Different strokes

Market Morsel

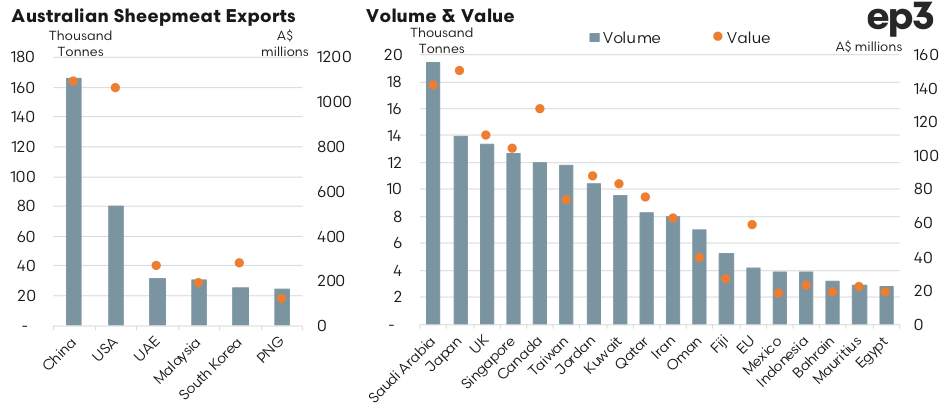

Australian Department of Agriculture, Fisheries and Forestry (DAFF) trade data on export volumes and value for sheep meat (mutton& lamb exports combined) filtered by top trade destinations during 2023 allows a visual comparison of high volumes versus high value sheep meat market destinations.

China and the USA are the top two destinations for Australian sheep meat exports, but a comparison of value versus volume highlights that the USA are a higher value market with annual trade volumes sitting at 52% below Chinese flows during 2023 while the trade value sits just 3% under the value of sheep meat shipments to China.

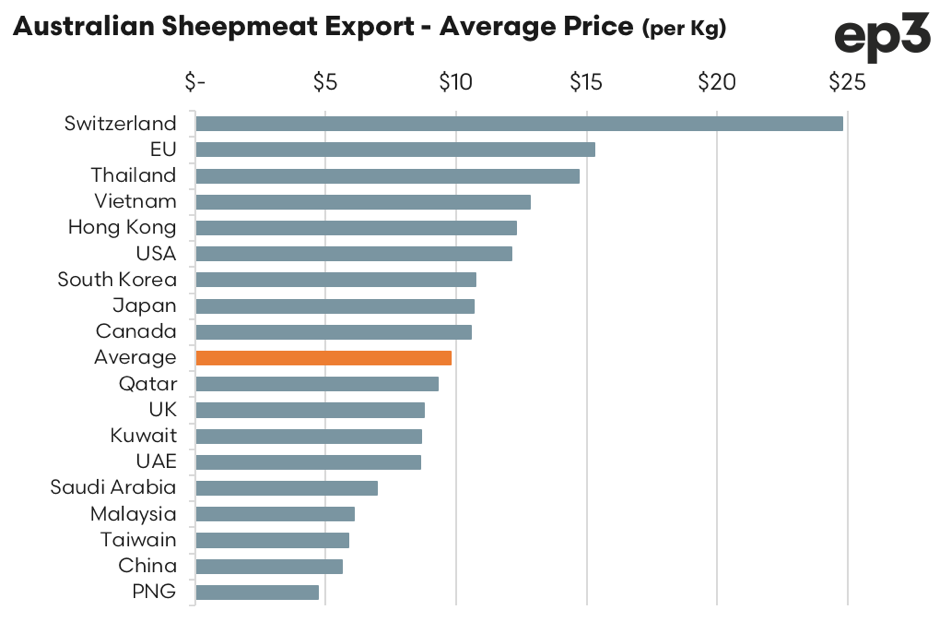

Analysis of the trade value versus volume for selected trade destinations allows us to calculate the average annual price per kilogram of sheep meat exported during the 2023 season. The USA, as one of the higher value markets, saw average per unit price of Australian sheep meat exports sit at A$12.13 per kilogram in 2023, versus the Chinese average per unit price of A$5.61.

European countries, particularly Switzerland, stand out as high value markets for Australian sheep meat. However, ongoing free trade agreement negotiations are limiting the volumes being sent to the European region and Australian sheep meat is subject to quota restrictions. Australia has a specific import quota for sheep/goat meat combined into the EU, totalling 5,851 tonnes cwt. Imports exceeding this quota face steep tariffs of 12.8%, with an additional charge levied of up to EU3.10/kg.

In comparison, New Zealand benefits from a significantly larger tariff-free quota of 125,769 tonnes cwt for sheep meat and goat meat, effective from July 1, 2023. Despite not fully utilising this quota in recent year (only 47% of the quota was used in 2022) New Zealand’s sheep meat exports to the EU were twelve times that of Australia’s for the same period.

