Better than last year

Market Morsel

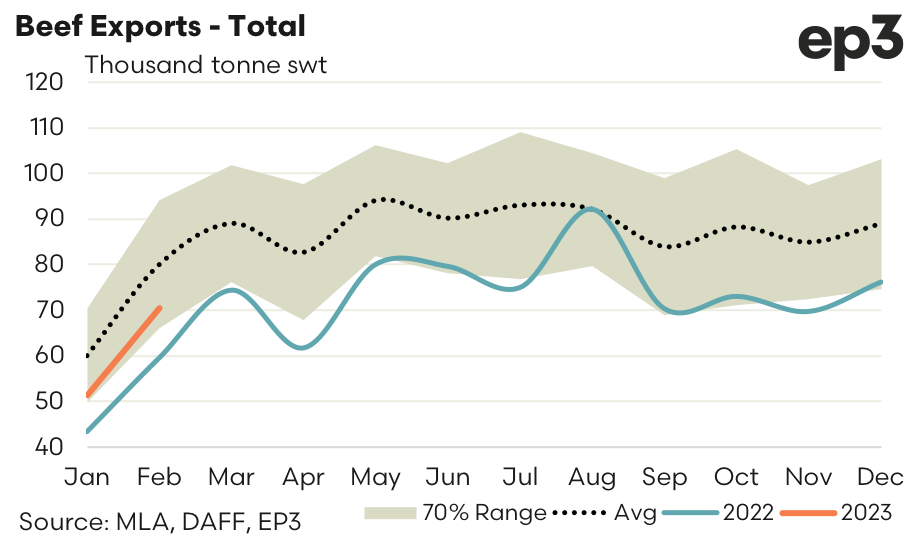

The trend in Aussie beef exports is still some way off the five-year seasonal average flows, but at least the 2023 season has begun in better fashion than what we saw in 2022. Total beef export flows for February lifted by nearly 37%, which is consistent with the gains your normally see from January to February, to hit 70,379 tonnes swt exported. This is the strongest February result since 2020 and represents flows that are 12% under the five-year average trend for February.

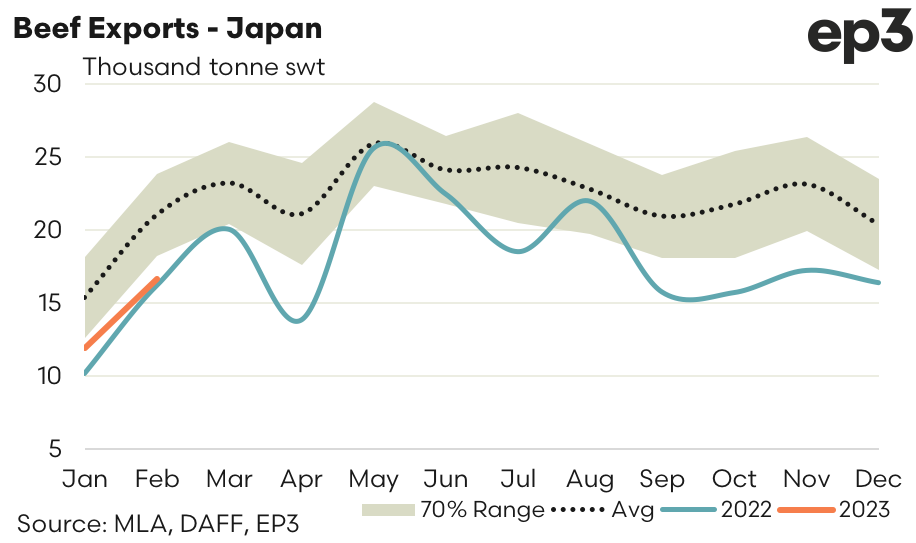

Aussie beef export flows to Japan marginally outdid last February with 16,657 tonnes reported shipped. However, compared to the five-year average for February exports to Japan remain nearly 21% under the “normal” volumes that would be expected for this time in the year.

