Beef, with China.

Market Morsel

Beef imports into China only really got moving in a big way over the last decade. Prior to 2012 the value of the total trade was less than $US0.3 billion. However, by 2013 it had lifted to $US1.3 billion and surpassed the $US10 billion threshold in 2020. The value of beef coming into China from Brazil alone lifted from $US0.3 billion in 2015 to over $US4.6 billion in 2021.

Between 2010 to 2015 beef imports from Australia dominated the trade into China, on a value of product basis. However, by the end of 2020 Australia had lost ground to the south American trio of Brazil, Argentina and Uruguay. The Phase 1 trade deal that Donald Trump managed to negotiate while in office saw Australia lose further ground to the USA from 2019 onwards with the value of the US beef trade into China eclipsing Australia in 2021, with the USA at $US 1.35 billion versus Australia at $US1.2 billion.

The eroded competitiveness of Australian beef flows into China since 2013 is clearly demonstrated in the measure of percentage market share of the trade into China. Up until 2014 Australia had managed to account for more than 50% of the trade, however, the herd rebuild phase in 2016 and its associated high Aussie beef prices, relative to our competitors, saw Australian market share slip to 20%. Recent trade tensions and the current herd rebuild (again with high cattle prices relative to our competitors) saw the market share slip again to under 10% of the beef trade into China.

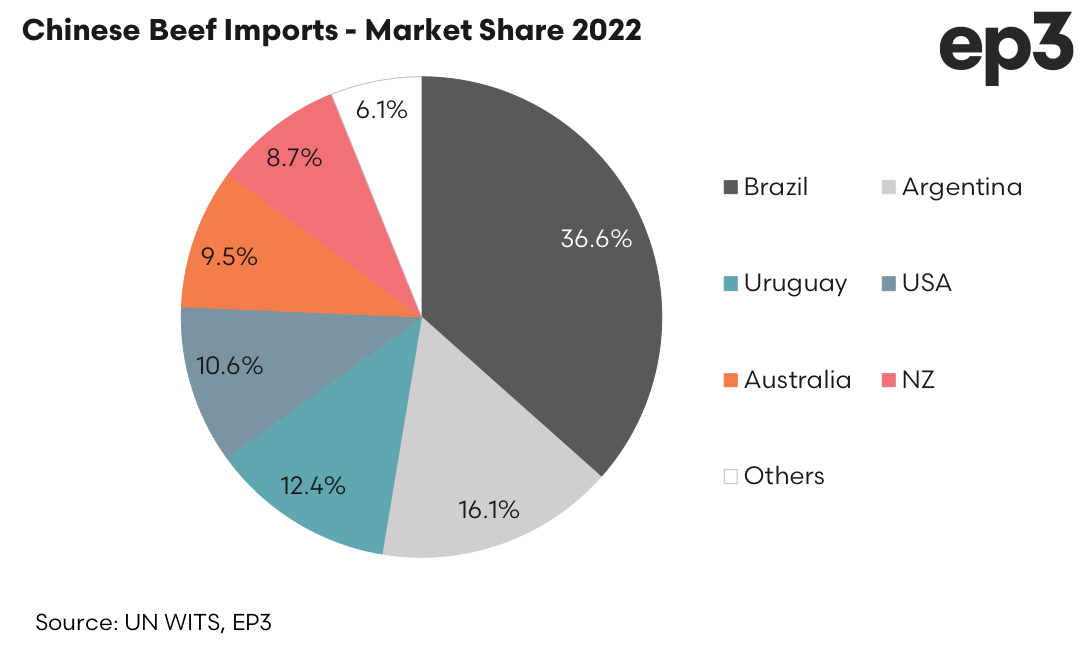

Since the ban on Brazilian beef into China was lifted in 2014, which was in force since late 2012 due to an outbreak of Mad Cow Disease, the Brazilian market share has climbed toward 40% of the total beef import flows, by value. After relatively stable market share in the first half of the last decade of around 22% Uruguay has seen their proportion of Chinese beef imports slip toward 12%. Meanwhile, Argentina has demonstrated relatively stable growth in market share since 2012 to near 20% of the total trade in recent years.

As at the start of 2022, the three amigos (Brazil, Argentina and Uruguay) accounted for around two thirds of the total beef trade into China. The USA has seen their market share lift from under 1% prior to 2017 to nearly 11% thanks to the Trump trade deal. Australia sits in fifth top spot on 9.5% of the trade value ahead of the Kiwis on 8.7% of the total beef trade into China.