Co-product price lift does little for processors

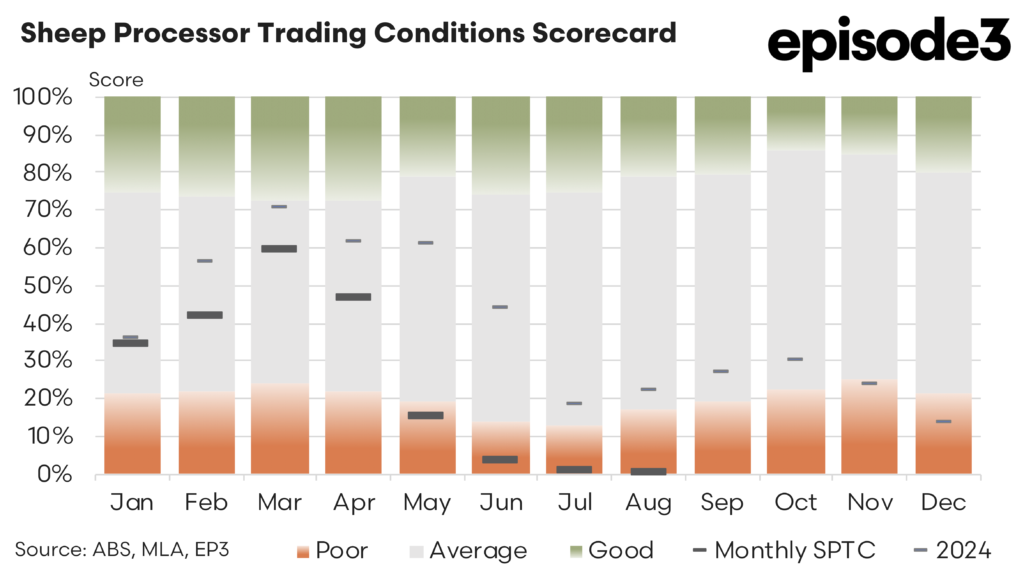

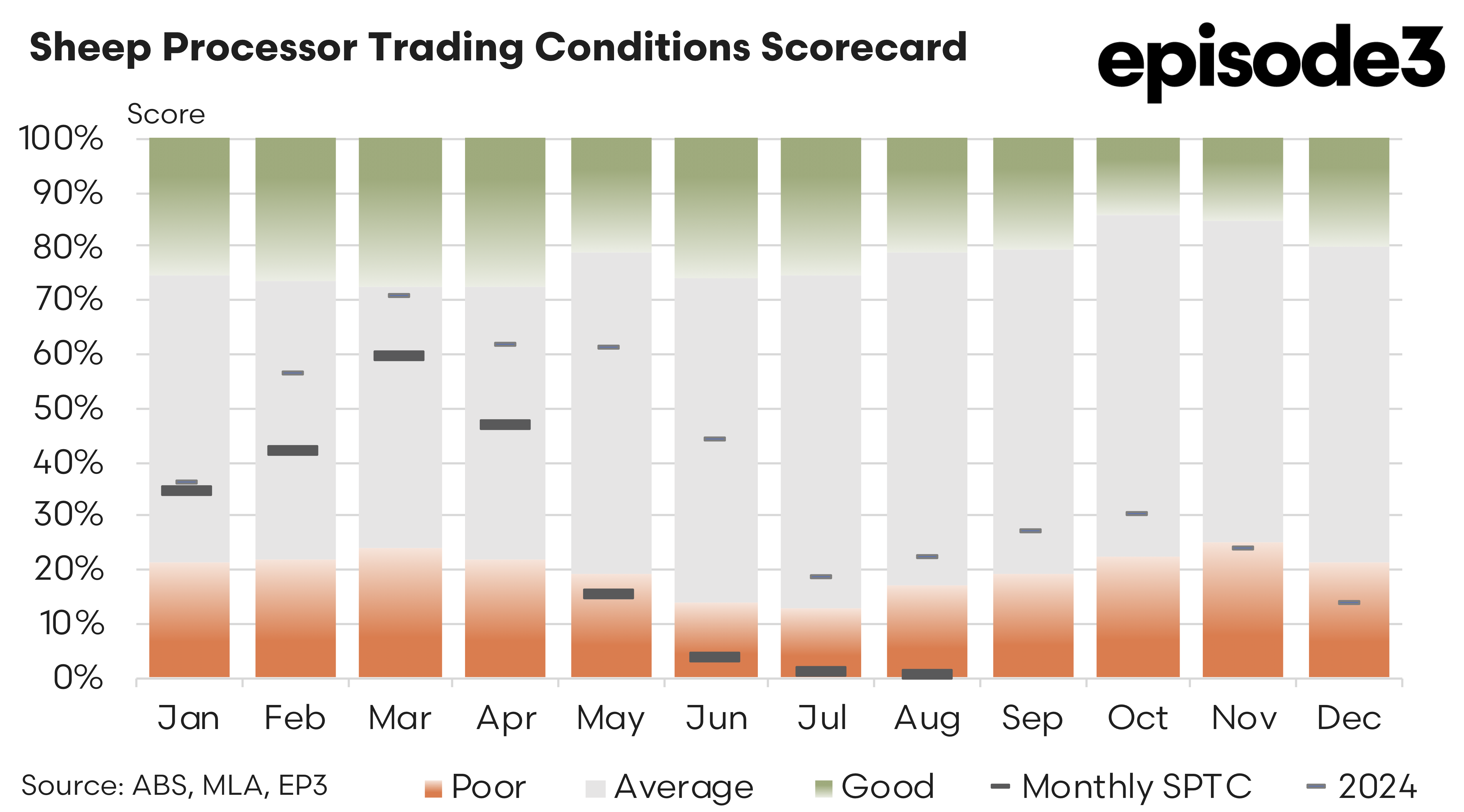

Sheep Processor Trading Conditions Model

Recent revisions to the Sheep Processor Trading Conditions (SPTC) index provided a slightly improved picture for July but they also confirm that the fundamental pressures on processor margins remain entrenched. The sector faces the difficult combination of elevated farm gate prices and limited ability to pass on higher costs to export or retail markets, leaving processors operating on historically thin margins.

Meat & Livestock Australia’s updated data, incorporating recently released adjustments to co-product and offal values, revised the July SPTC index to 1.0 percent, up from the initially reported 0.4 percent. The improvement stems from stronger returns in co-products, which play a critical role in offsetting primary processing costs. Since June 2025, average co-product prices have lifted by 13 percent, driven by a 28 percent increase for offal and a 10 percent gain in tallow. These gains have provided modest relief for processors, particularly those with efficient rendering and recovery systems that can maximise the value extracted from each carcase. Nonetheless, the revised figure still indicates a narrow margin environment, reflecting how dependent profitability has become on ancillary revenue streams rather than core meat sales.

The latest August SPTC index has fallen back to 0.4 percent, underscoring the fragility of the recovery and the ongoing sensitivity of processor margins to input costs. Livestock procurement costs for both mutton and lamb rose further in August, climbing by 5.5 percent and 2.6 percent respectively compared with July. These increases follow an already steep run-up earlier in the winter, when restocking demand and improved seasonal conditions tightened supply. With sheep and lamb prices rising at the saleyard, processors are paying more for every kilogram of liveweight entering their plants, yet export price growth has not kept pace. The gap between input and output values has widened once again, reversing the brief mid-year relief provided by higher co-product earnings.

Export data for August highlight how uneven international demand has become across key markets. Average export values rose slightly overall, up 0.9 percent from July, but this modest aggregate increase conceals large regional disparities. Exports to China edged up 1.7 percent to an average of A$6.02 per kg, while Malaysia and the United Arab Emirates both recorded stronger gains of 2.1 percent and 11.5 percent respectively. In contrast, the United States market weakened sharply, with average export values dropping 7 percent to A$15.00 per kg. The decline in US returns was particularly significant given the country’s importance as a high-value destination for chilled lamb. With American consumer demand subdued by economic uncertainty and high historic lamb costs, Australian exporters have been forced to accept lower prices to maintain volumes. The overall result is that export income growth remains too muted to counterbalance the escalation in livestock procurement costs.