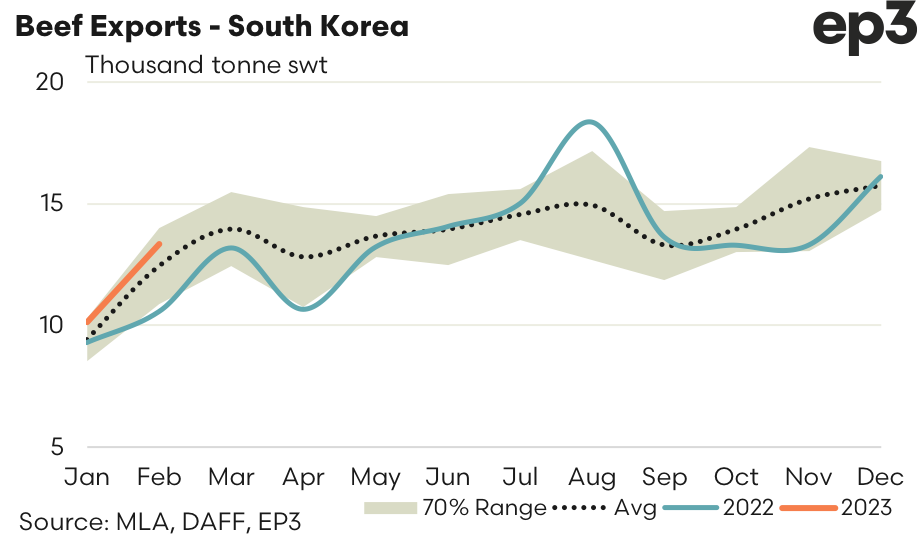

One shining light of optimism remains South Korea, the only top four destination that has reported above average beef export demand from Australia. South Korea has cemented second place as a top destination for Australian beef ahead of China, who sits in third place, accounting for 19.3% of total flows so far in 2023 compared to China’s 18.9% market share. South Korea saw almost a 32% increase in beef exports from Australia over February to hit 13,342 tonnes swt consigned, the strongest February flows since 2019, and representative of trade flows that are 7% above the five-year average pattern for February.

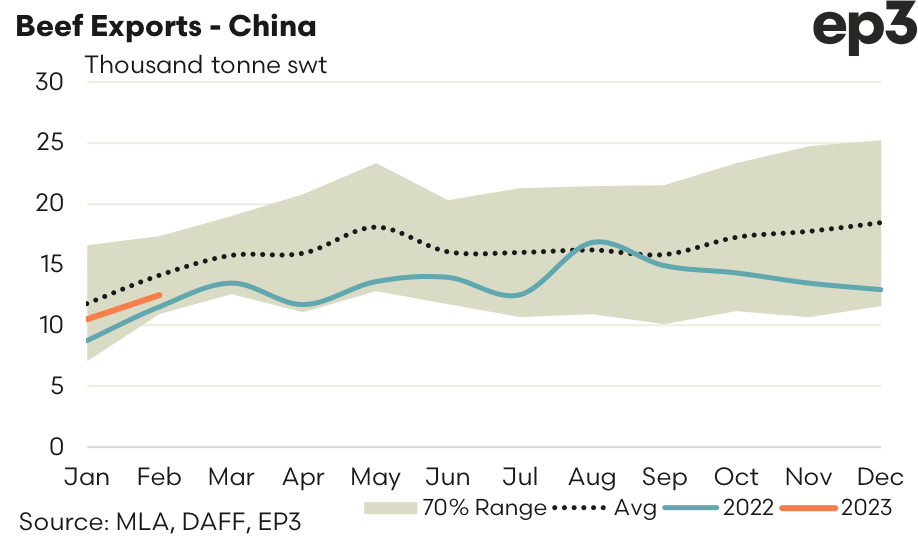

China posted a 19% lift in beef export demand from Australia over February to record 12,528 tonnes shipped over the month. This is the strongest February flows to China since 2020, but represents trade volumes that are still 11% under the five-year average pattern for February.

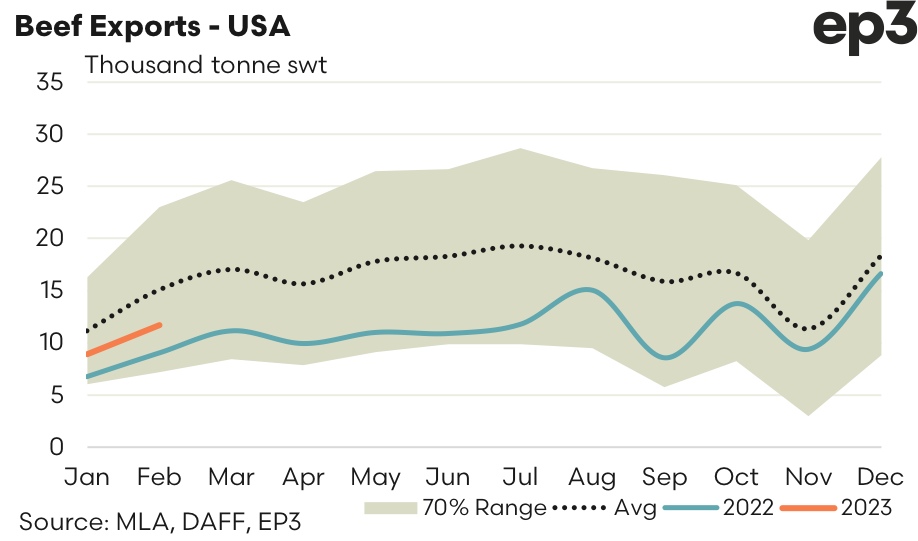

The USA managed a 30% increase in beef exports to see 11,693 tonnes swt consigned. Like China, this is the best performing February for the USA seen since 2020. However, also like China, the US beef export demand from Australia remains under trend with current volumes around 23% below the five-year average for February. At least it isn’t still as weak as the demand seen in 2022 which was 40% below the average seasonal pattern.

Photo credit – Brian Leahy