An exporting nation

Market Morsel

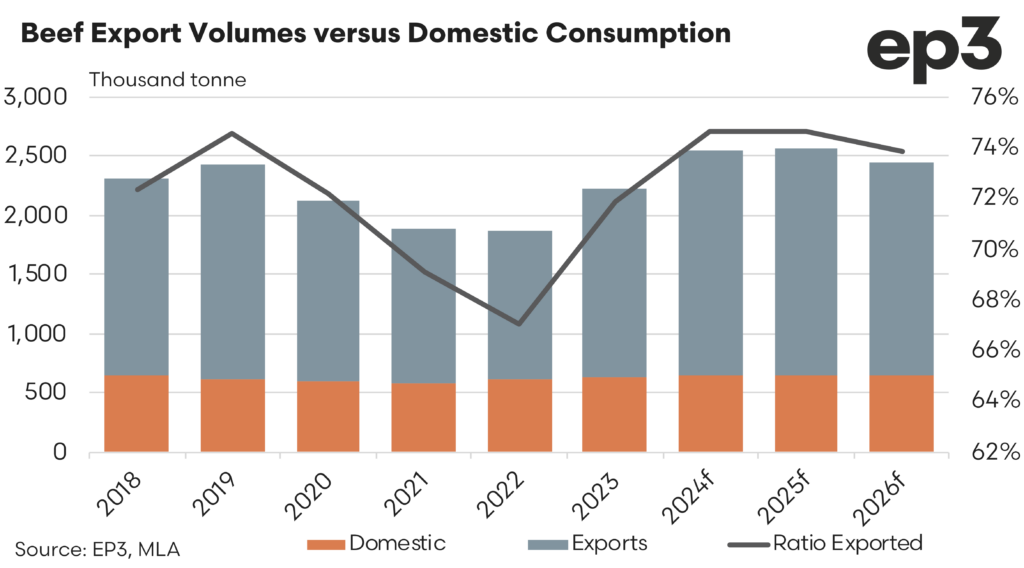

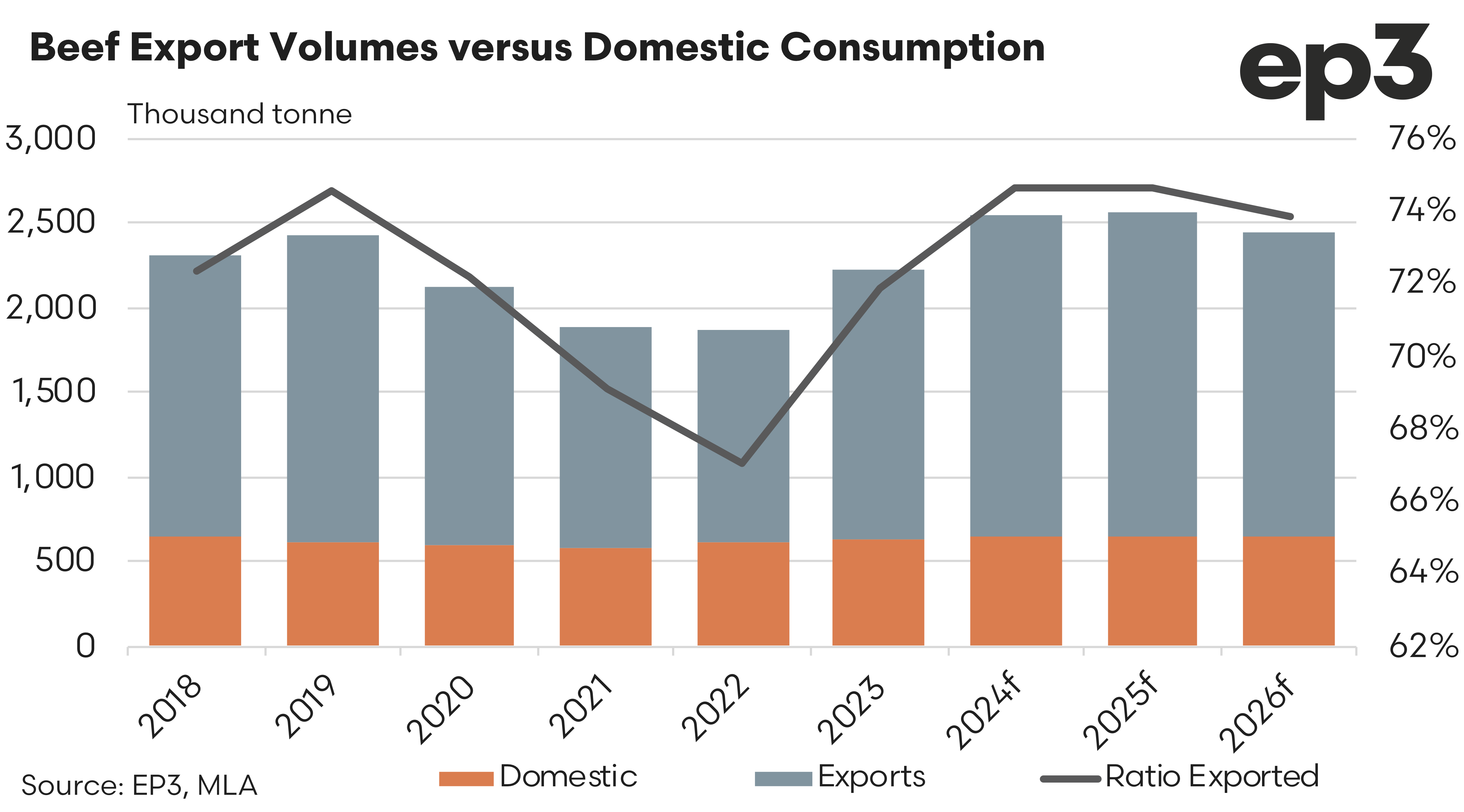

Over the last five-years, on average, Australia has exported 71% of the beef it has produced and the ratio of beef exported versus domestic consumption has increased from 67% in 2022 to nearly 75% in 2024, as forecast by Meat & Livestock Australia (MLA). Over the next few years the ratio of beef exports is anticipated to remain relatively firm staying at 74.7% in 2025 and easing marginally to 73.9% in 2026.

Analysis of monthly Department of Agriculture, Fisheries and Forestry (DAFF) trade flow data for beef exports from Australia allows us to calculate average beef export pricing levels to key trading partners. Each month DAFF provides an update of total beef trade volumes and total beef trade values to all trade destinations and we can use this information to construct an average monthly beef export price to selected offshore destinations.

