Exports are in sheep shape

Sheep Meat Export Summary July 2024

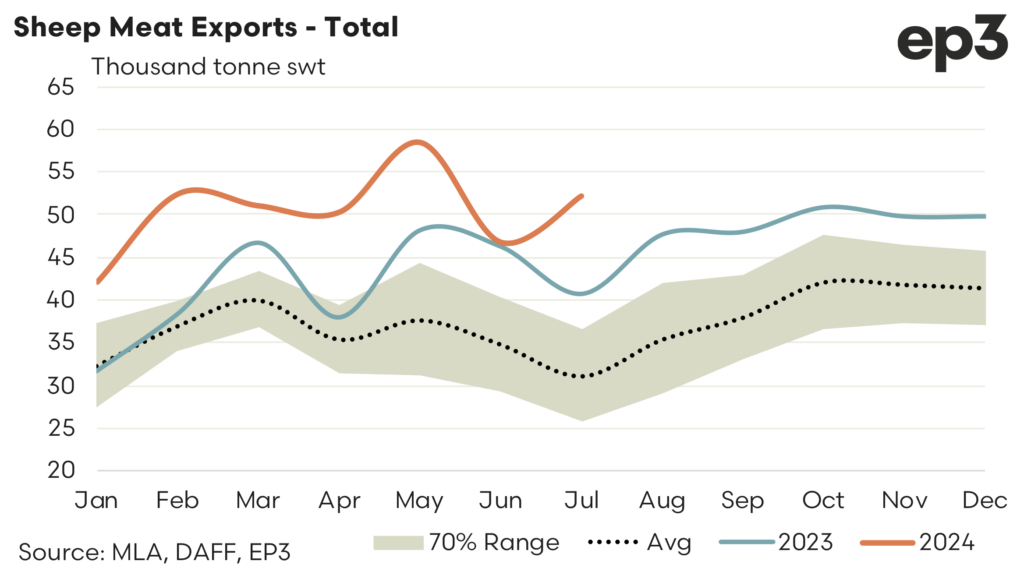

Total sheep meat exports from Australia saw an uncharacteristic lift in volumes from June to July 2024 with trade flows increasing by nearly 12% over the month. Usually in mid-winter the sheep export flows reach a seasonal lull but strong offshore demand from several centres has seen 52,109 tonnes swt shipped over July.

A comparison to July 2023 shows current export volumes are running 28% stronger and compared to the five-year average flows for July the current season is experiencing export demand that is 67% above the average levels.

