Brazil cutting our Vietnamese lunch

The Snapshot

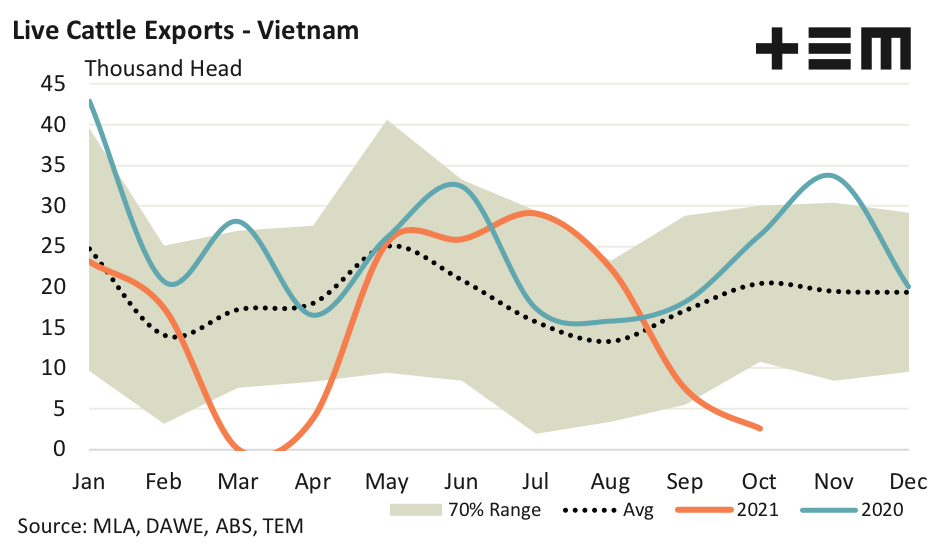

- The five-year average pattern for October demonstrates that the usual volume sent to Vietnam at this time in the year is around 20,000 head, so current flows are sitting nearly 88% under what would be considered normal.

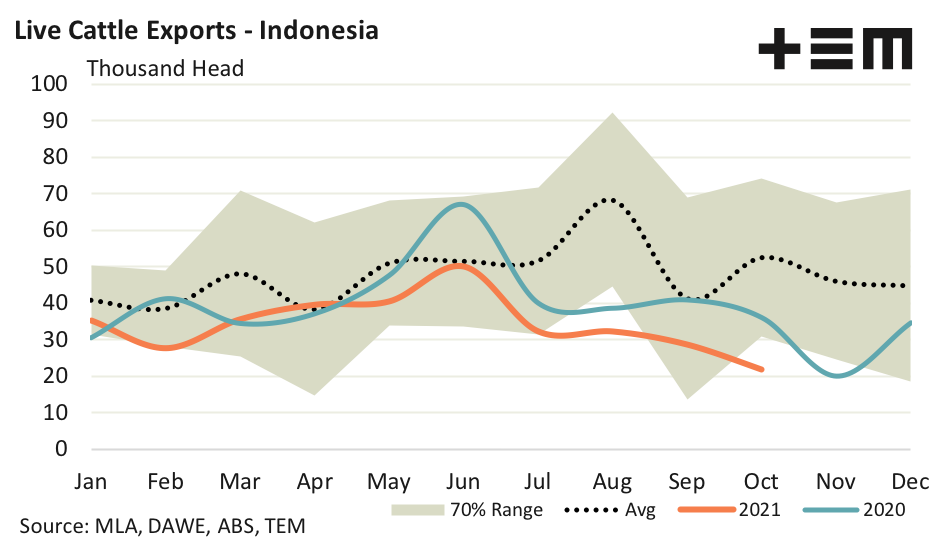

- Aussie cattle flows into Indonesia are 58% under the 50,000 plus head we normally see shipped from Australia to Indonesia at this time in the year.

- In some positive news, China saw an increase in volumes for October with a 168% gain during October.