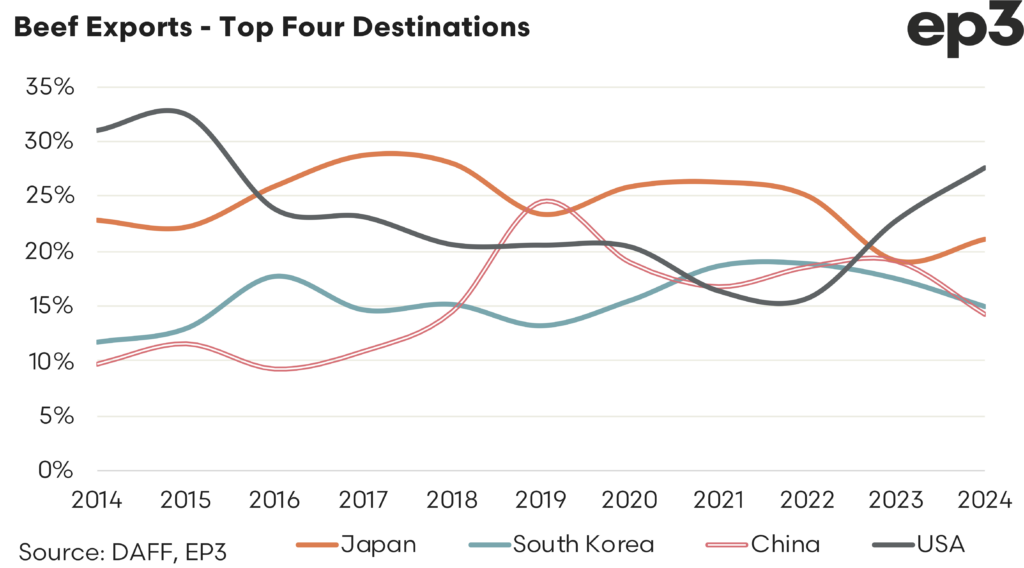

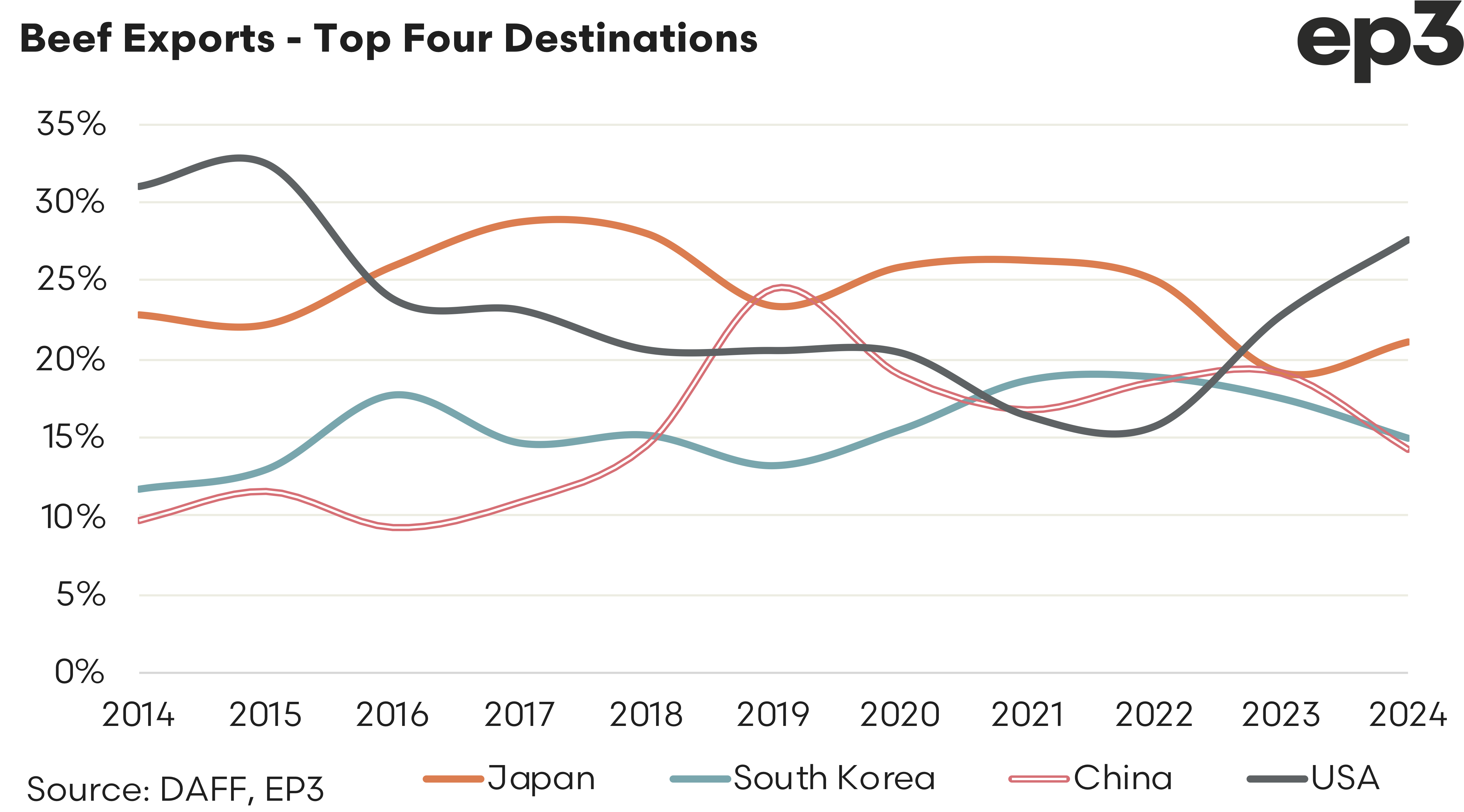

Australia’s largest four beef export trading partners during 2024, in order, are the USA, Japan, South Korea and China. Presently, the USA is Australia’s largest beef export destination accounting for 27.5% of total beef export flows this year, which is up from 22.7% in 2023.