This misalignment between costs and returns has left processors in a precarious financial position. Even with co-product revenues trending higher, the proportion of total income derived from meat sales continues to shrink relative to the overall cost base. For smaller regional processors, particularly those focused on domestic or niche export markets, this imbalance risks reducing operating viability. Many are now reviewing throughput schedules and tightening procurement strategies to manage exposure to price volatility. Larger processors with diversified export portfolios have fared somewhat better, using market flexibility to reallocate shipments toward destinations offering firmer returns, but the overall outlook remains challenging.

The broader structural picture also points to constrained recovery prospects in the near term. While global demand for sheep meat remains fundamentally strong, currency movements, freight costs, and competition from New Zealand continue to influence price outcomes. Australian processors are also managing a potential rebuild environment in which livestock supply has become more erratic. Producers, buoyed by improved rainfall prospects and rising confidence in flock rebuilding, are beginning to chase lighter lambs. For processors, this has created a scenario in which national slaughter volumes remain healthy but lamb procurement competition has remained strong, eroding per-head profitability.

Domestic market conditions offer little additional relief. Consumers, already under strain from broader cost-of-living pressures, are highly price sensitive, limiting the capacity of supermarkets and butchers to absorb further wholesale increases. As a result, processors find themselves squeezed between farmgate and retail price ceilings, with little room to protect margins without sacrificing throughput.

Despite these headwinds, some stabilising factors are emerging. The sustained improvement in co-product values provides a partial hedge against livestock cost volatility, particularly for integrated operations. Offal demand has been buoyed by strong purchasing from Southeast Asia and the MENA region, where organ meats are an important part of local diets, while tallow prices have strengthened in response to demand from renewable fuel producers. If these trends persist, they could provide a modest buffer for processors heading into the final quarter of 2025.