Cracker year, for some

Market Morsel

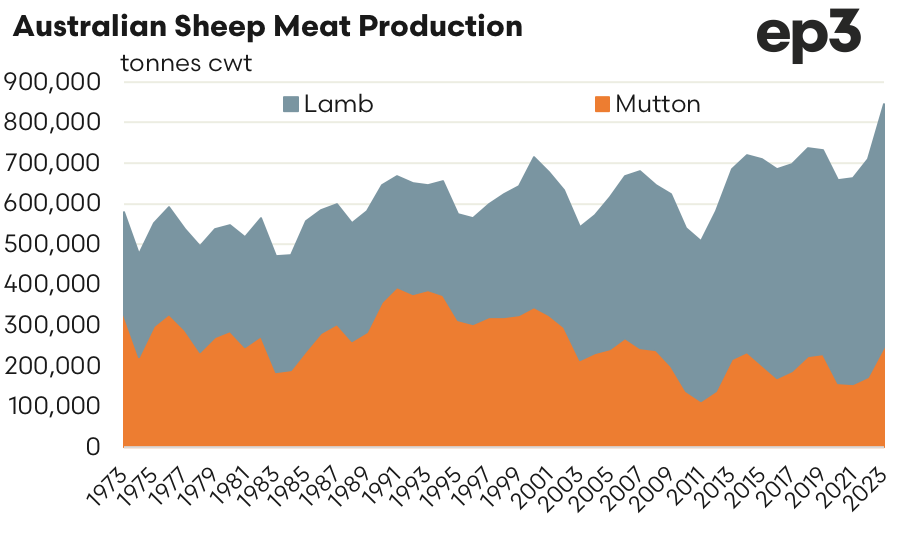

Combined lamb and mutton production for Australia reached a record 845,464 tonnes cwt in 2023, beating the previous peak of 736,558 tonnes set in 2018 by nearly 15%. A breakdown of the lamb to mutton ratio shows that there has been a noticeable shift toward more lamb production over the last three decades.

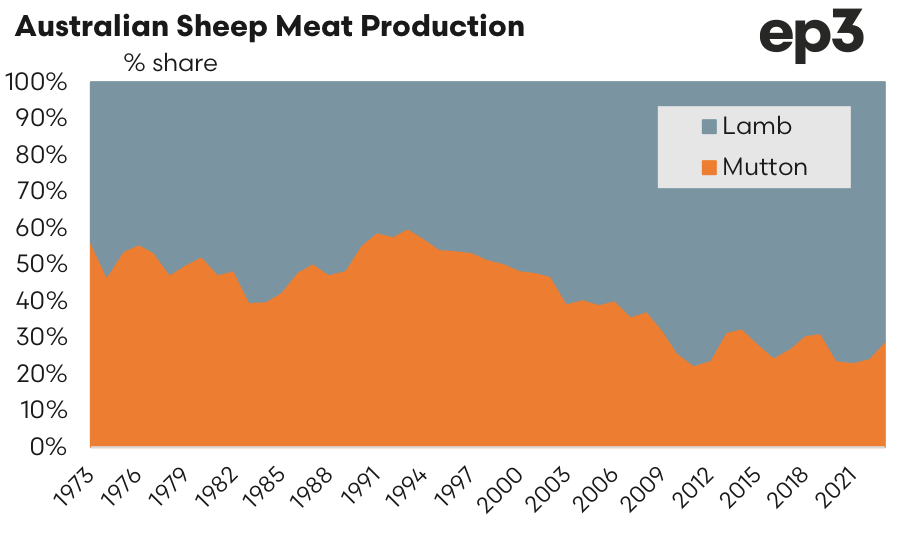

Through the 1970s the production of lamb and mutton in Australia was nearly a 50/50 split, with production volumes slightly favouring mutton most years. During the 1980s and early 1990s the share of mutton production climbed toward 60% of total sheep meat production as the Australian sheep flock increased from around 130 million head to a peak of 170 million head in 1990.

However, the collapse of the wool reserve pricing scheme in the early 1990s saw the flock dynamic begin to change and the flock numbers begin to decline. Sheep flock productivity increased into the early 2000s as the flock pivoted away from wool production toward more meat focused sheep production and export markets for lamb began to grow. By 2011 the share of Australian sheep meat production held by mutton reached a record low of just 22.5%.

Over the last decade (2013 to 2023) mutton production has averaged a 28% share of total sheep meat production in Australia versus lamb productions average share of 72%. In 2021 the share of mutton production dipped to 23.4% as a strong flock rebuild favoured the retention of breeding stock and reduced sheep turnoff. However, 2023 saw the share of mutton production increase to 29% of total sheep meat production versus lamb production share of 71%.