- Indonesia and Vietnam account for nearly 75% of Australian live cattle exports in 2021 so, with both destinations experiencing a decline in October, it is not surprising to see total cattle export volumes have eased a further 12% over the month.

The Detail

Australian live cattle exports to Vietnam continued to ease during October, dropping 66% over the month to register just 2,542 head. Late September saw a shipment of 14,000 bulls arrive in Vietnam from Brazil and this additional competition, along with the tight domestic supply and corresponding high prices of Australian live cattle, have seen trade flows to Vietnam from Australia impacted.

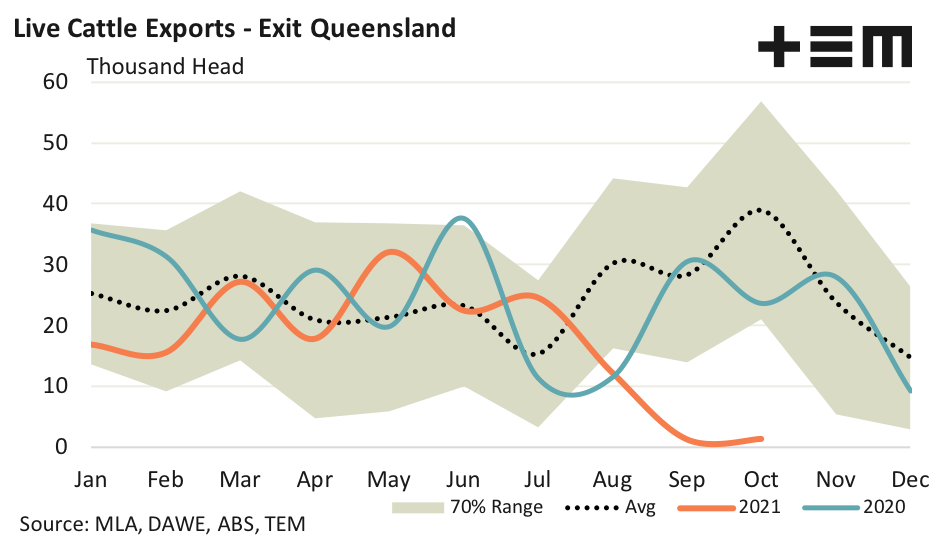

The five-year average pattern for October demonstrates that the usual volume sent to Vietnam at this time in the year is around 20,000 head, so current flows are sitting nearly 88% under what would be considered normal. The port of Townsville is a common departure choice for live cattle exports destined for Vietnam and the recent decline in traffic has seen Queensland register minimal live cattle exports since August. The five-year average trend for live cattle exports from Queensland shows that nearly 40,000 head are exported during October. However, this year there was a meagre 1,290 head shipped.

Trade chatter suggests that there are further shipments from Brazil to Vietnam scheduled, with once source reporting that a total of 60,000 head had been agreed over a series of consignments for delivery dates extending into 2022. Australia had been the primary supplier of live cattle into Vietnam so it will be interesting to observe how the increased competition will evolve into next year and how much market share the Brazilian exporters will be able to capture.

Australia’s largest export destination, Indonesia, also saw declining live cattle export volumes from Australia in October. There was a 24% drop in cattle exports during October to register 21,878 head of Aussie cattle into Indonesia. This represents levels that are 58% under the 50,000 plus head we normally see shipped from Australia to Indonesia at this time in the year, according to the average seasonal trend.

In some positive news, China saw an increase in volumes for October with a 168% gain during October. Although, it is prudent to mention that the strong percentage lift was off a very low base in September. Chinese demand for Aussie cattle went from 4,100 head in September to 11,005 in October, which is just 9% under the five-year average for October.

Indonesia and Vietnam account for nearly 75% of Australian live cattle exports in 2021, so with both destinations experiencing a decline in October, it is not surprising to see total cattle export volumes have eased a further 12% over the month. Total exports drifted off to register 45,106 head transported, the lowest monthly flows since February 2017 and levels that are 54% under the five-year October average.