Down on the upside

Mutton Export Summary July 2023

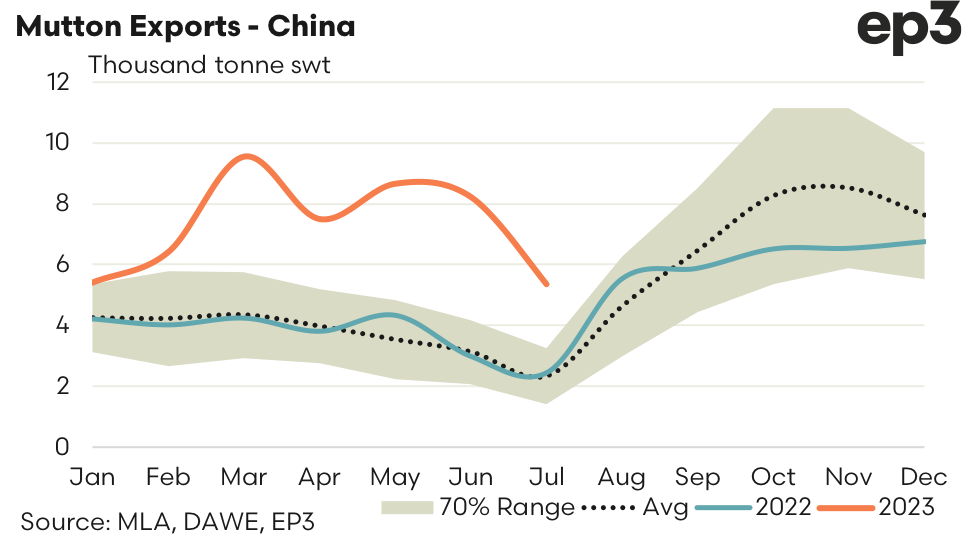

There had been several anecdotal reports over July that Chinese demand for Australian mutton had eased. Monthly trade data from the Department of Agriculture, Fisheries and Forestry shows this was the case, with a 35% drop in mutton export levels seen from June to July. There was 5,360 tonnes swt of Aussie mutton reported exported over July 2023, which still represents levels that are 118% above the July 2022 volumes and 129% higher than the five-year average for July.

So while mutton exports to China are down, it is also still ridding pretty high for this time in the season. Additionally, the July 2023 trade volumes are the strongest July mutton export figures from Australia to China on record. Interestingly, the stronger part of the season, in terms of Chinese mutton demand, usually occurs toward the final quarter in the year and if that normal trend plays out we may be in for some huge trading months from October to December – time will tell.

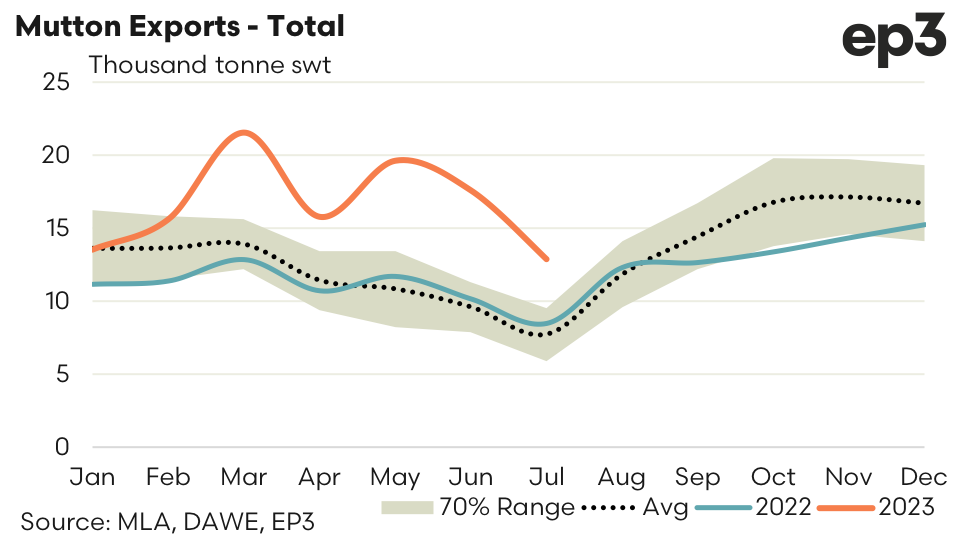

China take the bulk of Australian mutton exports, so it is no surprise that the seasonal trend displayed for exports to China mirrors the trend in total Aussie mutton exports. Total exports declined by 27% over July to see 12,883 tonnes swt consigned, which represents levels that are 67% above the five-year average for July and is also the strongest July volumes on record.