Furthermore, the recent New Zealand-European Union Free Trade Agreement, signed on July 1, 2022, is set to increase New Zealand’s quota to 163,769 tonnes seven years post-enforcement, though the agreement awaits ratification and is expected to be put into force during 2024.

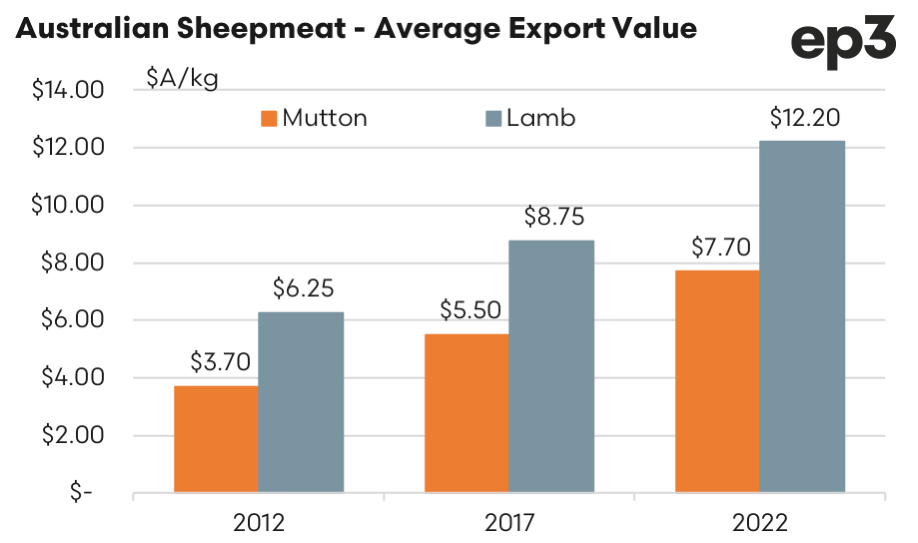

Despite some competitive trade barriers faced by Australia in markets like the EU, the growth in sheep meat exports over the last decade has allowed annual average per unit export values for Australian lamb and mutton to increase significantly. Over the decade to 2022 the average per unit value of lamb exports has increased by 95% and average per unit mutton export value has risen by 108%.

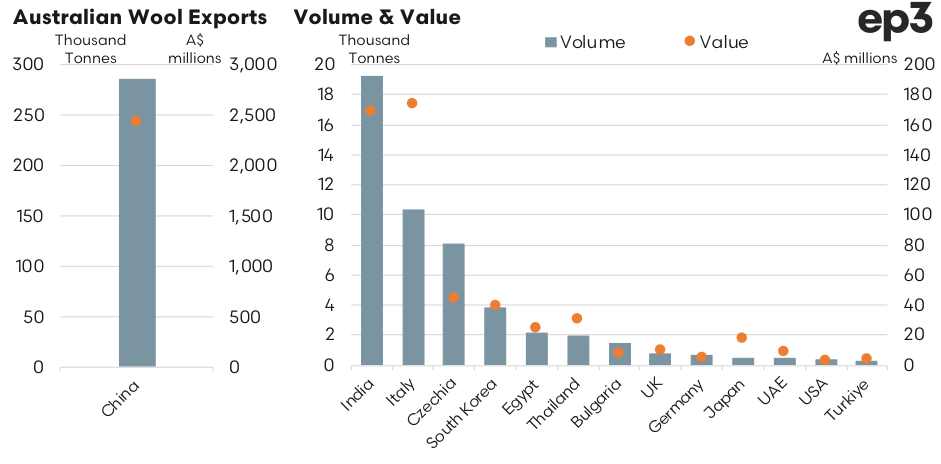

However, the export picture for Australian wool exports is a little different. DAFF trade data on export volumes and value for raw wool filtered by top trade destinations during 2023 allows a visual comparison of high volumes versus high value wool market destinations and highlights the dominance of China.

