Bring in the heavies

The Snapshot

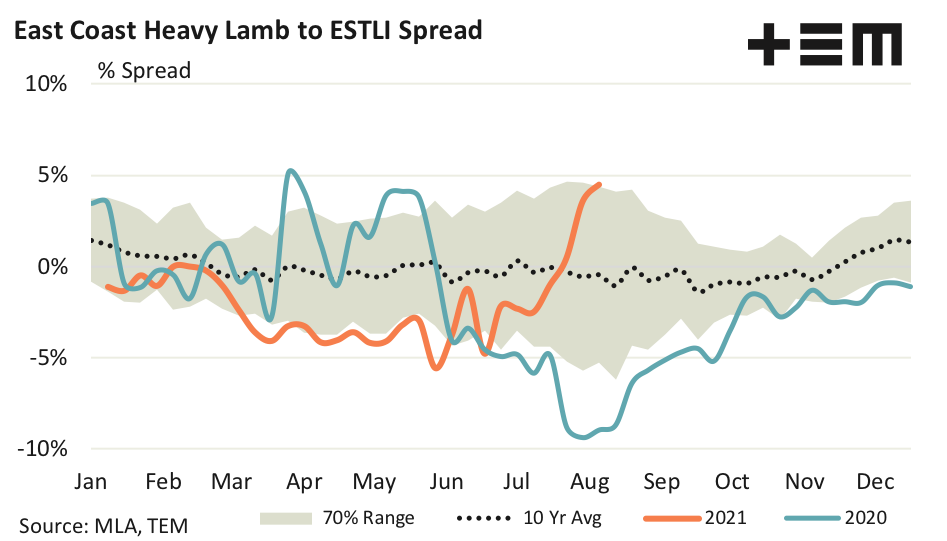

- The shortage of heavy lambs has seen the spread of heavy lambs to the ESTLI moving from a 5% discount to a 5% premium over July.

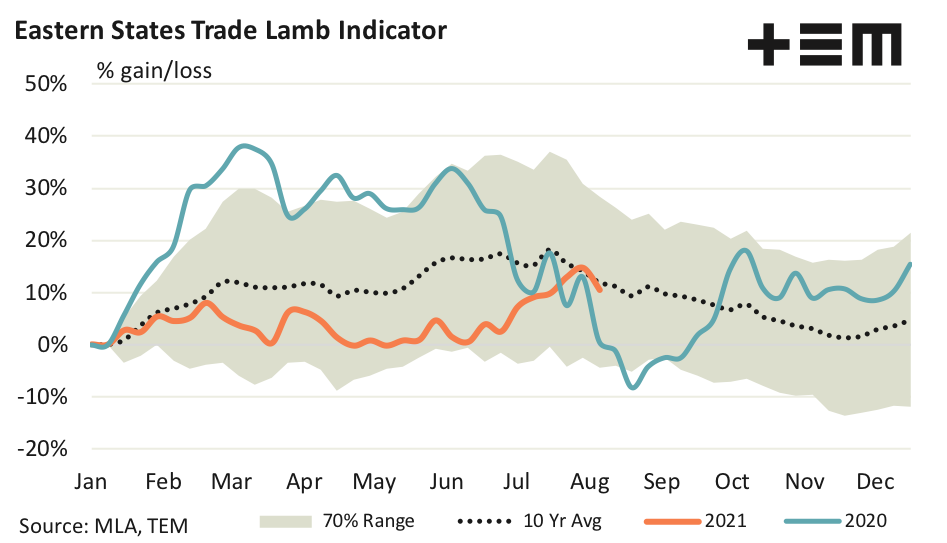

- The ESTLI price gain/loss chart shows the impact of Covid-19 inspired restrictions on Victorian meat works with the market moving from a 30% gain to a 10% loss through winter of 2020.

- An abattoir workforce disruption, causing a bottleneck during the spring flush, could force the ESTLI back under 600c/kg cwt this season.

The Detail

In a podcast recorded a few weeks back with Kerry Lonergan and Stocko’s Chris Howie there was a brief mention of tight times coming for heavy lamb supply as we headed into August. Recent price action across the east coast for Heavy Lamb appears to validate the anecdotal reports of limited supply with prices peaking at 957c/kg cwt a week ago.

The shortage of heavy lambs even more apparent when comparing the spread of heavy lamb to the Eastern States Trade Lamb Indicator (ESTLI) with the spread moving from a 5% discount to a 5% premium over July. Indeed, for much of the 2021 season the heavy lamb spread has trended along the lower end of the normal seasonal range, remaining at a discount throughout the year until the last few weeks.

The behaviour of the heavy lamb spread to the ESTLI is in stark contrast to the situation last season when Covid-19 disruptions to Victorian abattoirs, with government workforce constraints enforcing a 65% capacity restriction, pushing the heavy lamb spread from a 5% premium in Jun 2020 to a very unseasonal 9% discount in August 2020.

As we head toward the spring flush of lambs in Victoria there have been some murmurs of concern among processors that difficulties in finding enough seasonal abattoir workers due to international Covid-19 travel restrictions could force a supply chain bottleneck as the spring lamb volumes start to hit the saleyard.

Uncertainty about the limits on Victorian abattoir throughput capacity in 2020 caused an earlier than normal seasonal peak in the ESTLI with the market heading south in June as lockdown restrictions were placed on Victorian meat works. The ESTLI price gain/loss chart shows the impact quite clearly with the market moving from a 30% gain to a 10% loss through winter.

The ten-year average seasonal pattern for the ESTLI gain/loss highlights that the market often peaks in late July/early August, reaching a low ebb in November as the large volumes of Victorian spring lambs hit the market.

Last week the ESTLI hit a seasonal high of 924c/kg cwt and has since eased 4%. This could signal the beginning of the spring price decline this season. If we see workforce disruptions eventual this year it could place stronger than normal pressure on spring lamb pricing, pushing heavy lambs back toward a strong discount to the ESTLI. If the price decline seen in 2020 is any guide this could place the ESTLI back toward the mid/low 600 cent region, or perhaps under 600c/kg cwt if the supply chain disruption is severe.