Beef export update May 2025

May 2025 - Beef export update

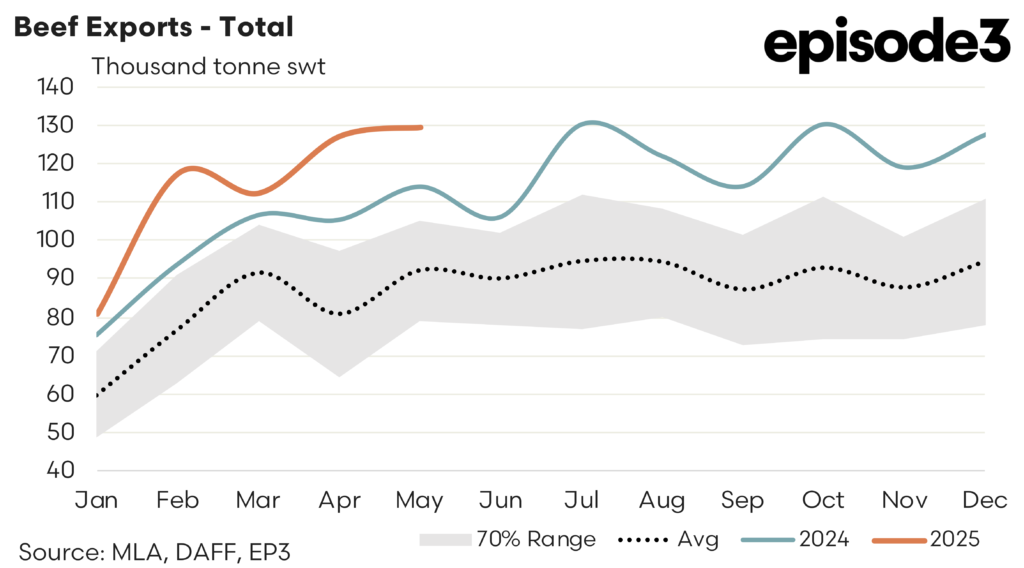

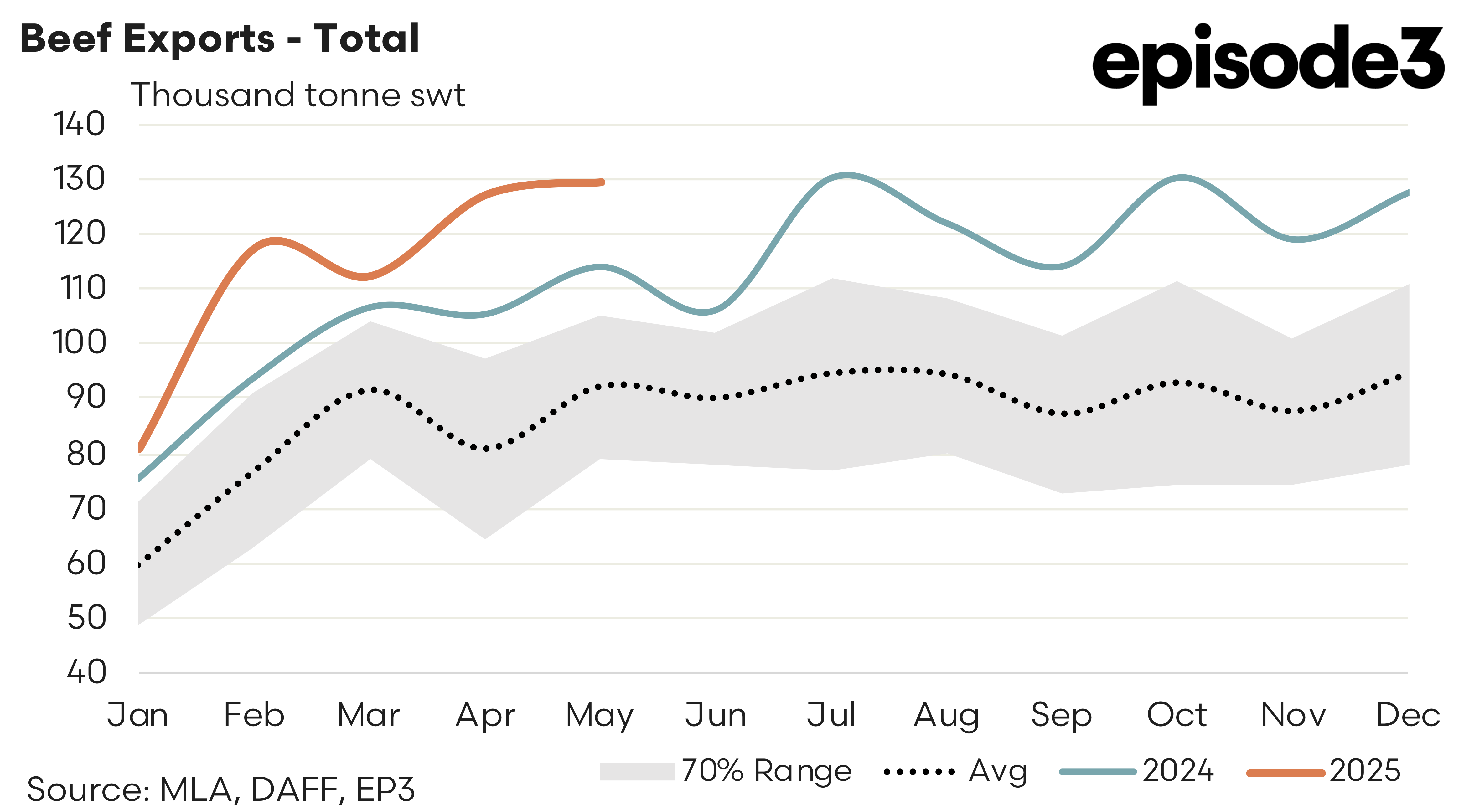

Australian beef export volumes have made a new monthly record for May with a 2% increase on the already high April trade volumes to see 129,477 tonnes swt exported offshore. At this level it is also the third highest month across all months and sits at levels 41% above the five-year seasonal average volumes usually seen during May.

A summary of the top trade locations, in order of top market share for 2025, is as follows:

