Cattle slaughter capacity lifts in May

Market Morsel

The Australian cattle market has entered a new phase of activity as national slaughter and yarding volumes lifted in May following April’s holiday disruptions and widespread weather delays. However, the recovery has not been evenly distributed across the country, with regional contrasts emerging in supply flows particularly in the east versus the west.

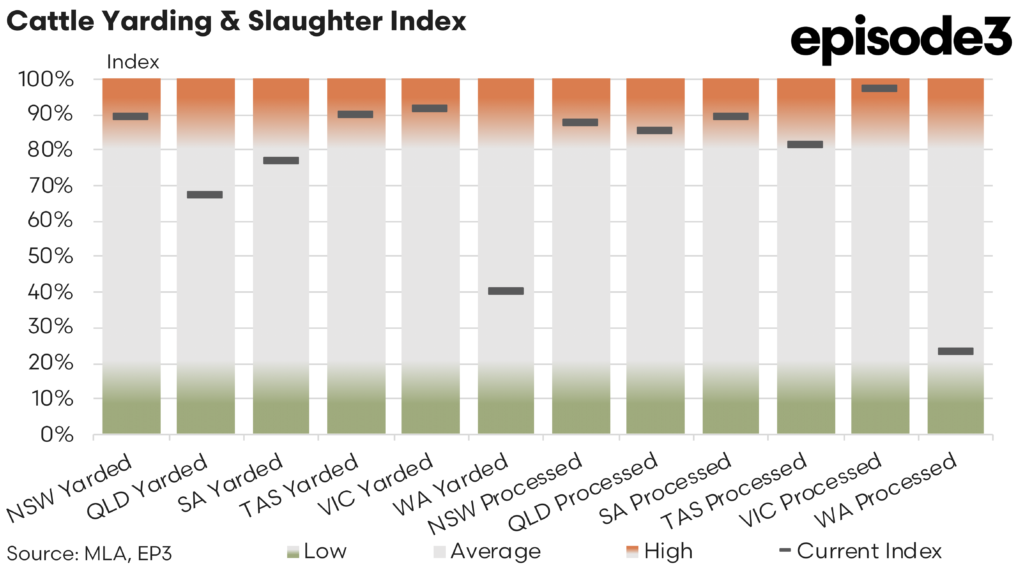

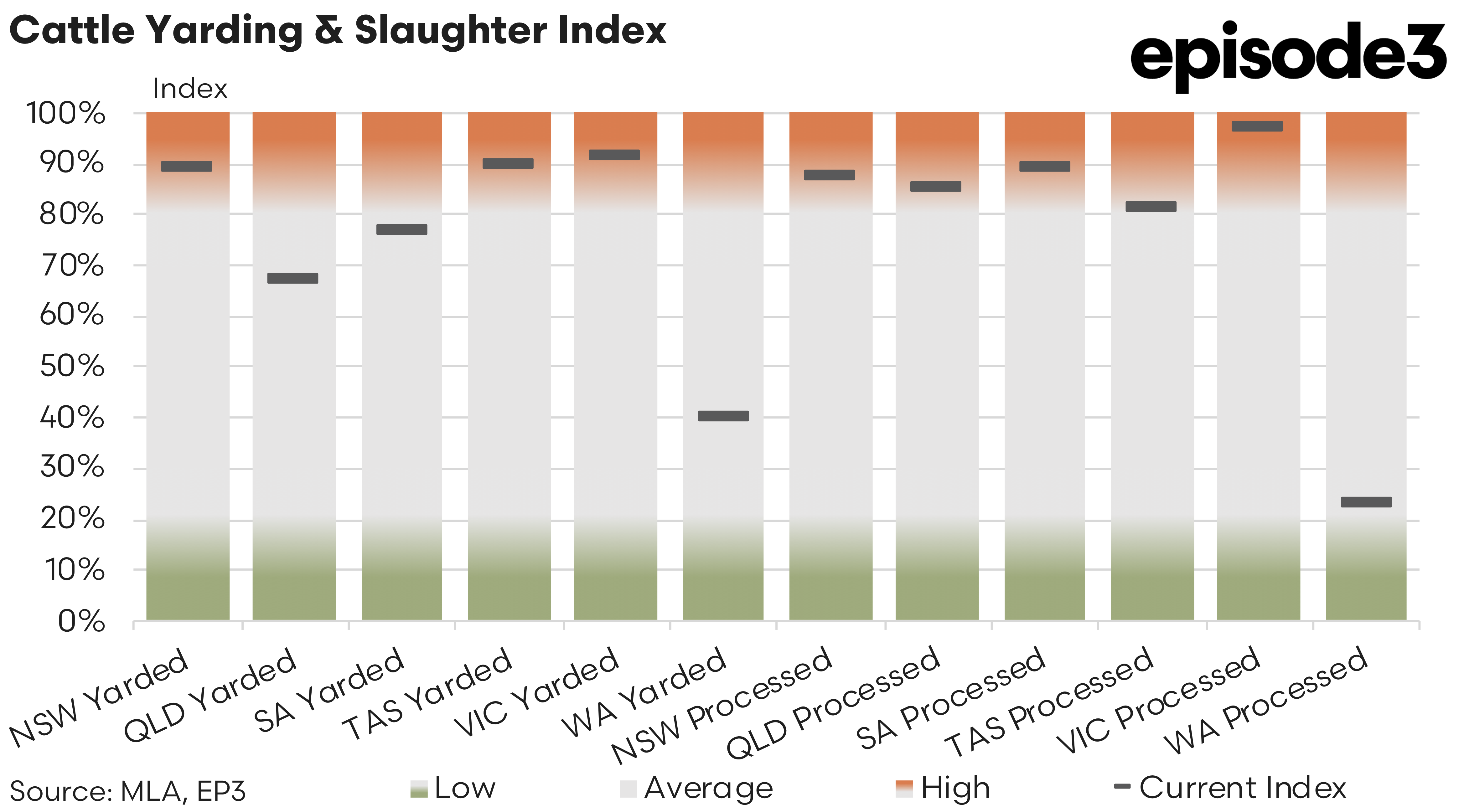

The clearest shift from April to May has been the strong rebound in both saleyard yardings and processor throughput across eastern and southern states. New South Wales lifted yardings from 63% in April to 89% in May, while slaughter volumes rose from 53% to 88%. Queensland saw the most dramatic recovery, with yardings jumping from just 16% in April to 67% in May, and processing rates climbing from 48% to 85%. These increases reflect improved paddock access following April rainfall and processors catching up on backlogs built up over the holiday period.

Southern states posted strong numbers too. Victoria increased yardings from 57% to 91% and lifted processing volumes from 67% to 97%, effectively running at near full capacity. South Australia similarly improved, with yardings up from 42% to 77% and processing up from 68% to 89%. Tasmania saw a rebound as well, with yardings climbing from 67% to 90% and processing improving from 47% to 81%, suggesting that earlier labour or capacity constraints may have eased.

Western Australia, however, remained an outlier. Yardings dropped slightly from 48% to 40%, and processing volumes fell from 34% to just 23%. The state continues to grapple with longstanding processor capacity issues and logistical barriers related to distance from major markets.

April’s downturn in processing volumes, especially in Queensland and NSW, was largely driven by heavy rainfall in northern and central regions, which made paddocks inaccessible and delayed mustering. This was compounded by limited processor availability due to public holidays, leading to booking congestion and logistical bottlenecks.

In contrast, southern producers, facing dry pasture conditions, continued to turn off cattle at pace. Victoria and South Australia’s resilience during this period underpinned national kill volumes. However, this accelerated southern supply is now testing processor capacity, particularly as Queensland throughput resumes. Some southern plants are experiencing backlogs, and lighter carcase weights due to declining pasture quality may begin to affect yields and margins.