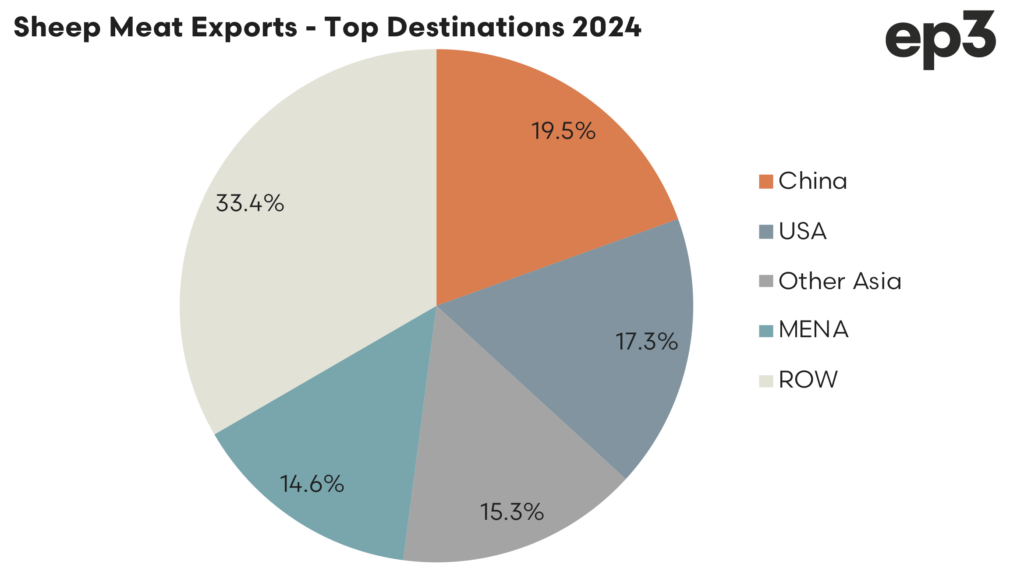

Key export destinations are relatively evenly distributed in terms of market share of sheep meat export volumes. China holds the top trade spot at 19.5% of total sheep meat export flows for 2024. The USA sits in second place on 17.3% of the trade and “other Asian” destinations is battling the Middle East & North African region (MENA) for third spot on 15.3% and 14.6%, respectively.

A summary of the trade flows to the top sheep meat destinations is as follows.

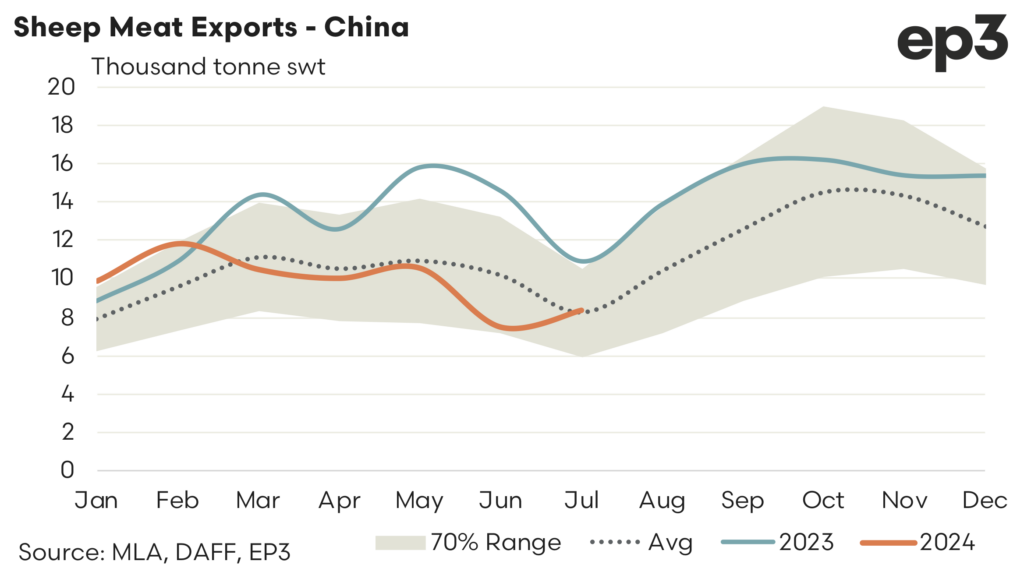

China – Aussie sheep meat flows to China lifted by nearly 12% during July 2024 to see 8,391 tonnes traded. This is 23% below the volumes exported in July 2023 but it it the first time since February 2024 that monthly sheep meat exports to China moved above the seasonal average trend, based on the last five years of the trade. Current July flows to China sit nearly 2% higher that the July average trend.

