Don’t stop, it hurts.

The Snapshot

- Saudi Arabia is a significant importer of boxed sheep meat from Australia, sitting in 9th place as one of the top ten destinations for Australian sheep meat exports in 2022 on 11,334 tonnes swt.

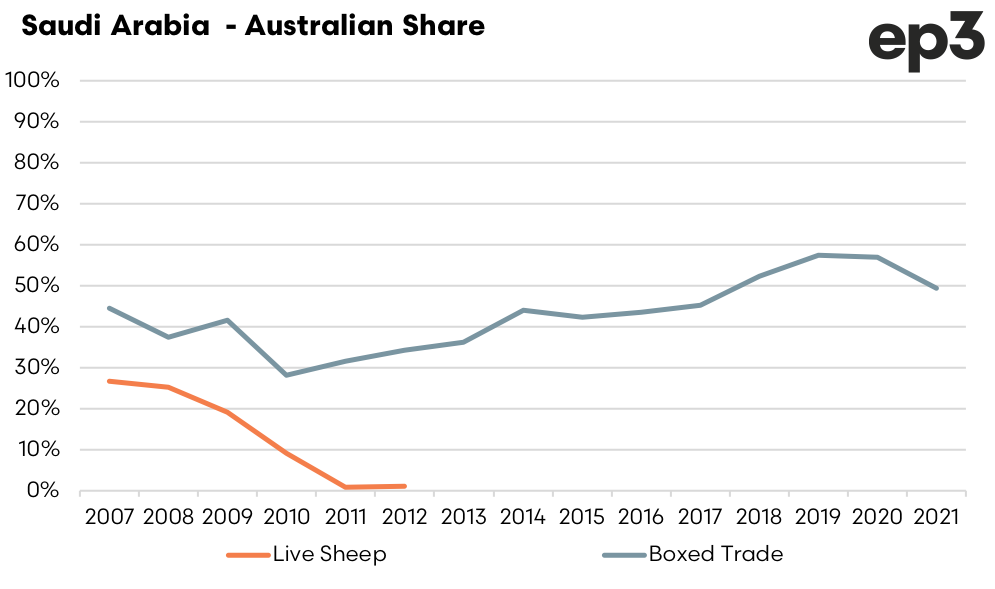

- The ceasing of the Australian live sheep trade in 2012 appears to have done little to impact the growth in market share for Australian boxed sheep meat export to Saudi Arabia.

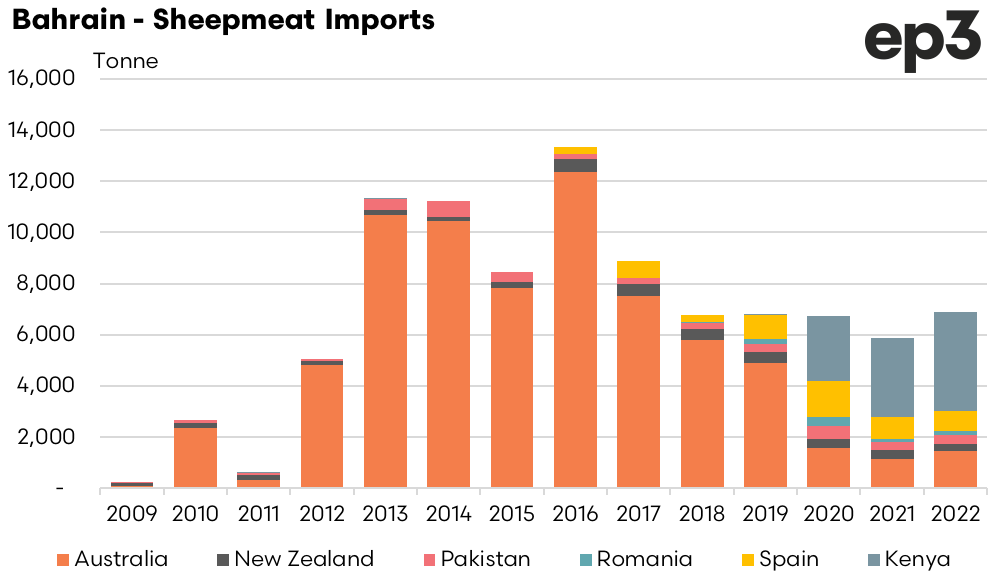

- In terms of Australian boxed sheep meat market share, Bahrain was placed 27th in 2022 with around 1,400 tonnes swt consigned.