Saleyard prices for slaughter cows have risen sharply in the past month, particularly in Queensland and southern NSW, due to tight supply and increased competition from southern processors. At some Queensland saleyards, prices for good cows surged from 280c/kg to 310c/kg in just a week, equating to around 530–585c/kg cwt over the hooks.

However, over-the-hooks prices have not followed suit. Many large processors remain well booked into June and are not feeling pressure to lift grid prices. For now, processor bids remain steady at around 520–540c/kg cwt for heavy cows in southern Queensland, with some isolated offers from further south reaching 575c, though these are anecdotal. Central Queensland prices continue to lag by 10–20c/kg.

The latest pricing data reveals varied movements across cattle categories over the past month. The MLA Processor Cow Indicator sits at 271c/kg liveweight, up 22c over four weeks, reflecting strong demand for lean beef despite volatility in US grinding meat prices and tariff uncertainties. The Heavy Steer Indicator has also risen, up 8c to 345c/kg, showing some resilience in finished cattle values even as slaughter levels fluctuate.

Additionally, the Feeder Steer Indicator has firmed 31 cents over the month and is now sitting at 397c/kg. Yearling heifers and restocker steers recorded modest monthly movements but remain substantially higher year-on-year, supported by confidence in seasonal recovery in parts of the north.

With rising cattle prices, processors continue to face tightening margins. According to recent margin analysis, livestock input costs have increased by 6% since the beginning of 2025, outpacing export price growth. While beef export prices to South Korea and China have risen by 4.1% and 2.8% respectively, average prices to Australia’s four key markets have only lifted 1.6%. Meanwhile, domestic retail beef prices are up just 1.5%, limiting processors’ ability to pass through higher costs.

Operational expenses, including manufacturing input costs, labour, and utilities, have also edged higher, compounding financial pressure. This margin squeeze is reflected in a decline in the Beef Processor Trading Conditions Index, which recently fell to 51% during April.

Looking ahead, the market is entering a critical period. With Queensland now resuming throughput and southern processors working at near maximum capacity, managing labour, logistics, and carcase quality will be key to maintaining performance.