China pips South Korea

The Snapshot

- Beef exports to China in 2022 sit at 19.1% of the market share compared to 18.6% for South Korea.

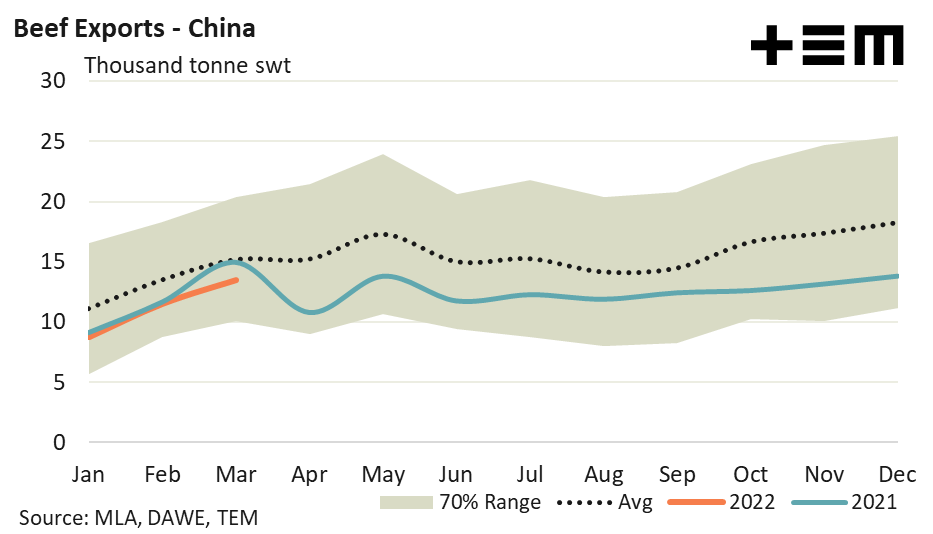

- Average monthly flows over the first quarter of 2022 to China are running 15% under the five-year average pattern.

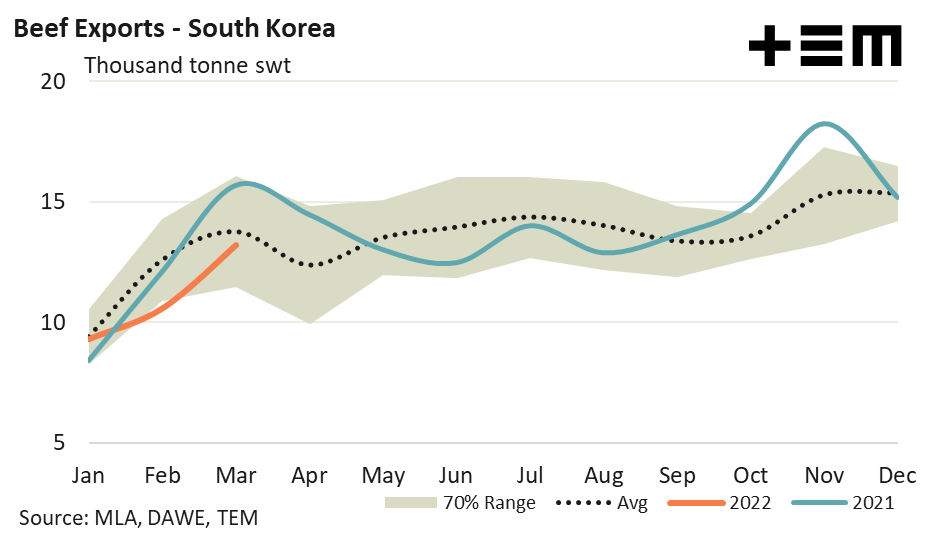

- The South Korean trade is running just 7.5% below the five-year average seasonal pattern for the first quarter of 2022.