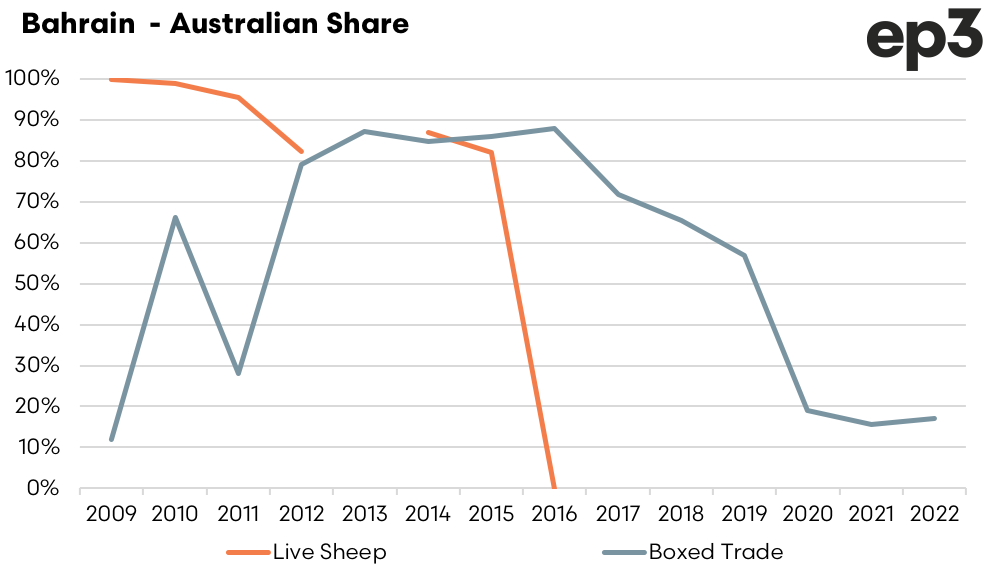

- Since 2020 Kenya and Spain have started to compete aggressively for market share resulting in the Australian proportion of the boxed sheep meat trade into Bahrain dropping from nearly 60% in 2019 to around 15%-20% in recent years.

- Meanwhile, Bahrain hasn’t imported any live sheep from Australia since 2016 and the sharp decline in Australian market share of the live trade into Bahrain was a precursor to the steep drop in the boxed trade from 2016 to 2020.

- This suggests that the cessation of live sheep exports from Australia may have implications for the boxed meat trade in some destinations, while others may demonstrate resilience. Overall, targeted business development and relationship building efforts are needed to address challenges and opportunities in each market effectively.

The Detail

It has been suggested that the proposed closure of the live sheep trade from Australia will negatively impact upon our access for boxed sheep meat exports into key Middle Eastern markets. Certainly for several destinations, such as Kuwait, Qatar and Oman, there has been a mutual decline in Australia’s market share of live sheep exports and boxed sheep meat exports since the northern hemisphere summer prohibition came into effect.

However, the last few years have also seen a period of high Australian sheep prices, low supply and flock rebuild that could have contributed to loss of market share for both live and boxed trade avenues due to reduced competitiveness. Additionally, changes to Qatari trade policy regarding the end of import subsidies favouring Australian sheep meat imports and disruptions to airfreight capacity to the Middle East during the Covid pandemic may have also “muddied the waters” somewhat. So, when assessing trade flows more recently it is hard to unpick what the real cause could be of declining Aussie market share to some of these destinations in recent years.

Certainly, Kuwaiti representatives have expressed the view that Australia’s decision to cease live sheep exports could damage trade relationships into the Middle East. During the midst of the Covid epidemic in 2020 the Kuwaiti trade and industry minister, Khalid Nassir Alrowdan, and the CEO of Kuwait Livestock Transport and Trading (KLTT), Osama Boodai, both penned individual letters to the Australian government pleading for reconsideration of the three month northern hemisphere summer moratorium.

Mr Boodai was noted asking the Australian government to “to consider the gravity of this decision making by your animal exports regulator and put into perspective what this means for bilateral relations, trade and social and economic well being of all countries impacted here, including your own.” Minister Alrowdan followed up by stating that “Kuwait considers Australia its strategic partner in securing its livestock needs” and requested that the Australian agriculture minister (at the time this was David Littleproud), “reconsider the Australian livestock export ban during the hemisphere summer to our region assuring that we will take all the necessary precautionary measures for animal welfare, to enhance our national food security and the Australian national economy”.

However, there are two Middle Eastern destinations that ceased taking Australian live sheep exports before the prohibition came into effect, before the Covid disruption to airfreight capacity and before Australian sheep/lamb prices became somewhat uncompetitive globally. These two countries are Saudi Arabia and Bahrain. Analysis of the trend in market share for live sheep export and boxed sheep meat could provide a clue as to the veracity of the claim that the loss of the live sheep market will also result in the loss of the boxed sheep meat market share for Australia.

