EYCI breach, not far away in time

The Snapshot

- The average price for restocker purchases of EYCI cattle is nearing 1090c/kg cwt, compared to 1007c/kg for feedlots and 903c/kg for processors.

- The current spread discount of nearly 21% for the 90CL to the EYCI is consistent with the levels seen during the last Australian herd rebuild phase during the 2016/17 season.

- Discount spreads are synonymous with tight seasonal conditions and low slaughter volumes, which are often seen during a herd rebuild phase.

- MLA are forecasting annual cattle slaughter at 6.3 million head for the 2021 season, which would suggest an annual average discount spread of around 28% wouldn’t be unusual this year.

The Detail

The Eastern Young Cattle Indicator (EYCI) is back probing record nominal highs, closing at 1026c/kg cwt on September 15th and just 5 cents shy of the historic peak. Local factors are at play, with both restockers and feed lot buyers chasing young cattle.

The Meat and Livestock Australia (MLA) reported breakdown of buyer types chasing EYCI cattle highlights that in recent sales 46% of the buyers were feedlots, 41% restockers and just 13% were processors. While feedlots dominated the sales volumes restockers are paying the big premiums with the average price for restocker purchases of EYCI cattle nearing 1090c/kg cwt, compared to 1007c/kg for feedlots and 903c/kg for processors.

Aside from local factors, the 90CL imported beef export price in the USA has been pushing higher in recent weeks as concerns over global beef supply, fuelled somewhat by a Brazilian mad cow disruption and continued supply chain shipping constraints, had export buyers scrambling for limited stock.

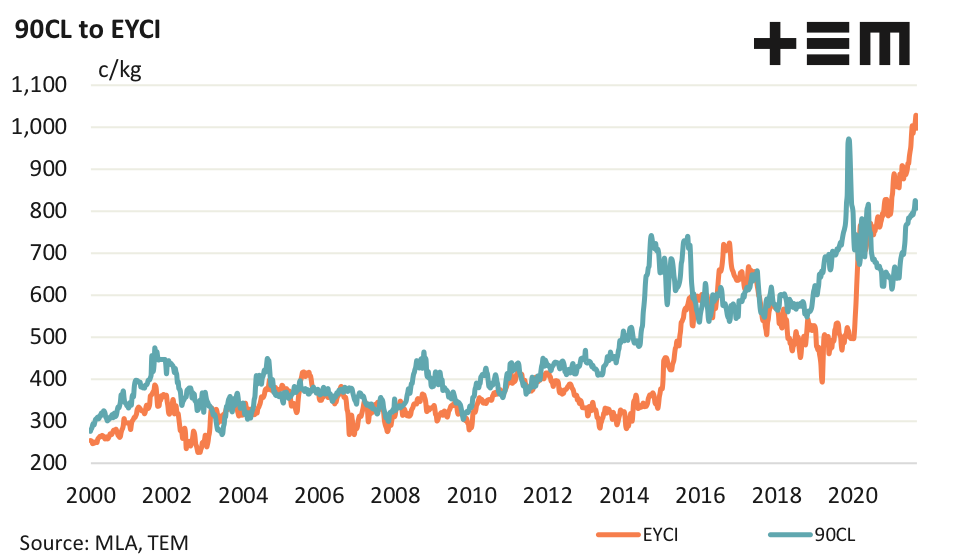

Historically, the EYCI and the 90CL often share the same directional movement in price. While the normal situation has been for the 90CL to trade at a premium spread to the EYCI the very tight situation in the Australian cattle market at present has seen the 90CL running at a significant discount to the EYCI for the last 12 months.

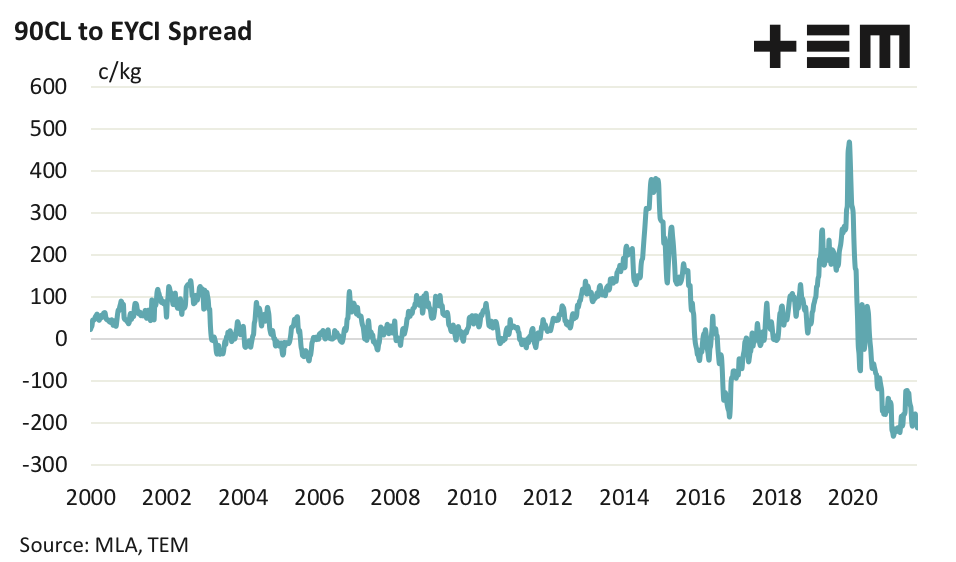

Indeed, the spread pattern for the 90CL to the EYCI for the last two decades highlights how extreme the current situation is for the discount spread in cent per kg terms with the 90CL more than 200 cents below the EYCI at present.

