Ewe beauty

Market Morsel

Scanned-in-lamb (SIL) ewes understandably achieve price premiums over regular ewes, but how much does this premium spread vary across different phases of flock rebuild or liquidation and across different sheep types?

This analysis compares the historic price and spread behaviour for Merino ewes, 1st Cross ewes and shedding ewe types, comparing quarterly average prices from AuctionsPlus for SIL ewes of each sheep type versus the MLA saleyard equivalent ewe price since 2016.

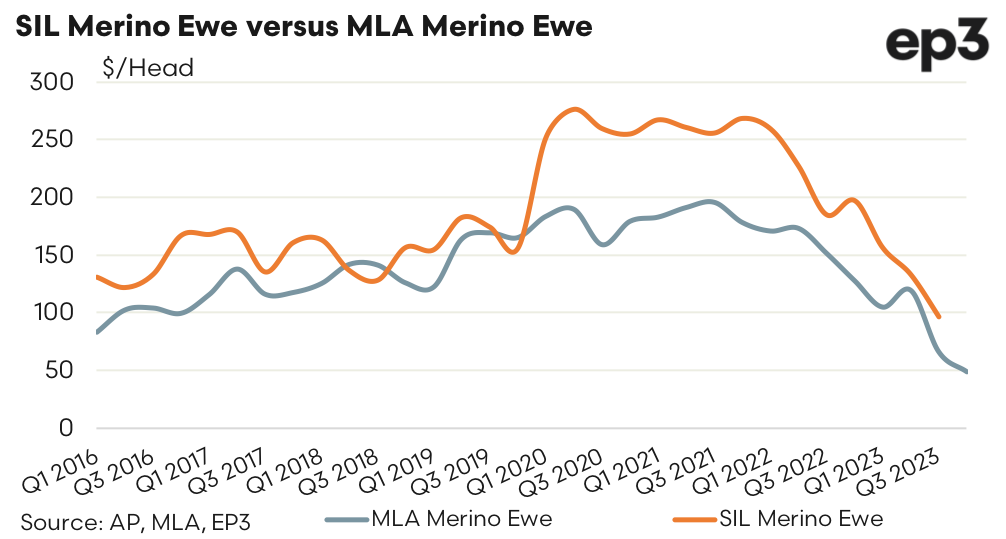

The flock rebuild during 2017 saw SIL Merino ewes average prices of $160 per head over the year compared to the MLA ewe annual average of $122. However flock declines from 2018 to 2020 saw SIL Merino ewes lose their appeal somewhat dipping to a discount to the MLA ewe briefly during 2018 and 2019.

The return of a strong flock rebuild sentiment in 2021 and 2022, with the flock increasing by 10.8% and 7.2% respectively during each year, saw strong premium pricing return to SIL Merino ewes. During 2020/21 the SIL Merino ewe average pricing of $240 per head versus the MLA Merino ewe average price of $172.

During the second half of 2023, falling producer confidence and the prospect of a El Nino into 2024 saw prices for both SIL Merino ewes and MLA Merino ewes ease sharply and SIL premiums narrow significantly.