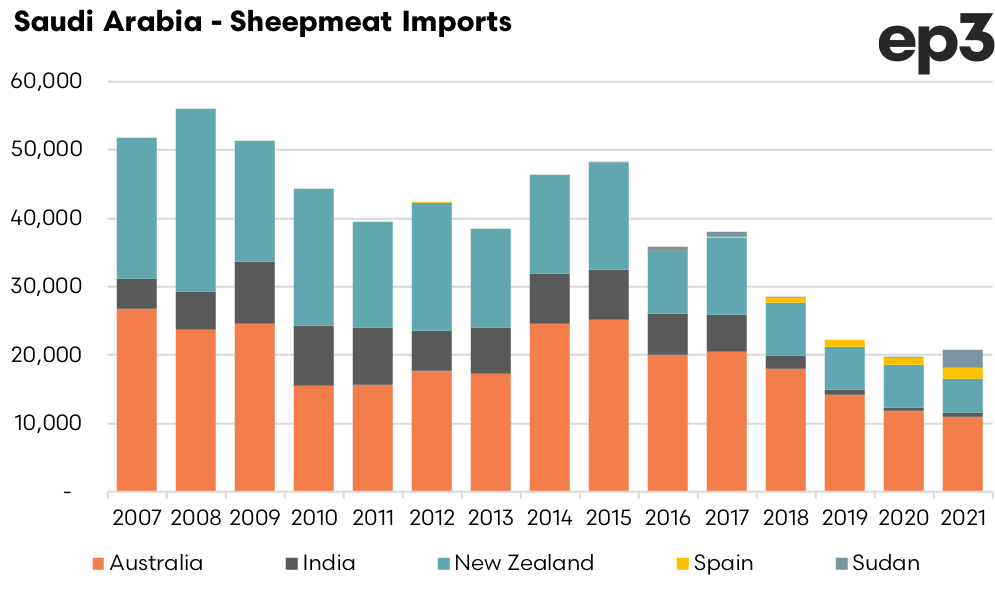

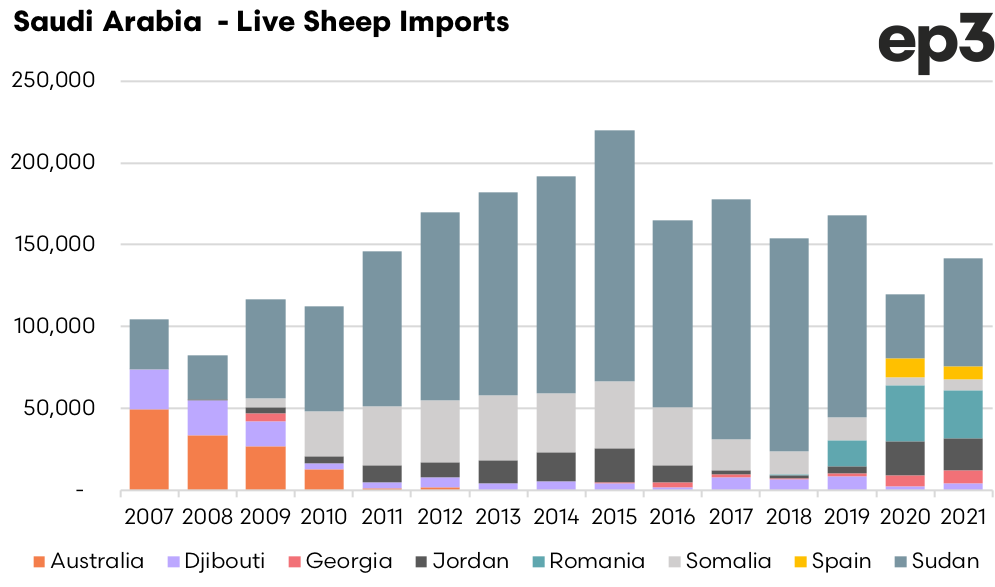

Saudi Arabia is a significant importer of boxed sheep meat from Australia, sitting in 9th place as one of the top ten destinations for Australian sheep meat exports in 2022 on 11,334 tonnes swt. Saudi Arabia is the second highest destination for Australian sheep meat in the MENA region, behind the UAE. Historically, Australian boxed sheep meat imports into Saudi Arabia have featured prominently alongside flows from New Zealand and, to a lesser degree, India. However, in terms of live sheep imports from Australia the Saudi Arabian trade declined significantly from 2007 to 2010 and effectively ceased over 2011/2012 as the introduction of the Australian Export Supply Chain Assurance Scheme (ESCAS) saw Saudi Arabia source their live sheep from alternative destinations.

