Beef export update June 2025

June 2025 - Beef export update

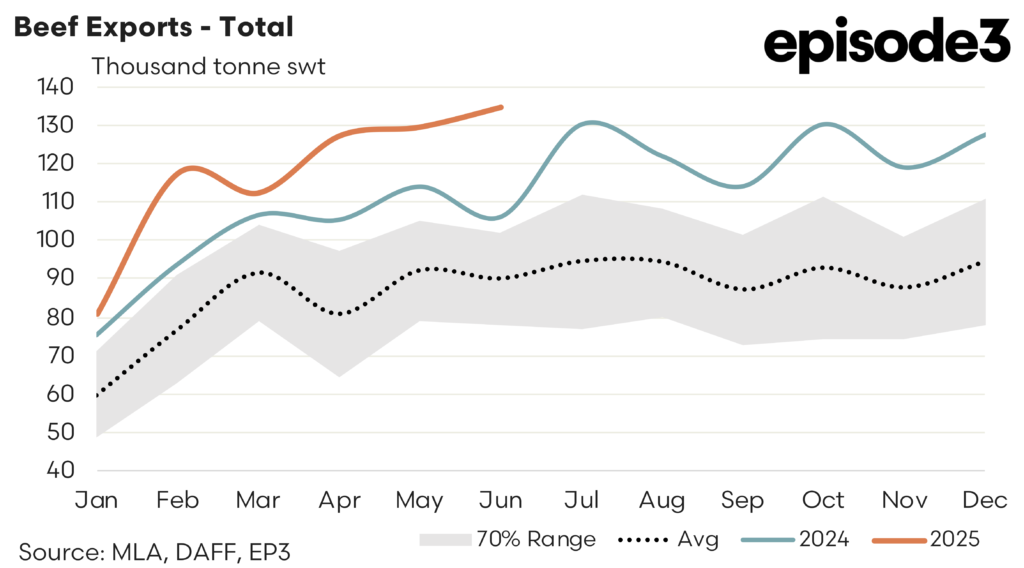

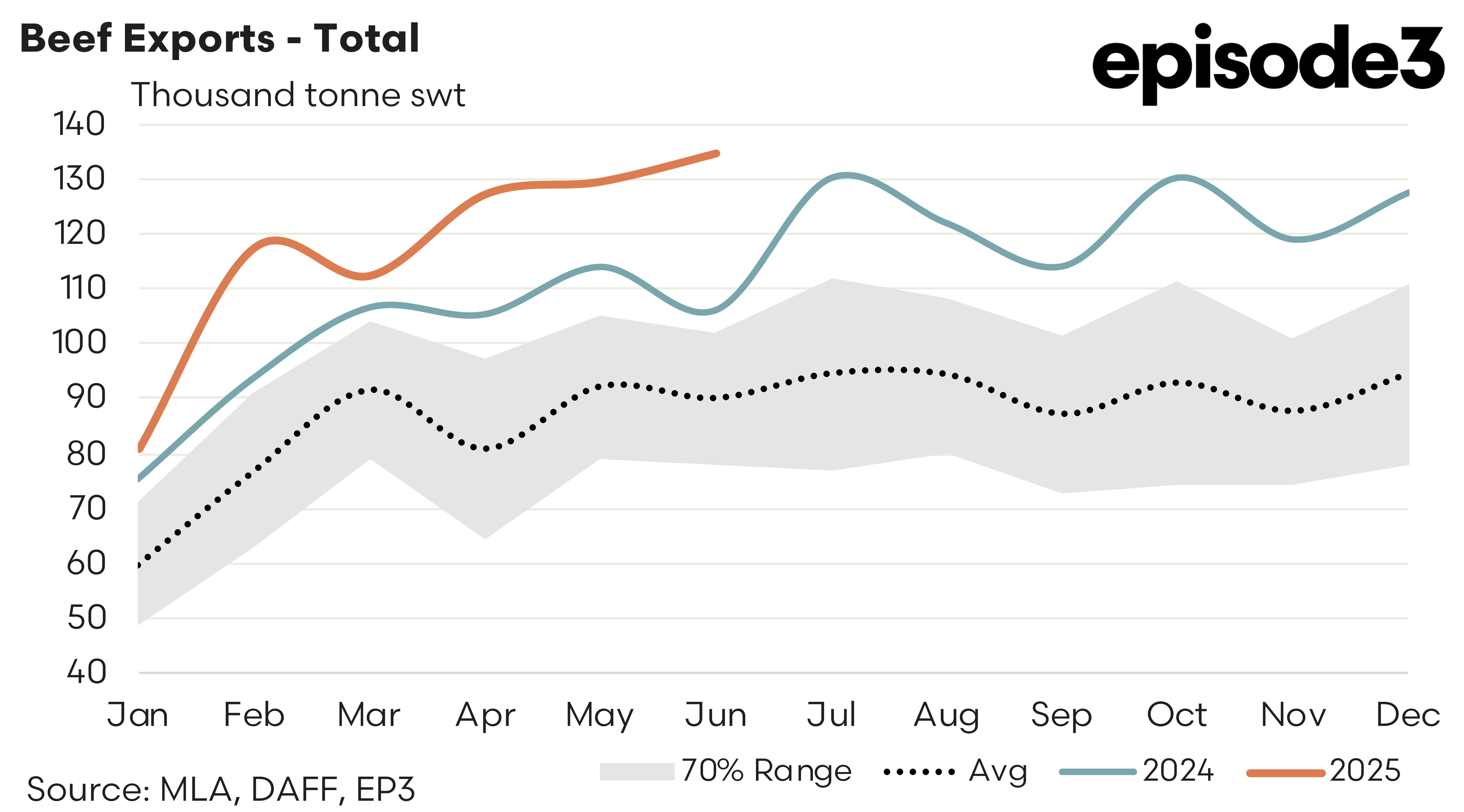

June 2025 saw record levels of beef exports leave Australia with a reported 134,596 tonnes shipped offshore over the month. This is a solid 4% higher than the previous record set in October 2024. Curiously, Australia’s largest market for beef, the USA, saw a decline in the trade over June but strong results in other top destinations more than offset this to see the record cracked.

Compared to June 2024 the current flows are 27% stronger and sit 50% above the five-year average volumes seen for the June period.

A summary of the top trade locations, in order of top market share for 2025, is as follows:

