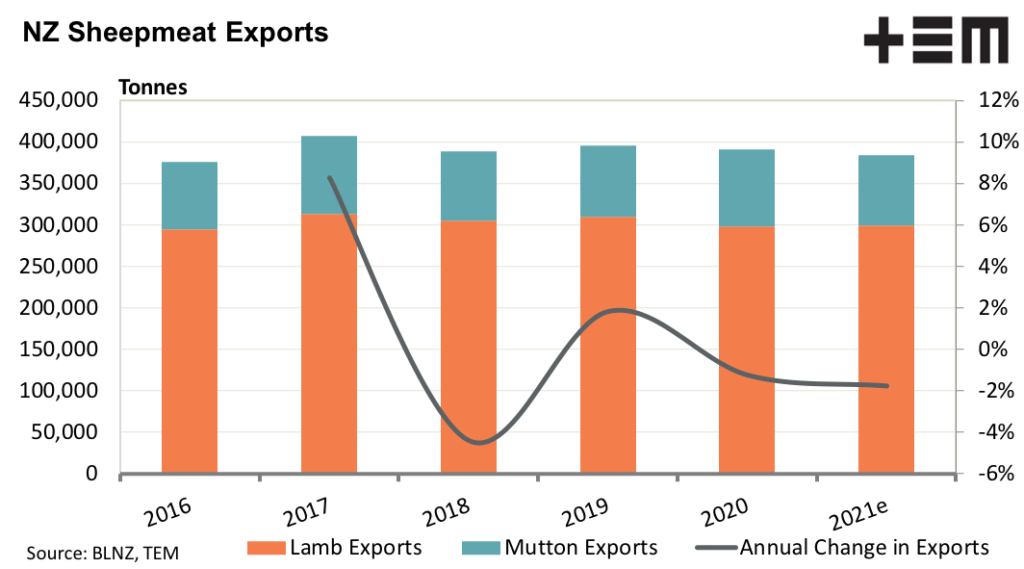

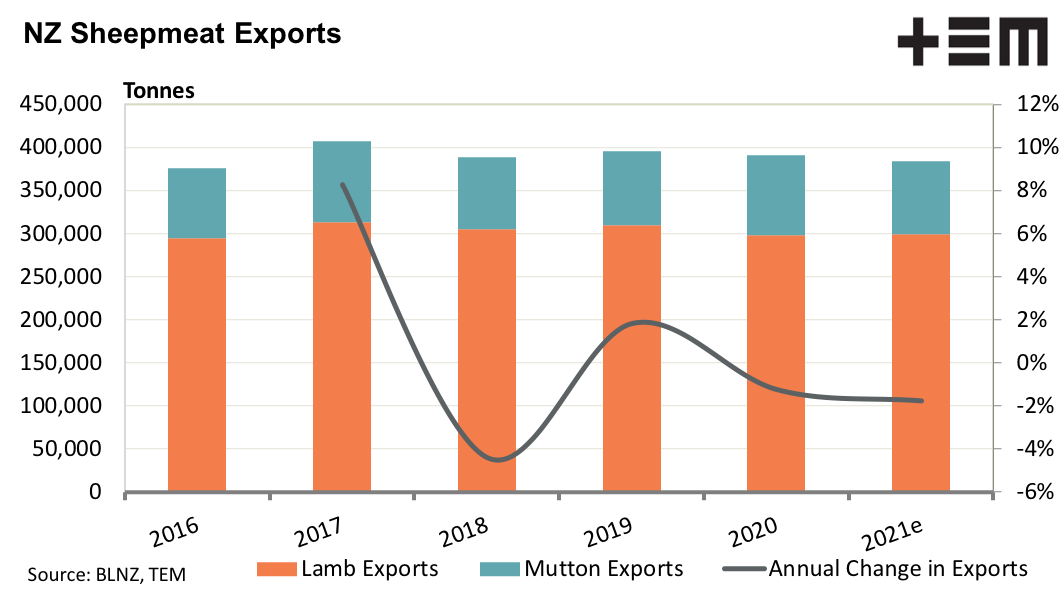

New Zealand’s lamb export volumes are forecast to trek sideways with 299,000 tonnes expected for 2021, up marginally from the 298,000 tonnes seen in 2020. Mutton export volumes are set to decline by 8.6% to 85,000 tonnes, putting pressure on total sheep meat export flows with the annual change for 2021 posting a 1.8% decline to 384,000 tonnes.

Total sheep meat exports for New Zealand have seen annual declines posted for three out of the last four years and annul sheep meat export volumes have fallen by 5.6% since 2017, providing Australian producers to capture export market share in recent years. Indeed, as Beef and Lamb New Zealand note during the 2020 season Australia hold the dominant trade position, accounting for 42% of the global sheep meat trade, compared to 39% for New Zealand.

Beef and Lamb New Zealand (New Season Outlook 2020-2021.)