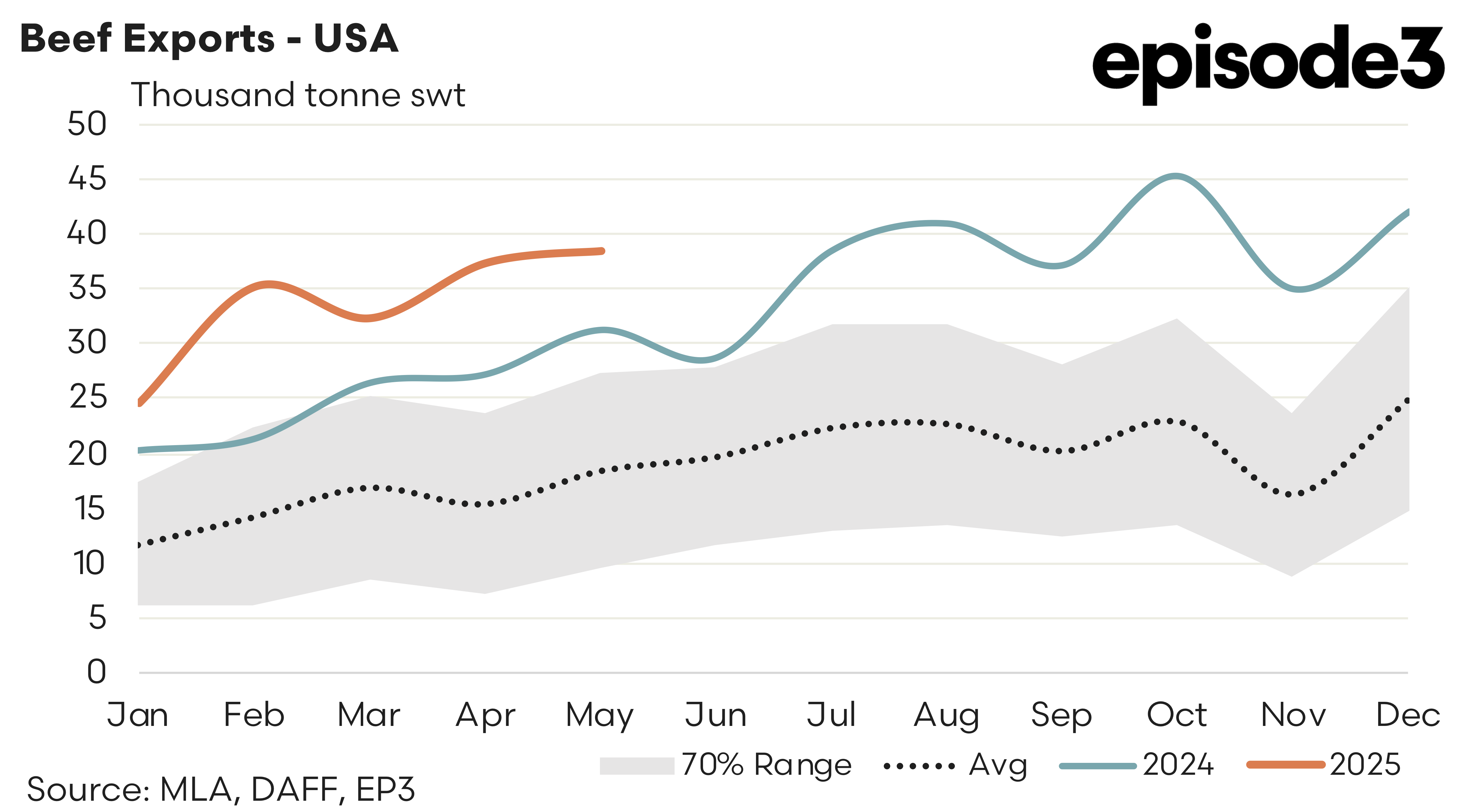

USA – The Aussie beef trade to the US remains firm despite the 10% Trump tariff, there just is not enough domestic beef in the US to satisfy the local demand it seems and our beef export values remain competitive even with the tariff imposed. There was 38,299 tonnes shipped to the US during May, which is just a 3% increase from the April trade volumes. Despite the marginally higher trade in May the volumes being sent presently are exceptional with the beef trade in May running at levels that are 108% higher than the May average, based on the last five years of the trade.