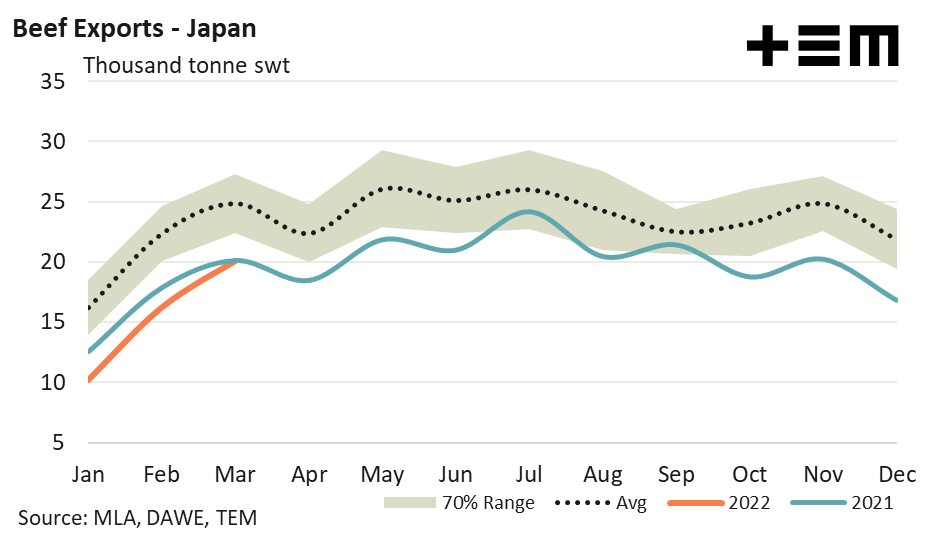

- Average monthly flows to Japan are running nearly 27% under the five-year seasonal pattern for the first quarter of the year.

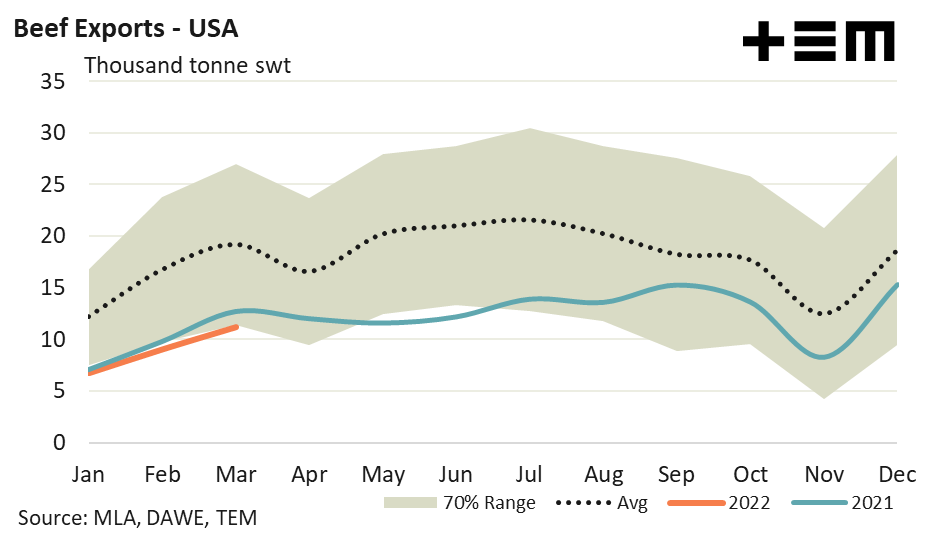

- Meanwhile, US flows are 44% under the five-year trend for the first quarter of the season.