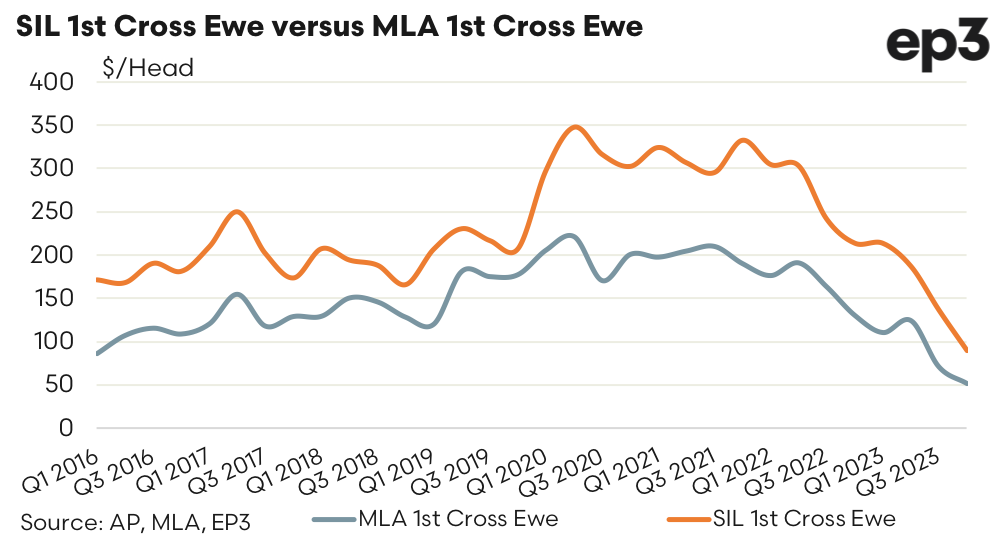

SIL 1st Cross ewes on the AuctionsPlus platform and MLA 1st Cross ewes at the saleyard demonstrate a broadly similar trend to the Merino types with the price differential between SIL and MLA types narrowing during the 2018/19 seasons and expanding during 2021/2022. However, unlike the Merino types the SIL 1st Cross ewes remained at a premium to the MLA 1st Cross throughout the entire 2016 to 2023 period.

Average prices for SIL 1st Cross ewes during 2018 and 2019 sat at around $200 per head versus $150 per head for the MLA 1st Cross ewe. During 2021 and 2022 the SIL 1st Cross ewe averaged pricing levels of $290 per head versus the MLA 1st Cross average price of $183 per head.

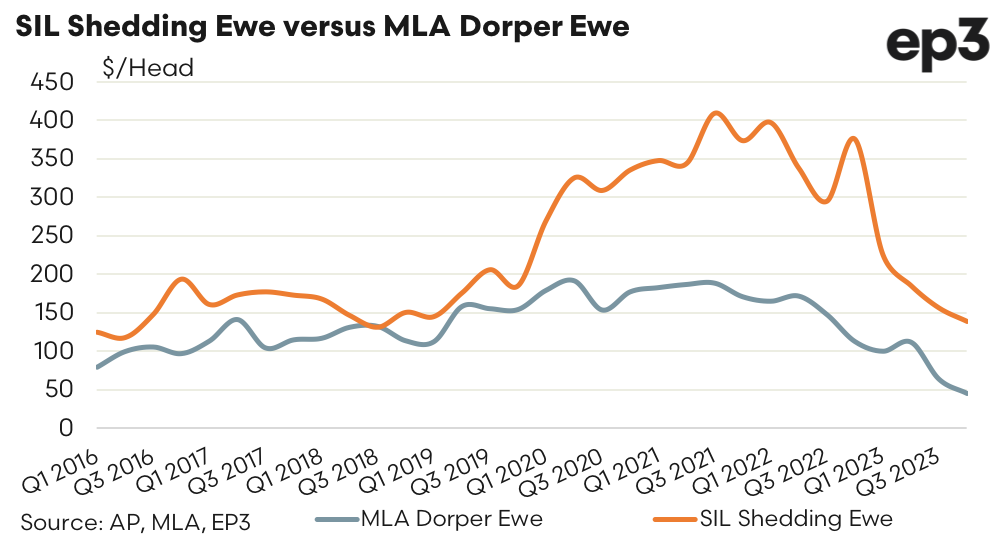

Price trends for shedding ewe varieties compares the SIL shedding ewe types available on AuctionsPlus to the MLA saleyard Dorper. Apart from Q3 2018 when prices were on par at $132 per head every other quarter from 2016 to 2023 saw SIL shedding ewes hold a premium to MLA Dorper ewes.

During 2016 to 2019, the SIL shedding ewe on AuctionsPlus averaged per head pricing of $160 versus MLA Dorper average pricing of $120 per head. However, during 2020 to 2022 the SIL shedding ewe achieved average prices of nearly $345 per head versus MLA Dorper average prices of around $170 per head.