Saudi Arabia are the largest importers of live sheep globally taking significant volumes from Sudan and Somalia each year. In recent years Jordan, Georgia and Spain have also been suppliers to Saudi Arabia. In terms of the live sheep export demise having little impact on the boxed trade, the Saudi Arabian experience appears to be a standout example that the closure of the live trade doesn’t have to result in a negative trade outcome for the boxed trade. As the chart of market share below highlights, the closure of the Australian live sheep trade over 2011/12 did little to impact the growth in market share for Australian boxed sheep meat export to Saudi Arabia in subsequent years with the percentage share growing from around 30% toward 50%-60% of the trade in recent years.

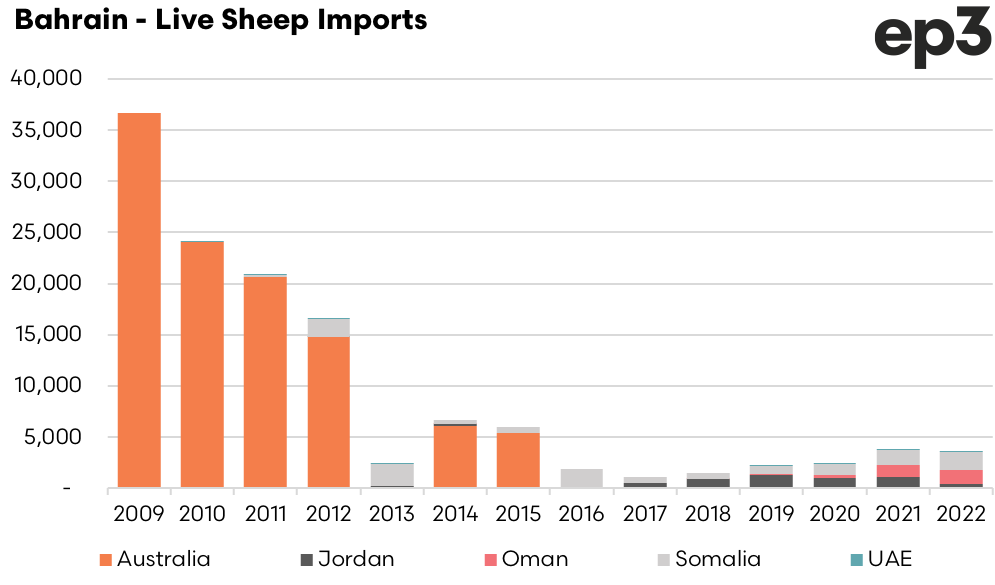

However, let us take a look at Bahrain and see if this trend has been replicated. In terms of Australian boxed sheep meat market share, Bahrain was placed 27th in 2022 with around 1,400 tonnes swt consigned. Meanwhile, Bahrain hasn’t imported any live sheep from Australia since 2016. From 2009 to 2016 there was strong growth in boxed sheep meat imports into Bahrain, with Australia taking a large share of this trade and averaging 71% of the export flows from 2010 to 2019. However, since 2020 Kenya and Spain have started to compete aggressively for market share resulting in the Australian proportion of the boxed trade dropping from near 60% in 2019 to around 15%-20% in recent years.

Just as the Saudi Arabian experience was a promising tale of the demise of the live sheep trade not impacting boxed export volumes from Australia the Bahraini experience could serve as a somewhat cautionary example that there could still be some correlation between live sheep export access promoting boxed access. As the market share chart below demonstrates, the sharp decline in Australian market share of the live trade into Bahrain was a precursor to the steep drop in the boxed trade from 2016 to 2020.

Just as a final complication to the picture, a comparison of the Saudi Arabian boxed versus live trade shows that Sudan and Spain have enjoyed increased boxed access along with a developing presence in the live trade, which lends weight to the argument that live sheep access is a leverage for the boxed trade. However, the Bahraini experience shows that their primary live sheep source nations of Jordan, Oman and Somalia don’t provide any boxed sheep meat imports.

Overall, this sheep meat and live sheep trade analysis of Saudi Arabia and Bahrain highlights the importance of understanding the differing market dynamics, pricing, competition, and policy changes within the region to maintain and strengthen Australia’s market penetration for both boxed sheep meat and live sheep exports.

It also suggests that the cessation of live sheep exports from Australia may have implications for the boxed meat trade in some destinations, while others may demonstrate resilience. Overall, targeted business development and relationship building efforts are needed to address challenges and opportunities in each market effectively.

The Meat & Livestock Australia Middle East & North Africa (MENA) in market team currently have a dedicated business development team member actively building relationships and promoting Australian sheep meat exports into the region. However, a little bird told me that the funding for this crucial role is due to expire at the end of 2023. Surely, given the importance of the role, and the MENA region, to our sheep meat export sector, irrespective of it being boxed or live, a long term funding strategy could be put in place to secure our market share in the region and demonstrate Australia’s commitment in being a reliable supplier of sheep meat protein to one of our most important trade destinations.