EYCI and the export price

The Snapshot

- Currently, on an annual average basis the spread is at a record premium of 190c/kg, and nearing a percentage premium of 30%.

- The normal situation for the EYCI is to run at a 15%-20% discount to the 90CL.

- Based on the historic relationship between annual slaughter and the EYCI/90CL spread the MLA forecast of 6.4 million head of slaughter would infer an annual average premium of approximately 75c/kg for the 2021 season.

The Detail

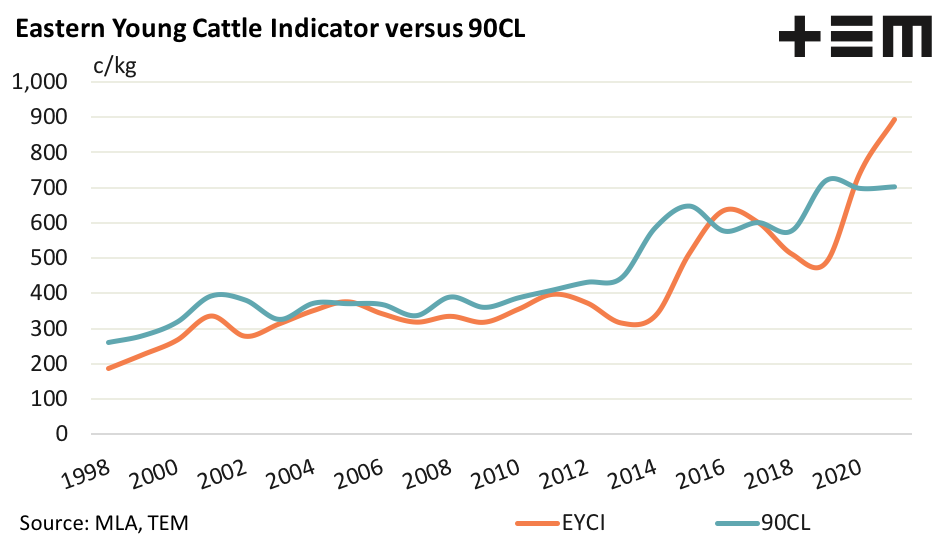

The Eastern Young Cattle Indicator (EYCI) and the 90CL grinding beef price in the USA generally share a close relationship. As the historic annual average price chart demonstrates the two often move in tandem. However, there are times, during drought in Australia when the cattle market is under liquidation pressure or when a favourable climate encourages strong restocking activity, that the spread between the EYCI and the 90CL can widen to a larger than normal discount or move into a premium.

Currently, on an annual average basis the spread is at a record premium of 190c/kg. Meanwhile weekly prices are sitting at a spread of approximately 205c/kg, or a 26% premium to the EYCI over the 90CL.

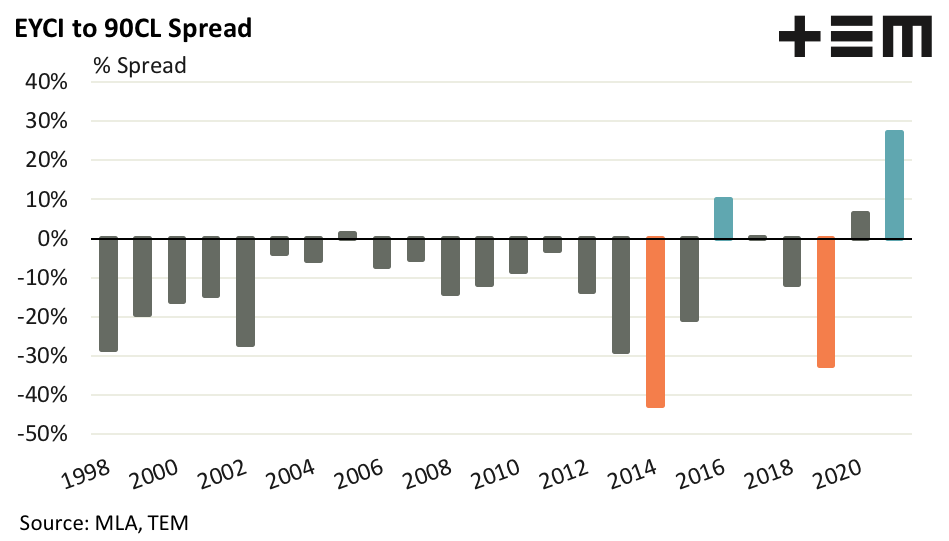

Taking a look at the annual average percentage spread since 1998 we can see that the usual situation for the EYCI is to run at a 15%-20% discount to the 90CL, under normal trading conditions. However, it is not uncommon to see the spread narrow during wetter times. Indeed, during strong restocking activity, particularly when domestic supply is very tight (like now), the spread can move into premium territory.

We saw this in 2016 when the EYCI/90CL spread averaged a 10% premium over the year, or a premium spread in cents per kg of 57c. This year we have seen the premium spread expand to a record level fuelled by the exceptional season and very tight supply.

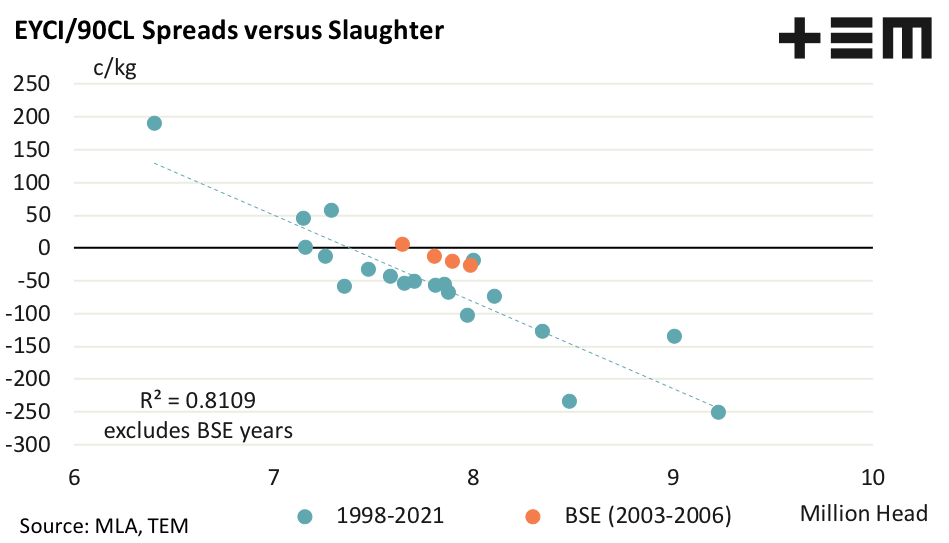

A comparison of the annual average spread to the annual Australian slaughter volumes highlights how strong the relationship is between domestic cattle supply and the price differential between the EYCI and the 90CL. Excluding the years when the US imports of beef into Japan were restricted due to mad cow disease (BSE), when the EYCI spread to the 90CL narrowed, but not because of climatic nor supply factors, we can see a very strong correlation between slaughter volumes and the spread. Indeed, the correlation coefficient sits at a healthy 0.8109.

Meat and Livestock Australia (MLA) are currently forecasting Australian cattle slaughter to come in at 6.4 million head in 2021. Based on the relationship between slaughter and the EYCI/90CL spread this would infer an annual average premium of approximately 75c/kg. While this suggest that the current spread of 190c/kg is at extreme levels, the distance it sits away from the line of best fit isn’t that unusual if you compare it to some of the other data points that are positioned above the line of best fit.