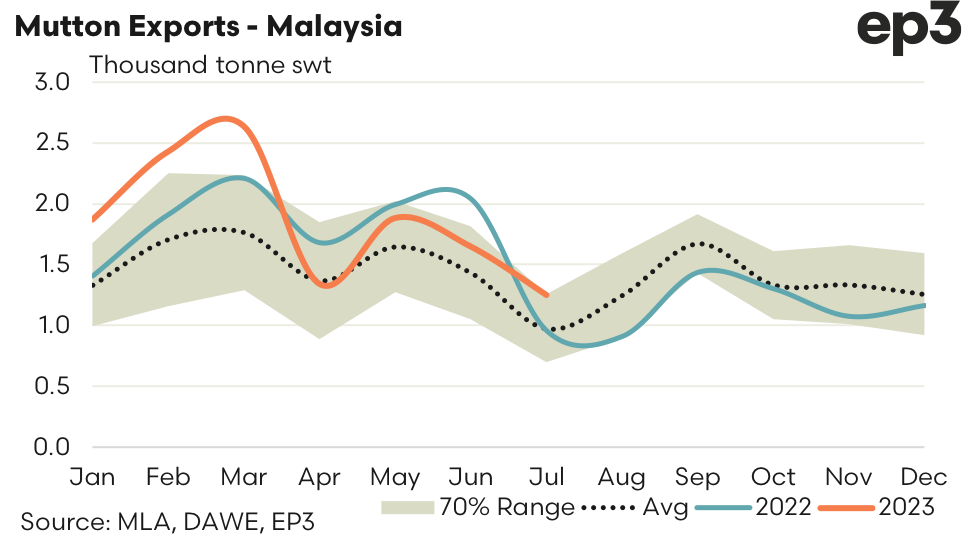

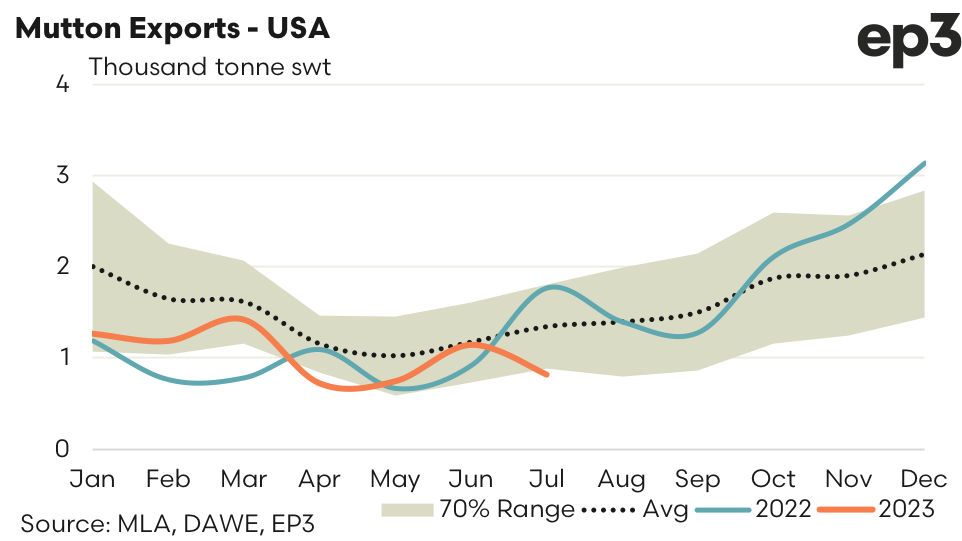

Malaysia has been the second top destination for Australian mutton exports in 2023 and while they too saw a drop in demand over July of 24%, to 1,249 tonnes swt, this still represents levels that are 28% higher than the five-year average for July. The USA now sits in third top place, in terms of market share of total Aussie mutton exports, pushed a peg lower by Malaysia during this year. July 2023 saw mutton exports to the USA decline by nearly 29% to record just 815 tonnes exported. Compared to the five-year average volumes for July this is 39% under the normal seasonal trend.