Normally Japan holds the number one spot as a beef trade destination however subdued demand in 2023 and a growing appetite for imported beef from the USA, due to their fifth year of cattle herd liquidation, has seen Japan usurped as the number one trade spot for Aussie beef. In 2024 Japan sits in second top spot with around 21% of the total beef export trade from Australia.

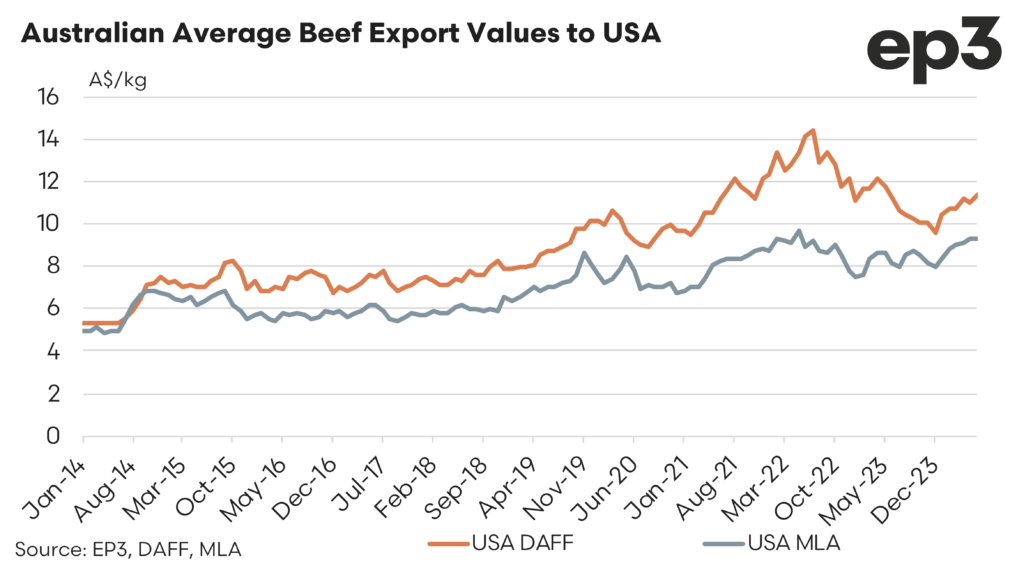

MLA report on a handful of beef export prices to offshore destinations so this allows us to compare the average monthly beef export prices from the DAFF dataset to what MLA publish. On the chart below is a comparison of the MLA average export prices to the USA, mostly for different CL (chemical lean) categories of grinding beef exports from Australia versus the average beef export prices across all exported beef product to the USA.

The phrase chemical lean refers to the ratio of lean red meat to fat in a meat sample and it is determined through an approved method of sampling and testing. This analysis is a compulsory requirement prescribed by AUS-MEAT for all bulk packed meat products intended for export markets. For example, a 90CL product indicates that the meat consists of 90% lean red meat and 10% fat. The CL rating is a measure used particularly in the meat processing and trading industries to specify the lean-to-fat ratio in meat products. This type of classification is especially relevant in the context of trading and exporting meat, where precise specifications are necessary for market and regulatory standards. As the MLA pricing is predominantly calculated by the various ground mince beef CL types it stands to reason that the average monthly pricing for these items runs at a discount to the DAFF average price data.

Nevertheless, both beef export price indicators have seen a rising trend since the start of 2024 with the DAFF beef export price lifting 18%, from A$9.63/kg to A$11.38/kg, and the MLA average pricing increasing by 15%, from A$8.03 to A$9.26, as at June 2024.

