Are we there yet?

The Snapshot

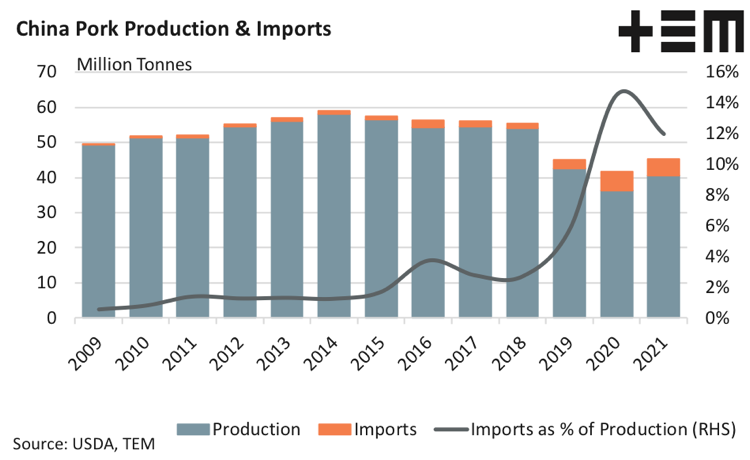

- During 2020 the proportion of pork imports as a percentage of domestic Chinese pork production reached a peak of 14.5%.

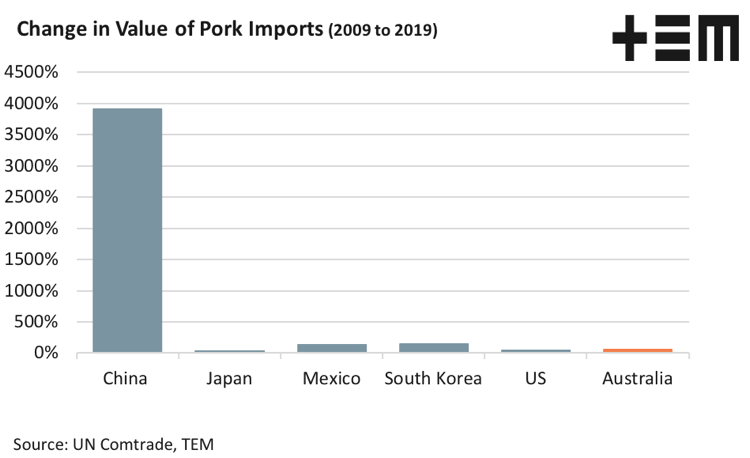

- Over the last decade the value of pork imports into China has lifted by 3,910%.

- Weighing heavily on global pork production has been a 25% decline in Chinese production from 2017 to 2020.

- Annual Chinese pork production is not expected to lift beyond pre-ASF levels until 2025.

The Detail

African Swine Fever (ASF) was first reported in China in August 2018. During 2019 the Chinese government publicly acknowledged significant impact to their domestic pig herd. In 2020 it was estimated that the decline in pork production within China created a 25 million tonne gap in available pork meat, which has been partially offset by an increase to imports of pork product.

During 2020 the proportion of pork imports as a percentage of domestic Chinese pork production reached a peak of 14.5%. Prior to the outbreak of ASF in China the previous peak in pork imports as a percentage of production was 3.7% in 2016.

Meat imports of all kinds had been growing in China before the outbreak of ASF, as the combination of increased population and per capita wealth growth fuelled the demand for meat proteins of all types. However, the outbreak of ASF in 2018 saw Chinese demand for imported pork product increase significantly. Over the last decade the value of imports into China has lifted by 3,910%.

Mexico and South Korea have also experienced robust growth in the value of their pork imports of 135% and 139%, respectively. Meanwhile Australia, the USA and Japan have demonstrated more moderate growth over the decade of 54%, 45% and 33%.

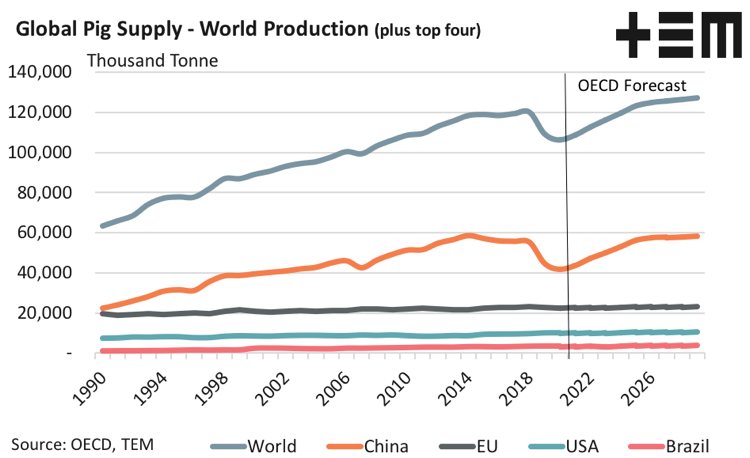

The global production of pork mirrors the fall seen in the global pig herd. The Organisation for Economic Co-operation and Development (OECD) pork production data demonstrates an 11% decline in global pork production from 119,446 thousand tonne in 2017 to 106,279 thousand tonne in 2020.

Weighing heavily on global pork production has been a 25% decline in Chinese production from 2017 to 2020, according to OECD estimates. Notably, annual Chinese pork production is not expected to lift beyond pre-ASF levels until 2025, based on OECD forecasts.

Should the rebuild to the Chinese herd, and restoration of their productive capacity, take until the middle of the decade as outlined by the OECD projections Chinese demand for imported meat protein of all types will remain robust for the next few years, at least.

Trade tensions between Australia and China, very elevated domestic beef prices and low supply have all contributed to a dampening of the demand for Australian beef into China this season and has allowed the USA to gain a greater foothold into China.

However, despite the low sheep supply and relatively high prices of lamb and mutton, the position Australia holds as a dominant supplier of sheep meat to the global market means there have been limited options for China to look elsewhere for lamb and mutton product. This has seen some very strong flows of sheep meat into China during 2021, particularly for lamb.

The slow recovery of the Chinese pork sector should continue to favour the Australian red meat producer (particularly the sheep meat producer) as we head toward the middle of the decade.