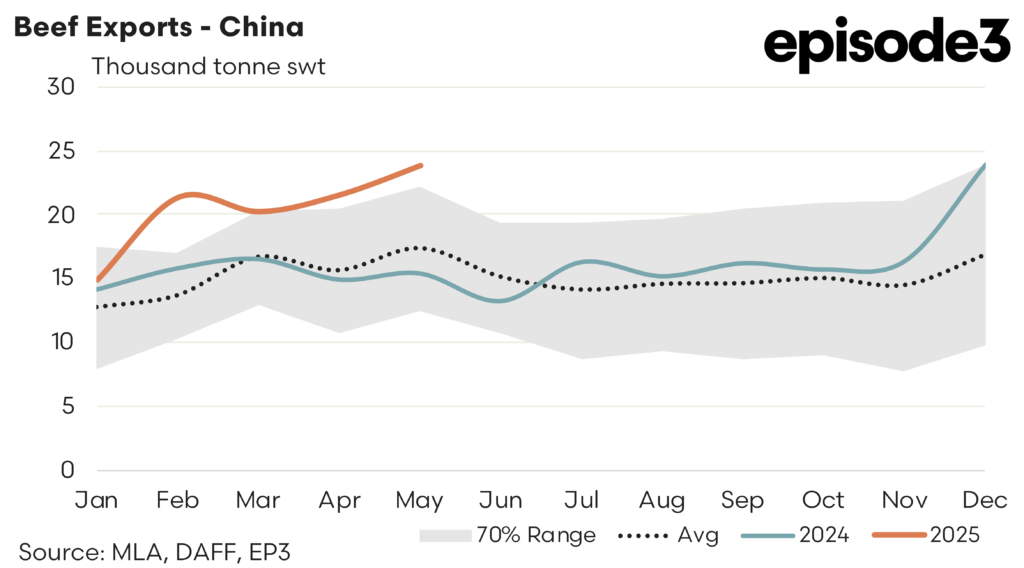

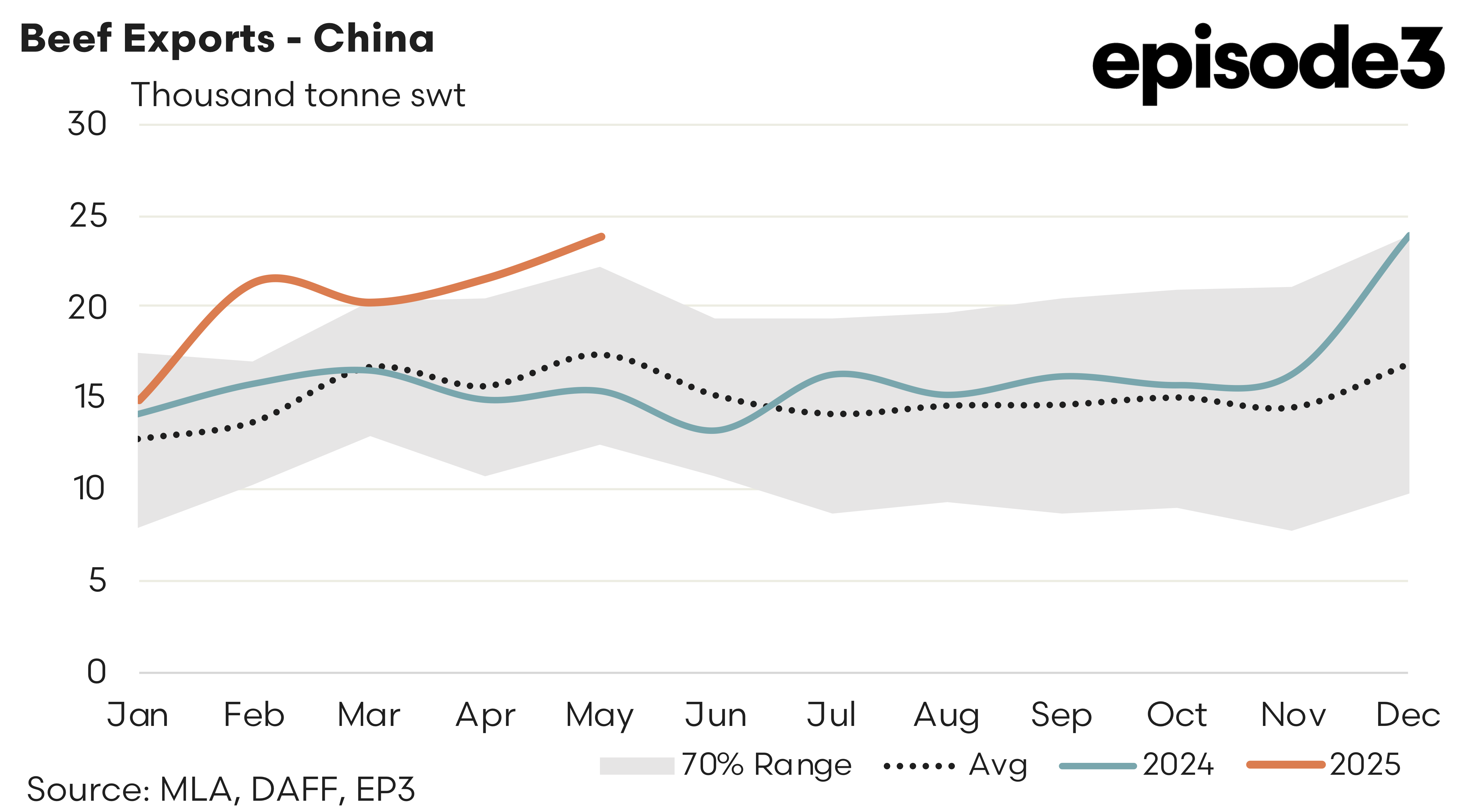

China – The ongoing trade issue between China and the US appear to be working in Australia’s favour in the beef export space, at least for the moment. There was an 11% increase in beef export flows from Australia to China during May to see 23,877 tonnes shipped and this is the strongest May result since 2020. Compared to the five-year average for May the current trade volumes to China are running 38% stronger.

