Beef exports down but not out for the count

The Snapshot

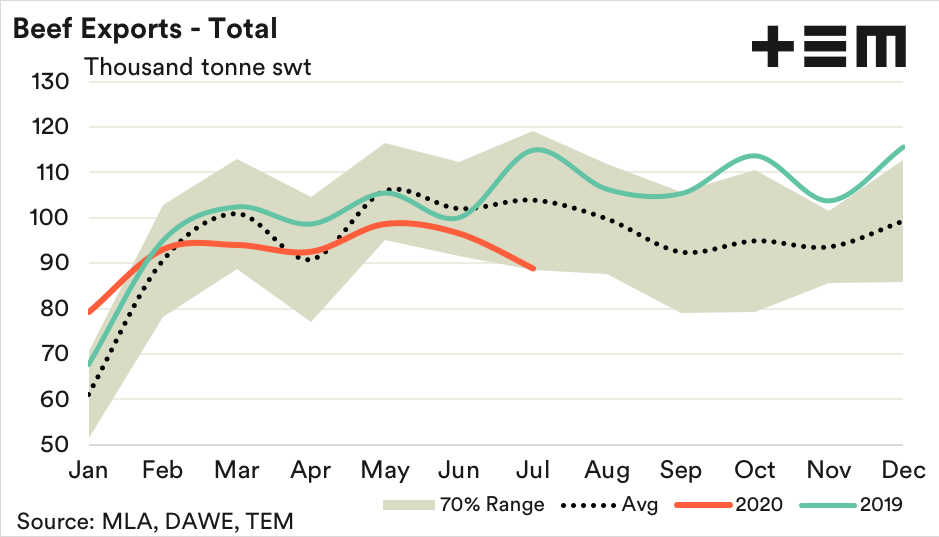

- Aussie beef exports are off 8% from June to July. Down toward the lower end of the normal seasonal range that could be expected for this time in the year.

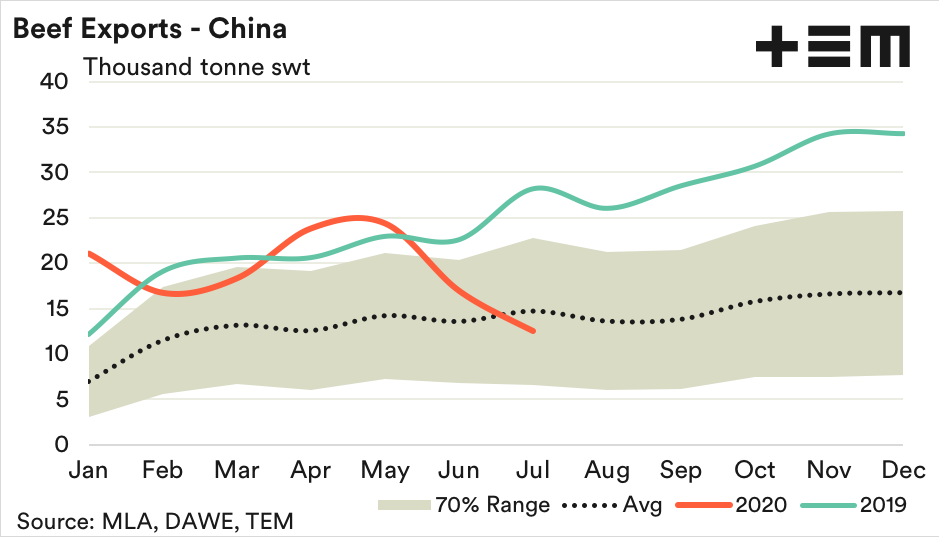

- Beef volumes to China off 26% from June to July. As they are coming off higher historic volumes it means that July 2020 is only 15% under the 5-year average trend for July.

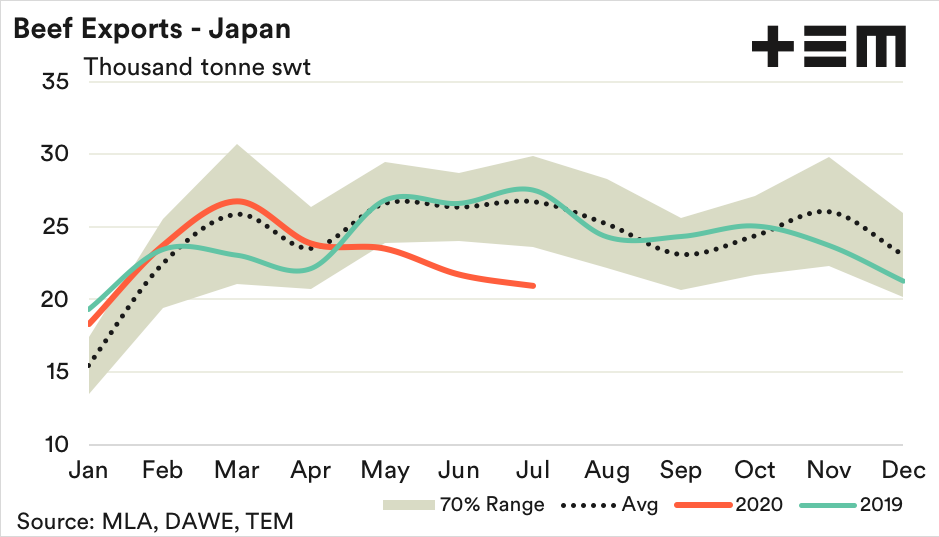

- Aussie beef flows to Japan continues to soften in July to see it 4% under the June 2020 figures and 22% below the 5-year average pattern for July.

The Detail

Earlier this month the Department of Agriculture Water and Environment (DAWE) published their monthly export trade figures showing that Australian beef consignments slipped 8% from June to July, extending toward the lower end of the normal seasonal range at 88,786 tonnes swt.

The top four export destinations for Aussie beef (Japan, China, USA & South Korea) all registered volume declines on the month sending the total monthly volumes to their second lowest level since the start of 2020 and the lowest July volumes since 2016.

Beef export consignments from Australia to China slipped below the seasonal average trend for the first time this year. Dropping 26% from June to July to see 12,554 tonnes swt exported for the month. However, as volumes are coming off higher historic levels it means that current consignments are only 15% under the 5-year average trend for July.

It will be interesting to see how the trend develops for the remainder of the 2020 season given the higher tariff on Australian exports is now in place. Furthermore, this drop could be a signal that recent political tensions between Australia and China are starting to have an impact, or the labelling issues and removal of some export abattoir access to China earlier in the year could be contributing to the decline.

Aussie beef flows to Japan continues to soften in July to see it 4% under the June 2020 figures and 22% below the 5-year average pattern for July. Japan has seen a resurgence in Covid 19 infections since early July to see the highest average daily infections since their outbreak began at over 1,300 new infections per day. Increased lockdown measures, a slowing economy and a reluctance for some Japanese consumers to eat out a potential drag on export beef demand.

US demand for Australian beef slipped 9% from June to July to see it running 12% under the 5-year average trend for July. As the American demand for Australian beef hasn’t retreated as much as China in recent months it has seen the USA recapture the second position in market share of beef exports from Australia at 21.5%, compared to China’s 20.8% for the 2020 season, thus far.

While it isn’t yet doom and gloom for Australian beef exports flows the uncertainty of global demand for red meat protein in a recessionary economic environment poses a bit of a potential headwind. Stay in touch with all the developments by joining the Episode3 email list – and best of all it is completely free.