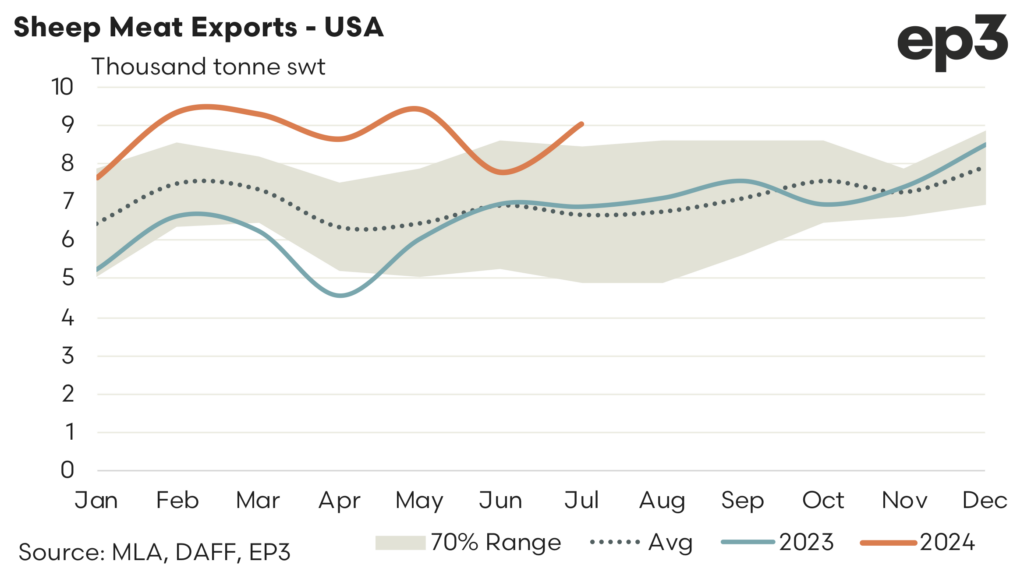

USA – American demand for Aussie sheep meat continues to demonstrate a robust trend with volumes during July 2024 running 35% above the five-year seasonal average for July. There was 9,015 tonnes swt shipped to the USA during July, which represents trade levels that are 31% higher than July 2023 and a 16% gain on the export volumes seen during June 2024.