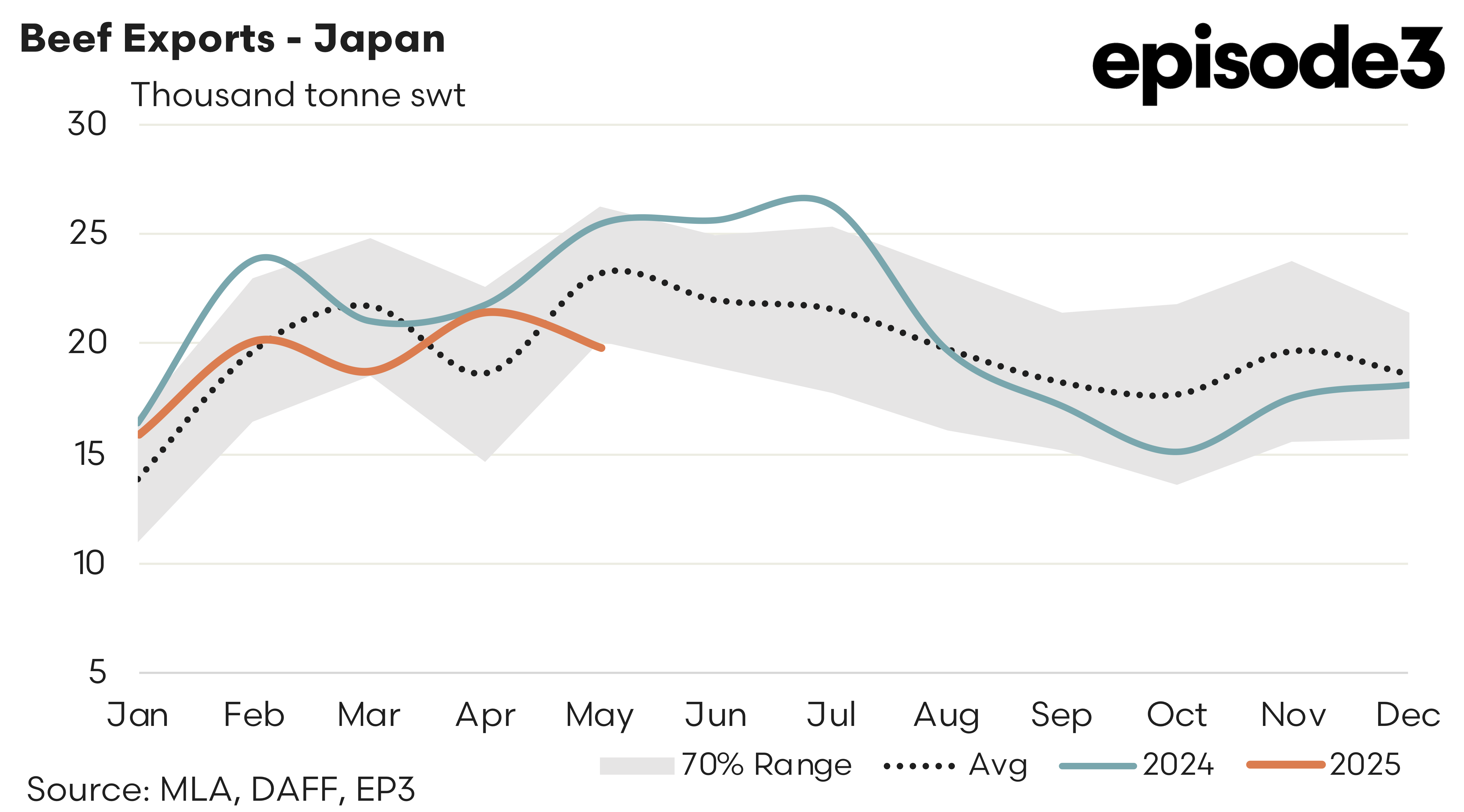

Japan – It appears the dwindling access for US beef into China in recent months has seen a renewed effort on the part of US exporters to place their beef into Japan and South Korea. The US is Australia’s major competitor into Japan and South Korea and May has seen Australian beef export levels ease, possibly due to increased US focus on these markets. There was an 8% decline in beef export volumes from Australia to Japan during May bringing the monthly volumes to 19,803 tonnes swt. At this level the trade is back below the seasonal average for May, based upon the last five-years average trade levels, sitting 14% under the seasonal average trend.