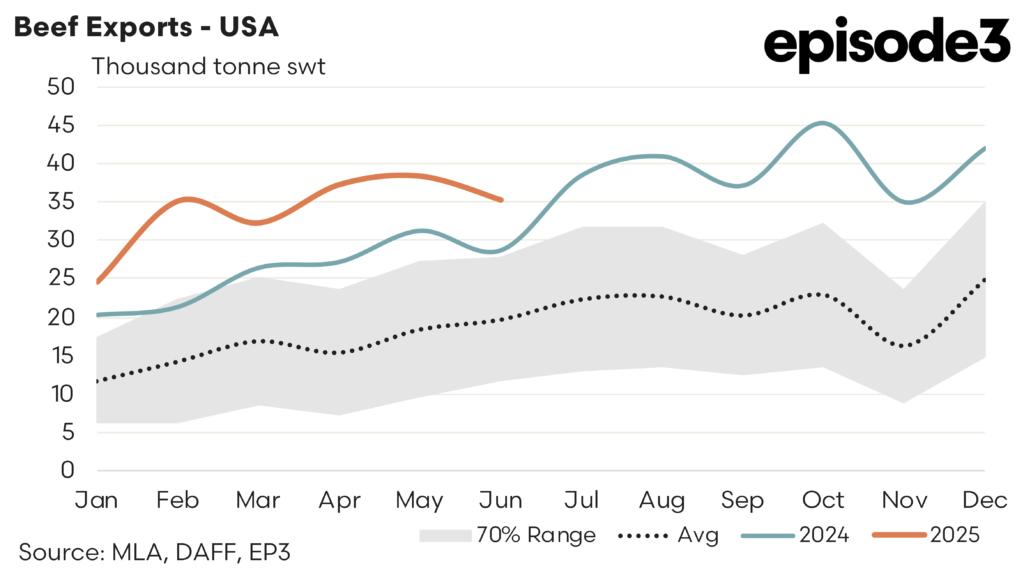

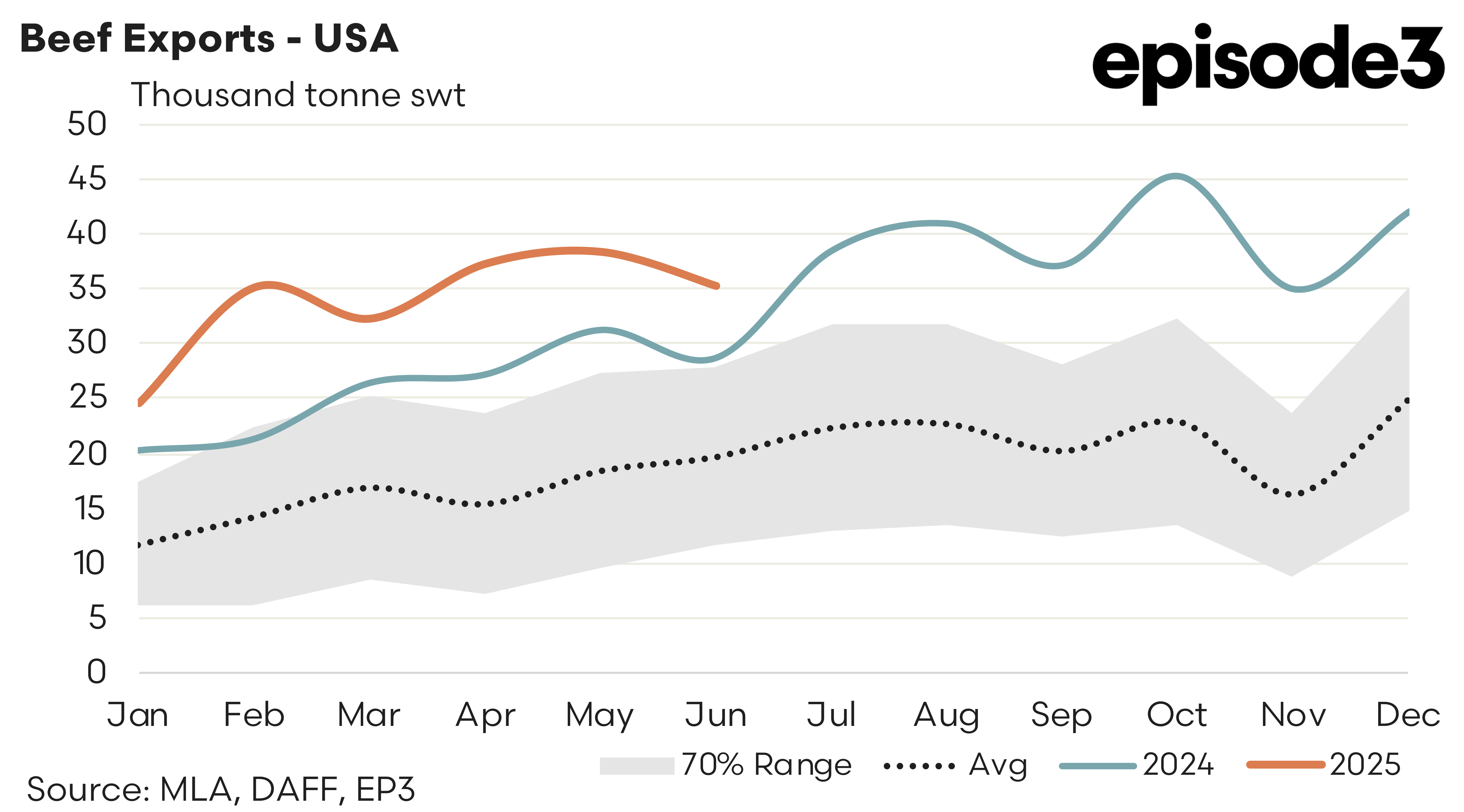

USA – There was an 8% easing in Aussie beef exports to the USA during June, but trade flows remain very elevated. There was 35,230 tonnes shipped during June which, despite the easing from May, still sits nearly 80% above the average trade flows seen during June, based upon the last five-years of the trade.