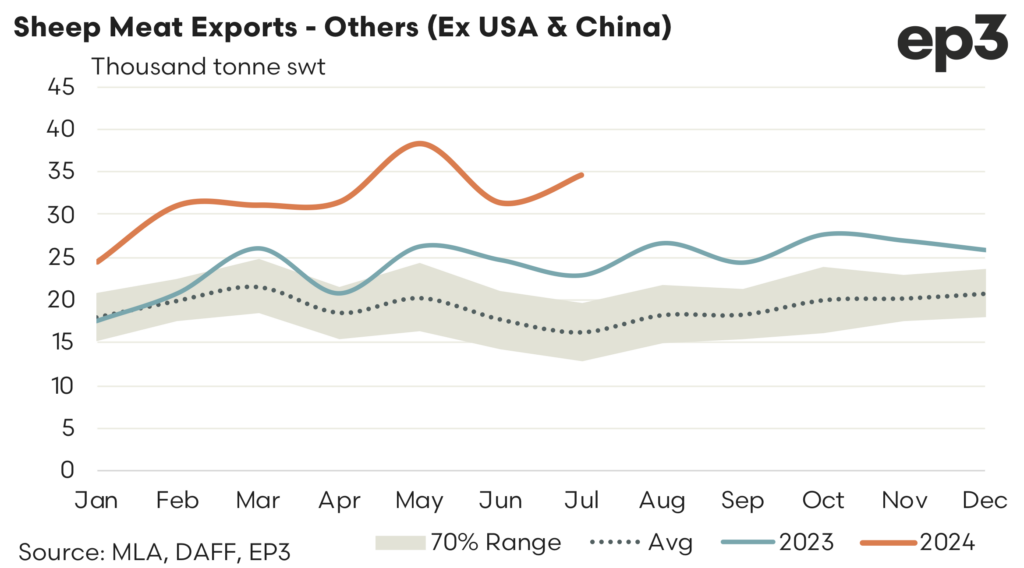

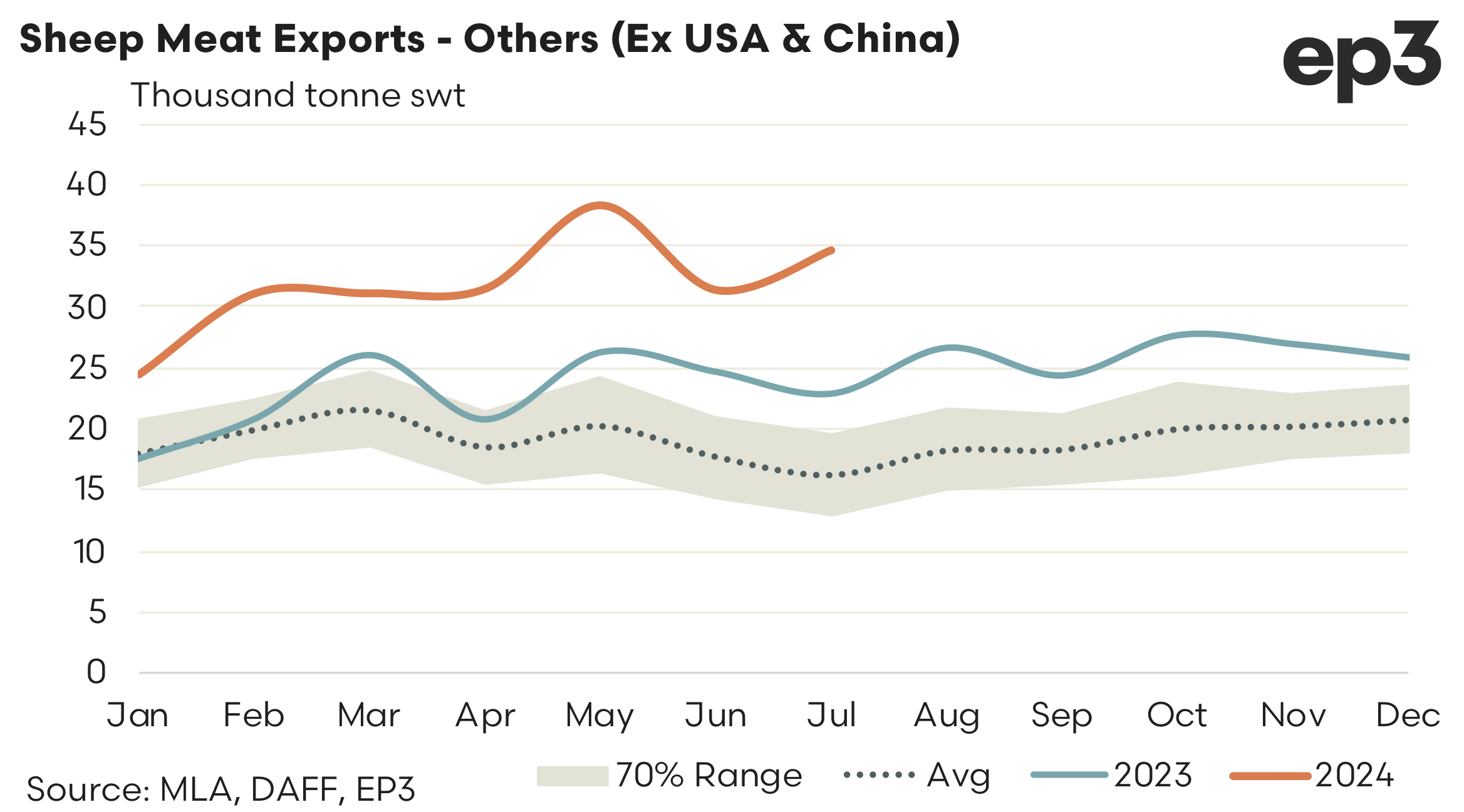

The Others – The trade flows of Aussie sheep meat to all of the “other destinations” (excluding the USA & China) remained strong too. During July 2024 there was 34,703 tonnes exported to these other regions. This represents trade volumes that are 113% above the five-year average volumes for July and nearly 52% higher than the levels seen exported during July last year.