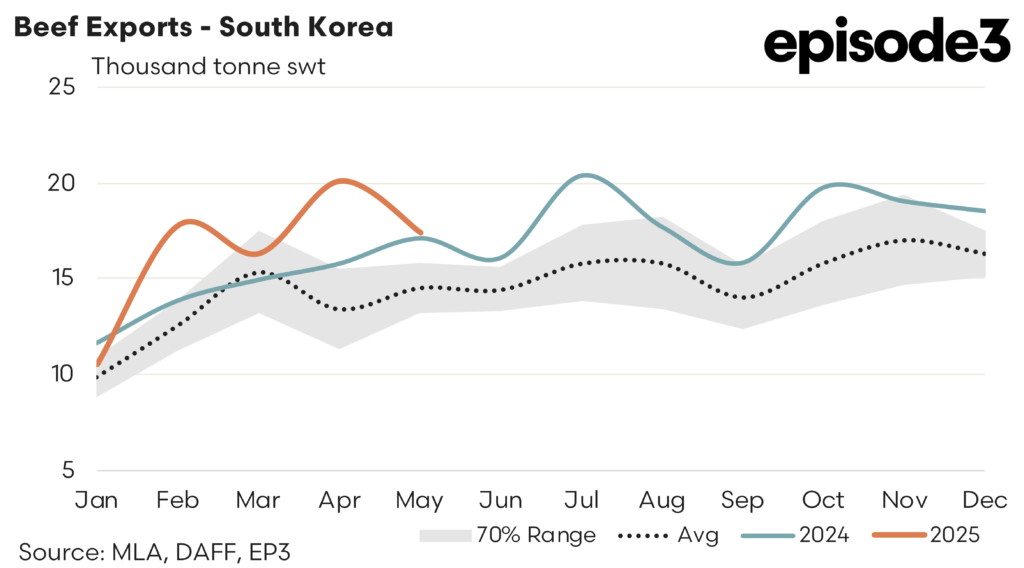

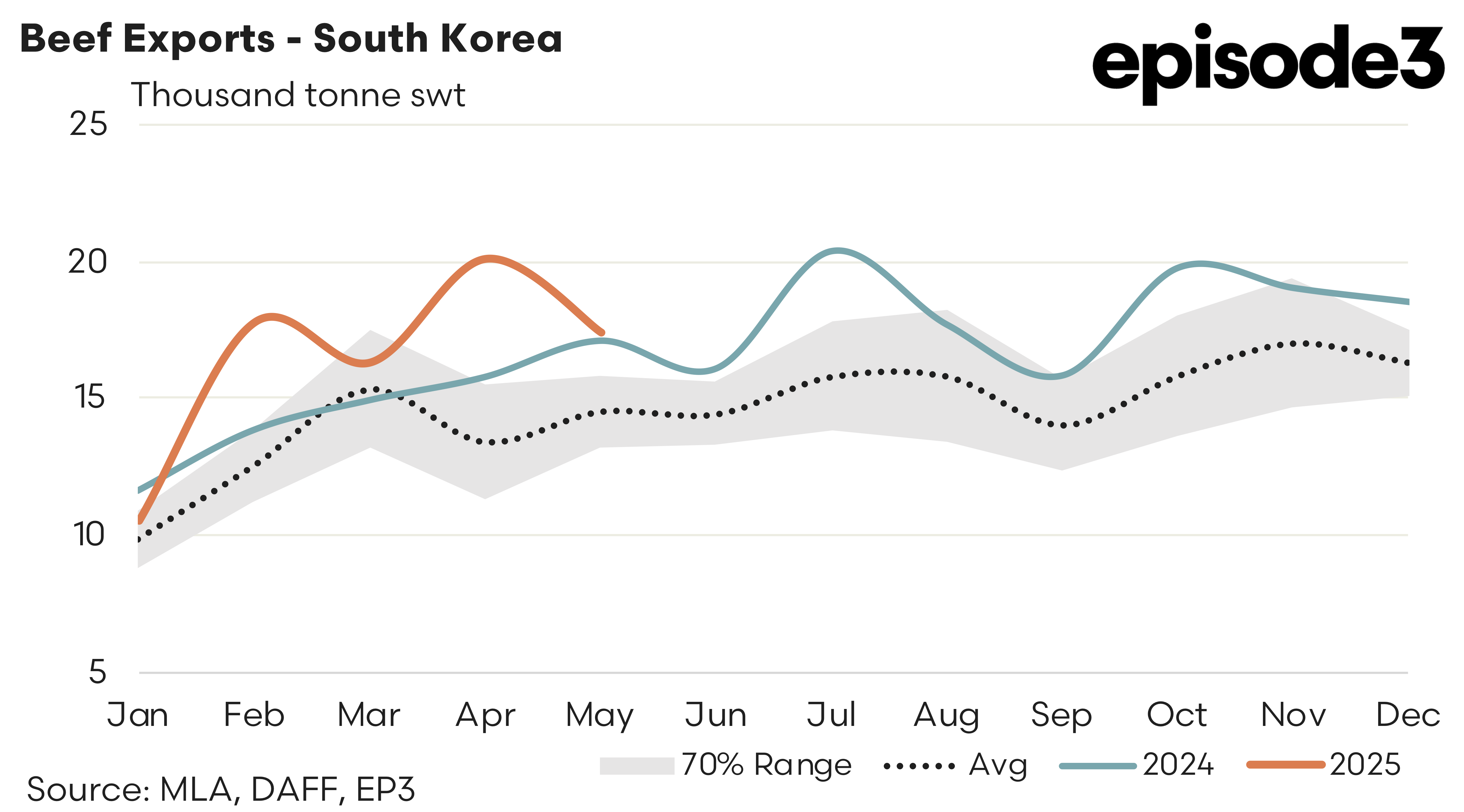

South Korea – There was a downturn in trade noted for South Korea, possibly due to renewed US export interest (as mentioned above). However, unlike Japan the South Korean demand for Aussie beef still remains 20% above the May average levels, based upon the last five-years of the trade. Trade volumes for May dropped by 13% to 17,409 tonnes but the decline wasn’t enough to push back below average levels as it has come off significantly high trade levels in April.