Collateral damage?

Market Morsel

In early February the Department of Agriculture, Fisheries, and Forestry (DAFF) issued a public statement regarding a Notice of Intention (NOI) to export around 15,000 sheep and 2,000 cattle via the MV Bahijah.

Initially, an export permit was granted to the MV Bahijah, and the livestock embarked for Israel. Due to security concerns in the Red Sea, the exporter proposed rerouting via the Cape of Good Hope, requiring new import permits and approval to load foreign fodder, which alters an animal’s health status. DAFF expressed concerns over animal welfare and the practicality of the proposed changes, leading to a decision to consider returning the livestock to Australia. Despite the exporter’s efforts to provide the required information and adapt plans, DAFF issued a direction to return the livestock to Australia due to insufficient assurances about the voyage’s safety and welfare provisions.

In-depth evaluations ensued, with the exporter submitting new plans and information, including extended long-haul management plans. However, potential legal challenges in Israel regarding import permits and the Israeli competent authority’s concerns led the delegate to doubt whether importing country requirements would be met. Despite an approved extended long-haul management plan and assurances of animal welfare, the delegate prioritised the Israeli authority’s preference for offloading and resting the livestock before re-export. The complexity of the voyage, potential injunction proceedings in Israel, and the absence of a feasible contingency plan contributed to the decision to refuse the NOI.

The decision impacted various stakeholders, including the exporter’s commercial interests and Israel’s food security. The delegate acknowledged the limited options for the exporter following a refusal, such as re-export at a later date, slaughter for the Australian food system, or euthanasia at sea. The decision was made in the context of ongoing conflict in the region and the objective of ensuring animal welfare, ultimately leading to the refusal to approve the NOI.

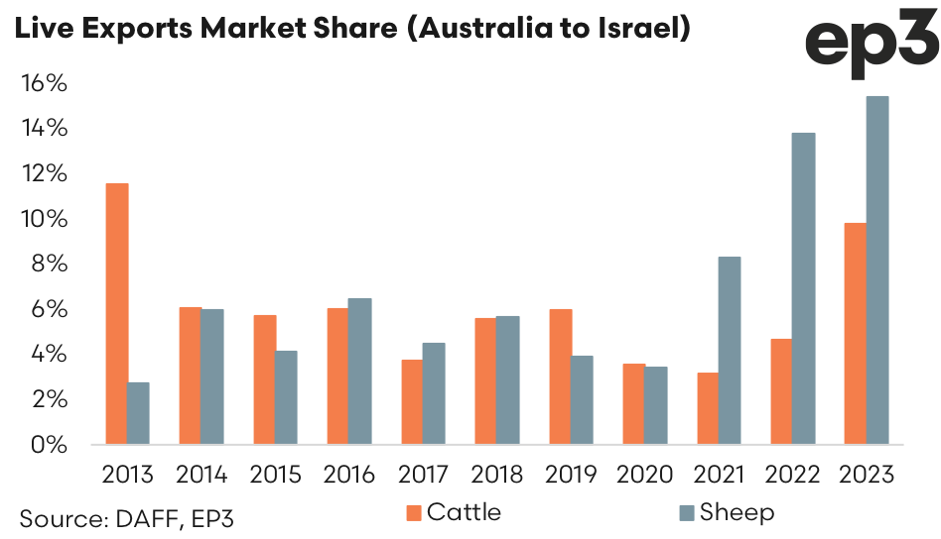

Analysis of the market share of Australian export of live cattle and sheep to Israel over the last decade highlights that in recent years the importance of Israel as a trade destination has increased, particularly for the live sheep trade which is dominated by Western Australian exports.

The market share of Israel as a trade destination for Australian live cattle has lifted from 3.2% in 2021 to 9.8% in 2023 of the total annual volumes exiting Australia. This places Israel as the fourth top trade destination for live cattle from Australia, behind China in third spot. Meanwhile, Israel’s market share of the Australian live sheep trade has increased from 3.4% in 2020 to 15.4% in 2023, which has pushed Israel to becoming the second top destination for Australian live sheep exports behind Kuwait.

The disruption of the MV Bahijah’s live export consignment to Israel presents significant implications for Australia’s reputation as a reliable trade partner in the global agricultural market. Live animal export is a sensitive issue, intertwined with ethical, environmental, and economic dimensions. The challenges faced by the MV Bahijah consignment, particularly in meeting the Export Control (Animals) Rules 2021, underscore the complexity of live animal trade and the high standards Australia is expected to maintain.

Australia is known for its stringent animal welfare standards and its commitment to meeting importing countries’ regulations. The inability to satisfy these requirements, as demonstrated by the MV Bahijah incident, raises concerns about Australia’s effectiveness in upholding these values under unforeseen circumstances, such as geopolitical tensions or logistical disruptions. When such incidents occur, they can lead to questions about the reliability and predictability of Australia as a supplier.

Furthermore, the extensive media coverage and the attention of animal welfare organisations can amplify the perceived risks of engaging in live animal trade with Australia. The potential for legal challenges, as in the case of the Israeli animal welfare groups’ involvement, adds a layer of unpredictability that trading partners may find concerning. This unpredictability can damage Australia’s reputation, making potential and existing trade partners hesitant to enter into or continue trade agreements.

Moreover, the decision-making process and the eventual refusal to approve the NOI due to animal welfare concerns, while ethically sound, can still be interpreted by international partners as a failure to fulfill trade obligations. This perception, especially if not managed carefully through diplomatic channels and transparent communication, could undermine Australia’s standing as a trade partner that can navigate complex situations while ensuring the welfare of livestock.

Trade relations thrive on consistency, predictability, and the ability to deliver on agreements, even in adverse conditions. The MV Bahijah case highlights potential vulnerabilities in Australia’s live export operations, suggesting a need for enhanced risk management strategies to uphold its trade commitments. Moving forward, Australia must demonstrate its capacity to adapt and manage challenges effectively to maintain confidence among its global trade partners.