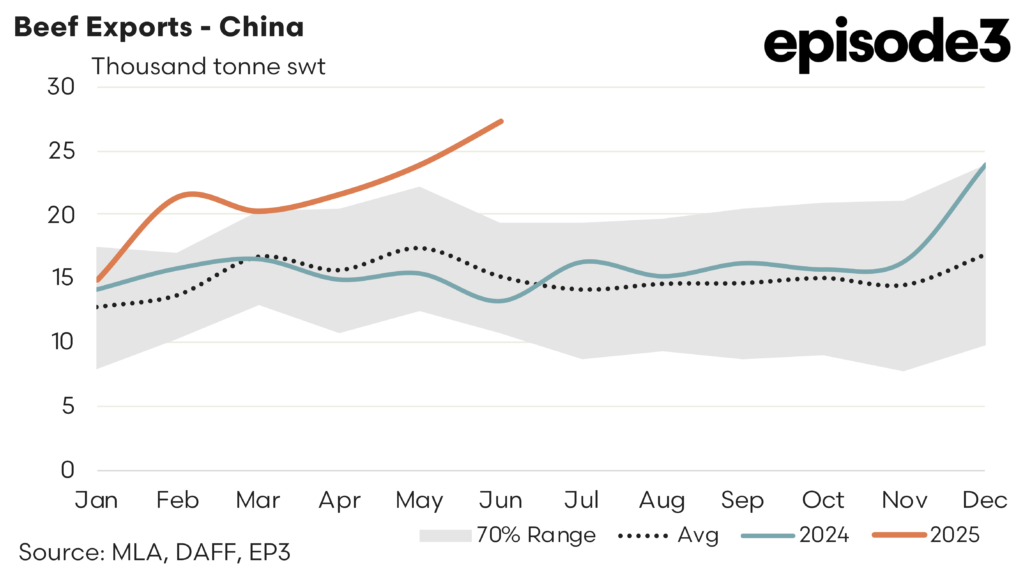

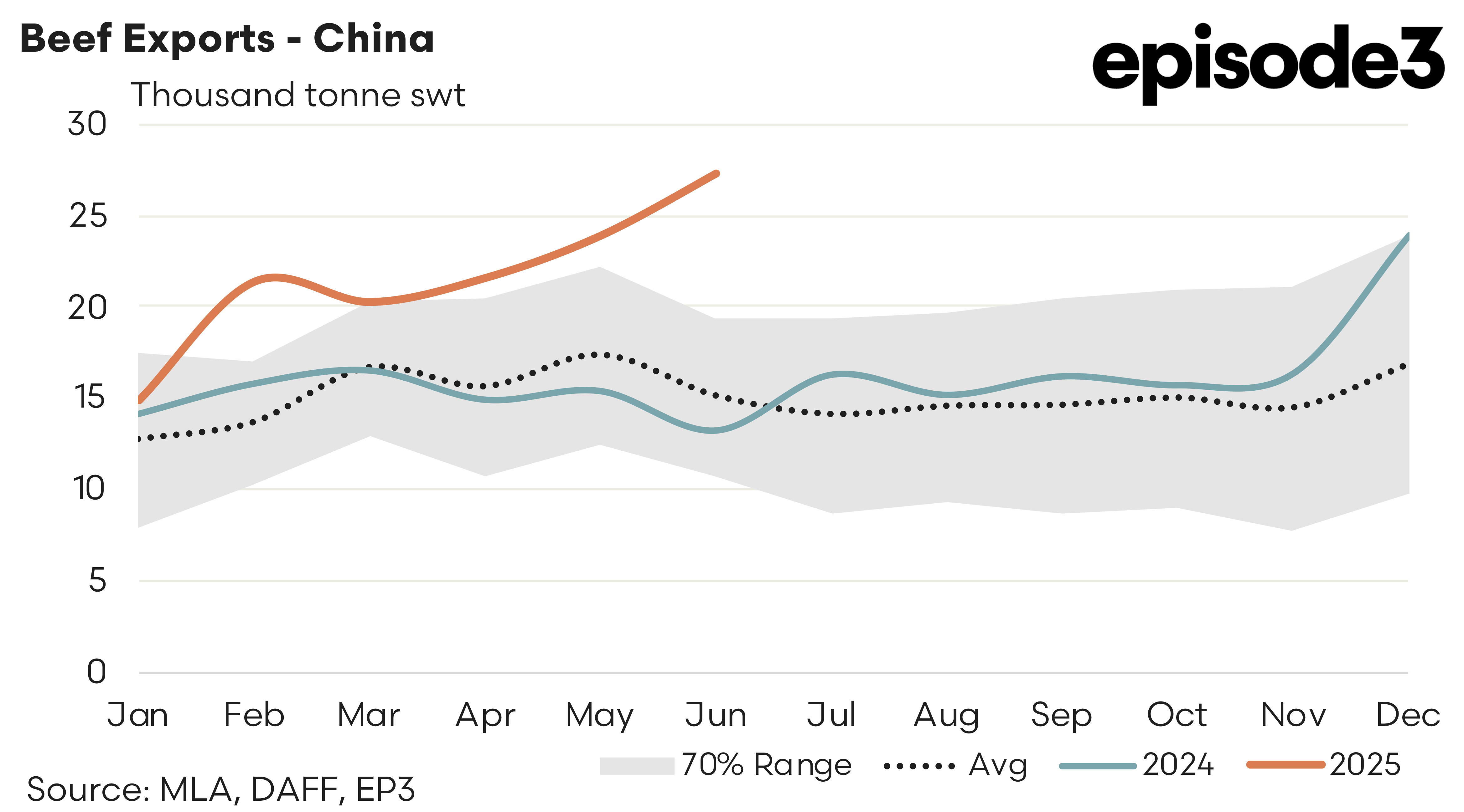

China – A move towards Aussie beef and away from US beef appears to remain the trend in China with nearly 390 US packer/exporters yet to have the access to China renewed for beef. June saw a 14% surge in Aussie beef exports to China to hit 27,265 tonnes shipped over the month. This represents trade levels that are 81% higher than the five-year June average seasonal trend.