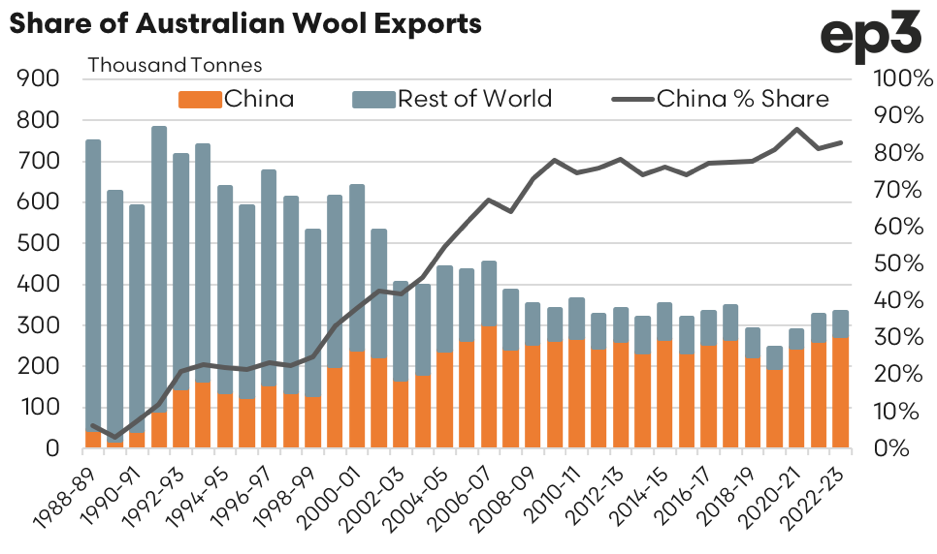

The chart below shows the evolution of Australian wool exports from 1988 to 2023 and outlines the volumes exported to China compared to the rest of the world, along with China’s percentage share of these exports. Over the decades, there is a marked increase in the volume of wool exports from Australia to China, which is mirrored by a significant rise in China’s share of these exports. Starting in the late 1980s and early 1990s, China’s share was relatively modest but began to grow steadily from the mid-1990s onwards. By the early 2000s, China emerged as a dominant player, reflecting its expanding textile industry and increasing demand for raw materials like wool for manufacturing.

In recent years, particularly from around 2010, China’s share has consistently been above 80%, peaking close to 90% in some years, indicating an increasing reliance of the Australian wool industry on the Chinese market. This trend underscores China’s critical role in the global textile supply chain, particularly in processing raw wool into finished products.

In contrast, the volume of Australian wool exports to the rest of the world has declined both in absolute volumes and on a proportional basis, indicating that other markets have not grown at the same pace as China or that China’s demand has effectively outpaced other regions.

This data highlights the significant impact of China’s economic policies and market demands on Australian wool exports and illustrates the interconnected nature of global trade where shifts in one country’s industrial strategy can have profound effects on another country’s export dynamics.

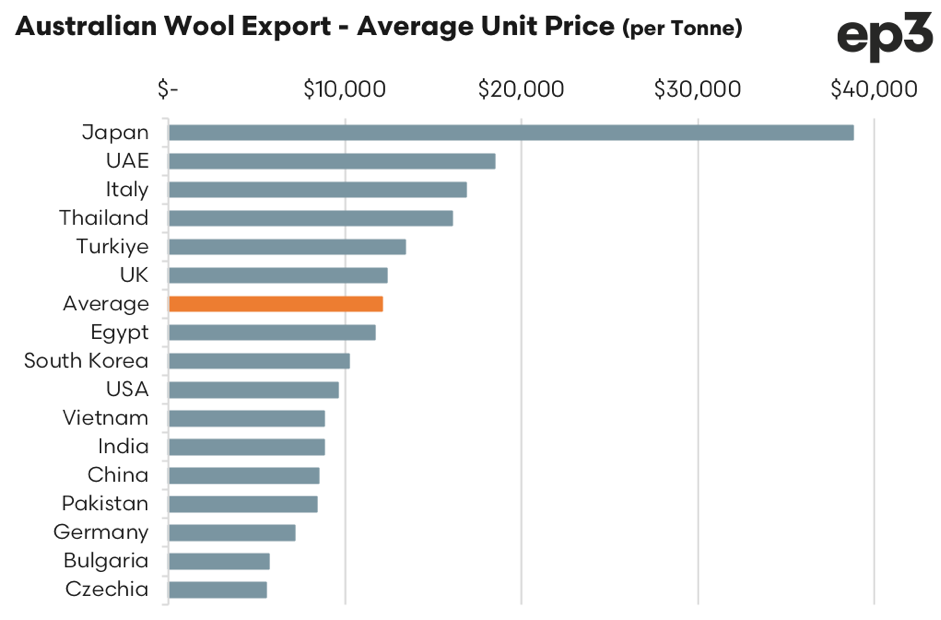

Analysis of the trade value versus volume for selected trade destinations allows us to calculate the average annual price per tonne of greasy wool exported during the 2023 season. The average unit prices per tonne for Australian wool exports to various countries, highlighting significant differences in pricing across these markets.

Japan commands the highest average unit price, nearing $40,000 per tonne, indicating a preference for high-quality or specialty wools which are likely used in premium textile products. UAE and Italy also exhibit high prices, each around the $30,000 mark, suggesting these countries import finer grades of wool for luxury and high-end fashion industries.

Thailand, Türkiye, and the UK show moderately high prices, ranging from $20,000 to $25,000 per tonne, which might reflect a blend of medium to high-quality wool used for diverse textile applications. South Korea, USA, and Vietnam feature around the middle of the price range, between $10,000 and $20,000 per tonne, possibly indicating a more mixed import of wool qualities for varied uses. At the lower end of the spectrum, countries like India, China, and Pakistan show relatively lower average prices, under $10,000 per tonne, suggesting these markets predominantly import lower-grade wool possibly for bulk or commodity textile production.

This analysis underscores the varied global demand for Australian wool, with different markets prioritising different grades and qualities of wool based on their specific industrial and consumer needs. Such data is crucial for understanding market positioning and the strategic pricing of Australian wool exports worldwide.