Market Morsel: China still needs meat………for now.

Market Morsel

At EP3 we are naturally sceptical at times. We don’t tend to take things at face value, as a team of data-driven analysts, we always delve into the numbers behind the stories.

One of the areas which we have been most sceptical about is the speed of the pig herd rebuild in China. The herd will be rebuilt, that is a given, the question is how fast it will be.

Pork is the most consumed protein in China, and due to African Swine Fever, imports of all protein sources have increased.

At present, we believe that numbers of pigs are increasing, however, that the efficacy of the rebuild program is not high. This is resulting in continued strong imports of meat.

In the first chart below the provisional import volume for November is displayed, whilst lower than the record levels during the mid-year period, they remain well above pre-ASF levels. The November imports are provisionally forecast at 15kmt higher than October.

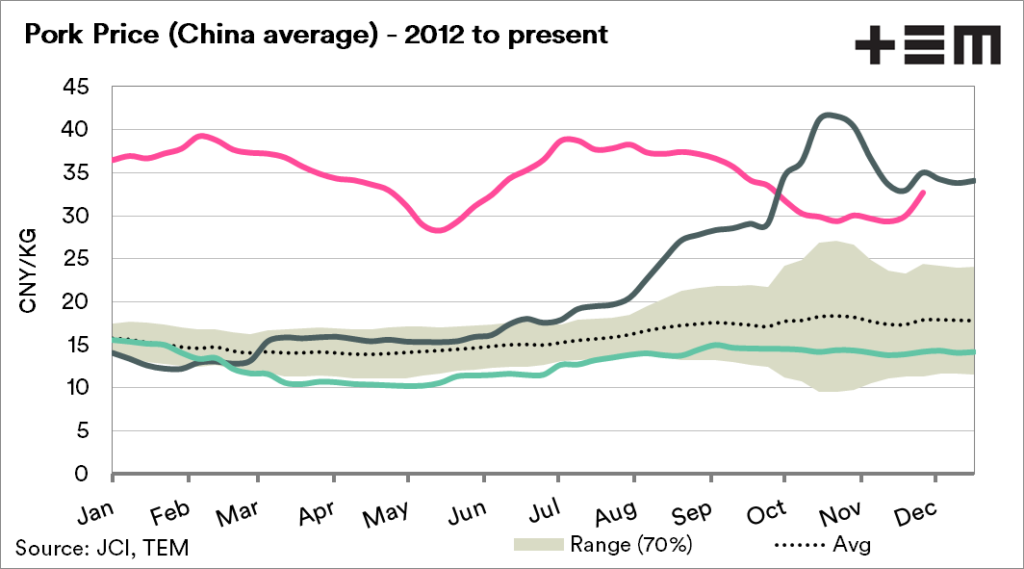

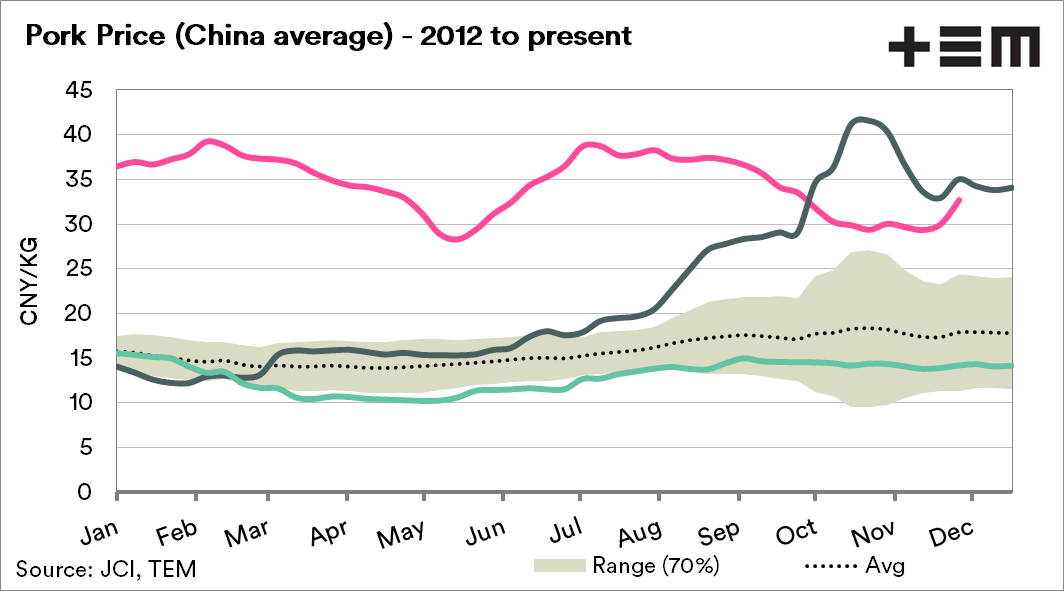

The price of pork is another strong indicator of the health of the rebuild, and the price doesn’t lie. Rather unexpectedly, the pork price in China has declined from record levels. During the past week, average pork prices rose 9% on the prior week.

Whilst the rebuild is according to Chinese sources close to complete, the reality is that pork price remains only 7% below last year, and a whopping 130% above the same time during 2018.

The protein market globally has been supported by Chinese demand driven by ASF. When the rebuild is complete, the demand will drop and could have a large impact on prices. At present, the signals show continued demand.

We need to see further drops in prices and import demand before a herd rebuild can be seen as wholly effective, and influential on our protein pricing.

China still needs meat, the question is whether with recent political issues whether it is from Australia or elsewhere.