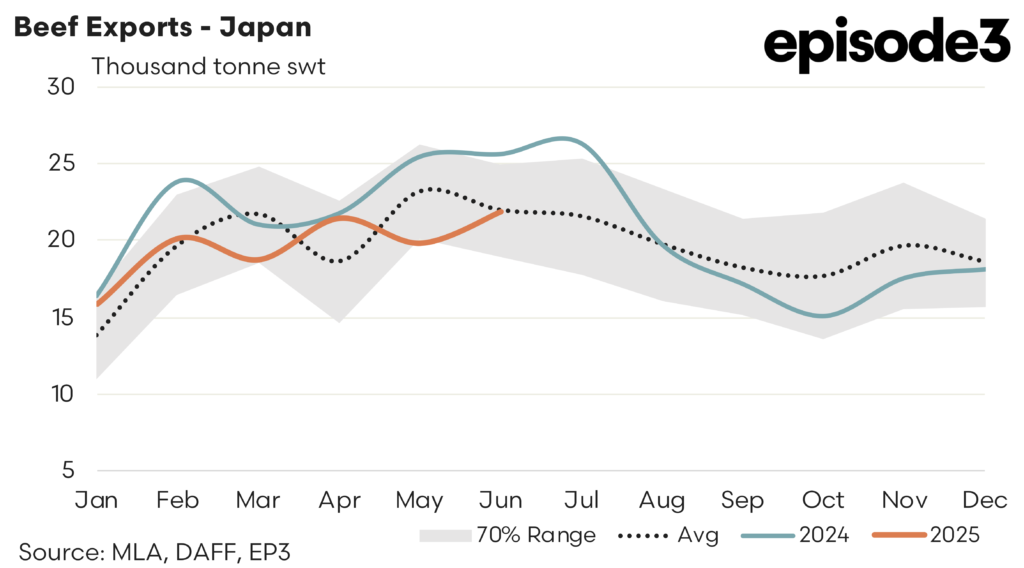

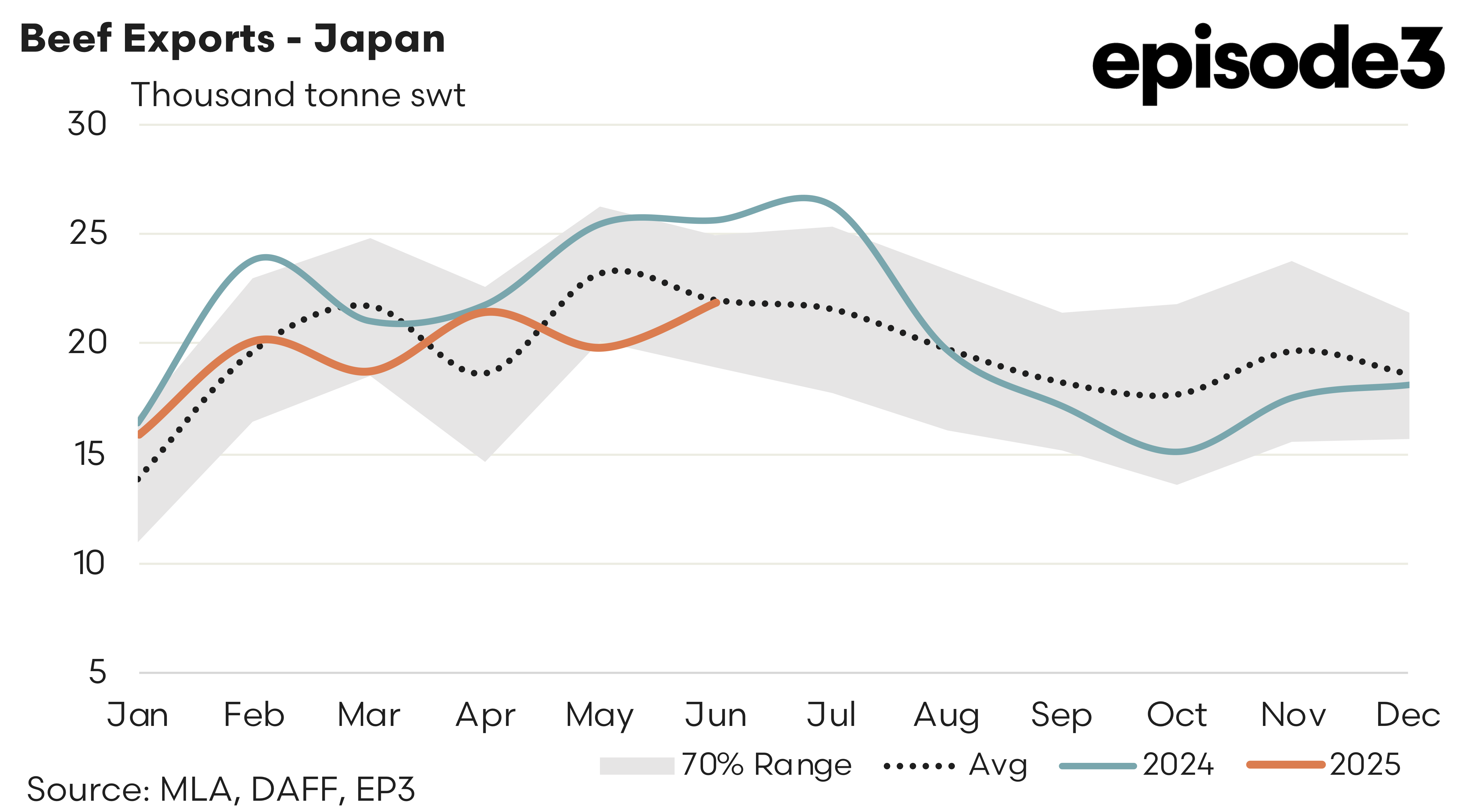

Japan – The beef trade to Japan lifted by 10% during June, bringing trade levels back on par with the June five-year average after spending May below the average seasonal trend. There was 21,876 tonnes of beef shipped to Japan from Australia during June, a good recovery but still nearly 15% below what what was exported in June 2024.