The Detail

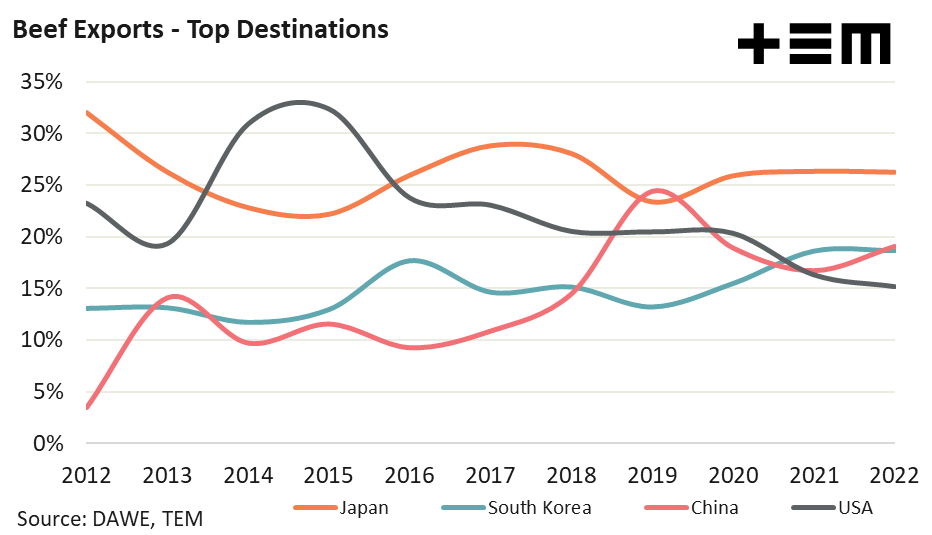

March 2022 beef export data shows that China have managed to wrestle second top place from South Korea for the Aussie beef export trade, despite ongoing trade tensions between Australia and China. Keeping in mind that a selection of beef export abattoirs are still unable to access the Chinese market this is a pretty solid result.

Beef exports to China in 2022 sit at 19.1% of the market share compared to 18.6% for South Korea. Japan remain in top destination despite continued lacklustre trade flows this season with 26.3% of the beef export volumes so far this year. The USA remain soft, in fourth spot, with just 15.2% of the Aussie beef export flows.

China saw a 17% lift in beef export consignments from Australia over March to record 13,483 tonnes swt traded. Average monthly flows over the first quarter of 2022 to China are running 15% under the five-year average pattern, considering the trade tensions, high local prices compared to offshore values and tight domestic supply, the trade result to China isn’t looking too bad.

Although South Korea were ousted by China for second place they still managed a 25% lift in beef trade volumes from Australia over last month. South Korea managed beef export levels of 13,187 tonnes swt, which isn’t that far off the five-year average for March. Looking at average monthly flows over the entire first quarter of 2022 the South Korean trade is running just 7.5% below the five-year average seasonal pattern for this time in the season.

As previously mentioned, the beef export trade to Japan has been underwhelming this year. Average monthly flows are running nearly 27% under the five-year seasonal pattern for the first quarter of the year. March saw a 24% lift in the volume of Aussie beef exports to Japan from levels seen during February to register 20,083 tonnes swt exported, which represents levels that are 19% under the March average, according to the five-year trend.

Meanwhile the USA are demonstrating a similar trend to beef exports from Australia as seen in 2021, over the first quarter of 2022 average monthly flows are running 44% under the five-year average pattern. The weak demand continues to be shown out of the USA, despite volumes lifting over March by 23% to 11,142 tonnes.

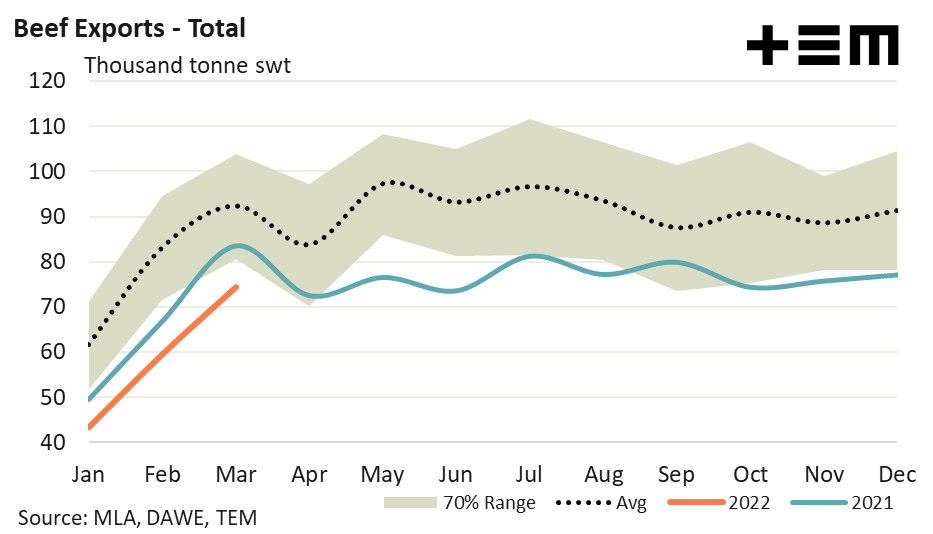

Weak demand from Japan and the USA continues to drag on total beef export flows out of Australia. The total monthly beef exports for March managed 74,348 tonnes swt, which is nearly 20% under the March average levels for the past five seasons. Looking at the total flows over the first quarter of 2022 volumes are running 25% below the seasonal average trend.