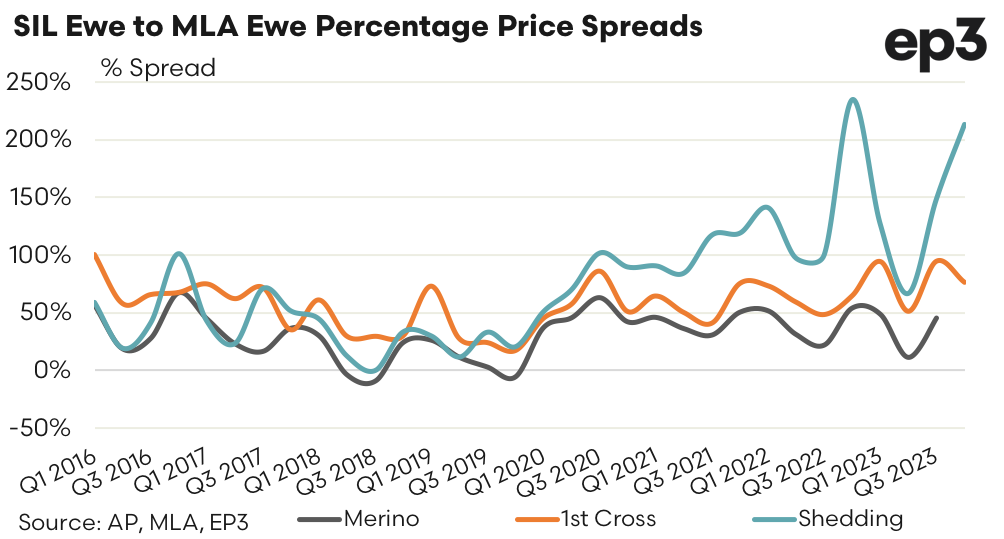

Analysis of the price spreads for each type of sheep assessed paints an interesting picture, particularly for the shedding ewe varieties. Percentage price spreads for SIL Merino ewes to MLA Merino ewe types from 2016 to 2023 shows premium spread peaks at around 60%, usually during times of strong flock rebuild and much narrower premiums to occasional price discounts of around 10% during times when the flock is in a liquidation phase.

The price spread behaviour for 1st Cross varieties shows that SIL ewes generally achieve higher premiums than their Merino counterparts, but still demonstrate the same directional trend of widening premiums during flock rebuild phases and narrowing premiums during flock liquidation. Across the 2016 to 2023 period 1st cross price premiums have ranged from peaks of 100% to troughs of around a 25% premium spread.

During 2016 to 2019, price premiums for SIL shedding types mostly mirrored the trend set by the Merino ewes and occasionally widened slightly to sit more in line with the 1st Cross premiums. However, since 2020 there has been a significant shift in SIL shedding premiums opening a progressively wider and wider premium spread during 2021 and 2022 culminating in a peak in Q4 2022 of 234%.

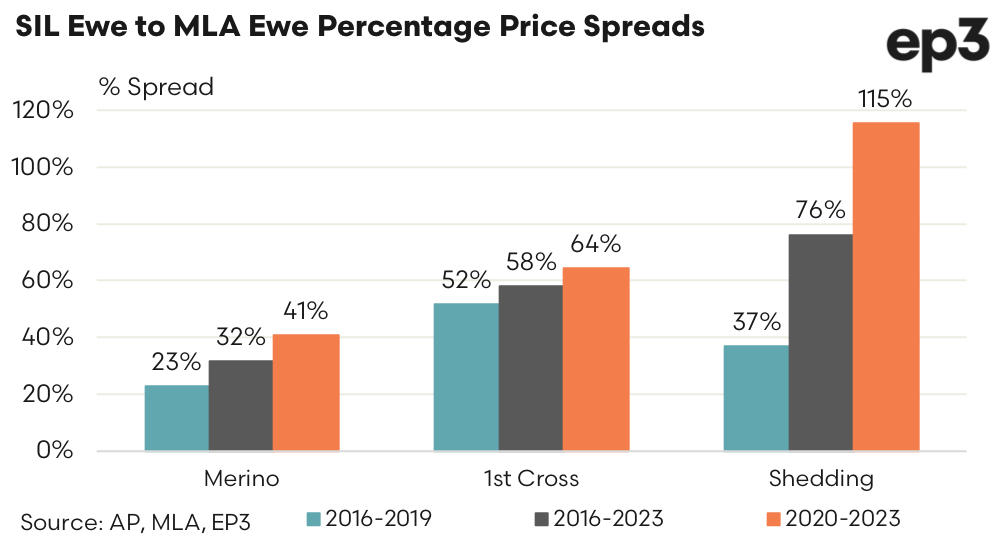

The difference in price premium behaviour for SIL shedding ewes versus their Merino and 1st Cross ewe counterparts can be seen in the analysis of average percentage price spreads from 2016 to 2019, 2020 to 2023 and the 2016 to 2023 period as outlined in the diagram below.

Average price spread premiums achieved for each SIL ewe type during 2016 to 2019 sit at a 23% premium for Merino ewes, a 52% premium for 1st Cross ewes and a 37% for shedding ewes. In contrast the average premium spreads for the 2020 to 2023 period are 41% for Merino ewes, 64% for 1st Cross ewes and 115% for shedding ewes.

The premium difference between the 2016-2019 values and the 2020-2023 values for SIL shedding ewes is interesting and probably warrants further investigation or ongoing analysis as we progress through more flock rebuild and liquidation phases.

It begs the question, “Does this data show that SIL shedding ewes have greater price spread volatility across different phases of the flock cycle or has there been an underlying shift in the popularity of shedding sheep types in the last three years that is underpinning producer behaviour to pay more of a premium for SIL shedding ewes?”