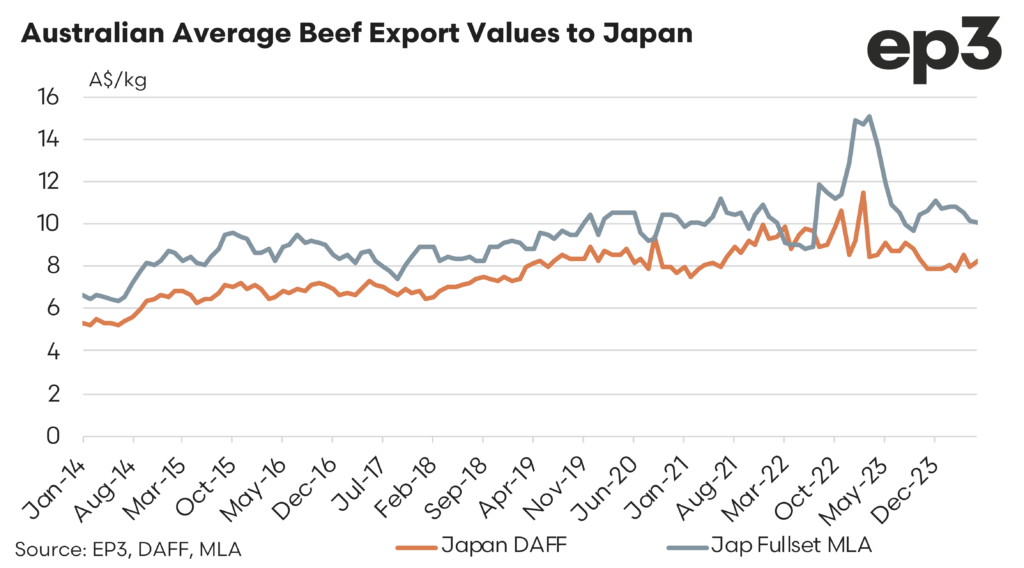

Average beef export pricing from Australia to Japan hasn’t been as robust this year with the Japanese consumer sector still recovering from the low beef demand cycle seen during 2023. The chart below outlines the DAFF export pricing compared to the MLA reported “Japanese Full Set” pricing.

The “Japanese Full Set” price in meat markets refers to the wholesale price of a specific set of beef cuts that are typically exported to Japan. This term is used predominantly in the context of the Australian and U.S. beef export markets. The “Full Set” generally includes a range of beef cuts, like loin, rib, and rump, that are popular in the Japanese market. The price set for this specific bundle of cuts reflects the demand and preferences in Japan for these particular beef products, and it is often quoted per kilogram.

This pricing is crucial for exporters and traders because it provides a benchmark for the value of beef exports destined for Japan, allowing them to gauge market conditions and set prices accordingly. Since the start of 2024 the DAFF export pricing has lifted by 5%, from A$7.93/kg to $8.29/kg. Meanwhile the MLA Full Set pricing has eased by 10% from A$11.15 to A$10.09/kg, as at June 2024.