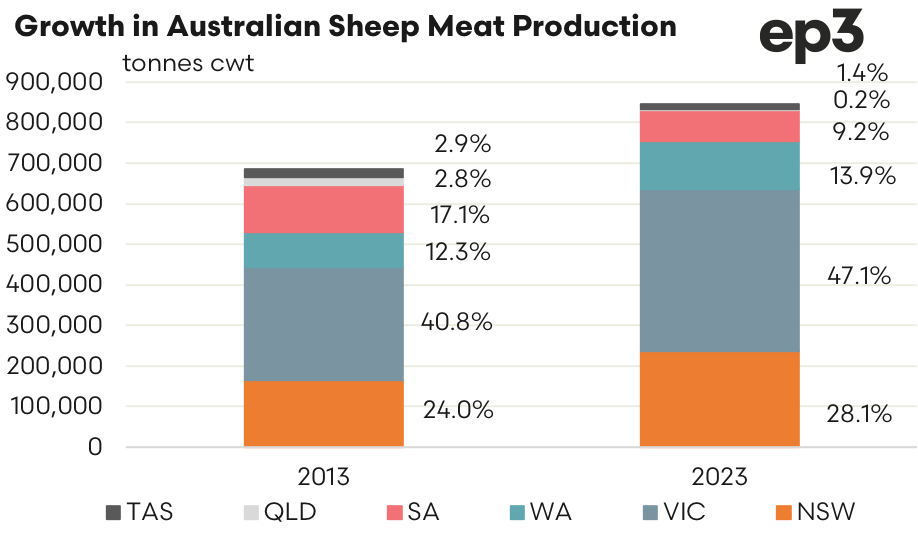

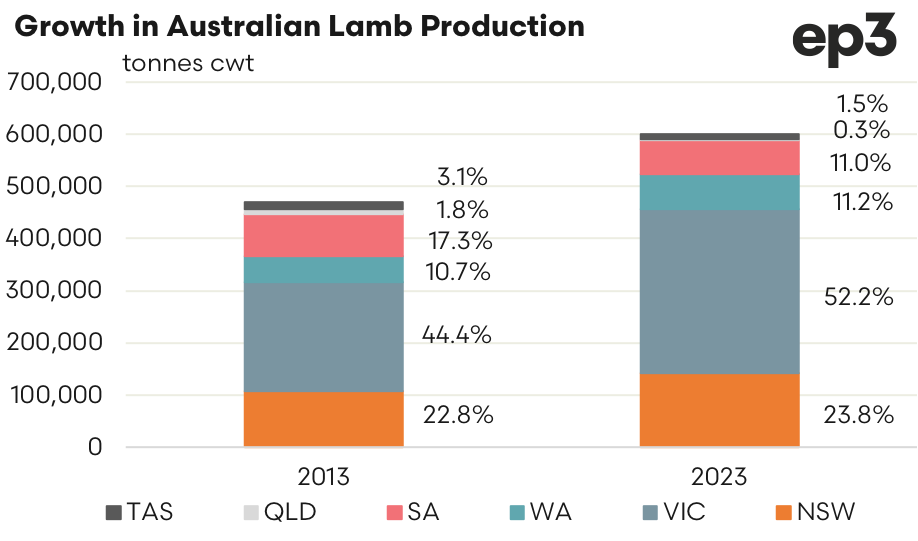

The distribution of lamb and mutton production has seen significant shift in the last decade. In terms of combined sheep meat production volumes Victoria has dominated production levels with the share of production of lamb & mutton in Victoria lifting from 40.8% in 2013 to 47.1% in 2023. New South Wales holds the second place for Australian sheep meat production with its share of combined production lifting from 24.0% in 2013 to 28.1% in 2023. Western Australia has also seen sheep meat production grow over the last decade with a lift from 12.3% to 13.9%.

The increased share of production in Victoria, NSW and WA have come at the expense of South Australia, Queensland and Tasmania. SA has seen their share of lamb & mutton production drop from 17.1% in 2013 to 9.2% in 2023, although the re-opening of the Thomas Foods plant in SA may see their share begin to climb again in future years. Tasmanian share of total sheep meat production has dropped from 2.9% to 1.4% over the decade. Meanwhile production levels in Queensland are almost non-existent at just 0.2% in 2023 versus 2.8% a decade ago.

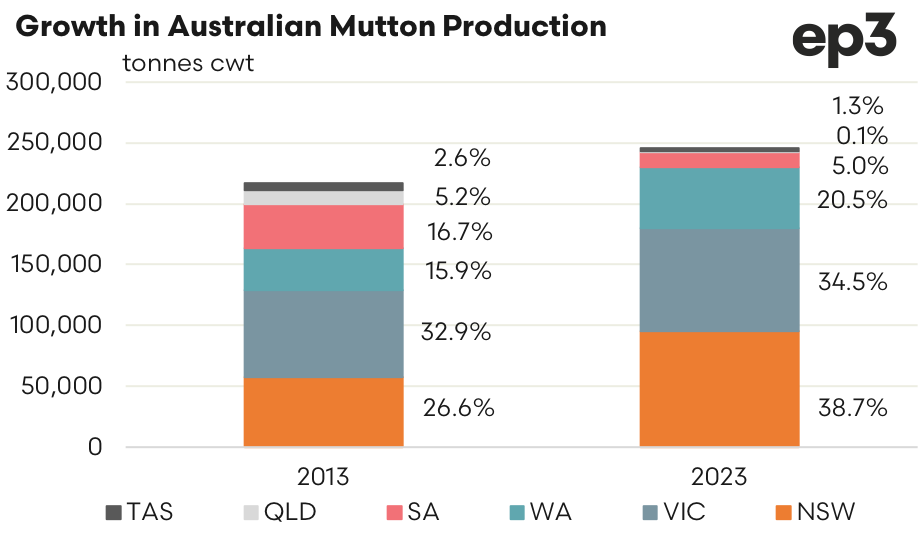

A breakdown of production across Australian states for the last decade, separating mutton and lamb as individual product lines, shows a slightly different picture than the combined production volumes. NSW has wrestled the number one position away from Victoria as top mutton producing state with their share of mutton production lifting from 26.6% in 2013 to 38.7% in 2023. While Victoria also saw their share of mutton production grow from 32.9% to 34.5% over the last decade it wasn’t enough to out compete the increase in share seen in NSW.

However, it wasn’t all bad news for Victorian meat works as their share of lamb production gained significantly over the last decade from 44.4% in 2013 to 52.2% in 2023, to dominate the domestic lamb production volumes. NSW retains the second top producer status for lamb production with the share lifting marginally from 22.8% to 23.8% over the last decade.