When comparing price spreads over a long time frame it is often useful to convert the spread from cents per kg to percentage spread terms as it more accurately reflects the true magnitude of the spread, as the percentage spread calculation takes into account rising prices. For example, a 100c/kg discount on a 500 c/kg priced EYCI is the same magnitude discount as a 200c/kg discount on a 1000 c/kg EYCI, the discount in percentage terms is 20%.

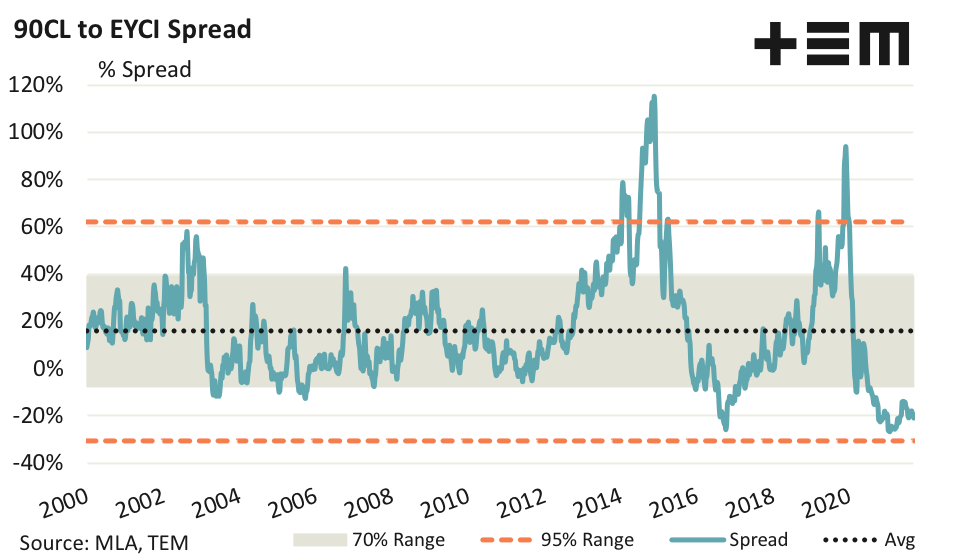

Analysis of the 90CL to EYCI spread in percentage terms over the last two decades demonstrates that the average spread has been a 16% premium, with a normal range in the spread from a 7% discount to a 40% premium. The 90CL to EYCI spread wouldn’t be considered extreme until it was below a 30% discount or above a 62% premium. The current spread discount of nearly 21% is consistent with the levels seen during the last Australian herd rebuild phase in the 2016/17 season.

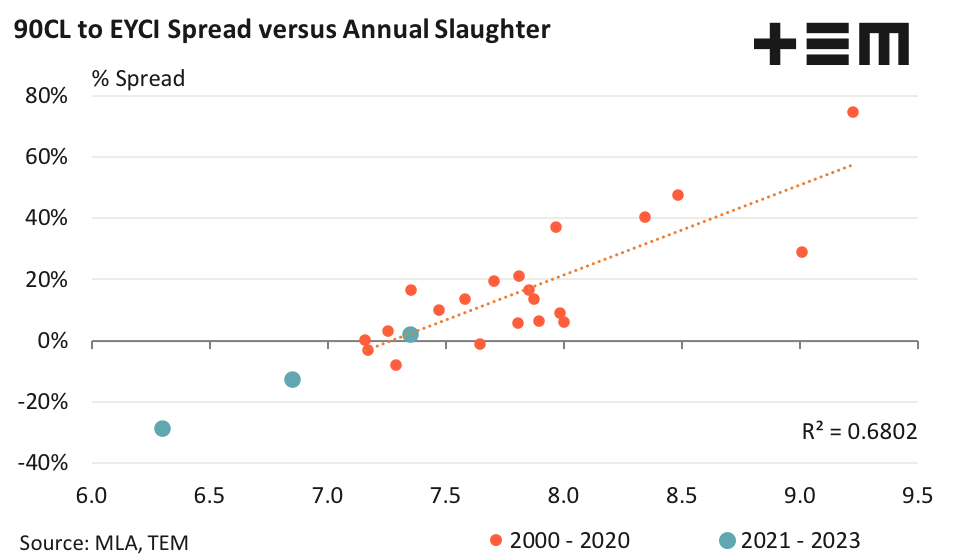

A comparison between the 90CL/EYCI annual average spread and annual cattle slaughter volumes in Australia highlight the strong relationship between spreads and seasonal conditions. Discount spreads are synonymous with tight seasonal conditions and low slaughter volumes often seen during a herd rebuild phase. Meanwhile, extreme premium spreads are often seen during times of high cattle turnoff during drought induced herd liquidation phases.

MLA are forecasting annual cattle slaughter at 6.3 million head for the 2021 season. Based on the line of best fit this would suggest an annual average discount spread of around 28% wouldn’t be unusual this year. Currently, the annual average spread discount for the 90CL to the EYCI sits at nearly 21%. From that perspective, the strong performance of the EYCI this year compared to the 90CL price levels, isn’t that extraordinary.

Interestingly, the forecast of 6.85 million head of slaughter for the 2022 season indicates that the spread discount between the 90CL and the EYCI could be around for another 12 months, with the line of best fit indicating an annual average discount of 12% likely for next year.