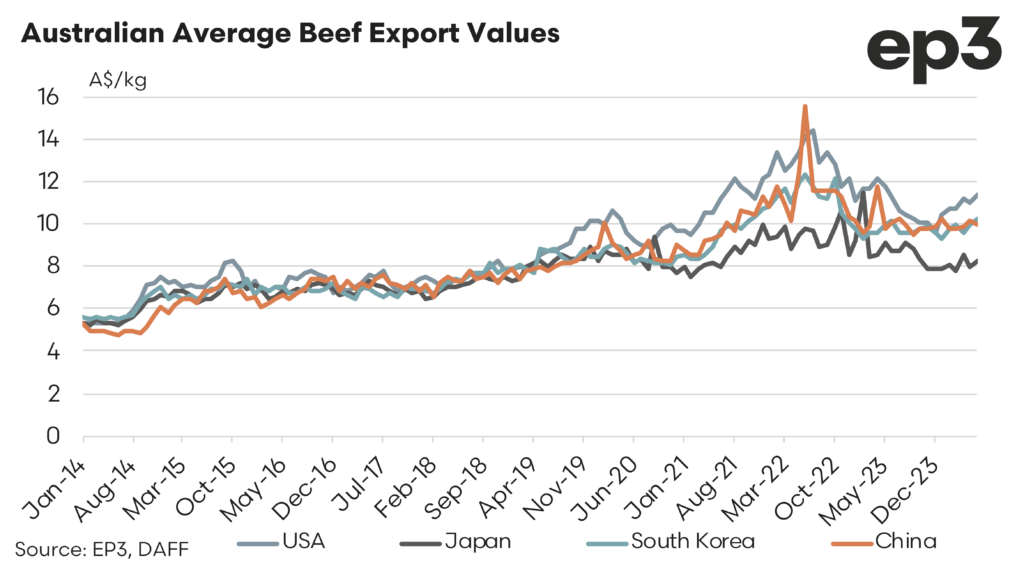

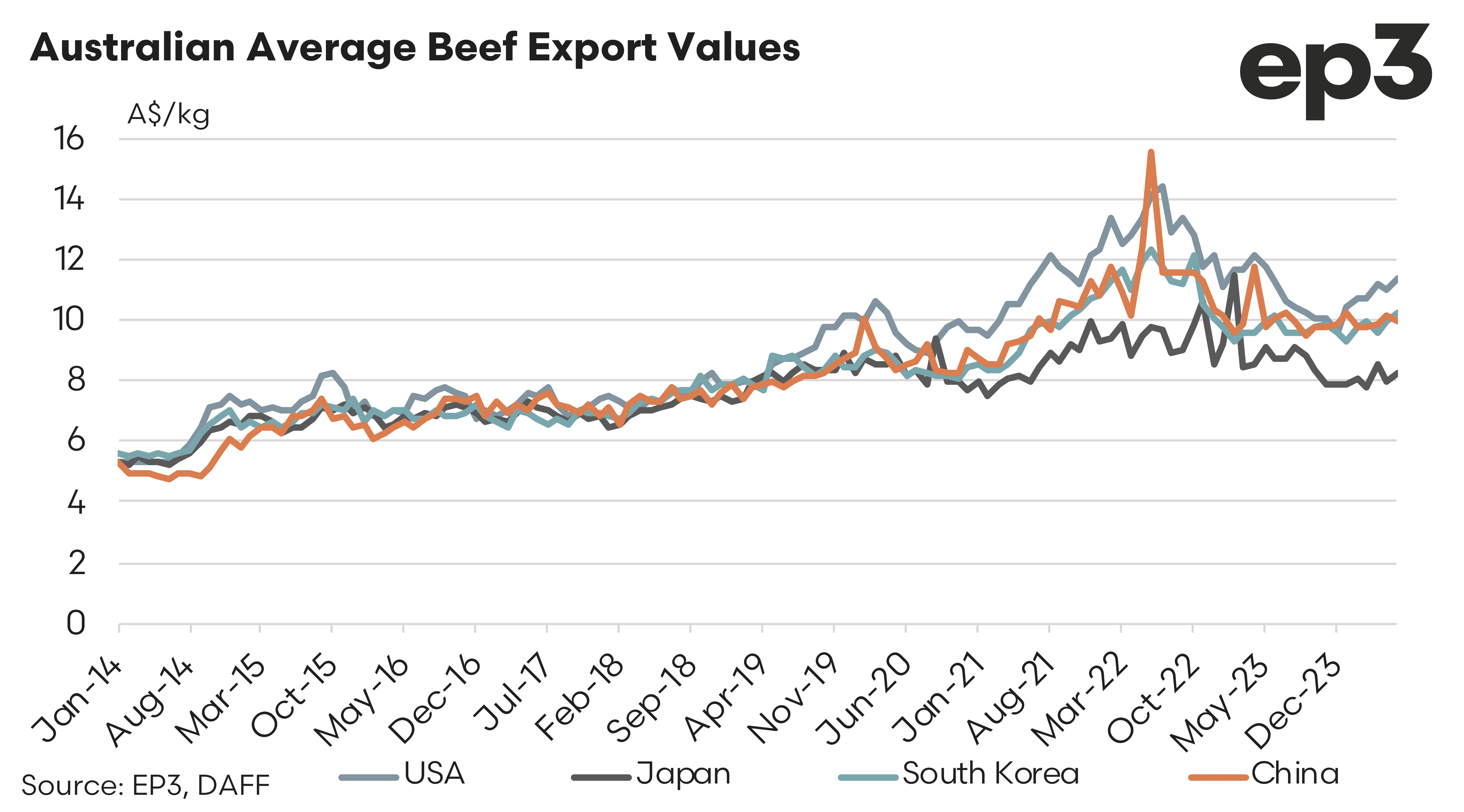

Analysis of the average monthly beef export pricing for the last decade from the DAFF data for the top four beef export trade destinations is shown below. Interestingly pre Covid pricing was trending within a much narrower pricing range across the four destinations. However, through Covid and post Covid the average pricing, particularly for USA and Japan have diverged significantly.

Since the start of 2024 average beef export pricing from Australia to South Korea and China has lifted by 7% and 2%, respectively. This variation in price change for the first half of this year reflects the strong growth in demand from South Korea in recent years for Australian beef and the subdued economic situation presently faced in China.