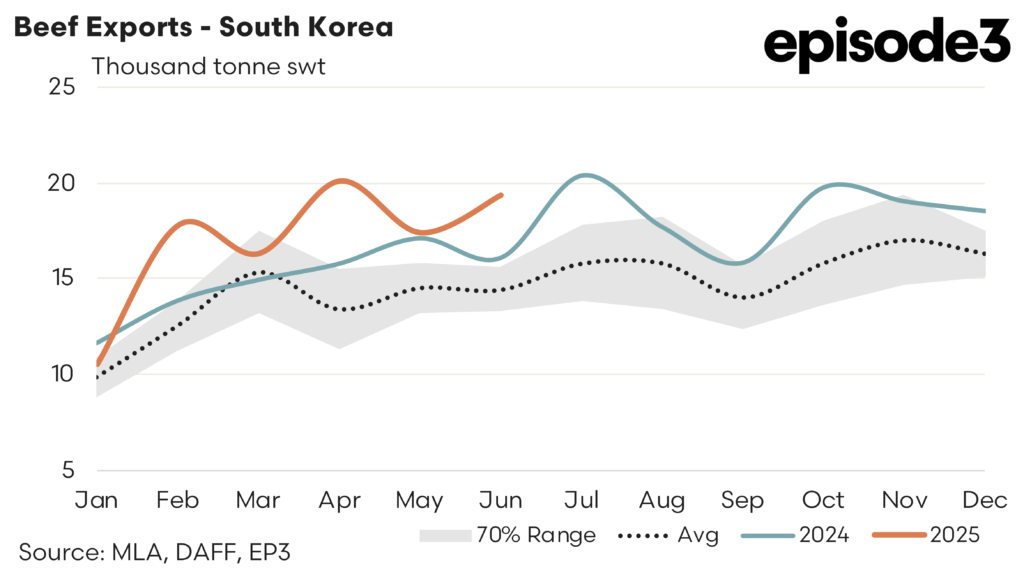

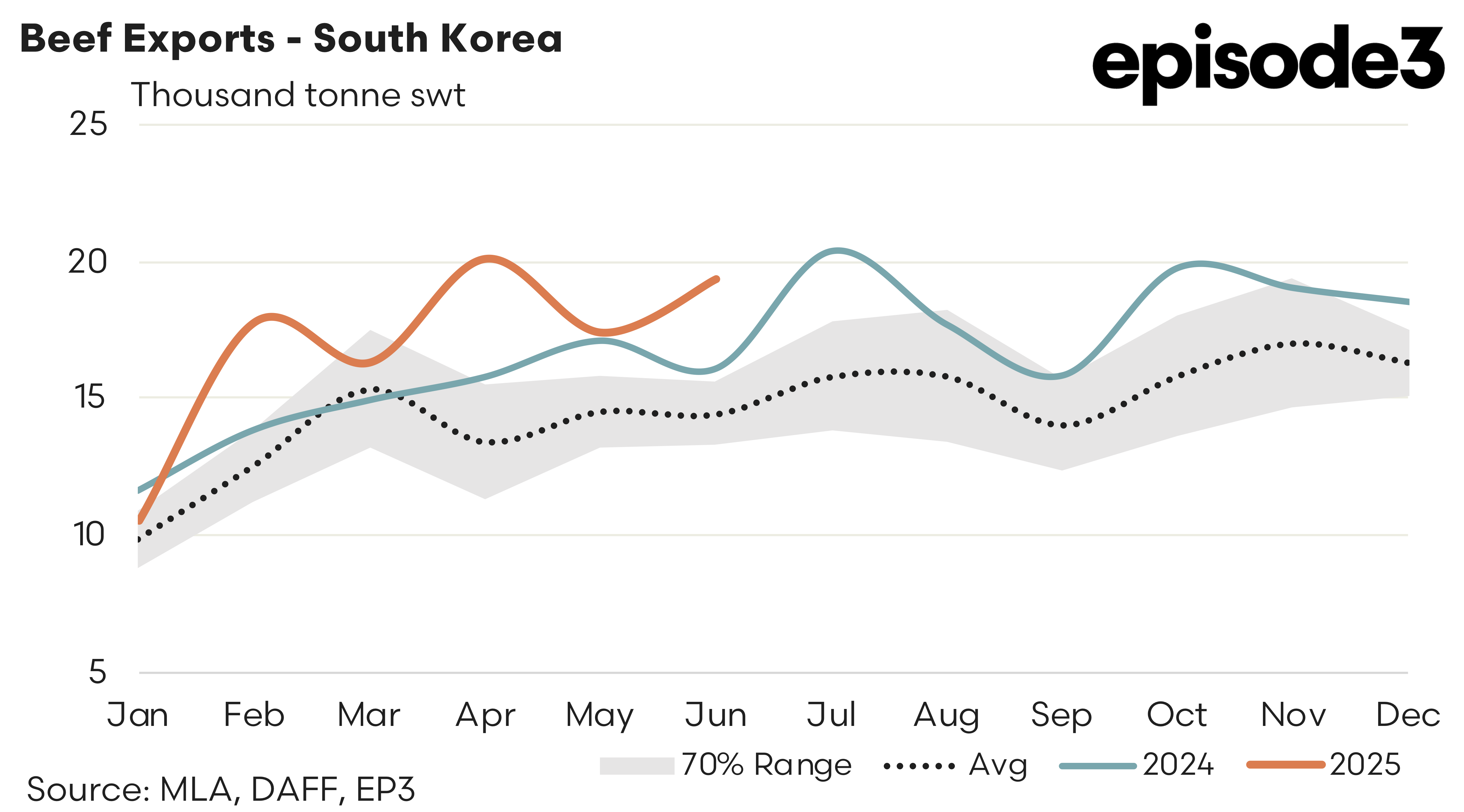

South Korea – There was 19,343 tonnes of Aussie beef exported to South Korea in June, representing an 11% increase on the flows seen in May. Compared to the five-year average the South Korean trade in Aussie beef currently sits 34% above the average seasonal trend.

The USA is Australia’s main beef competitor in South Korea, as is the case too in Japan, and it appears the high US cattle and beef prices relative to Australia are taking their toll on US competitiveness. The trade antics of the Trump administration are probably not encouraging the South Korean and Japanese consumers to favour US beef over Aussie beef either presently. The reliability, consistency and quality of Aussie beef supply to these key markets, not to mention our current cost advantages to the US, are setting Australia up for a strong second half of 2025, particularly given the unfriendly trade rhetoric coming from the Whitehouse presently towards Japan and South Korea.